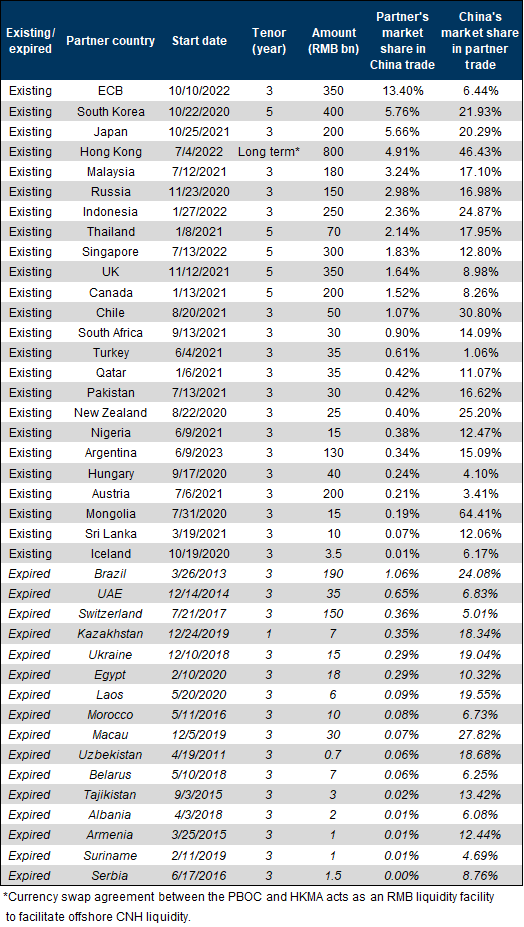

Chinese policymakers accelerated the push for RMB internationalization recently amid increased geopolitical uncertainties. Earlier this year, Brazil and Argentina announced they would allow RMB settlements in trading with China. According to SAFE, in March this year, RMB surpassed the USD for the first time for use in China’s own cross-border payments.

