China Musings

China reopening playbook (Part 2): Multiple policy pivots to drive further gains

Table of Contents

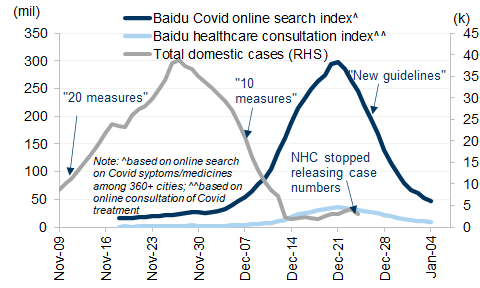

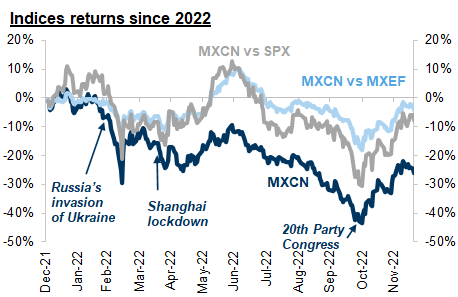

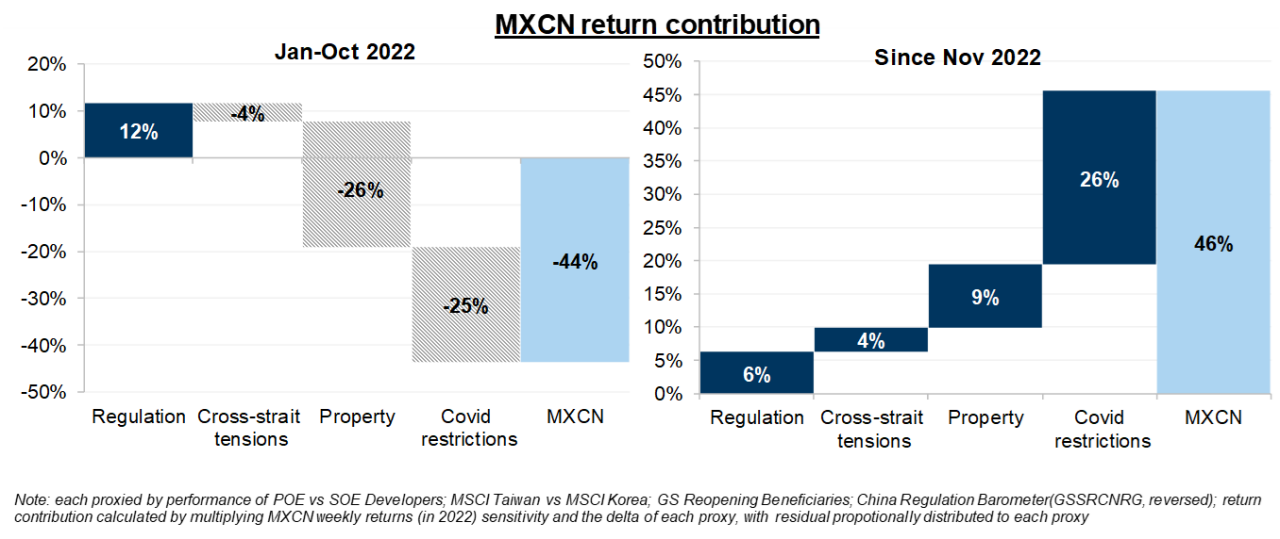

1. Many surprises in 2022, including the latest pivot in Zero Covid Policy (ZCP). Chinese stocks had an extremely volatile year in 2022, registering an intra-year trading range of 47%, the 2nd highest in the past decade. Geopolitical shocks, rising global rates, and concerns about China's Zero Covid Policy, housing market conditions, political configuration, and ADR delisting risk at one point (on Oct 31) drove MSCI China to an 11-year low, prompting investor debates about the investability of Chinese assets. The investment narrative has however swiftly changed post the 20th National Party Congress, most notably on China's ZCP approach, with policy focus shifting from stringent Covid testing, isolation, quarantine, and mobility measures to effectively full-reopening and herd immunity in an accelerated fashion. As a result, reported Covid cases surged to all-time highs in late November, and some survey data at the provincial/local government levels indicated as high as 60% of the respondents have already tested Covid positive by end-22. Despite the outbreak, Chinese stocks have staged a strong recovery in the past 2 months, with MSCI China rallying 29% in November (the best monthly return since July 1999) and 46% since the local trough, led by Internet and Developers which have gained 80% and 73% respectively in the past 9 weeks. The historic rebound pared the 2022 index losses to 24% (MXEF/APJ: -22%/-20%), and the upward momentum has extended into 2023, with the index gaining 8% in the first trading week of the new year, the best start since 1995.

