Global Views: Lower Risks, Higher Rates

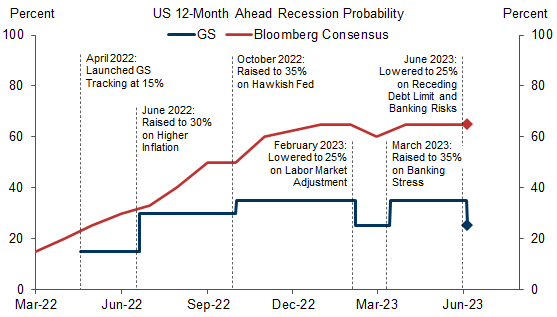

1. We have cut our judgmental probability that the US economy will enter a recession in the next 12 months back to 25%, undoing our upward revision to 35% shortly after the SVB failure. There are two reasons for this change. First, the tail risk of a disruptive debt ceiling fight has disappeared. The bipartisan budget agreement to suspend the debt limit will result in only small spending cuts that should leave the overall fiscal impulse broadly neutral in the next two years. Second, and more importantly, we have become more confident in our baseline estimate that the banking stress will subtract only a modest 0.4pp from real GDP growth this year, as regional bank stock prices have stabilized, deposit outflows have slowed, lending volumes have held up, and lending surveys point to only limited tightening ahead. Meanwhile, the economy is getting a sizable boost from the recovery in real disposable income and the stabilization in the housing market. This leaves us with a 2023 growth forecast of 1.8% (annual average), well above both the private-sector consensus and the Fed’s view.

2. Will the Fed ultimately need to generate a recession to bring inflation back to the 2% target? We agree with Ben Bernanke and Olivier Blanchard that the key issue to watch is whether the labor market can rebalance smoothly. Most of the news in this regard has been positive. Although nonfarm payrolls grew another whopping 339k in May, the unemployment rate actually edged up 0.26pp to 3.65% because of a decline in self-employment. For over a year, the US economy has found ways of creating large numbers of jobs while keeping the unemployment rate very close to its pre-pandemic level of 3½%. Once again, we note that this cycle is different.

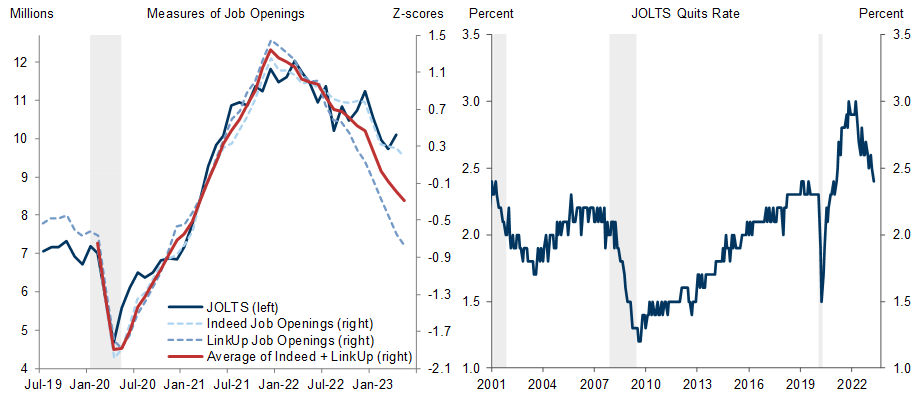

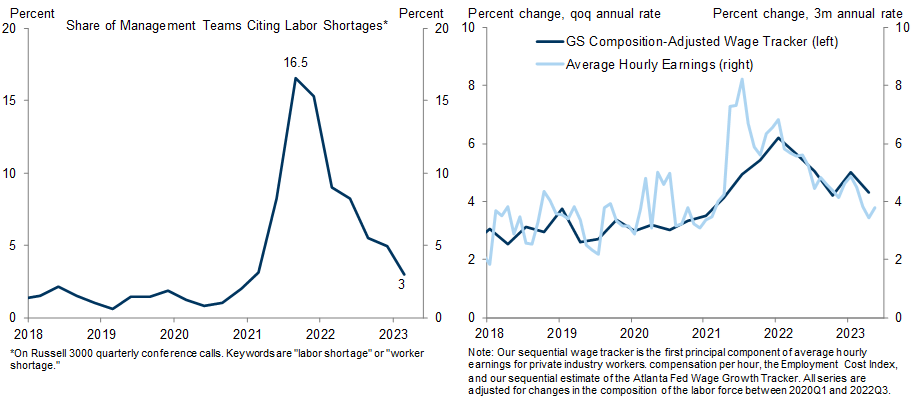

3. Meanwhile, broader measures of labor market overheating continue to improve. First, although the JOLTS measure of job openings showed a surprise increase to 10.1 million in April, the private-sector measures from LinkUp and Indeed declined further in April and May. Second, the quits rate has returned to the top end of the pre-pandemic range. Third, the share of Russell 3000 earnings calls that mentioned labor shortages fell further to 3.0% in 2023Q1, relative to a peak of 16.5% in 2021Q3. And fourth, both average hourly earnings and our revamped sequential wage tracker have continued to trend down (albeit more slowly than in 2022). Each of our preferred measures of labor market balance has now reversed significantly more than half of its post-pandemic overshoot, but most still have some way to go before they are consistent with 2% inflation.

