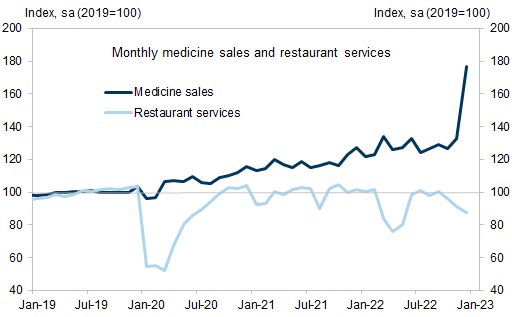

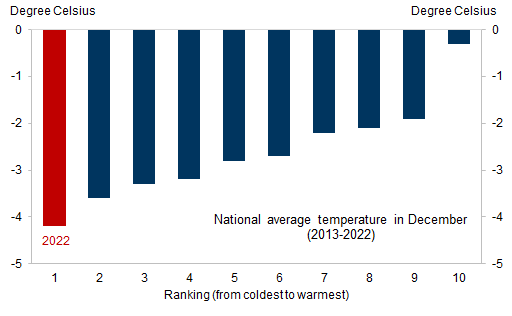

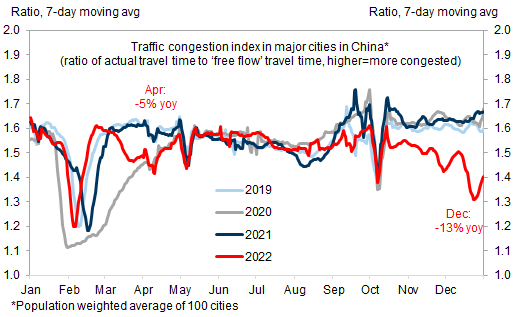

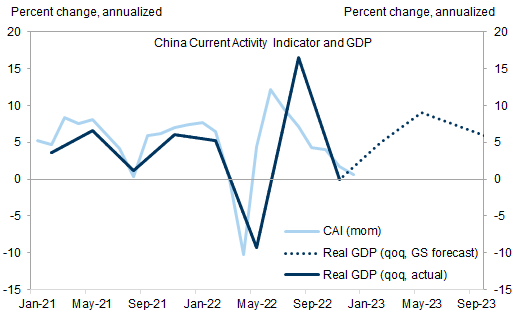

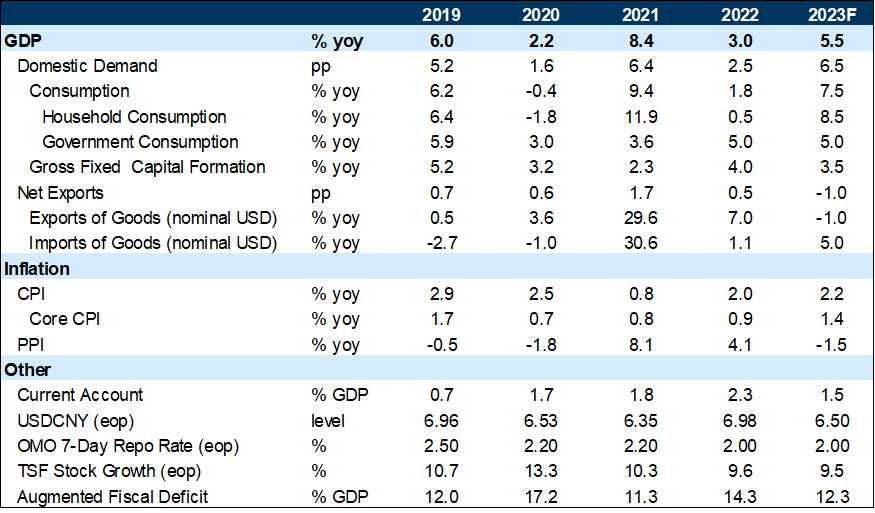

China's December activity and Q4 GDP data were big upside surprises. While many patterns in the detailed data make intuitive sense (e.g., sharply rising medicine demand amid surging Covid cases), the monthly and quarterly headline numbers appear stronger than high-frequency data and other official measures. Nonetheless, we recently adjusted our 2023 real GDP growth forecast to 5.5% (from 5.2% previously) after incorporating the Q4 official data and benchmarking to the faster-than-expected reopening process.

