Global Views: Receding Recession Risk

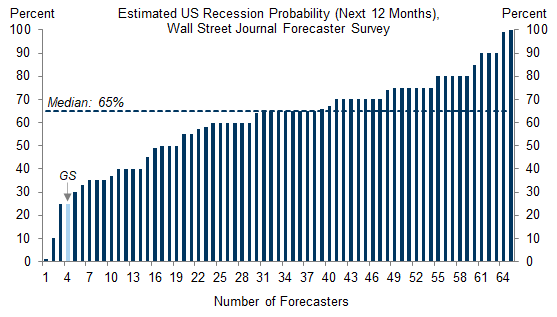

1. We have cut our subjective probability that the US economy will enter a recession in the next 12 months from 35% to 25%, less than half the 65% consensus estimate in the latest Wall Street Journal survey. Continued strength in the labor market and early signs of improvement in the business surveys suggest that the risk of a near-term slump has diminished notably. And while Q1 GDP still looks soft—our latest tracking estimate is +0.4%—we expect growth to pick up in the spring as real disposable income continues to increase, the drag from tighter financial conditions abates, and faster growth in China and Europe supports the US manufacturing sector.

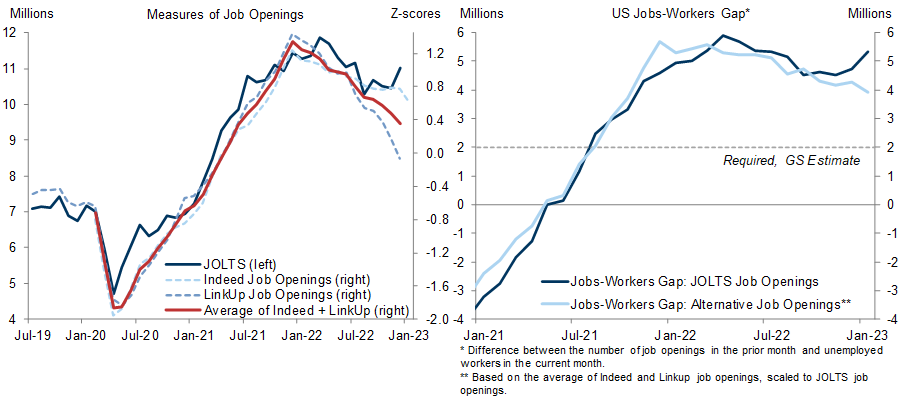

2. Even our revised 25% estimate is above the unconditional probability that the US economy will enter a recession in any given 12-month period, which has historically averaged 15%. The main reason is that the rebalancing of the labor market remains incomplete. That said, we would heavily discount the latest JOLTS report—which implies a jobs-workers gap of nearly 5½ million—because it is so far out of line with timelier indicators. Averaging job openings as measured by LinkUp and Indeed at the end of January implies a jobs-workers gap of 4 million, halfway between the 6 million peak of early 2022 and the 2 million pre-pandemic level that we think is compatible with the Fed’s 2% inflation target. (On a similar note, the latest quits rate is about halfway between the peak of late 2021 and the pre-pandemic level.)

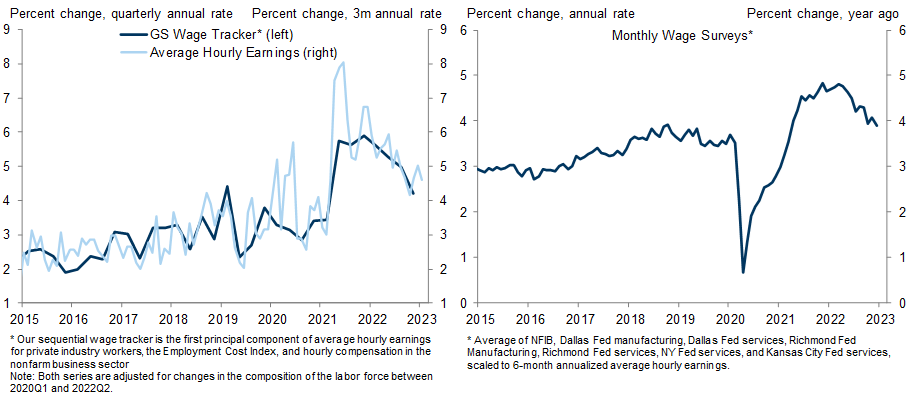

3. The wage slowdown also suggests that the labor market is rebalancing more quickly than suggested by JOLTS job openings. With the Q4 employment cost index as well as January average hourly earnings in hand, we estimate that the sequential trend in nominal wage growth has fallen to about 4¼%. Our monthly wage survey indicator implies a similar number. This means that wage growth has fallen nearly two-thirds of the way from the 5½% peak seen in early 2022 to the 3½% pace that we think is compatible with the Fed’s 2% inflation target.