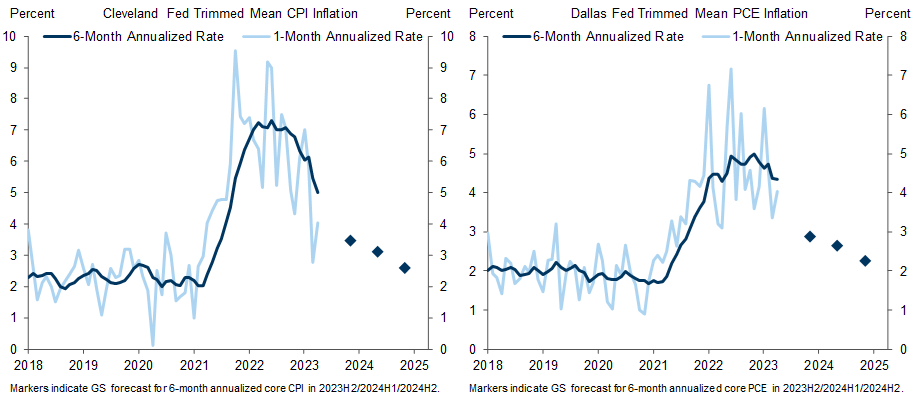

4. What about inflation itself? The bad news is that progress (at least on the core measures) has continued to fall short of expectations. The good news, however, is that deceleration across a broad range of indicators—including statistical measures such as the Cleveland Fed trimmed-mean CPI and the Dallas Fed trimmed-mean PCE—is now a fact, not just a forecast. The prospects for further progress in the second half of 2023 also look good. First, improving supply chains and declining used car auction prices should bring down core goods inflation materially starting in June, following what is likely to be another used car price increase in the May CPI. Second, the news on rent inflation remains encouraging, with signs that seasonally adjusted asking rents fell in May despite the rebound in house prices. And third, the rebalancing in the labor market should bring down core service inflation excluding shelter (although we expect progress to remain only gradual in this category). All told, we expect core PCE inflation to come down to 3.7% by December 2023, with sequential rates averaging 2.9% in H2.

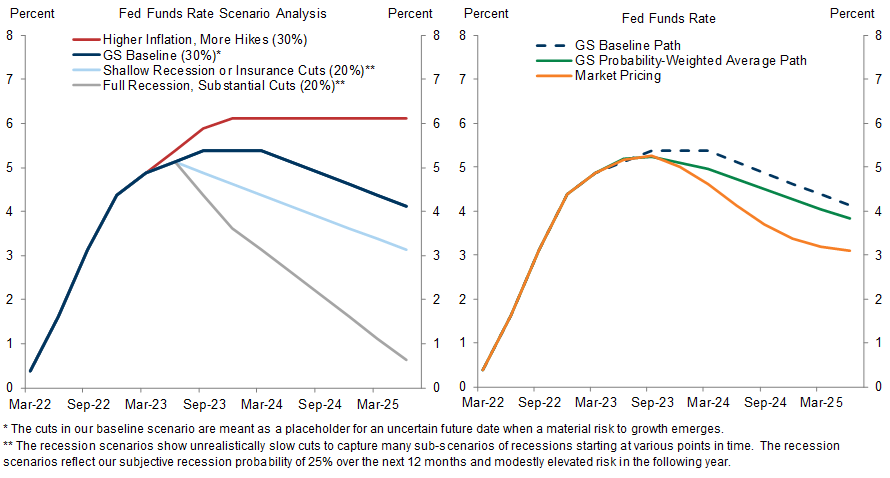

5. While FOMC participants seem divided about the policy decision at the June 13-14 meeting, it generally pays to follow the signals from the leadership. These have been clear, with both Chair Powell and Vice Chair nominee Jefferson indicating a preference to pause. The main question is therefore whether the 339k payroll gain was strong enough to change the leadership’s views. We think the answer is probably no, as the higher unemployment rate, the moderate AHE gain, and the drop in the workweek all cut the other way. However, the leadership seems quite willing to signal additional hikes down the road, potentially via a higher peak rate in the June dot plot. Together with our above-consensus growth forecast, this has led us to add a 25bp hike, most likely in July, which would leave the peak funds rate at 5¼-5½%. Subsequently, we see a long pause of about a year, followed by very gradual cuts. On a probability-weighted basis, we continue to think that the rates market is underpricing the outlook for the funds rate over the next 1-2 years.

