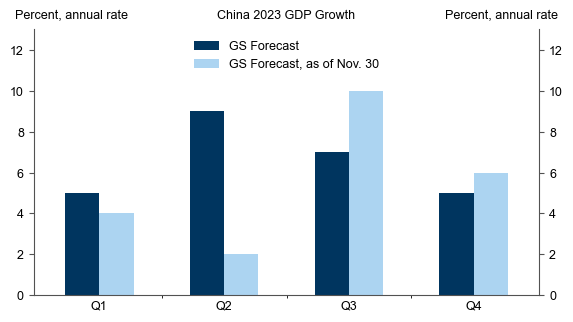

Growth in China is set to accelerate as the country reopens sooner than expected. This rapid reopening will likely generate moderately positive spillovers to global growth in 2023, as well as a more modest boost to global inflation.

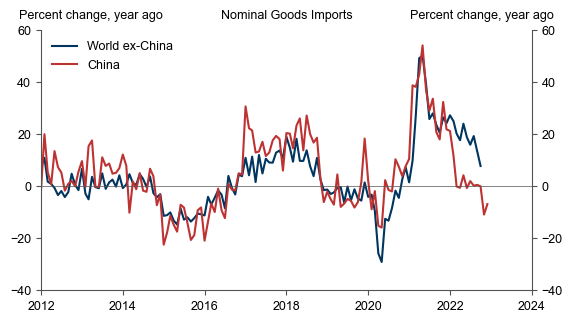

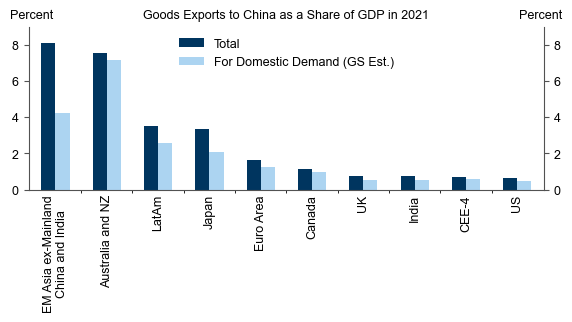

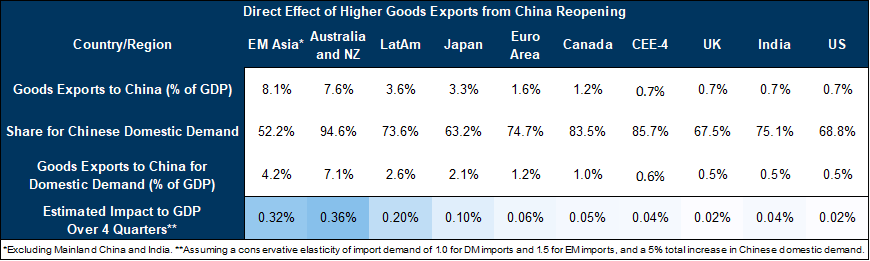

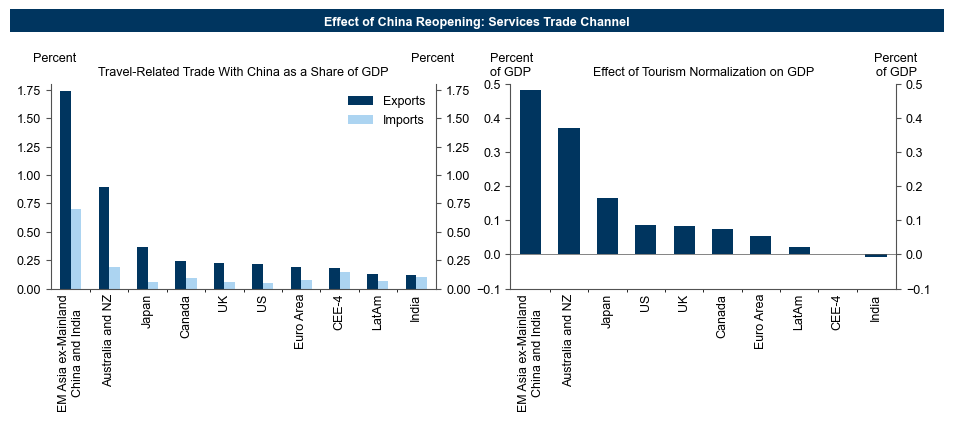

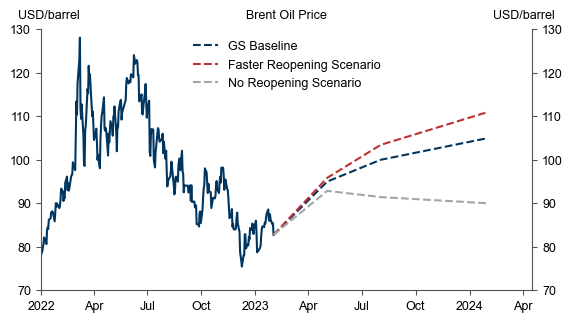

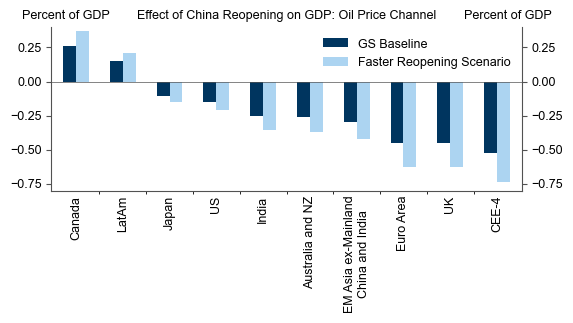

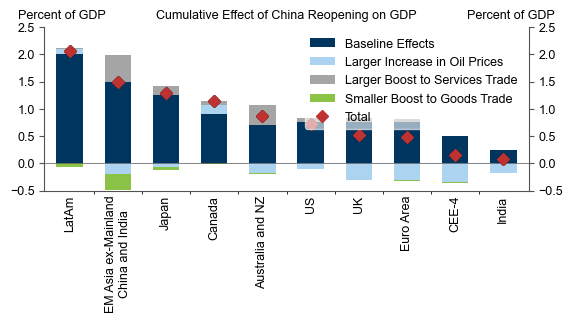

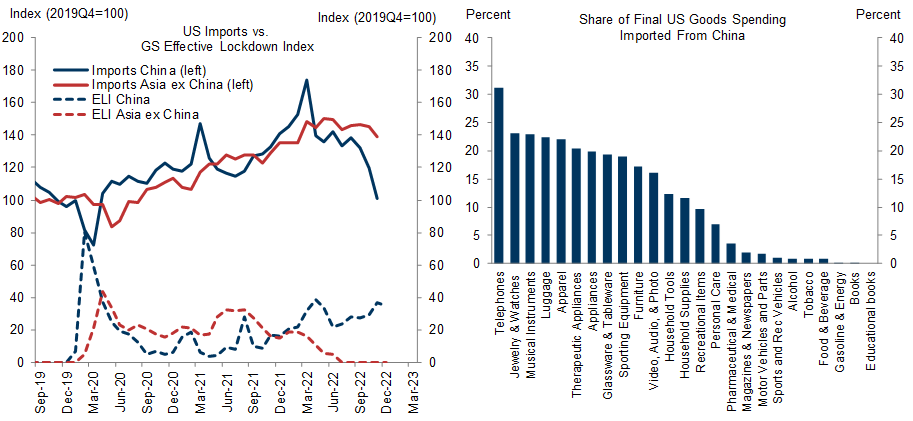

There are three direct channels through which China’s reopening will likely impact global growth. First, increased domestic demand in China—to the tune of a 5% increase—should boost goods exports from other economies, although this growth boost should prove modest outside of Asia-Pacific economies. Second, a recovery in demand for foreign services—particularly for international travel—should provide a modest boost to global growth as well. Third, higher oil demand will benefit oil exporters, but higher oil prices will likely weigh on real income and growth in other economies.

