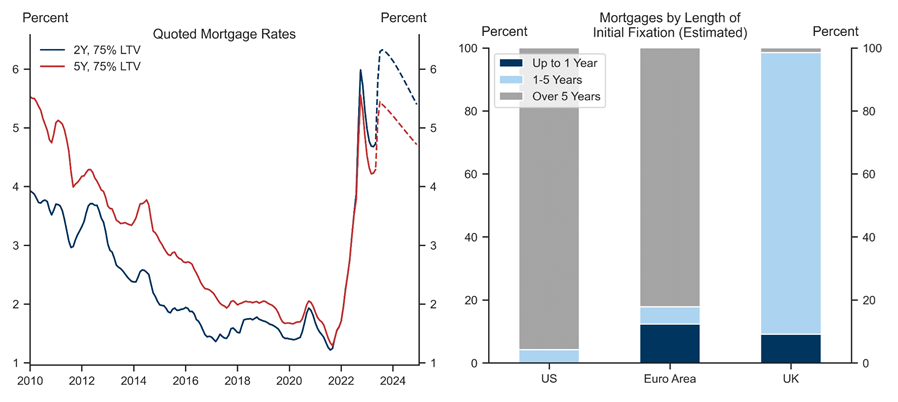

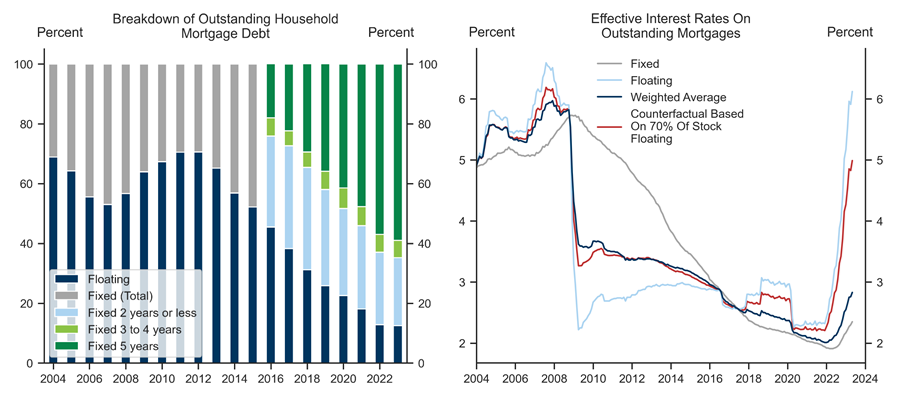

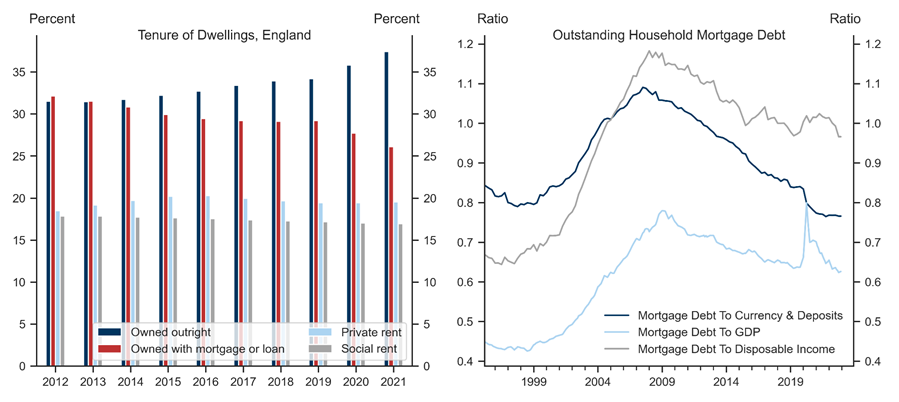

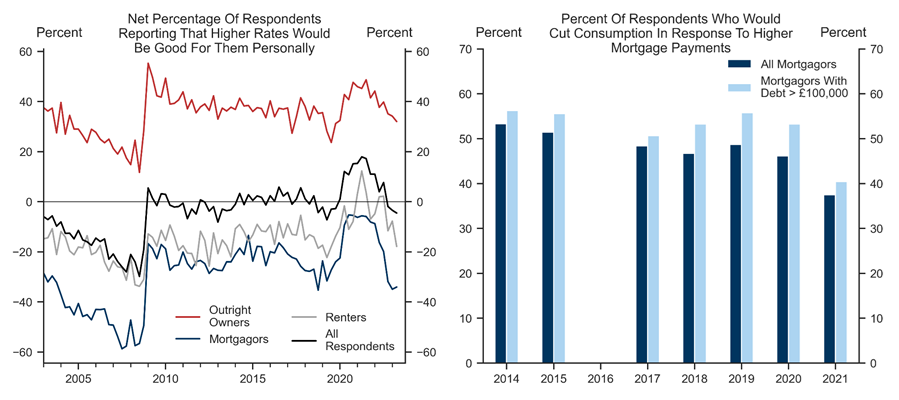

Quoted mortgage rates have risen sharply in recent weeks on the back of higher expectations for Bank Rate. The UK stands out as relatively exposed to mortgage refinancing risks compared to the US or Euro Area given short fixation periods. That said, effective rates on the stock of outstanding mortgages are responding more slowly to policy rate changes than in the past because of the shift from floating to fixed-rate mortgages over the last decade.