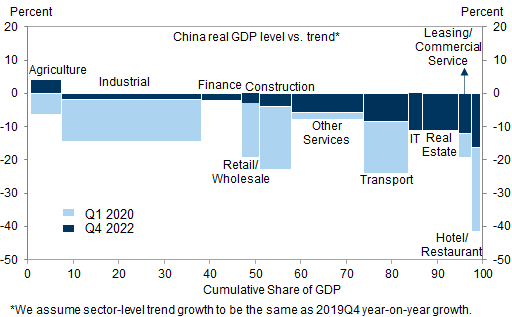

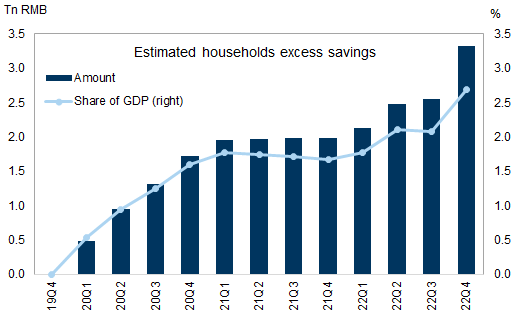

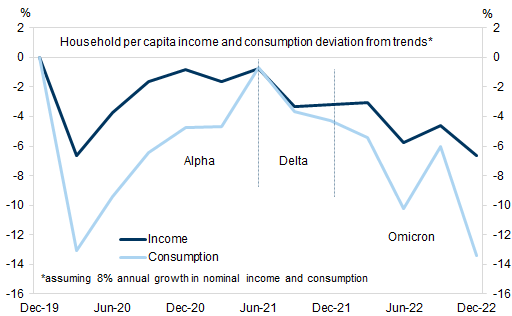

Consumption and property are the two areas where the post-Lunar New Year (LNY) recovery path is most uncertain. On consumption, our 8.5% real household consumption growth forecast this year originates mainly from the fact that household consumption was extremely depressed (on par with 2020Q1 during the national lockdown) on the eve of reopening in 2022Q4. Our baseline projection takes into consideration potential scarring effects of the pandemic and does not assume households tap into their “excess savings” in 2023.

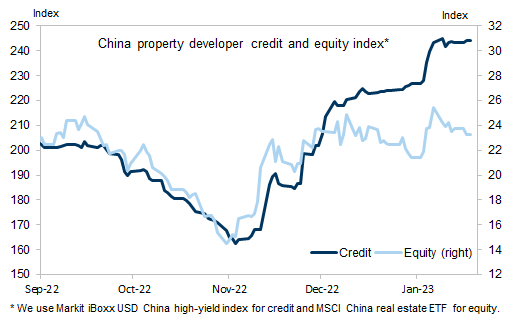

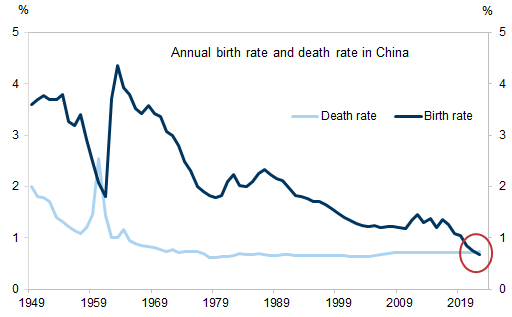

On property, we assume an “L-shaped” recovery. The emphasis of property policy has clearly shifted from developer deleveraging in 2021 to preventing the property slowdown from further damaging the economy and imposing systemic risks. If the post-LNY recovery were to disappoint, we believe policymakers will stand by and ease more. However, the objective is to manage the multi-year slowdown rather than to engineer an upcycle given the challenging long-term demand outlook, as evidenced by the first population decline in 60 years in 2022.

