We wish our readers a happy and healthy new year. In our first Asia Economics Analyst of the year, we offer our answers to ten economic and market questions for the Asia-Pacific region and individual countries in 2023. We also review our questions and answers from one year ago.

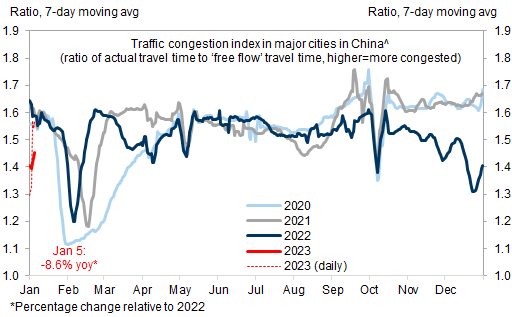

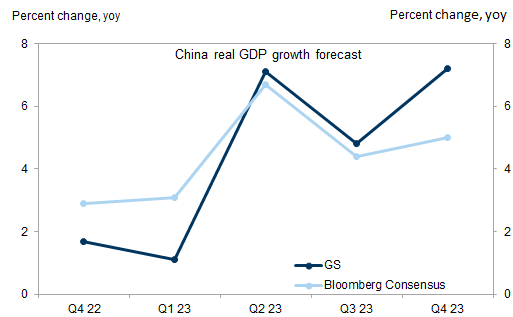

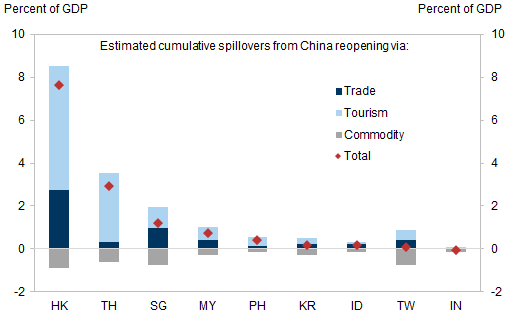

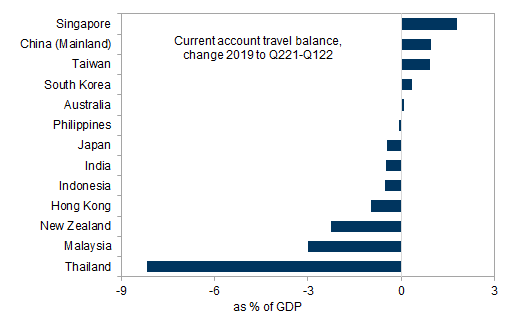

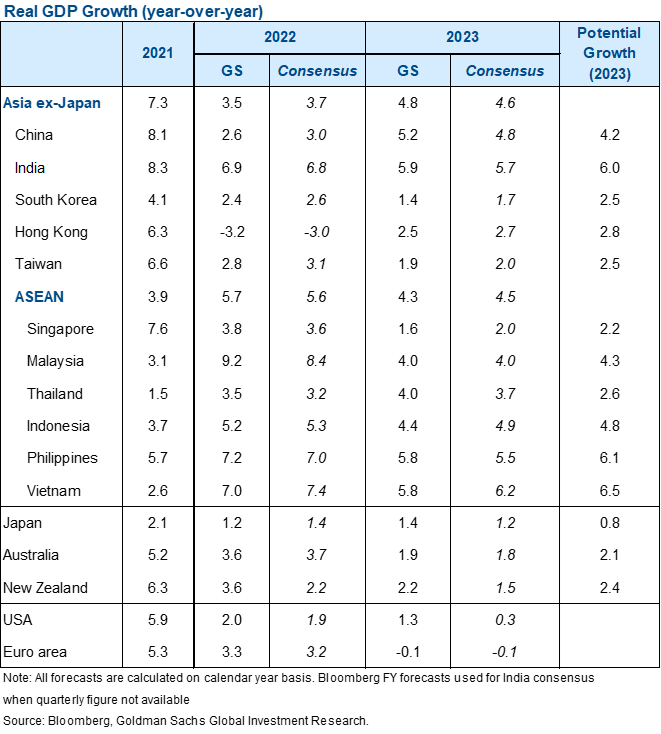

China's reopening should result in a burst of growth over the coming year (we estimate 7.2% GDP growth on a Q4/Q4 basis) and benefit regional economies, with Hong Kong and Thailand likely to see significant boosts from mainland tourists. While domestic inflation pressures are likely to increase, we do not think they will constrain the PBOC significantly this year.

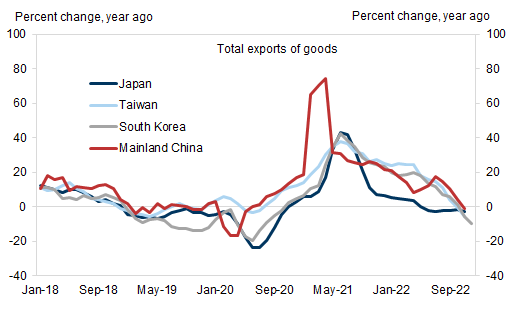

Asia-Pacific manufacturing and trade should bottom out in early- to mid-2023; along with China's reopening this should help regional growth in the back half of the year.