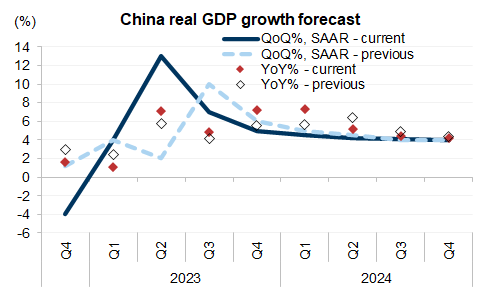

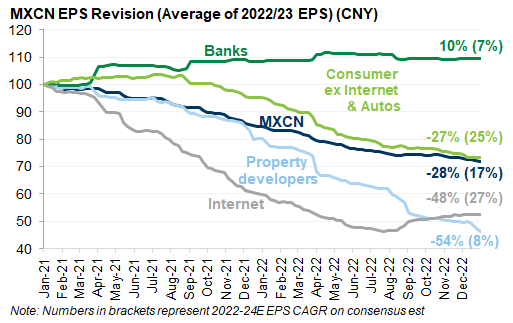

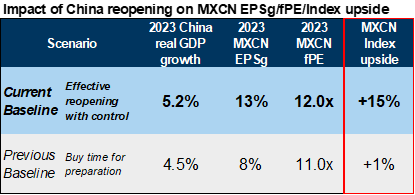

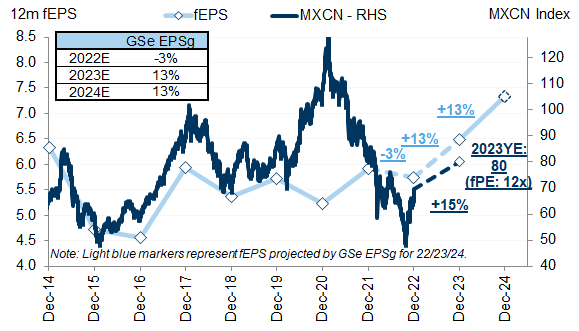

2. The U-turn in Covid policy is consequential to growth and equity returns. First, our economists recently raised their 2023 full-year GDP growth forecast from 4.5% to 5.2% on the back of the earlier-than-expected reopening timetable, with 2Q23 sequential annualized growth potentially reaching 13% on their projections assuming a significant part of the reopening disruptions would occur in 4Q22/1Q23 (or before the Chinese New Year holidays, which take place from January 21 to 27). The growth impulse will be predominately led by a recovery in consumption demand where Chinese households have accumulated roughly Rmb2tn of excess savings in the past year. Second, the stronger economic growth prospects for 2023 have prompted us to revise up our earnings forecasts to 13% from 8%, putting our 2023 EPS growth estimate on par with consensus. Third, equity valuations and investor sentiment should also benefit from a more pro-growth policy orientation, partly reflected by the sharp Covid policy pivot but more broadly by concrete policy loosening actions and market-friendly government rhetoric centering on the digital economy, the housing market, and to a lesser extent, the private economy (more details below).

Exhibit 3: We cut our GDP growth forecast for 2022 from 3.0% to 2.6% but raised it for 2023 from 4.5% to 5.2%, mainly to reflect the earlier-than-expected reopening

Source: Goldman Sachs Global Investment Research

Exhibit 4: Consensus earnings have stabilized in recent months, led by TMT

Source: FactSet, MSCI, Goldman Sachs Global Investment Research

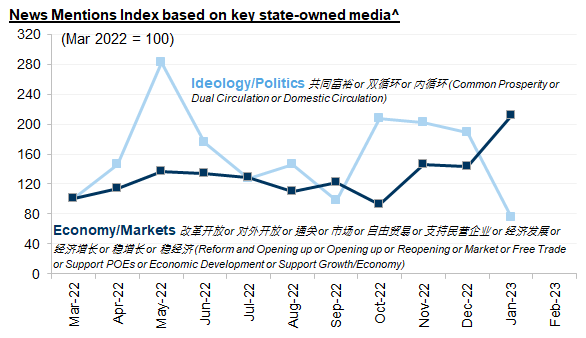

Exhibit 5: Policy tone and rhetoric appears to have turned more pro-growth post the Party Congress

