The FOMC raised the funds rate by 25bp today to 4.75-5%, against our expectation of a pause, but projected a weak economic outlook for the rest of 2023 and a more cautious path for the funds rate than Chair Powell had indicated was likely before the recent banking turmoil. Powell said that tighter credit conditions are likely to weigh on economic activity and might substitute for one or more rate hikes, but he was quick to note that the FOMC could reevaluate as it learned more about the impact of recent events.

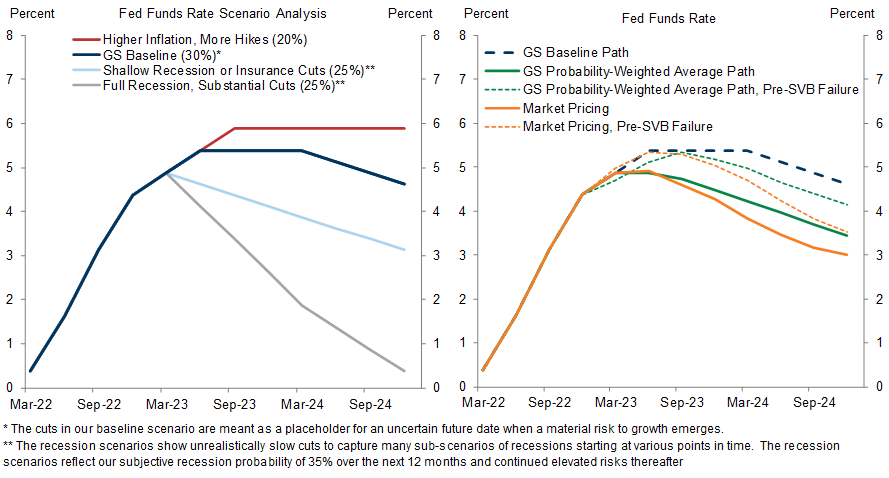

We also expect stress on small and midsize banks to result in a tightening of lending standards, which we estimate will impose a ¼-½pp drag on GDP growth, equivalent to the impact of 25-50bp of rate hikes. While we also think that the pressure on banks has raised the odds of a more serious downside scenario, our baseline economic forecast is stronger than the FOMC’s.

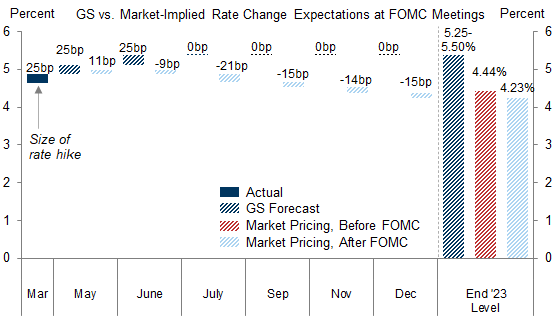

We have left our forecast for the peak funds rate unchanged at 5.25-5.5% and now expect additional 25bp rate hikes in May and June. Our baseline forecast is 25bp above the FOMC’s forecast of 5-5.25%, and our weighted-average path for the funds rate is above market pricing.

March FOMC Recap: Tighter Credit Can Substitute for Rate Hikes

David Mericle

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.