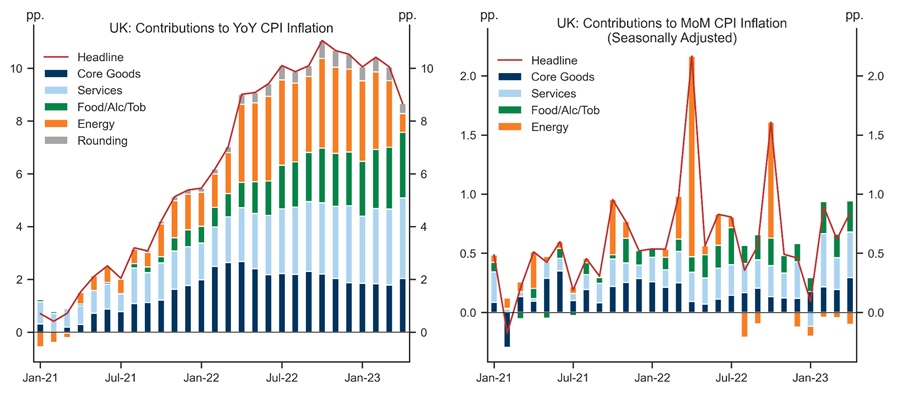

The April inflation print delivered yet another upside surprise on the back of a broad-based re-acceleration in core pressures. In this Analyst, we take stock of inflationary pressures across the major inflation components and update our outlook for UK inflation.

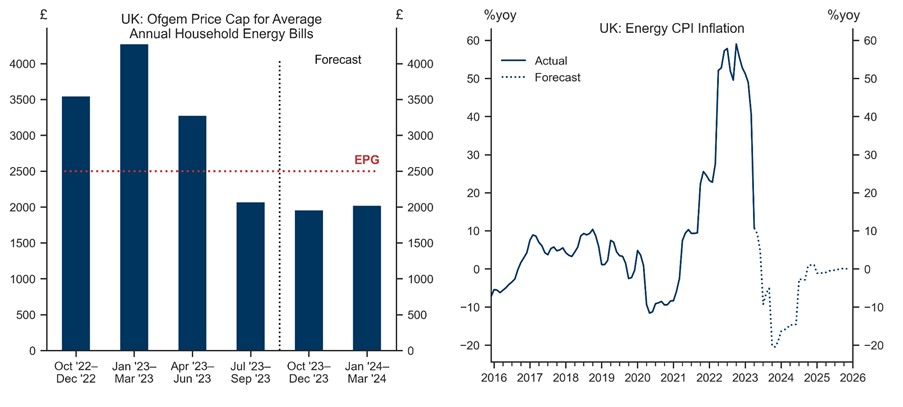

Starting with energy, electricity and gas prices have continued to decline in recent weeks and household energy bills are set to decline by 17% in July. Taken together with the expectation of energy bills remaining broadly flat thereafter (based on latest energy forward curves), energy inflation should decelerate sharply in H2, especially in year-over-year terms.