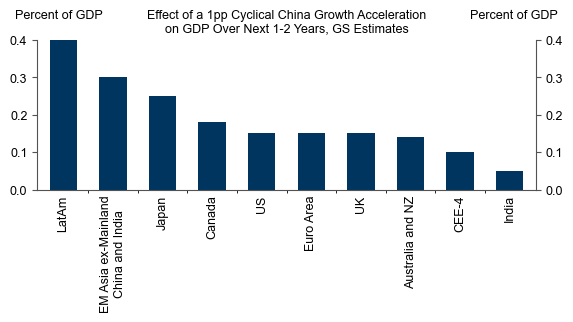

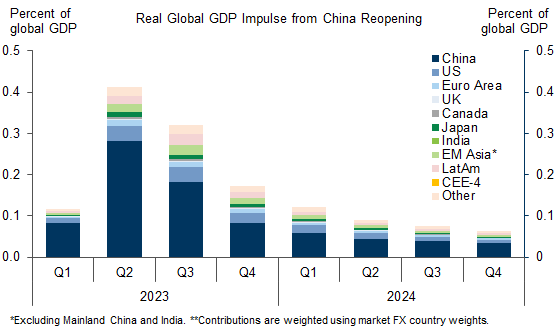

Second-round spillovers should also provide a meaningful growth boost, since standard top-down estimates suggest that each 1% increase in China GDP raises broader global growth by 0.2pp. After adjusting these elasticities to incorporate the factors unique to China’s current reopening, we estimate that the full recovery in Chinese domestic demand should raise global GDP by around 1% through end-2023, with a smaller boost extending into 2024.

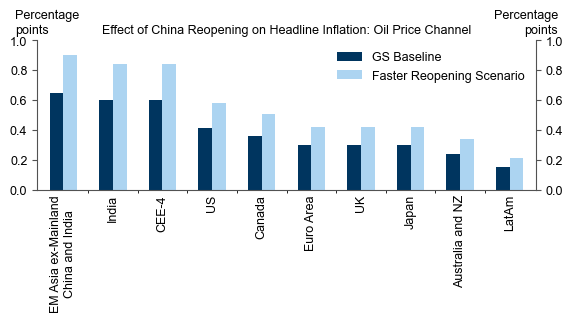

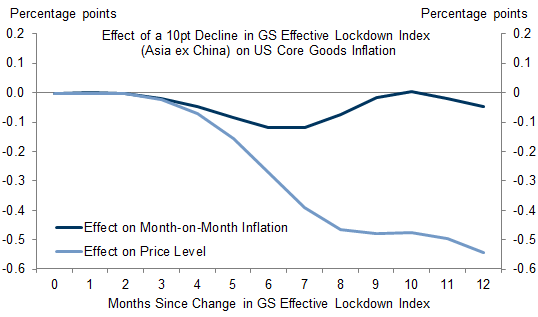

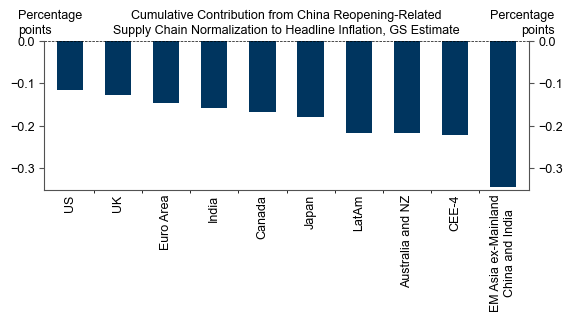

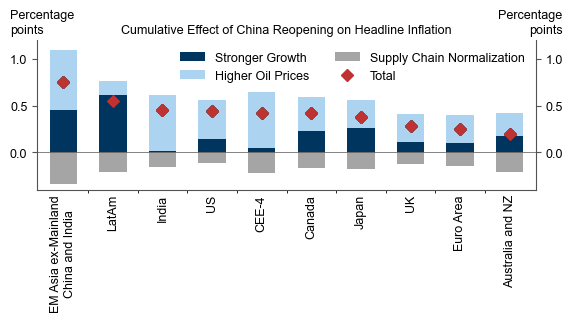

We also anticipate that China’s reopening will boost global inflation. Supply improvements from China’s reopening should lower US core inflation by around 0.1pp, but this core inflation drag will be mostly offset by a boost from higher aggregate demand, and—according to our commodity strategists’ oil price estimates—the full effect of China reopening could raise US headline inflation by ½pp. We similarly estimate that China’s reopening will moderately boost headline inflation in most other economies.

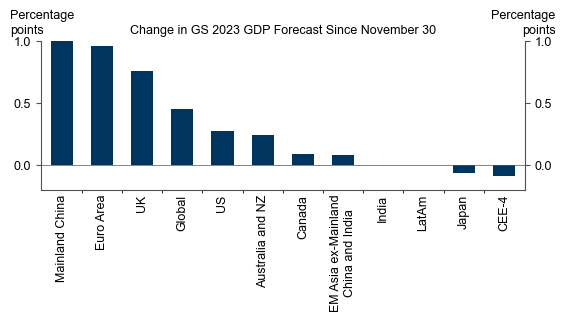

These effects are now fully incorporated into our economic forecasts. Most notably, since the publication of our outlook in November, our global growth forecast for 2023 has increased by 0.5pp to 2.3%, and the more aggressive reopening pace in China is one important reason why our GDP forecasts are well above consensus in most major economies.