^based on % of news articles with keywords (title and lead paragraph only) in all news articles from People's Daily, China Daily, Xinhua, Cankao Xiaoxi and Global Times

Source: Factiva, Goldman Sachs Global Investment Research

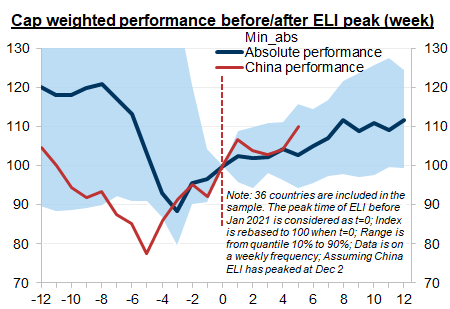

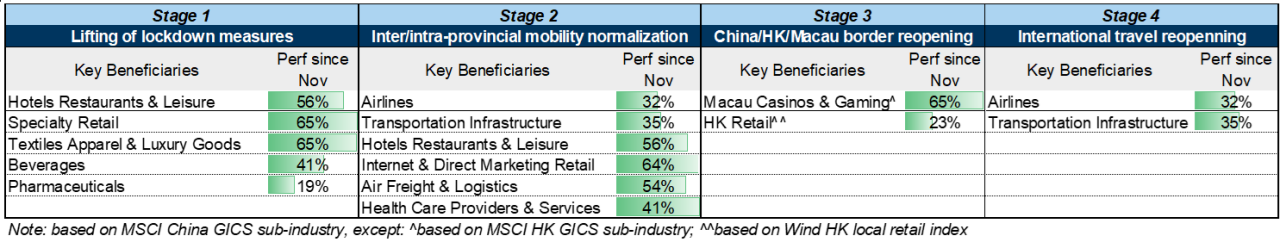

3. As noted in our Reopening Playbook (Part 1), equities are a forward-looking asset class and could trade well before actual Covid cases and/or disruptions peak, as evidenced by the reopening recoveries from 36 equity markets globally in the past 2.5 years. Specifically, we note that these equity markets typically bottom about one month before Covid-related disruptions peak, and the positive market momentum usually extends for 3-4 months post the policy inflection point, generating 11% reopening gains during that 6-7 month period. This trading pattern is consistent with our recent global marketing feedback which suggests that equity investors are willing to look through the potential near term disruptions (rising Covid and death cases, and the related growth drags) as long as the path towards reopening is clearly communicated to the market and the actual casualty rate is relatively well contained. In terms of sequencing, we believe the Chinese reopening journey could be broadly divided into 4 main phases--removal of local restrictions (e.g. lockdown measures), inter/intra-provincial mobility normalization, lifting of border restrictions between China/HK/Macau, and international travel reopening--with the first 2 stages more or less completed or in process and the latter two phases kicking off soon as per the government's stated schedule.