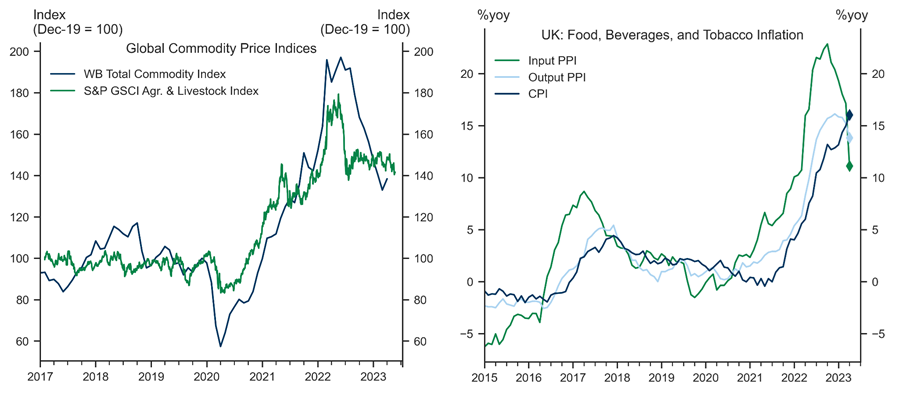

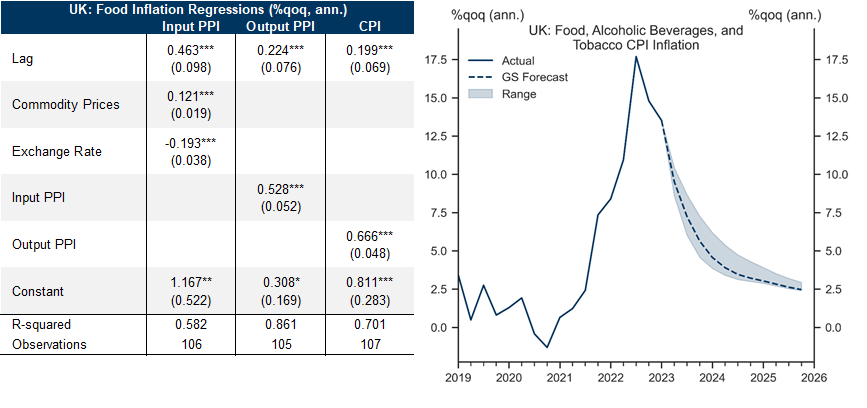

Food inflation, on the other hand, remains at record levels and has shown limited signs of slowing so far. Our analysis suggests that this strength in food inflation has largely been due to high input costs being faced by food producers as supply bottlenecks, the conflict in Ukraine, and adverse weather shocks pushed up energy and agricultural commodity prices sharply higher. More recently though, commodity and energy prices have declined, and this has been accompanied by a meaningful decline in food input PPI. Going forward, we therefore expect sequential food inflation to moderate, albeit at a more gradual pace.