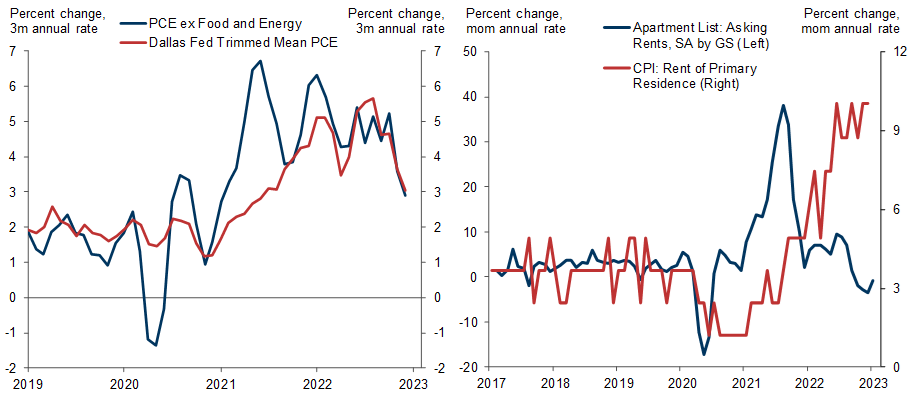

4. Progress on price inflation has been particularly rapid in recent months. Over the past three months, core PCE inflation—whether measured by trimmed-mean PCE or ex-food and energy PCE—has averaged about 3% at an annual rate, which is more than two-thirds of the way from the 5%+ peak of mid-2022 to the Fed’s 2% target. It is true that part of this deceleration reflects the temporary impact of healing supply chains in the consumer durables sector, which will end at some point. But the resulting upward pressure on inflation is likely to be (more than) offset by downward pressure from the large deceleration in rent and owners’ equivalent rent inflation implied by timelier measures of asking rents on new leases.

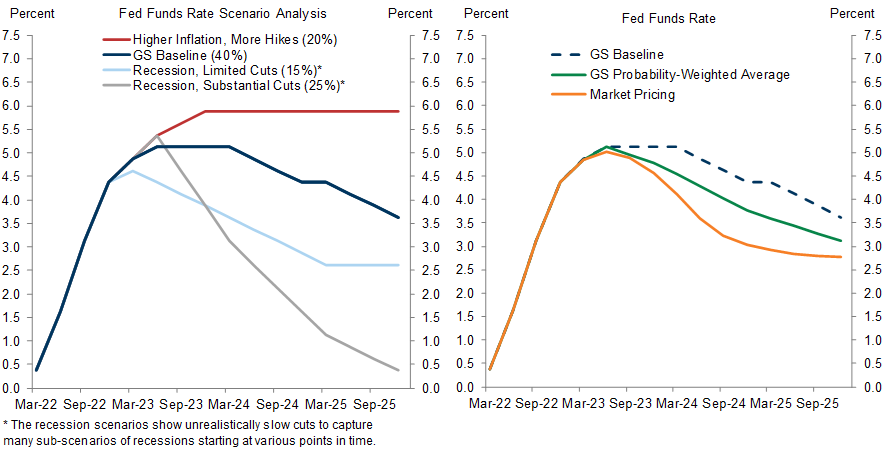

5. Taken together, these observations support not only Chair Powell’s optimism that a soft landing is achievable but also his insistence that the Fed’s job is not yet done. Our baseline forecast calls for 25bp hikes at the FOMC meetings in March and May, followed by about a year of unchanged rates at 5-5¼%. Our probability-weighted path for the funds rate—which incorporates the downward revision in our near-term recession probability—thus remains above market pricing.

