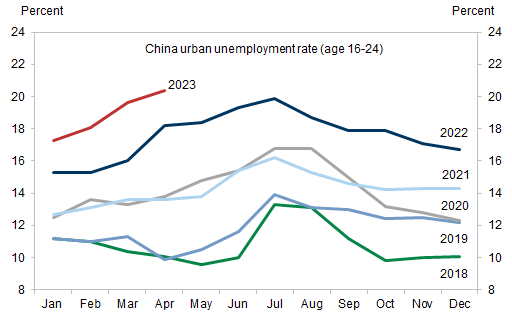

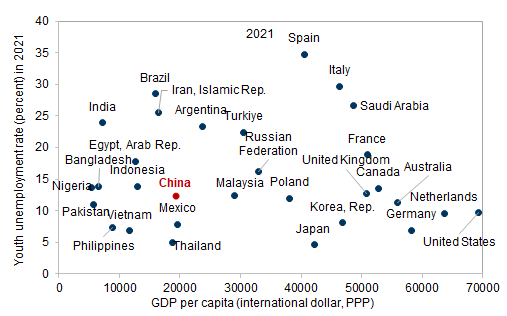

China’s youth unemployment rate (16-24 year olds) rose to 20.4% in April, despite a tick lower in the overall urban unemployment rate in April. Cross country experiences suggest youth unemployment rates tend to be higher than overall unemployment rates as this group appear particularly vulnerable to economic downcycles, likely due to a lack of experience. In this note, we examine potential drivers of China’s high youth unemployment rate.

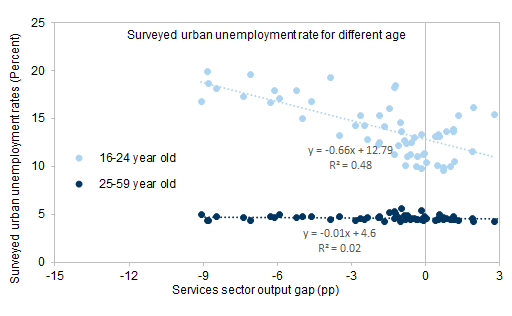

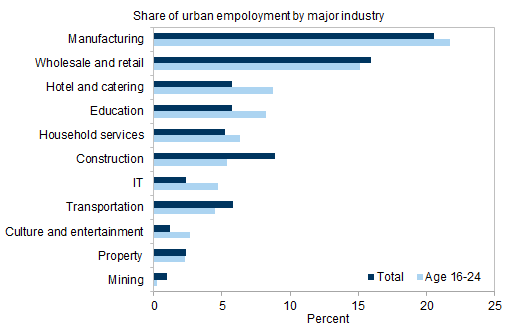

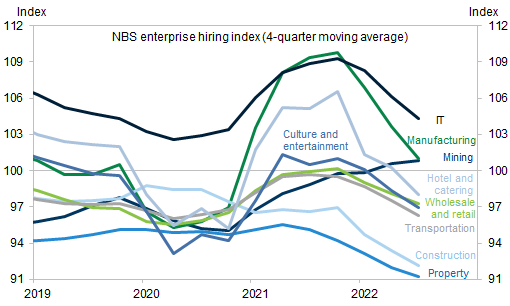

We think both cyclical and structural factors have contributed to the elevated youth unemployment rate in China. On the cyclical front, the correlation between unemployment rate and services sector output gap is much stronger for the 16-24 age group compared with the 25-59 year-olds. NBS’s labor survey shows that services industries such as hotel and catering, education, and information technology sectors tend to hire more young workers. Services sector slackening before reopening therefore contributed to the high youth unemployment rate. The improvement in service sector activity growth in Q1 should lower youth unemployment rate in Q2 by 3pp based on our estimate. While the improvement in service activity growth implies rising demand for young workers, this increase in demand could be more than offset by strong supply seasonality. As we enter the graduation season, youth unemployment rate could rise by 3-4pp and peak in summertime (usually in July or August) before starting to decline from end of Q3, if we look at the seasonal pattern in 2018 and 2019 (prior to Covid).

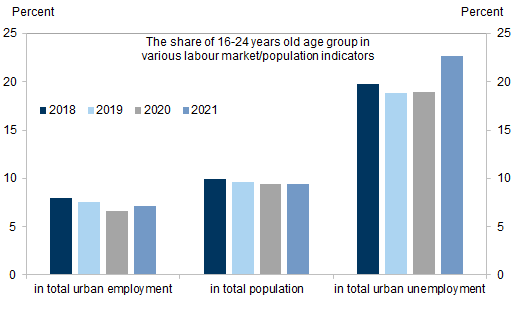

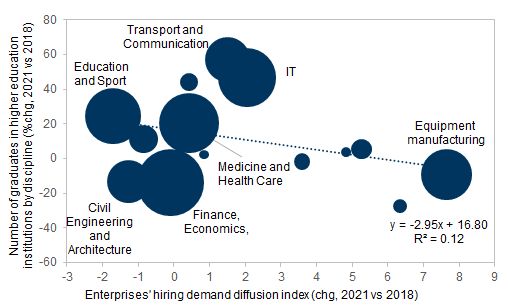

Structural imbalance is another reason behind the high youth unemployment rate. Despite the fact that a rising share of unemployed persons aged 16-24 years old have higher education, there appears to be misalignment of academic disciplines with business requirements. For example, the number of graduates from vocational schools who majored in education and sports rose by more than 20% in 2021 vs 2018, but hiring demand of education industry weakened meaningfully during the same period. Regulation changes over the past few years likely contributed to the weakening of labor demand in sectors such as Information Technology, Education and Property, which tend to hire more young workers. Skillset mismatches can only be dealt with gradually and might be a factor that contributes to high youth unemployment rate in the next few years.

We might see youth unemployment continuing its upward trend in the next few months on the back of strong supply seasonality despite government policies to create more jobs for graduates. Promoting further recovery of the services sector while exploring ways to reduce misalignment between discipline and business requirements seems key to reduce the youth unemployment rate over the medium term.

Why has youth unemployment risen so much in China?

Exhibit 1: Youth unemployment rate continued to climb in the first four months of the year despite China’s post-reopening recovery

Exhibit 2: According to International Labor Organization’s data, China’s 15-24 age group unemployment rate was not really an outlier relative to other countries in 2021

Exhibit 4: Youth unemployment rate demonstrated bigger cyclical pattern than unemployment rate for 25-59 age group

Exhibit 5: Hotel and catering, education, household services industries tend to hire more 16-24 year-old employees

- 1 ^ We estimate the output gap of the services sector by looking at the difference between actual performance of the service production index, after SA, and our estimate of the trend level of services output. We apply HP filter to estimate trend before 2019, and roll the trend level series forward through 2023 by assuming the trend growth rate from 2020 to 2023 decelerates by around 0.5pp per year vs the growth rate in 2019. We also tried to include output gap of the manufacturing sector in the analysis, but it is not significant.

- 2 ^ We look at vocational schools’ data as the Ministry of Education provides more comprehensive data on vocational schools’ disciplines. Graduates from vocational school take around 40% in total graduates from higher education institutions.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.