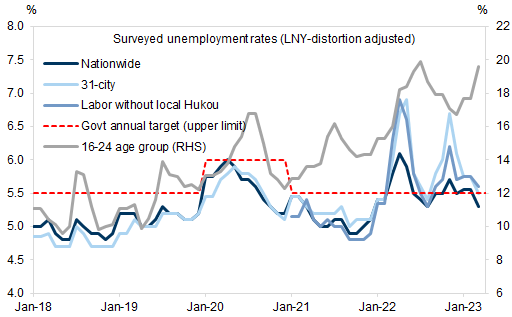

Nationwide: 5.3% in March, vs. 5.6% in January-February (5.5% in January and 5.6% in February).

31 major cities: 5.5% in March, vs. 5.8% in January-February (5.8% in January and 5.7% in February).

Floor space sold: -3.5% yoy in March, vs. January-February: -3.6% yoy (value of sales: +6.3% yoy in March, vs. January-February: -0.1% yoy).

Floor area under construction: -5.2% yoy in March, vs. January-February: -4.4% yoy.

New home starts: -29.0% yoy in March, vs. January-February: -9.4% yoy.

New home completions: +32.0% yoy in March, vs. January-February: +8.0% yoy.

Real estate investment: -5.9% yoy in March, vs. January-February: -5.7% yoy.

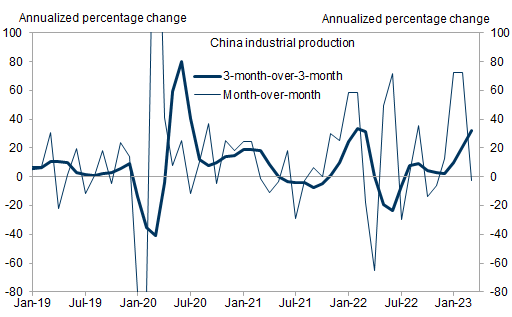

Exhibit 1: Industrial production declined sequentially in March from January-February

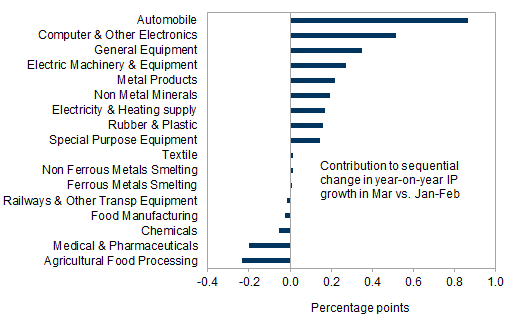

Exhibit 2: Output of automobiles, telecom & electronics and general equipment contributed the most to the IP year-on-year growth acceleration in March from January-February

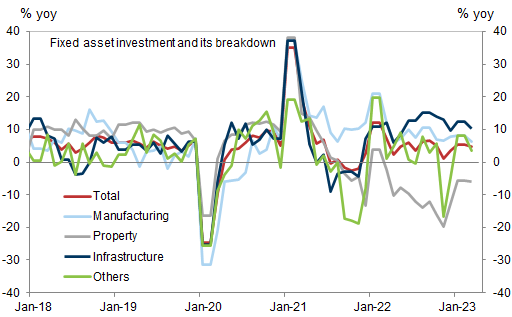

Exhibit 3: Year-on-year FAI growth slowed in March from January-February, with weakness broadly based and led by services-related investment

Exhibit 4: Nationwide surveyed unemployment rates moderated seasonally in March from January-February, while the youth unemployment rate rose further

- 1 ^ Our estimate for infrastructure FAI is based on a GS definition, which includes not only the three sectors under the NBS classification (i.e., transportation, storage & postal service; water conservancy & environmental protection; and electricity, gas & water production and supply), but also four more industries that provide public goods mainly by the government sector (e.g., scientific research & polytechnic service; education; healthcare, social security & welfare; and culture, sport & entertainment).

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.