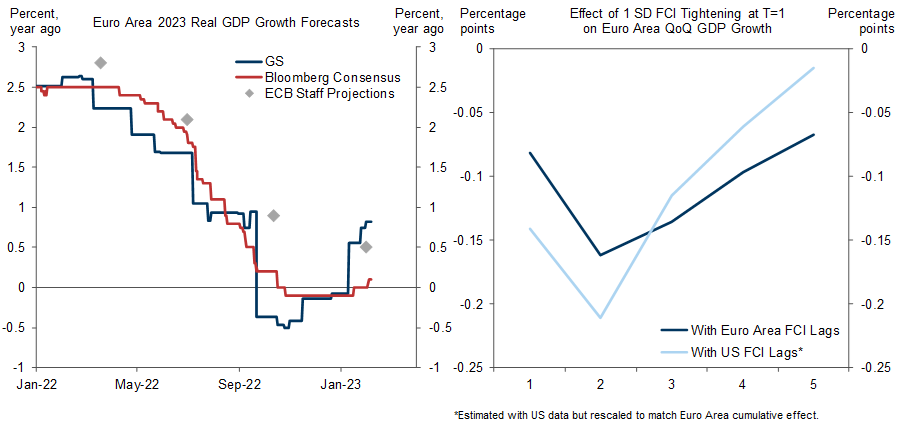

6. The latest data support our no-recession forecast in the Euro area, with Q4 GDP printing a better-than-expected +0.1% (qoq not annualized) and the business surveys improving further. But we only expect a gradual improvement, in part because the impact of tighter financial conditions on growth is more backloaded than in the US. The inflation outlook is also improving at a slower pace than in the US, with headline now falling quickly but core inflation and wage growth still rising on a year-on-year basis. On net, we think the outlook remains consistent with our call that the ECB will deliver a 50bp hike in March followed by a final 25bp hike in May to a terminal rate of 3.25%, close to market pricing.

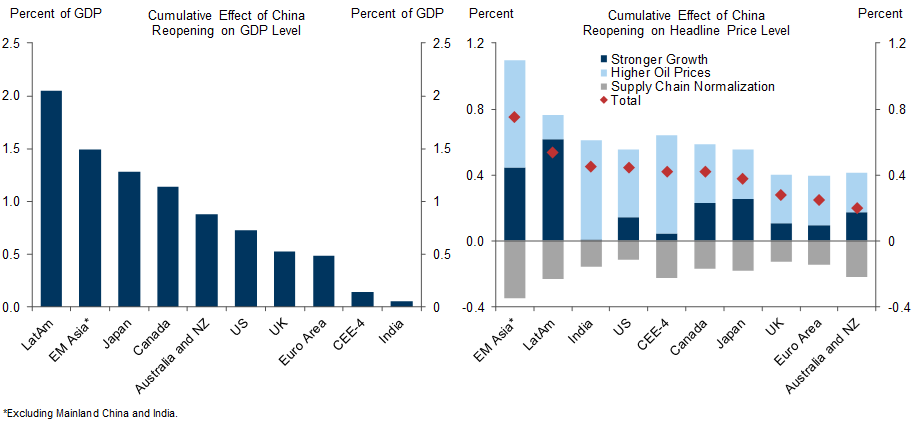

7. Growth in China has already started to accelerate sharply, with a jump in our current activity indicator to 8.1% in January on the back of stronger service PMIs. If February and March show additional gains, as we expect, consensus GDP growth forecasts for China are likely to continue climbing; our 2023 estimate is 5.5% in annual-average terms and 6.5% in Q4/Q4 terms. Growth outside of China is also likely to benefit, especially in commodity-exporting economies as well as Asian economies popular with Chinese tourists. On the price side, we expect mixed effects on global core inflation as supply chain normalization and stronger growth largely cancel out, but positive effects on global headline inflation because of higher oil prices.

8. At a broad level, the combination of stronger growth and lower inflation should support cyclical assets. However, our strategists think the upside is somewhat capped. Equity valuations are high in both absolute and relative terms (especially in the United States), spreads are already quite tight, profit margins are elevated, and our short-term and long-term interest rate forecasts are at or above the forwards across the major markets. From an economic perspective, the flip side of a soft landing at high employment levels is less room for a strong rebound. That limits the room for large asset market gains.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.