Global Views: The Narrative Turns

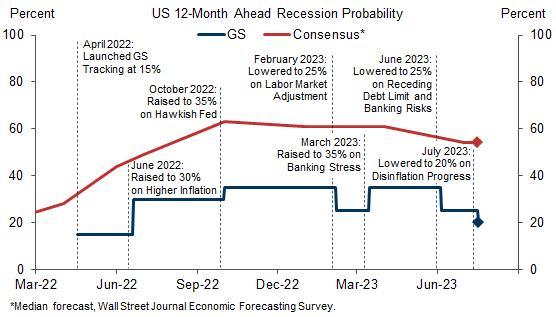

1. We are cutting our probability that a US recession will start in the next 12 months further from 25% to 20%. This remains slightly above the unconditional average postwar probability of 15%—a recession has occurred approximately every seven years—but far below the 54% median among forecasters in the latest Wall Street Journal survey (which is down from 61% three months ago). The main reason for our cut is that the recent data have reinforced our confidence that bringing inflation down to an acceptable level will not require a recession.

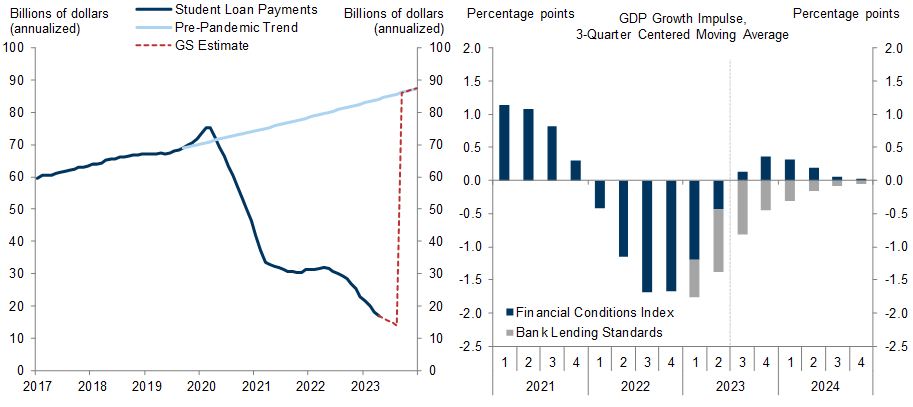

2. US economic activity remains resilient, with Q2 GDP growth tracking 2.3%, consumer sentiment rebounding sharply from depressed levels, unemployment falling back to 3.56% in June, and initial jobless claims reversing their most recent mini-spike. We do expect some deceleration in the next couple of quarters, mostly because of sequentially slower real disposable personal income growth—especially when adjusted for the resumption of student debt payments in October—and a drag from reduced bank lending. But the easing in financial conditions, the rebound in the housing market, and the ongoing boom in factory building all suggest that the US economy will continue to grow, albeit at a below-trend pace.