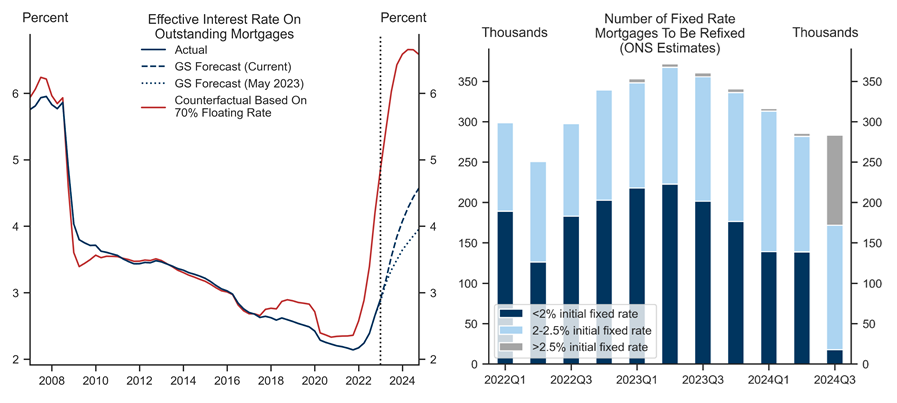

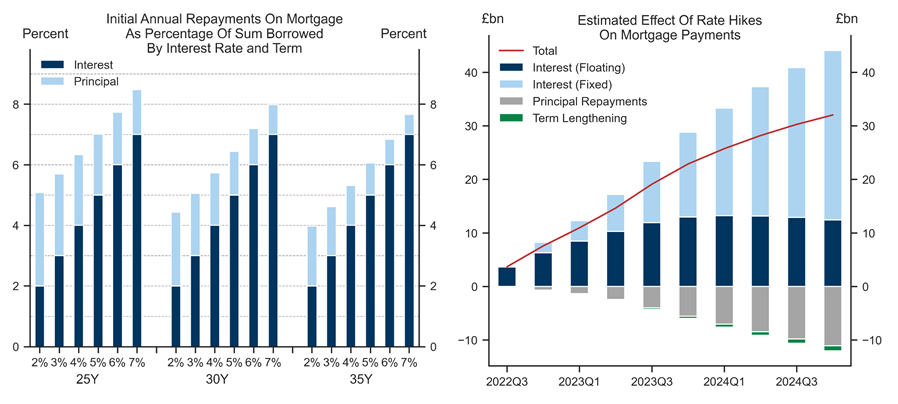

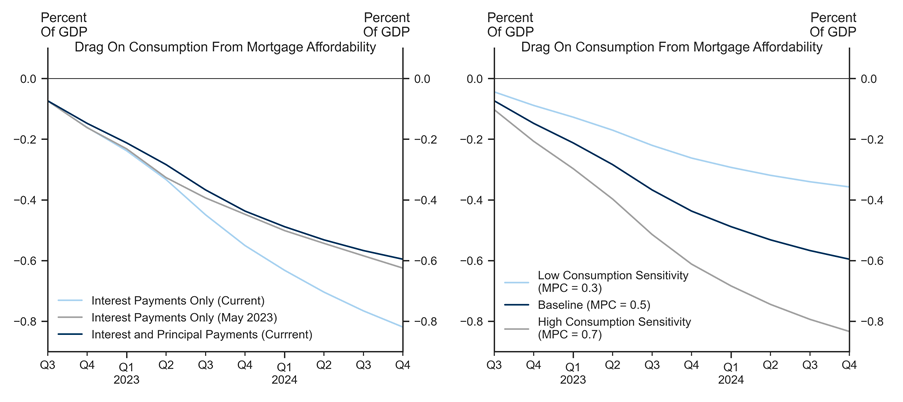

Our models suggest that the effective rate on outstanding mortgages will rise to 4.6% in 2024Q4 from 2.9% in 2023Q1 (and 2.1% in mid-2021). Based on a reasonable sensitivity of consumption to income, this translates into a meaningful cumulative drag on the level of GDP of 0.6% by the end of 2024, excluding second-round effects. Moreover, just over 50% of this drag is still to come.