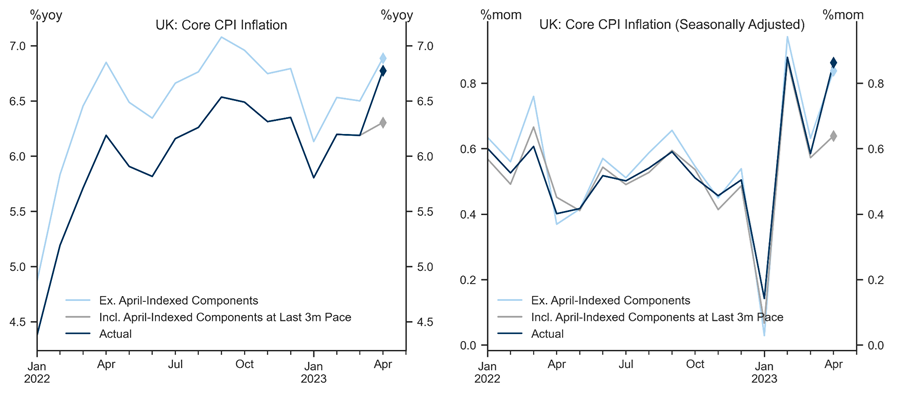

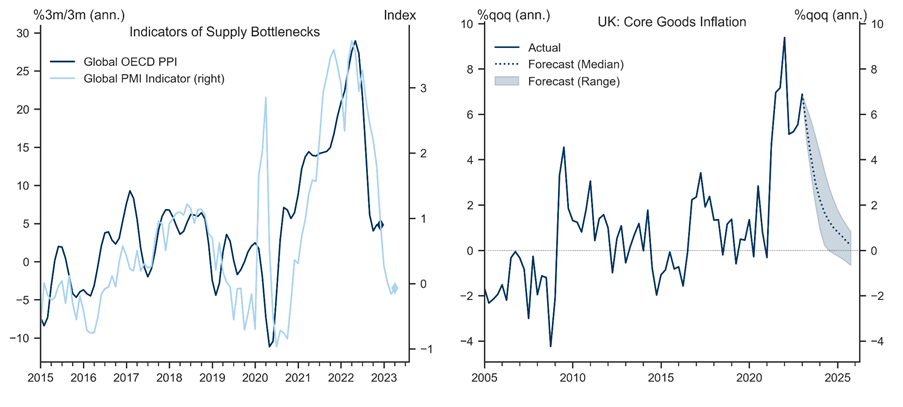

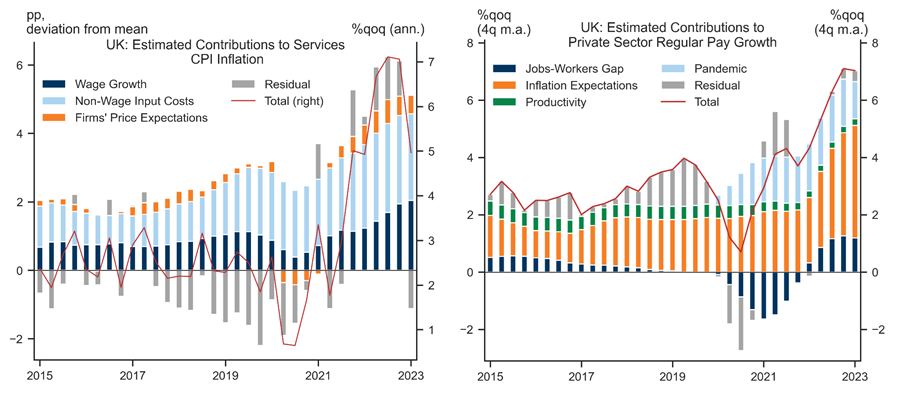

Turning to core inflation, indicators of global supply constraints have eased notably recently and point towards a slowing in core goods inflation going forward. That said, we also find that sequential core goods pressures have historically tended to be very sticky, which suggests that near-term goods inflation may remain elevated for a while. We expect services inflation to stay elevated for longer, however, largely because we remain concerned about wage growth not cooling sufficiently and sustainably over the medium term.

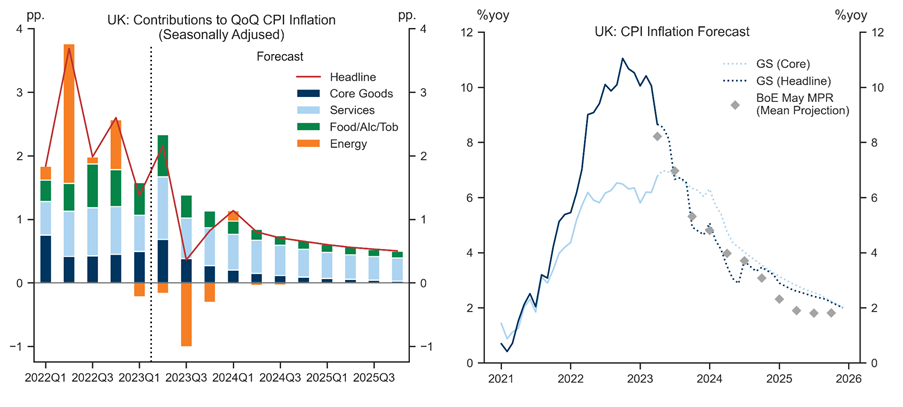

Taken all together, we revise up our core inflation forecast further, and now expect core inflation at 6.0%yoy (vs 5.6%yoy previously) in December 2023 and at 3.3%yoy (vs 2.9%yoy previously) in December 2024. Taken together with a lower energy price cap forecast but a more gradual decline in food inflation, we keep our end-2023 headline inflation projection unchanged at 4.7%yoy but revise up our end-2024 headline inflation projection to 3.2%yoy (vs 2.7%yoy previously).

Our analysis reinforces our view that resilient growth, a tight labour market, and persistent inflationary pressures will convince the MPC to deliver significant additional tightening. We maintain our forecast of two further 25bp hikes at the upcoming June and August meetings for a terminal policy rate of 5%, but see risks to our terminal rate forecast as skewed to the upside.

UK Inflation—Higher for Longer

Energy Inflation

Food Inflation

Core Goods Inflation

Services Inflation

Pulling It All Together

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.