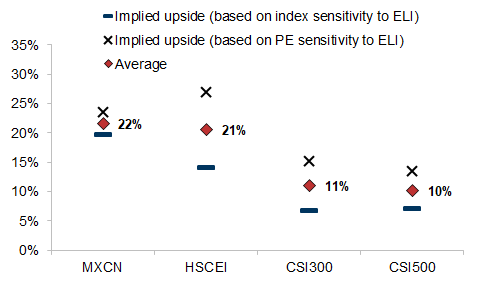

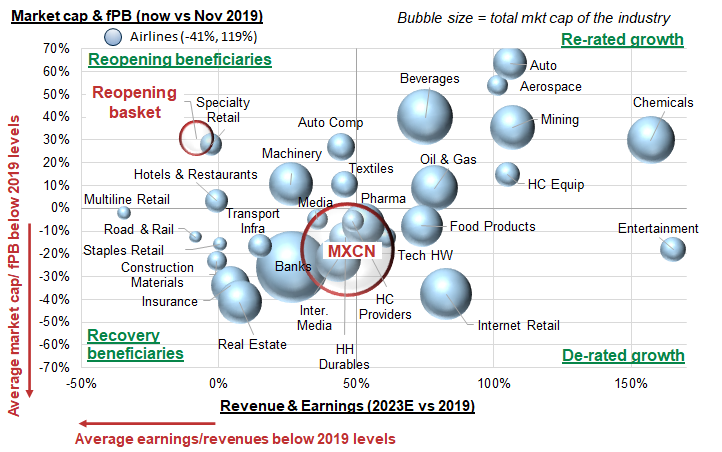

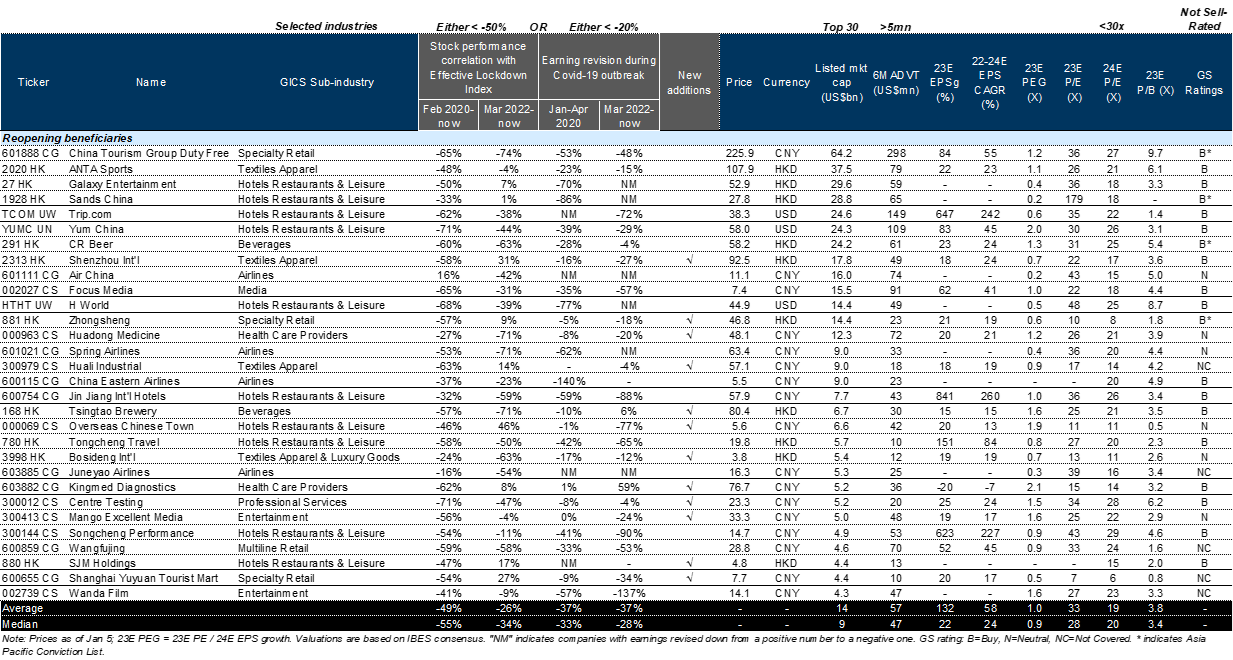

4. The speed of reopening has surprised investors on the upside, but the substantial gains have also left them pondering to what extent the full reopening growth impulse is already discounted in equity prices. We attempt to answer this question from the following approaches. First, mapping our economists' latest 2023 GDP growth forecasts (a full-reopening scenario) onto equity earnings and valuations, we note that it would point to 15% further index upside from current levels; Second, applying the cross-country reopening equity beta (with respect to GS China Effective Lockdown Index, a mobility/traffic measure) to Chinese stocks, we estimate that the market could rise by another 20% if ELI normalizes. Third, while our Reopening Beneficiaries portfolio, comprising mostly Consumer Cyclicals and consumer-facing names, has rallied 46% since November, it has just performed in-line with the aggregate index, implying more broad-based re-rating outside of Consumer equities is also underway.