The Boost to Global Growth and Inflation From China’s Reopening

Direct Effects on Growth

Channel #1: Core Goods Trade

Channel #2: International Travel

Channel #3: Commodity Demand

Sizing the Overall Growth Impulse

Effects on Inflation

Upside to Global Growth and Inflation

Joseph Briggs

Devesh Kodnani

Appendix: Recent Coverage of China's Reopening From Our Regional Economics Teams

Team | Publication |

EM Economics | EM Macro Navigator: China's Reopening—How Much of a Lift to EM?, 23 January 2023. Key finding: Spillovers from China's growth will be mostly positive, especially for Asia, with trade effects outweighing higher commodity prices and limited potential for supply-side disruptions. |

Europe Economics | European Economics Analyst: Spillovers From China's Reopening, 16 January 2023. Key finding: China's earlier reopening should boost European growth noticeably this year, accounting for roughly one-third of our recent 0.6pp growth upgrade in the Euro area, and is thus a key reason why we no longer expect a Euro area recession. |

Asia Economics | Asia in Focus: Sizing the Regional Trade Boost From China's Reopening, 19 January 2023. Key finding: Potential upside for regional trade could be sizable, particularly in the tech and auto sectors which were disproportionately impacted by pandemic disruptions. - Asia Economics Analyst: The Impact of China's Reopening on Other Regional Economies, 11 December 2022. Key finding: Hong Kong looks posed to benefit the most from China's reopening, followed by Thailand, Singapore, and Malaysia, with higher tourism contributing disproportionately. |

Japan Economics | Japan Economic Flash: Tightening FCI vs. Improving Global Climate: We Trim Our 2023 Japan Growth Forecast, 27 January 2023. Key finding: Tighter financial conditions and weaker consumption resulting from higher covid-19 infections should lower growth by as much as 0.7pp, but the growth boost from China's reopening and firmer European growth should offset roughly 80% of this negative impulse. |

Australia and New Zealand Economics | Australia and New Zealand: Energy Intervention and China Reopening Risks in Focus, 15 December 2022. Key finding: China's faster reopening pace provide 0.1-0.2pp of upside risk to ANZ GDP growth, but effects on goods exports should be more muted than usual due to a likely goods-to-services rotation in China. |

CEEMEA Economics | CEEMEA in Focus: Impact of China Reopening on CEEMEA — Meaningful but Mostly Indirect, 20 January 2023. Key finding: China's faster reopening should be a positive for CEEMEA growth, with second-round trade effects from stronger activity in Western Europe disproportionately contributing in CEE-4, but the growth impulse could turn negative if oil prices rise by at least 10%. |

LatAm Economics | Latin America Economics Analyst: China's 'Zero-Covid' Exit: A Potential LatAm Entry Into Higher Growth Path, 27 January 2023. Key finding: China's reopening is likely to have a mild-to-moderate positive impact on growth in LatAm economies (especially in net oil exporters), providing support for our already above-consensus growth forecasts. |

- 1 ^ We previously found that the sensitivity of real exports to real GDP generally ranged between 1.0 to 3.0 from since 2000, approaching 1.5 in years leading up to the pandemic. Separately, as part of this piece, we estimate an average elasticity of Chinese goods imports to GDP of 2.6 for EMs and 1.7 for DMs. We judgmentally adjust these estimates downward to 1.5 and 1.0 respectively to reflect lower global slack in activity and a likely goods-to-services rotation as Chinese demand recovers.

- 2 ^ China’s travel trade deficit remained somewhat elevated because travel imports also include tuition payments by overseas students and other items.

- 3 ^ For the outlook of the tourism rebound in Thailand, for example, our 2023 ASEAN outlook has more detailed estimates.

- 4 ^ Market forwards, unlike our commodity strategists' estimates, do not imply a large increase in oil prices this year. In this piece, we only consider the estimated incremental impact of China's reopening on oil prices, which is agnostic to the ultimate level of oil prices.

- 5 ^ See, for example, IMF research note Furceri, Jalles, and Zdzienicka (2017).

- 6 ^ For EM economies, we use our existing estimate that each 1pp increase in the output gap increases inflation by 0.3pp. For DM economies, we combine our US Okun’s law coefficient relating changes in GDP growth to changes in the unemployment rate of 2 and our estimated Phillips curve coefficient of 0.1 to produce an overall coefficient relating changes in growth to changes in inflation of 0.2.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.