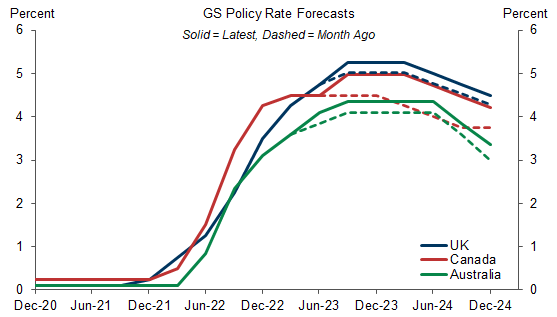

6. Our monetary policy views in other English-speaking countries are also fairly hawkish. We recently added a third 25bp hike to our BoE call and now see a 5.25% peak rate in the UK, as policymakers have been slow to get on top of the highest core inflation rate across all major DM economies. We just added two 25bp hikes in Canada and now see a 5% peak rate there (although we think the odds narrowly favor a pause at this week’s BoC meeting). Last week, we also added a hike in Australia and now see one more move after today's to a peak rate of 4.35% for the RBA. The common theme is that while most of the heavy lifting is done, many central banks are finding that they still have a bit more work to do before monetary policy is at an appropriately restrictive setting.

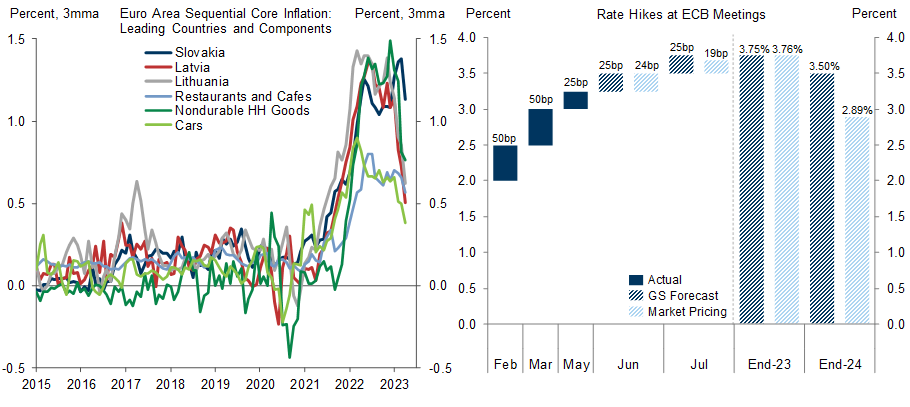

7. The inflation news has been a bit more dovish in the Euro area. To be sure, the sharp slowdown in sequential core HICP inflation to 0.3% in May partly reflects a German public transport subsidy worth 0.12pp, so we expect a reacceleration in June. However, using a broad range of both EA and non-EA indicators, we think the underlying trend is now clearly improving and see a decline in sequential EA core inflation to 0.2-0.25% by the end of 2023. Although we still expect the ECB to deliver two more 25bp hikes—in part because the recent weakness in the industrial sector is likely to reverse—we no longer view the risks to our terminal rate forecast of 3.75% as tilted to the upside.

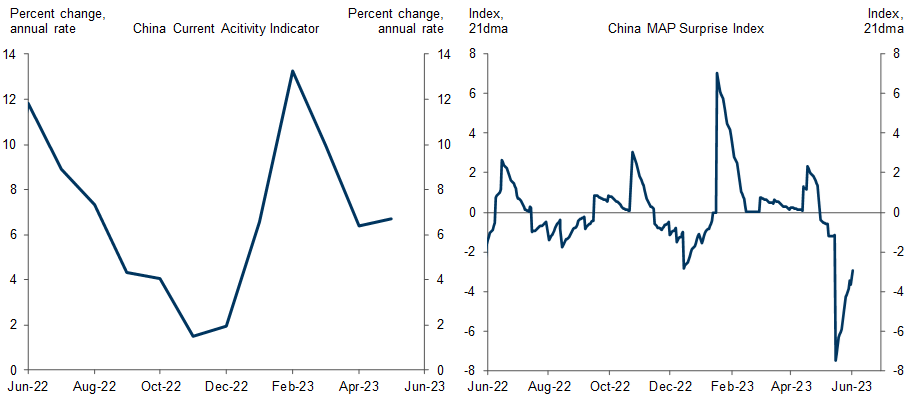

8. Investor views about China remain pessimistic, partly because of skepticism about near-term growth momentum and partly because of worries about the longer-term outlook given weak demographics, downward pressure on the property market, and US-China tensions. We share the longer-term worries but think the skepticism about near-term growth may have overshot. Although the April data did soften significantly, the early May data have looked more encouraging, with the Markit PMIs beating expectations despite weakness in the official PMIs and our current activity indicator stabilizing at a level close to our 6% GDP forecast for the year as a whole. However, the risk is that, without more measures to boost confidence by the government, pessimism among consumers and private entrepreneurs could feed on itself and generate a negative feedback loop.

9. The downgrade to our US recession risk estimate and the upgrades to our policy rate forecasts in the US and other English-speaking countries support our strategists’ forecast of higher DM rates, especially at the shorter end of the yield curve. Risk asset markets may continue climbing the wall of worry as most forecasters and investors still hold overly pessimistic views about the sustainability of the expansion, in our view. That said, the high level of valuations on both an absolute and relative basis likely limits the upside, especially if rates continue to grind higher. Lastly, our oil strategists expect much of the past year’s 35% decline in Brent crude prices to reverse as the expansion in oil supply—which they estimate explains over 80% of the price decline—slows and oil demand holds up better than widely anticipated.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.