Exhibit 8: Reopening boost could translate into 15% incremental index upside via the earnings and valuation channels

Source: MSCI, FactSet, Goldman Sachs Global Investment Research

Exhibit 9: Activity normalization could boost equity prices and valuations by 20% per our economists' Effective Lockdown Index

Source: Bloomberg, Goldman Sachs Global Investment Research

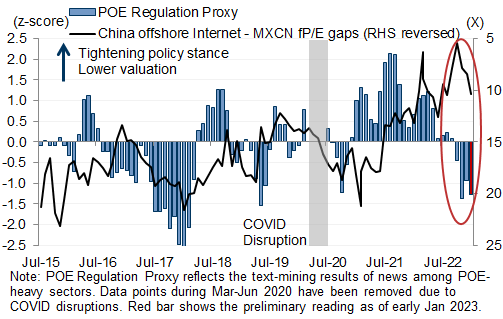

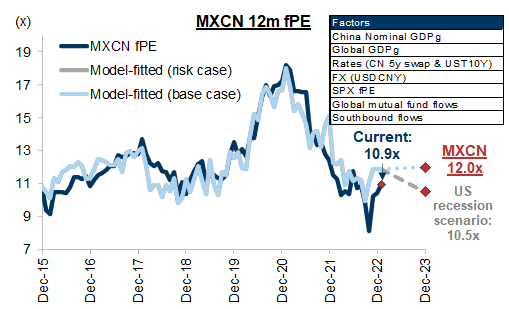

5. Multiple policy pivots are at work. Why are we expecting further upside to Chinese stocks despite the 46% market rally? Our explanations are as follows: a) the starting point of the recovery is low in both price and valuation terms, with MSCI China index PE reaching 8.1x on Oct 31 (-1.6 sd, the lowest since the GFC). The rally has propelled the index PE to 11x (-0.4 s.d.), roughly on par with its trailing 5-year average but still 7% below where it started 2022; b) the arguably aggressive housing policy measures focusing on stimulating demand, delivery of pre-sold properties, and developers’ financing needs in the past several months have effectively backstopped the downward spiral and reduced the left tail risks in equity valuations, in our view; c) the domestic regulation cycle targeting the Internet sector has eased into a supportive territory per our POE Regulation Proxy, consistent with the recent acceleration of Banhao approvals and resumption of capital market activities for Fintech companies, likely benefiting TMT equities; d) investor concerns revolving around cross-strait and US/China relations appear to have moderated temporarily after the inaugural face-to-face meeting between President Xi and President Biden in Bali on Nov 14, with KWEB gaining 16% since the PCAOB confirmed its ability to inspect the audit papers of US-listed Chinese companies on Dec 15 and the MSCI Taiwan Index also rallying 14% from its recent lows and outperforming Korea by 8pp post the G20 Summit. Using specific equity market portfolios and indicators to proxy the above macro and policy factors, we estimate that "reopening" has been responsible for around 26pp of the 46% rally since last November. Overall, these (improving) factors have also led us to raise our index PE target from 11.2x to 12x per our top-down PE model.

Exhibit 11: An improving regulation cycle should be supportive to China TMT's valuations when other macro concerns moderate

Source: MSCI, FactSet, Factiva, Goldman Sachs Global Investment Research

Exhibit 12: Our top-down modeling suggests China should trade at around 12x fP/E by end-2023