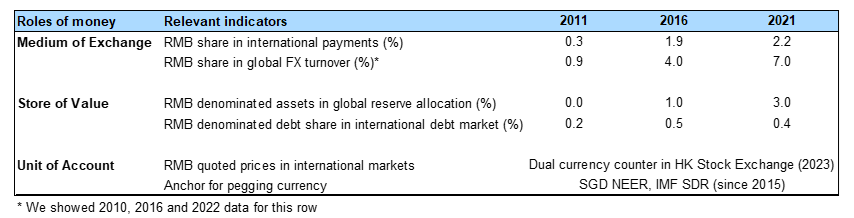

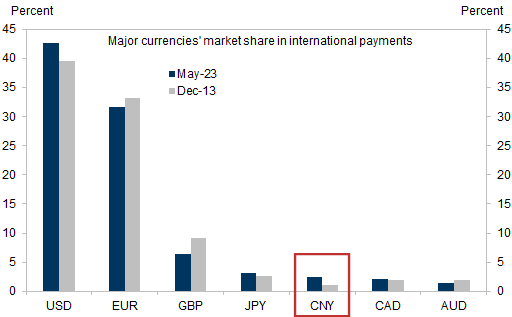

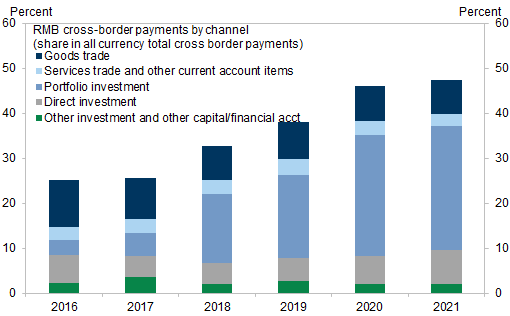

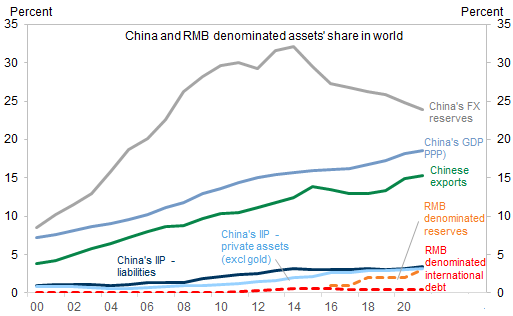

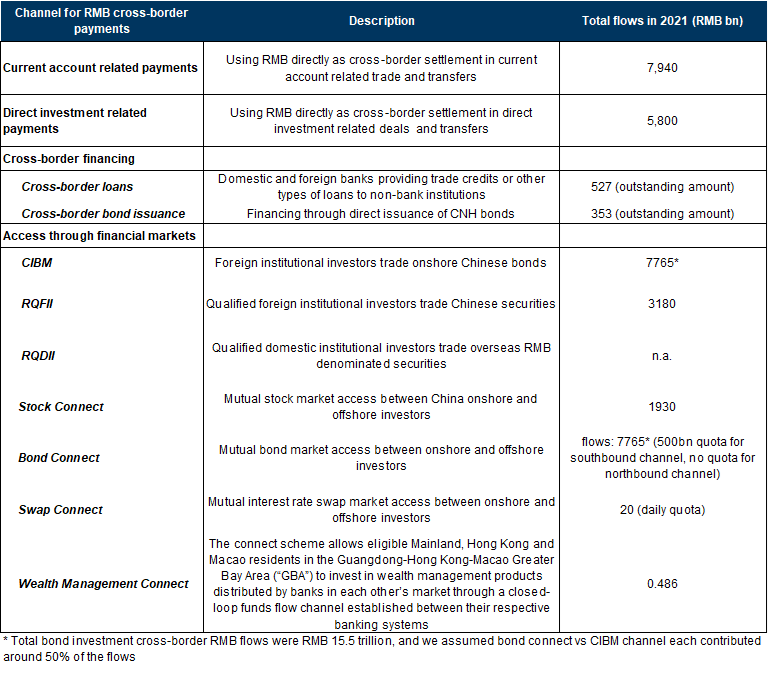

We provide a progress check on RMB internationalization in this report. As a “medium of exchange”, RMB has gained market share in international payments, especially in China’s cross-border transactions. The share of RMB settlement in China’s cross-border payments increased materially to 47% in 2021, almost double the share five years earlier. On the back of foreigners’ more active trading of RMB assets, RMB settlement under the capital and financial accounts contributed the most to the rapid increase in RMB cross-border payments in China. However, the usage of RMB in global cross-border payments has grown but remains small in a global context - RMB's global market share increased to 2.5% as of May 2023, from 1.1% by the end of 2013.

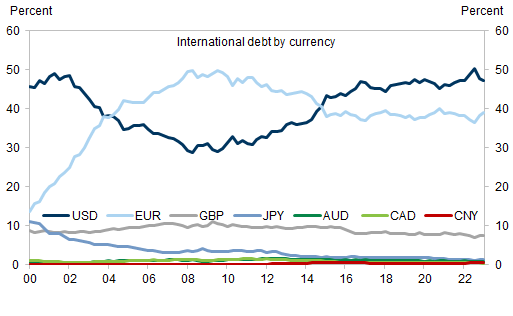

Compared with RMB’s progress in functioning as a “medium of exchange” in international markets, RMB is still little used in “store of value” and "unit of account" roles. RMB denominated reserves and international debt remain small in global markets, and very few currencies use RMB as a reference rate in deciding their own exchange rates.

Use of RMB cross-border payments for portfolio investment is likely to slow in the near term because of unfavorable interest rate spreads and foreign investors' net selling of RMB assets. China's capital account liberalization is likely to be a gradual process, and thus limit the speed of RMB internationalization. Promoting RMB usage in trade settlements and developing RMB offshore markets could be the next key areas for Chinese policymakers to push forward RMB internationalization.

Progress check on RMB internationalization

Internationalization of a currency

Medium of exchange

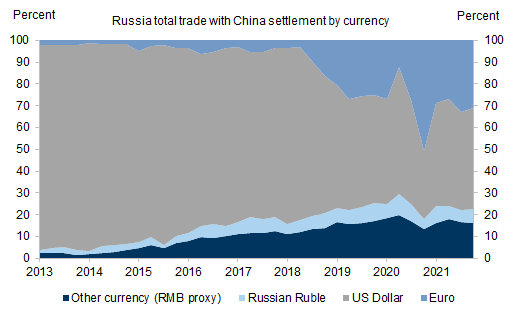

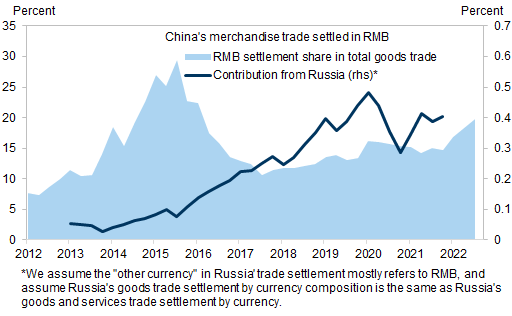

Exhibit 4: Russia has used more RMB in its trade settlements with China since US sanctions in 2014

Exhibit 5: ...although Russia's contribution to the share of RMB settlements in China's total trade was relatively small

Store of value

Unit of Account

RMB was officially included in the SDR basket in 2016. The current weight for RMB in SDR is around 12.3%. There are only around USD 943bn reserves held in SDR after the most recent allocation of USD650bn in 2021 to boost global liquidity.

Singapore manages its exchange rate against a basket of currencies of its major trading partners. While Singapore does not release the specific composition of this basket of currencies, we estimate RMB likely has a 16% weight in the basket.

There are no other currencies explicitly pegged to the RMB.

Constraints on increasing RMB cross-border usage

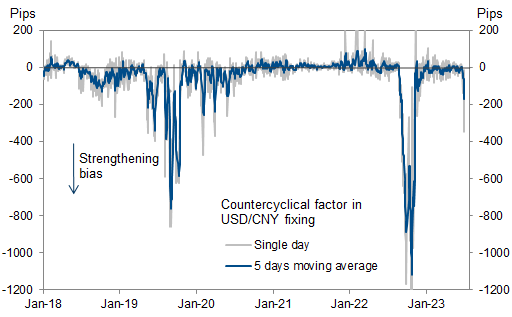

Exhibit 10: PBOC leaned against depreciation in recent days through more negative countercyclical factors in the CNY fixing

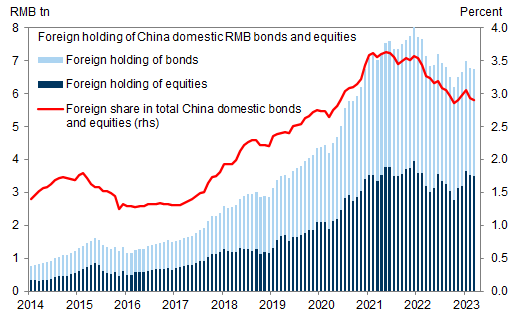

Exhibit 11: Foreign investors reduced their holdings of RMB bonds and equities in recent months

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.