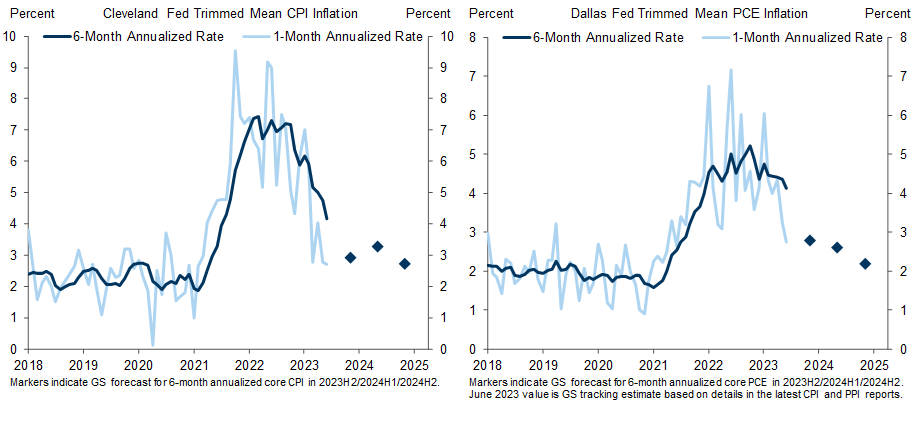

3. The 0.16% increase in the CPI ex food and energy in June was the lowest since February 2021 and follows a string of 0.4% readings in 2023. But that doesn’t mean it’s just one month of better news, as measures of underlying inflation such as trimmed-mean CPI and PCE have been easing for quite a while. Moreover, there are strong fundamental reasons to expect ongoing disinflation. Used car prices are sliding on the back of higher auto production and inventories, rent inflation still has a long way to fall before it catches up with the message from median asking rents, and the labor market has continued to rebalance with an ongoing downtrend in job openings, quits, reported labor shortages, and nominal wage growth.

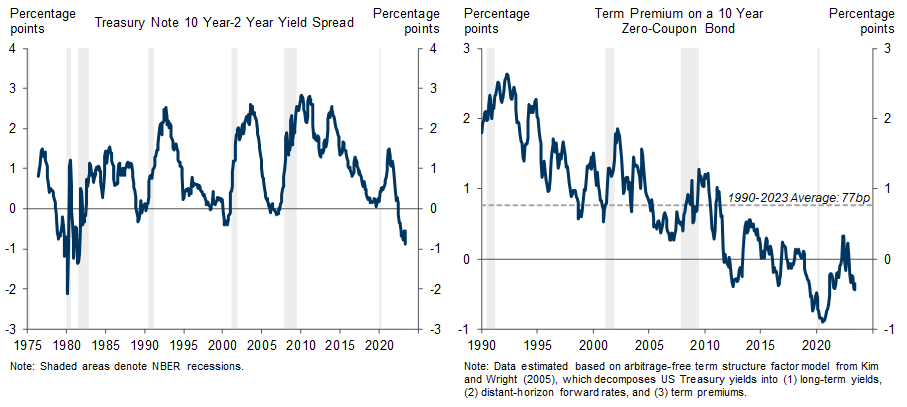

4. We don't share the widespread concern about yield curve inversion. Conceptually, an inverted curve means that the rates market is pricing future cuts that are large enough to outweigh the term premium (which accounts for the usual upward slope). In the past, this has generally only happened in situations when a recession was becoming clearly visible—hence the curve’s strong track record as a recession predictor. But three things are different about the current cycle. First, the term premium is well below its long-term average, so it takes fewer expected rate cuts to invert the curve. Second, there is a plausible path to Fed easing just on the back of lower inflation—in fact, both our and the FOMC's non-recession projections call for more than 200bp of gradual cuts in the next 2-3 years. Third, if forecasters are overly pessimistic now, rates market investors—and thus the expectations priced into the yield curve—are probably also overly pessimistic. So the argument that the inverted curve validates the consensus forecast of a recession is circular, to say the least.