That said, our models indicate that if the share of floating rate mortgages were as high as ten years ago, the effective rate would have already risen to almost 5% by 2023Q1 and would exceed 6.5% by 2024Q4. As such, the mortgage affordability channel, which has historically been highly important for UK policy transmission, is operating far more gradually than in previous hiking cycles.

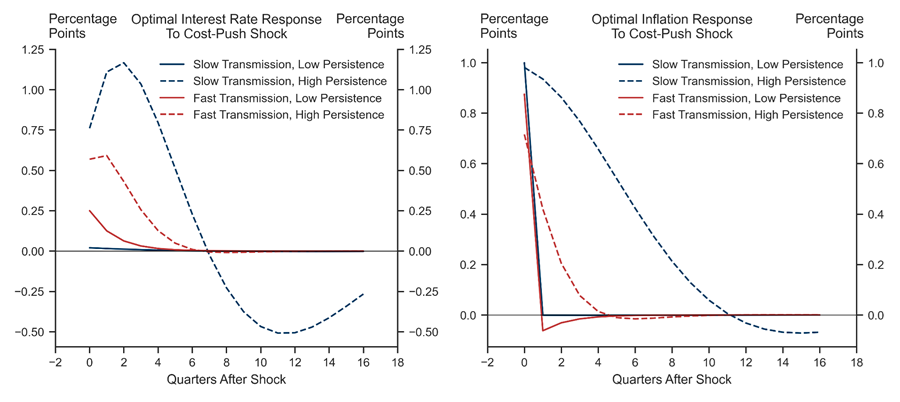

How does this more gradual growth drag affect monetary policy? In a scenario in which inflation appears to be transitory, delayed transmission encourages policymakers to “look through” rises in inflation which are unlikely to persist. However, in an environment in which inflation shows signs of persistence, making it more important to reduce output in the immediate term to prevent inflation becoming entrenched, slower transmission means that a larger adjustment in rates is needed to move output into contractionary territory.

As such, we expect slower transmission to result in a more aggressive response of Bank Rate to signs of inflation persistence. Given the recent indications of persistence in the labour market and inflation data, we now expect a further 25bp hike in November, taking our terminal rate forecast to 6%, and forecast the first cut in 2024Q3.

UK—Slower Mortgage Drag, Bank Rate To 6%

Exhibit 1: The UK Is More Exposed To Refinancing Risks Than The US Or Euro Area...

Forecasting Effective Interest Rates

Interest and Principal Repayments

How Sensitive Is Consumption?

Exhibit 6: Rate Sensitivity Likely Fell During The Pandemic

Implications For Monetary Policy?

- 1 ^ Although the counterfactual in Exhibit 2 (right) shows a sharp difference in the speed of transmission, it may understate how fast effective rates would have risen if the market structure had not changed in the last decade. This is because it only considers the changing fraction of floating vs. fixed rate mortgages, and not the shift from two-year to five-year fixation periods. On the other hand, we also do not account for shifts in the composition of floating rate mortgages between those on a standard variable rate and those on a base rate tracker mortgage.

- 2 ^ The ONS estimates imply a slight decrease in the number of mortgages being refixed from 2023Q3 onwards, which could make the rise in effective rates slightly more gradual.

- 3 ^ Over the longer term this is likely to lead to faster growth in the stock of outstanding mortgages as the principal is repaid slower, which could mean a larger long-run drag from higher interest payments.

- 4 ^ For a more detailed discussion of this assumption, see our previous analysis of the cash-flow channel.

- 5 ^ As we have previously noted, one key uncertainty is around the timing of the consumption response to higher mortgage rates. Our model implicitly assumes that each household's consumption falls at the time at which their mortgage rate increases, rather than consumption declining ahead of time. On the one hand, there is evidence that consumption does respond to anticipated income shocks (see e.g. Kueng (2018)). On the other hand, there is some evidence that spending decisions may be affected by news about future income losses (Fuster et al., 2021).

- 6 ^ In addition, note that these estimates also do not include the effect of higher mortgage rates via the rental market.

- 7 ^ This model builds on our previous analysis for the Euro Area.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.