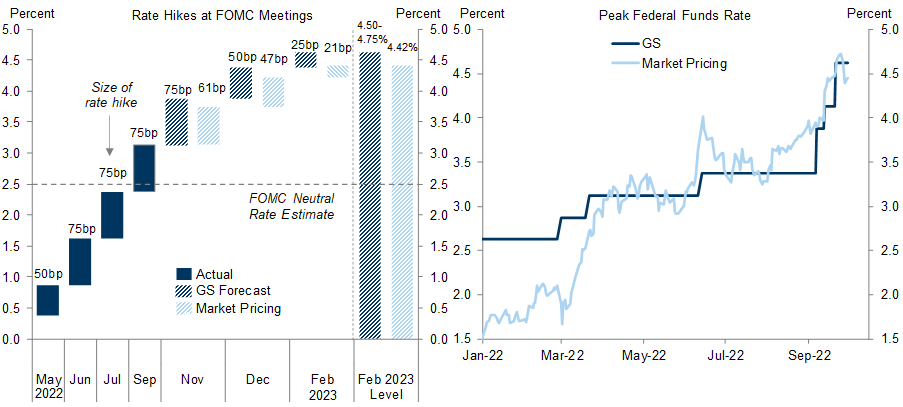

Our baseline forecast calls for the Fed to deliver a 75bp rate hike in November, a 50bp hike in December, and a 25bp hike in February, for a peak rate of 4.5-4.75%. To make our expectations comparable to market pricing, we update our scenario analysis of possible paths for the Fed.

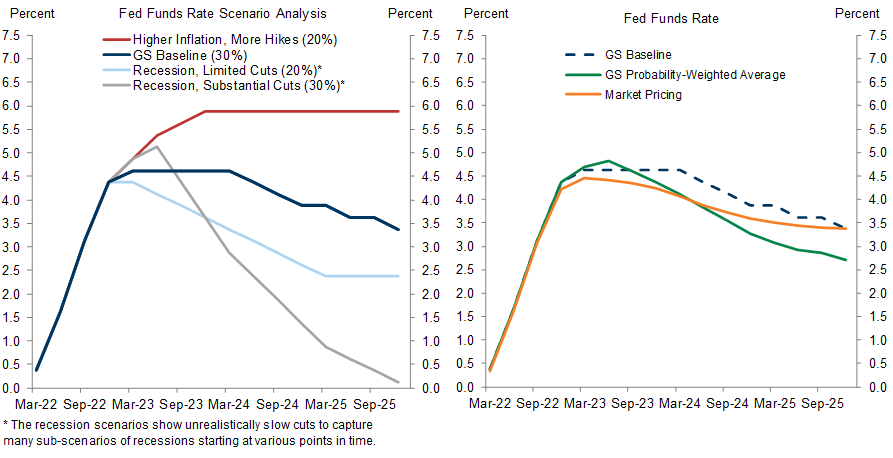

We consider four broad scenarios for the next couple of years. In a non-recession outcome, we see the Fed as most likely to follow roughly our baseline path (30% subjective odds), but we also see a meaningful risk of an upside scenario in which the Fed hikes more than we expect (20%). In a recession outcome, we see the Fed as most likely to cut substantially (30%), but we could imagine more limited cuts if inflation proved stickier in a downturn than we would expect (20%).

We use these four scenarios and our subjective odds to calculate a probability-weighted average path of the funds rate. The resulting probability-weighted average path is a bit above both our baseline and market pricing in early 2023 but falls below both later on.

Updating Our Fed Scenario Analysis

David Mericle

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.