Source: Bloomberg, FactSet, Goldman Sachs Global Investment Research

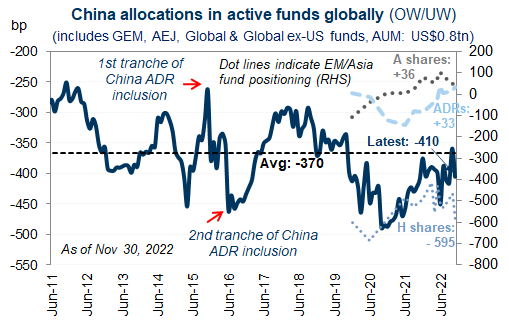

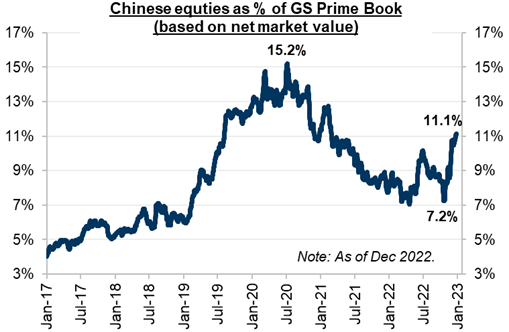

6. While structural headwinds stemming from a likely prolonged housing market downturn, the aging population, US-China tensions, and geopolitical overhangs remain valid, they don’t disqualify our view that China looks well positioned across the growth, policy, and inflation cycles in a global context in 2023 as we have emphasized in the past months. Importantly, with index valuations around 10% below our macro-driven target, mutual fund mandates still meaningfully trailing benchmark weights on their China allocations, and hedge funds just starting to increase risks on China after cutting exposures by more than 50% since early 2021, the reopening excitement in conjunction with other policy pivots could catalyze further positioning normalization flows into Chinese stocks and usher in an asymmetric supply/demand dynamic to the upside, at least tactically. Put differently, the prevailing market backdrop leads us to believe that the downside risk of maintaining underweight or shorting Chinese stocks is meaningfully higher than going long. As such, we reiterate our Overweight recommendation on Chinese equities (both A and Offshore), and raise our 12m target for MSCI China from 70 to 80, factoring in a stronger 2023 EPS growth prospect and a higher PE target multiple.

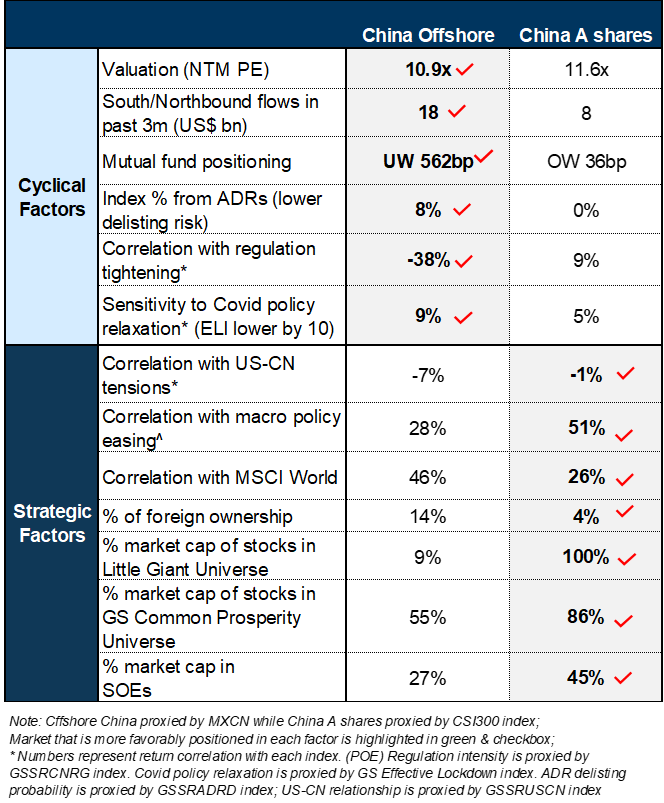

7. As we wrote in our 2023 Outlook report: "We like the tactical case for the Offshore market in 1H23 considering the possibility that the market may pre-trade the potential catalysts of reopening, likely more clarity of ADR delisting risks by end-22 or early 2023, and higher flow and sentiment sensitivity to the Fed hiking cycle (ends in May per GS expectation). However, we'd look to take profit on Offshore equities if the recovery materializes and rotate to the A-share market given its more compelling strategic investment case". These views/arguments remain valid (and have been reinforced by the accelerated reopening timetable) as we believe Offshore equities offer a more favorable reopening beta to investors (lower relative valuations, deeper underperformance, light positioning from foreign investors, and higher index representation from Internet and Consumer Cyclicals) but the A-share market boasts a stronger strategic investment case for international investors underpinned by its size, liquidity, diversification, and alpha generation appeal. Thematically, the A-share market also appears more favorably exposed to long-term policy and development trends under the new Party leadership, namely Common Prosperity and Little Giants, and could benefit more than H shares/ADRs from the developing structural trends of asset reallocation flows from property to equities and financialization of housing savings. While it might be premature to make the shift (given a higher MSCI China target), we do recognize that long-term policy and geopolitical trends could cap the normalized profitability and re-rating potential for Offshore stocks.