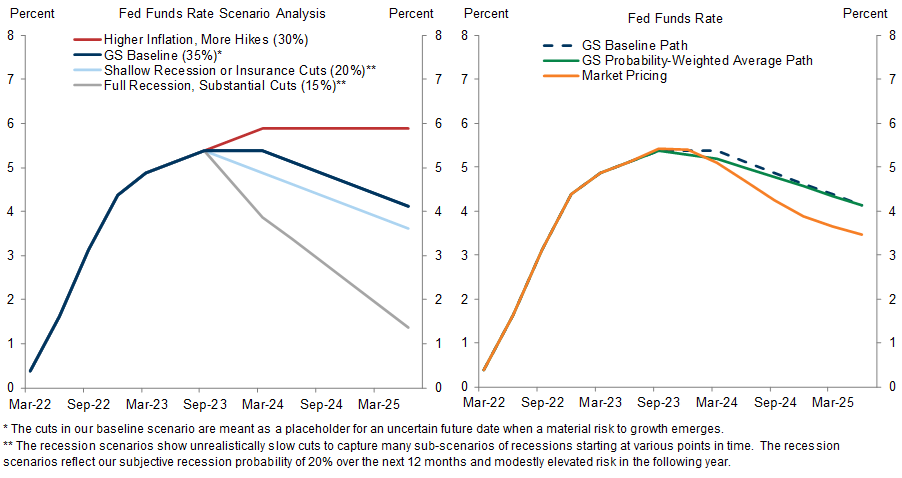

5. A 25bp hike to 5¼-5½% at the July 25-26 FOMC meeting is almost certain, but we expect it to be the last of the cycle. Despite some assertions to the contrary from more hawkish participants, we don’t think the September meeting is truly “live.” Both in the June press conference and in his Congressional testimony, Chair Powell argued for moving at a “careful pace” now that the committee is closer to its destination, which most observers interpreted as an every-other-meeting strategy. The FOMC minutes suggest that Powell probably didn’t have a majority for formally signaling such a shift at the time of the meeting, but additional members may have converged on it following the better inflation data. If so, the next “live” meeting is October 31-November 1, which is three CPIs (and four PCEs) from now. Under our forecast, the committee will probably not see a need to hike further at that point, consistent with current market pricing. Beyond 2023, we think the market is once again building in too many rate cuts, not only relative to our baseline funds rate forecast but also relative to our probability-weighted path.

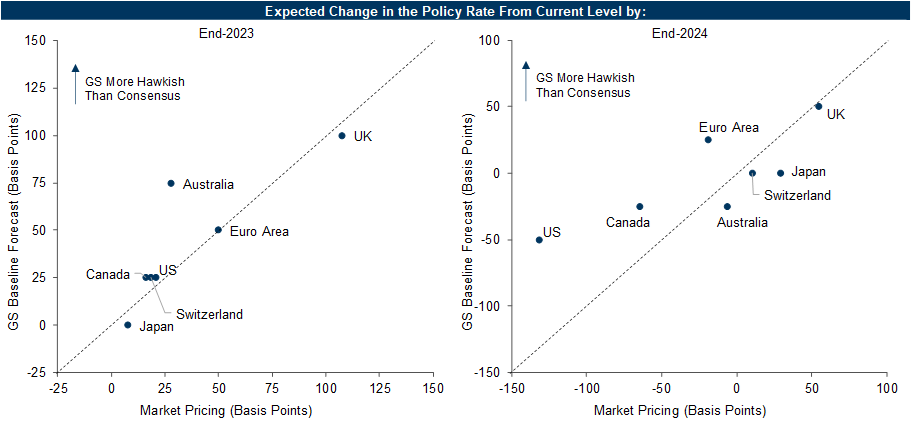

6. Most other major G10 central banks are still a bit further than the Fed from completing their tightening cycles. We now expect the Bank of Canada to deliver a final 25bp hike to a 5¼% terminal rate at the October meeting, in part because of the remarkable house price rebound. We still expect the Reserve Bank of Australia to deliver one 25bp hike in August and another two 25bp hikes to a 4.85% terminal rate later in the year; we don’t see major implications from the replacement of Governor Philip Lowe with Michele Bullock, his current deputy. Following more disappointing inflation data, we recently added another 25bp hike in the UK and now see a cumulative 100bp from here to a 6% terminal rate in November, which would be the highest across the G10. And we continue to expect two last 25bp hikes from the ECB to a 4% terminal rate, despite the more encouraging inflation data for May/June and the continued soft activity data concentrated in the manufacturing sector. In most G10 economies, we think markets are appropriately priced for the remaining rate hikes, except in Australia where we are more hawkish. In 2024, we expect fewer cuts than the market in Canada and the Euro area (as well as the US).

