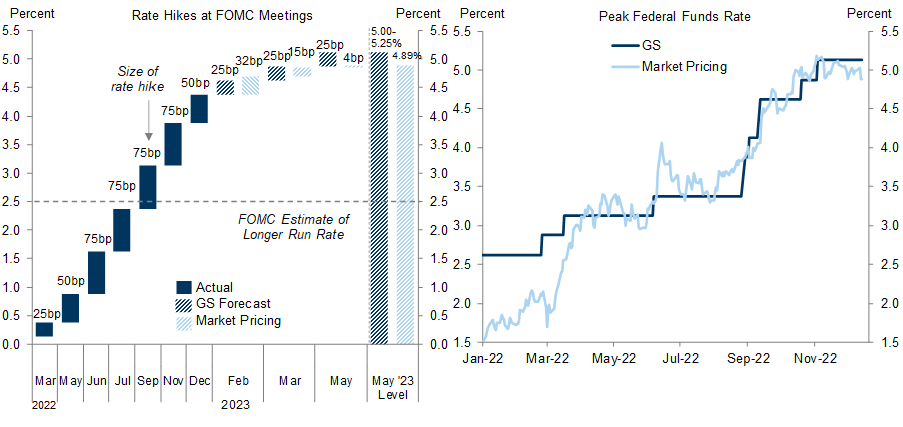

The December FOMC meeting went largely as we expected. The FOMC delivered a smaller 50bp rate hike but raised its projection of the peak fed funds rate in 2023 by 50bp to 5-5.25%, showed slightly larger cuts in 2024 from that new higher peak, kept the reference in its statement to “ongoing” increases in the funds rate being appropriate, and left its options open in February. More surprisingly, the median inflation projections rose despite better recent inflation news.

We continue to expect three additional 25bp rate hikes in February, March, and May, for a peak funds rate of 5-5.25%. We do not think that Powell meant to send a strong signal about the size of the next hike in February today, but we see his intention to “feel our way” to the appropriate policy rate as most consistent with our forecast of another stepdown in the pace to 25bp.

Asked about the possibility of rate cuts next year, Chair Powell said that the FOMC will only cut when it is confident that inflation is moving down in a sustained way. We are doubtful that the inflation path that we forecast for next year would be enough to provide that confidence.

December FOMC Recap: A Slower Pace but a Higher Peak

David Mericle

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.