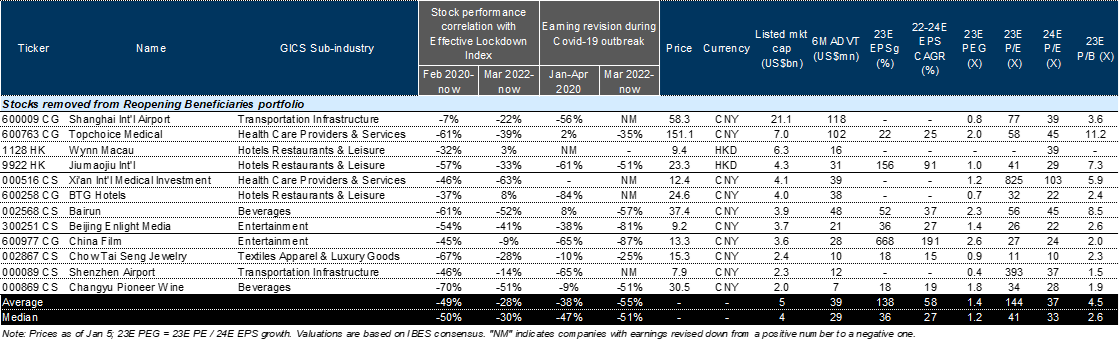

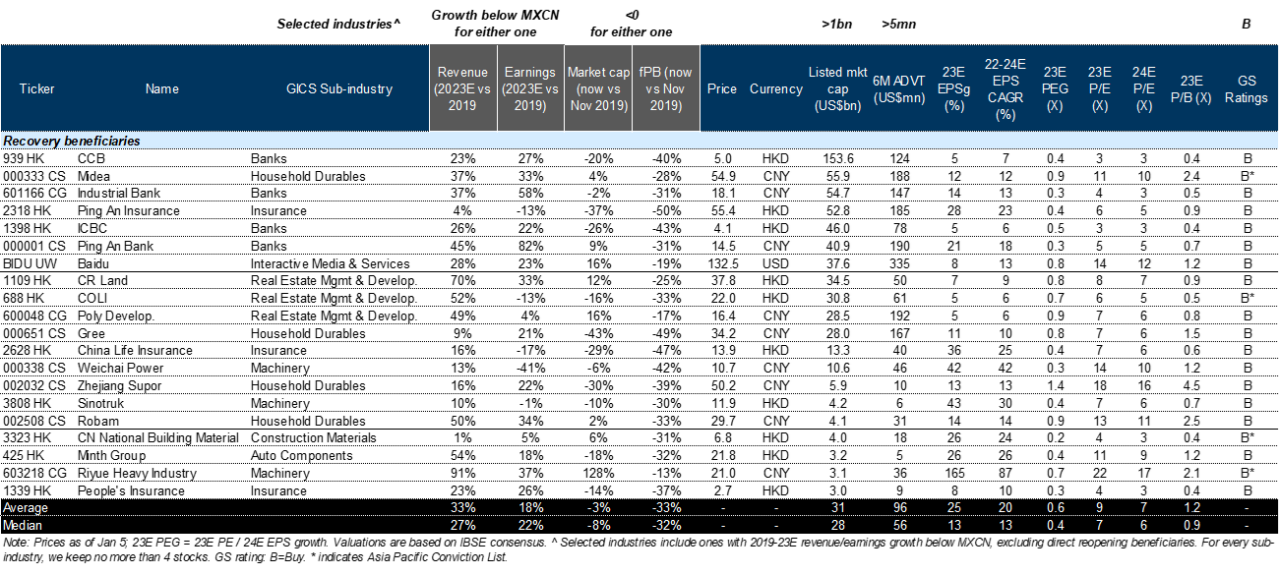

8. From Reopening to Recovery and Regulation. Top down, we’d emphasize a two-pronged approach–a heavy consumer tilt to monetize the tactical reopening upside, and strategic exposures to areas that are favorably linked with long-term policy goals–to position in Chinese equities across the market, sector, and thematic dimensions. This underpins our continued OW stance on Consumer Services, Durables, Healthcare Services, Online Retailing, and Semi, sectorally. That said, with a number of consumer-facing sectors already trading above-midcycle valuations post the recent upsurge, we’d focus on subsectors and names where fundamental recovery potential remains significant. Specifically, we refresh our Reopening Beneficiaries portfolio to include Consumer Cyclicals where consensus 2023 revenues and earnings are still meaningfully below their 2019 pre-Covid levels or valuations are below historical averages or still at reasonable levels. Outside of Consumer, the improvement in growth momentum could drive recovery and re-rating