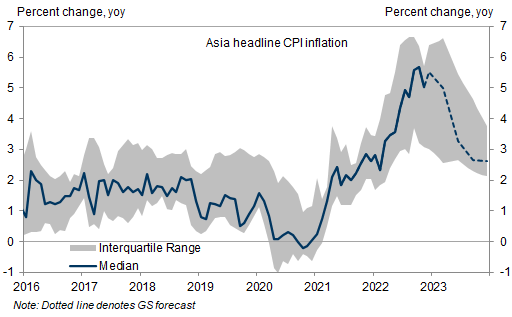

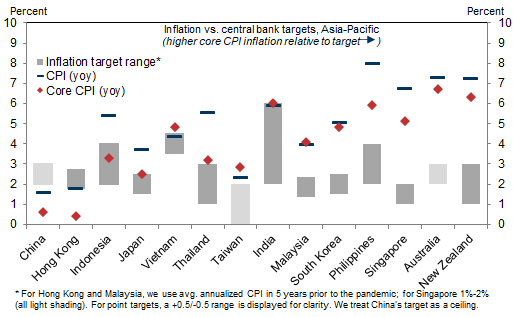

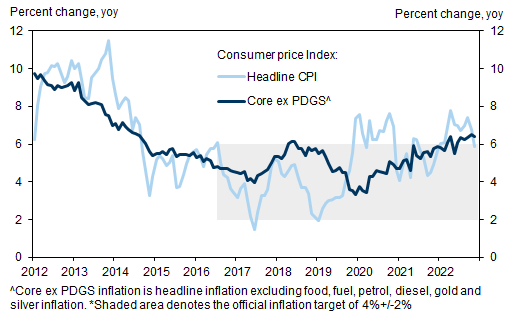

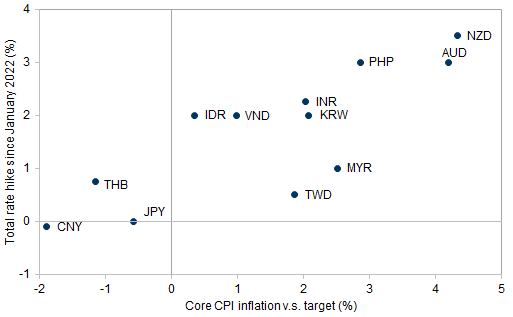

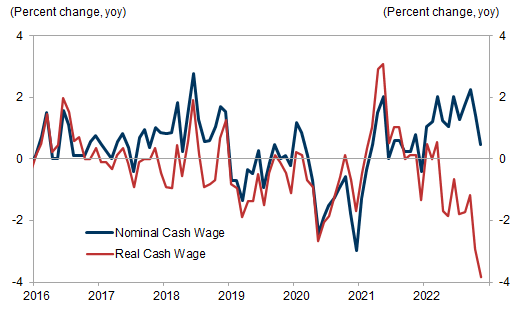

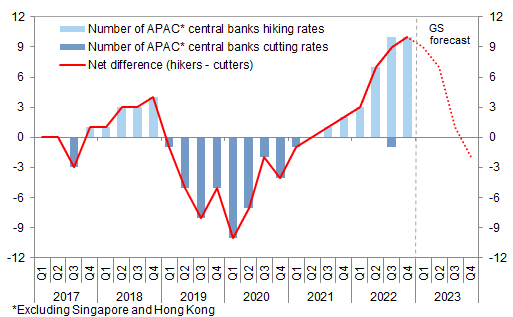

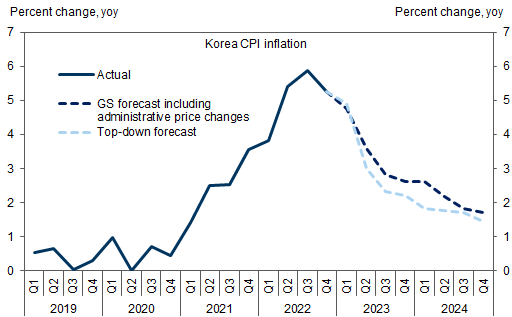

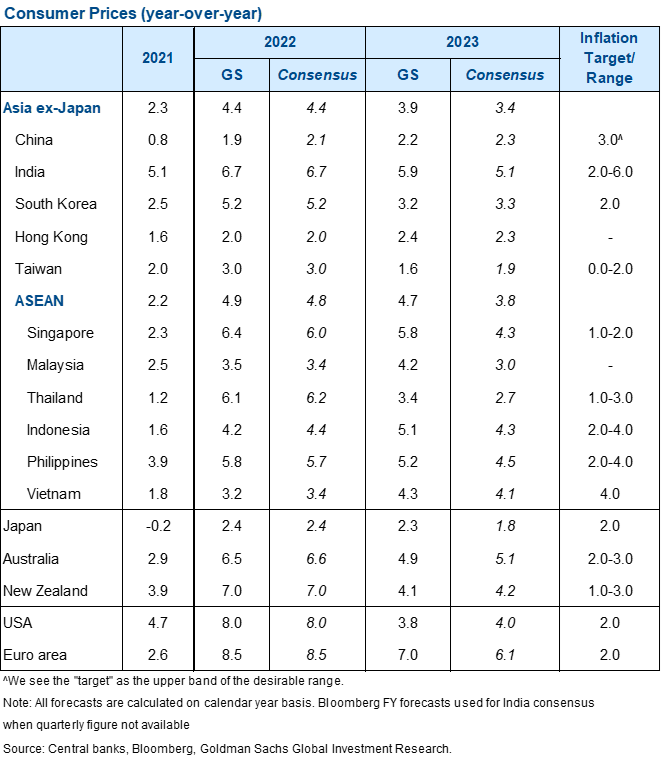

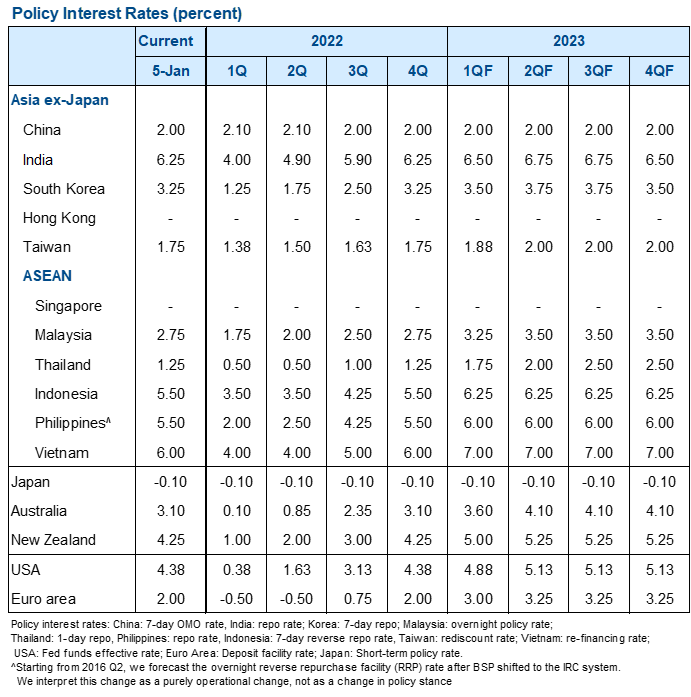

Inflation is peaking, in our view, though it will remain high in many economies (particularly smaller open economies) through mid-2023. Strong growth and resilient core inflation in India could push the central bank to tighten more than markets expect in H1. Very late in the year, with pressures having eased, we think the Bank of Korea could be among the first to cut rates. The Bank of Japan may tweak policy further, but we think yield curve control could stay in place this year.

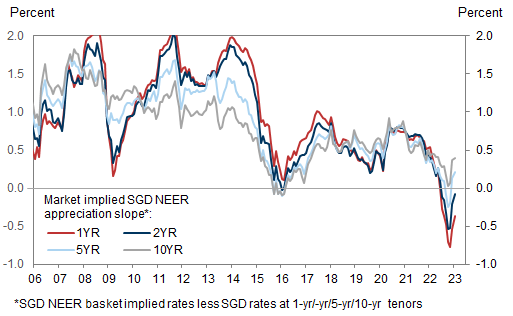

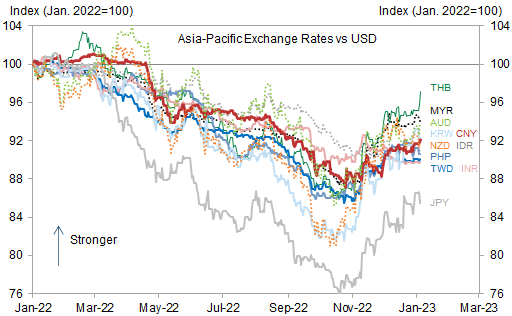

With our global view of Fed hikes ending in H1 and the US narrowly avoiding recession, and regional growth improving later in the year, we think many regional currencies—including the CNY and JPY—could rally further against the USD.

While the majority of our 2022 answers worked out broadly as anticipated, we underestimated the inflationary pressure that would hit the region—exacerbated by Russia's invasion of Ukraine in late February—and the extent of the policy tightening that would result in some countries. We also were surprised by the extent of CNY weakness—reflecting an even worse economic outcome in China than our below-consensus view to start the year, as well as rapid USD appreciation on the back of the fastest pace of Fed hikes in decades.

Questions for 2023

A brief recap of our questions and answers from 2022

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.