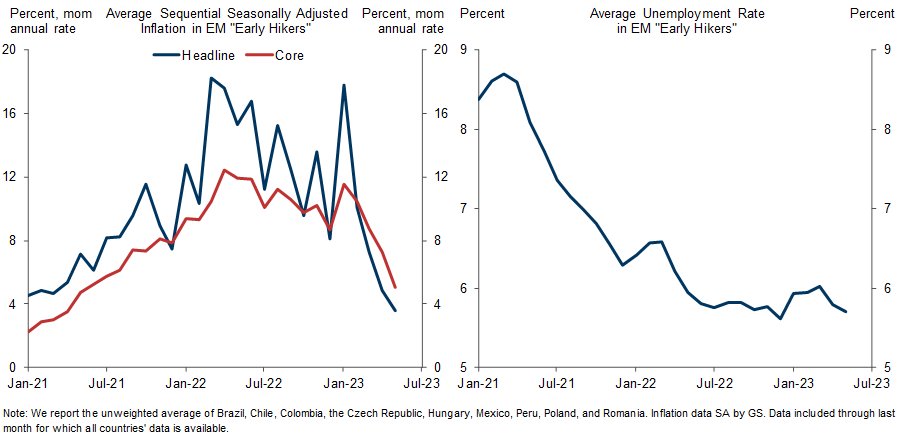

7. One reason why we expect most DM economies to achieve a soft landing is that many EM economies have already done so, despite more difficult starting positions in terms of the size of the energy hit and/or the stability of inflation expectations. Following their earlier aggressive rate hikes, most of our “early hikers”—including Brazil, Chile, Poland, and Hungary—have recently seen large declines in sequential inflation (not only headline but also core) amidst broadly resilient output and employment. They are now well positioned to cut rates from levels that are much further above neutral than in DMs, probably starting with Chile later this month and Brazil in August.

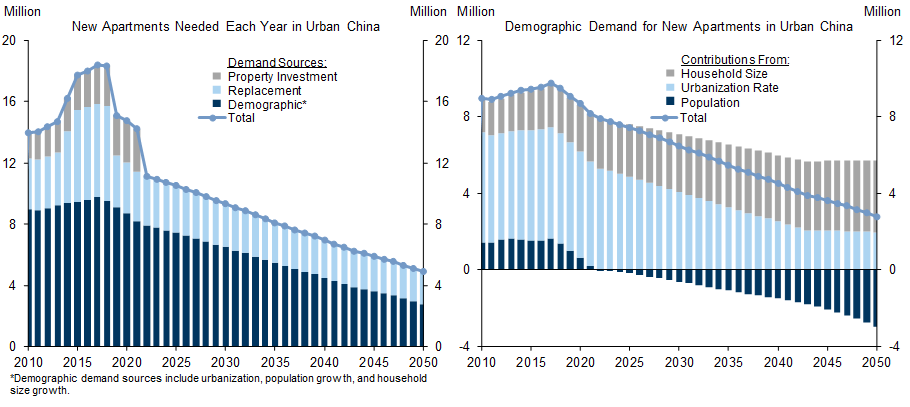

8. Near-term market sentiment around China has stabilized. Although the economic data remain soft, with Q2 GDP falling short of expectations, service PMIs declining, and inflation again surprising on the downside, policymakers have stepped up easing measures and Treasury Secretary Yellen’s trip was viewed as a successful step toward putting a floor under the US-China relationship. The bigger issues are long-term, not only with respect to geopolitics but also property and demographics. We have revised down our estimates of Chinese property activity on the back of new data on population growth, urbanization, and demolitions, and we still estimate a large fall in demand for urban housing units from 11 million in 2023 to 5 million by 2050. Shifting resources out of the bloated homebuilding sector and into more productive areas of the Chinese economy will be the central challenge for domestic economic policy in coming years. This structural transition is likely to be painful and prolonged, given local governments’ fiscal reliance on land sales and the outsized role property plays in household balance sheets as well as consumer confidence in China.

9. Valuation remains a challenge for the risk asset outlook, but the newsflow should remain broadly supportive in the near term. Our US equity strategists expect companies to meet or exceed the low bar set by the consensus forecast that S&P 500 earnings per share will fall 9% year-on-year in Q2, our credit strategists continue to recommend overweight positions in lower-rated bonds given the benign backdrop in defaults and ratings migrations, and our FX strategists predict continued near-term downward pressure on the dollar. On the rates side, our strategists are looking for a widening of US breakevens; although we usually find ourselves on the optimistic side in the inflation debate among economists, rates market pricing of inflation is even lower than we think is justified, probably in part because of greater worries about recession. Lastly, we see room for the oil market rally to extend in the near term, though the upside is probably capped by the increase in OPEC spare capacity on the back of the series of production cuts over the past year.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.