opportunities in areas where both fundamentals and valuations are still suppressed relative to historical ranges, such as Construction/Property Cyclicals and select and Financials (GS Buy-rated names in Exhibit 20). Lastly, the inflection of the regulation cycle should bode well for Internet stocks, especially those that could disproportionately benefit from potential Southbound inclusion and the reduction of ADR delisting risks.

Appendix

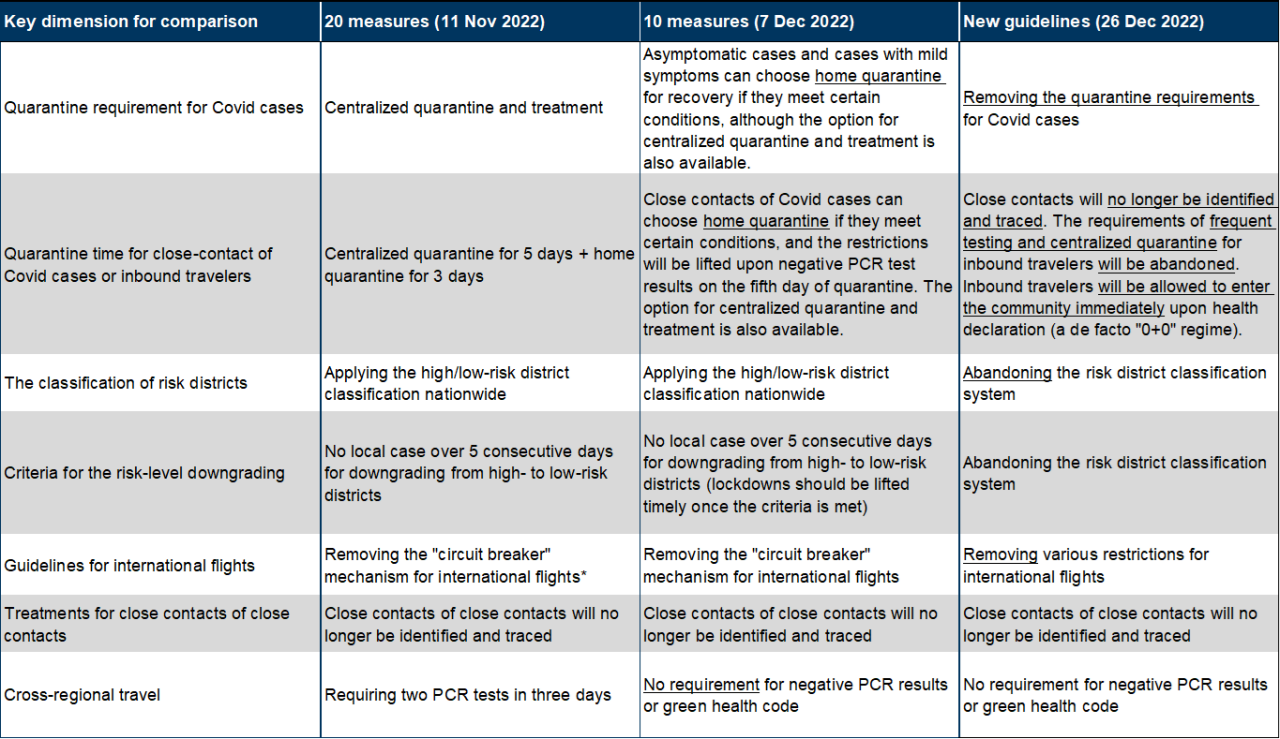

Exhibit 21: Key differences between Covid policies in the "20 measures", "10 measures" and the latest guidelines

*This mechanism requires airline companies to temporarily ban specific routes into China for one-to-two weeks, depending on how many Covid cases were identified among passengers of the specific flights.

Source: Government websites, data compiled by Goldman Sachs Global Investment Research

Basket disclosure

The ability to trade the basket(s) in this report will depend upon market conditions, including liquidity and borrow constraints at the time of trade.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.