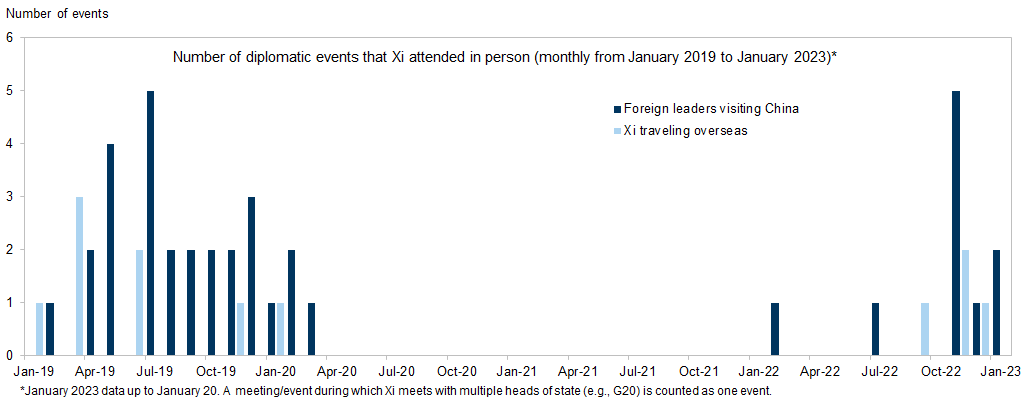

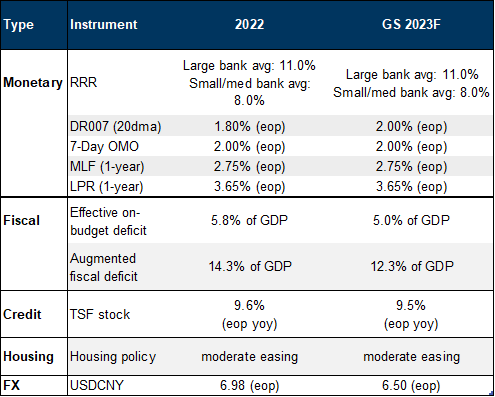

The policy tone has been unmistakably “pro-growth” of late. But pro-growth in this cycle means easing industry-level policies (e.g., property and internet) rather than further monetary and fiscal loosening. On the contrary, we expect monetary and fiscal policy to gradually normalize as reopening boosts consumption and services activity in 2023 after being very accommodative in 2022.

Structurally the Chinese economy still faces multiple challenges, including demographics, debt, and decoupling. Cyclically, however, we believe reopening is in the driver’s seat for Chinese economy and markets in the coming quarters.

What Comes Down Must Go Up

Exhibit 7: We estimate RMB3.3tn excess savings accumulated by Chinese households over the past three years

Exhibit 8: The gap between actual consumption and trend level in 2022Q4 was as wide as in 2020Q1

Exhibit 9: USD China property credit has rallied more than China property equities

Exhibit 10: Chinese population declined for the first time in 60 years on falling birth rate

Appendix

- 1 ^ Our China Current Account Indicator (CAI) measures annualized growth rate using monthly official statistics (see here for more details). The stronger-than-expected December activity data feed into CAI and translate into the better-than-expected CAI shown in Exhibit 6.

- 2 ^ In 2019, nominal income and consumption per capita in the NBS quarterly household survey grew 8.9% and 8.5%, respectively. In Exhibit 8, we assume a trend growth rate of 8% per year in subsequent years. It is possbile that trend growth rate was below 8% in 2020-22 in which case the gap between trend and actual income/consumptoin in 2022Q4 would not be as large as shown in Exhibit 8.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.