Global Views: Runway in Sight

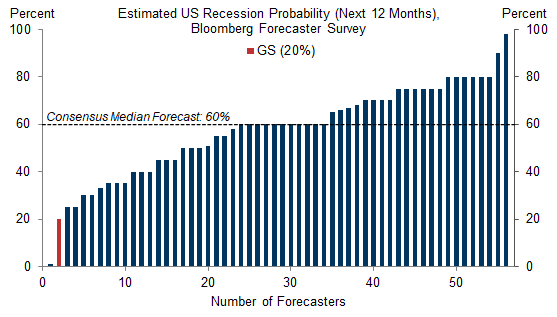

1. Despite some high-profile forecast changes over the past month—most notably from the Fed staff—most US economic forecasters still predict a recession and our 12-month probability of 20% remains near the bottom end of the range. In our forecast, the continued strength of real disposable income growth and a reduced drag from monetary tightening keep growth solidly positive and the unemployment rate stable near 3½%. Despite this strength, declining core goods prices, slowing rent inflation, and a gradual reduction in labor demand—achieved mostly via lower job openings as opposed to increased layoffs—bring down inflation to near the Fed’s 2% target by the end of 2024.

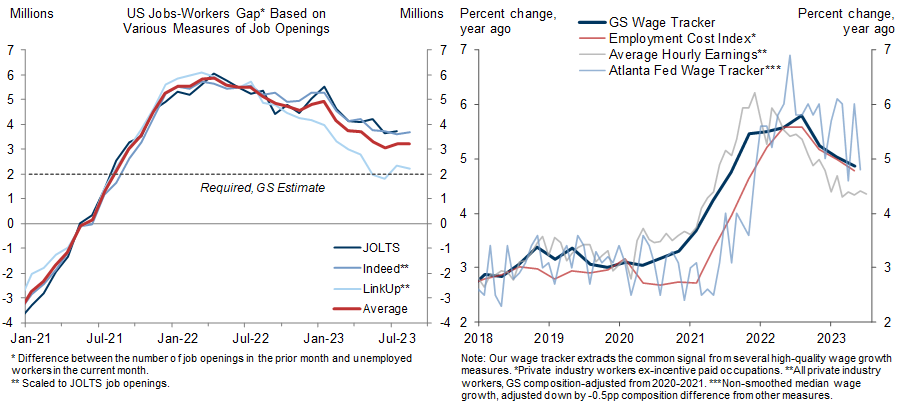

2. Although the July employment report showed a weaker-than-expected nonfarm payroll gain of 187k as well as downward revisions to prior months, the unemployment rate edged back down to 3.5% as the rebound in labor force participation has slowed and the breakeven job growth rate is therefore normalizing. Despite continued low unemployment, our jobs-workers gap is trending down on the back of reduced job openings. And while average hourly earnings grew a faster-than-expected 0.4% in July, other wage indicators such as the Q2 ECI and the Atlanta Fed wage growth tracker measure came in on the softer side; all told, our GS wage tracker has slowed from a peak of nearly 6% in 2022 to the 4½-5% range now.

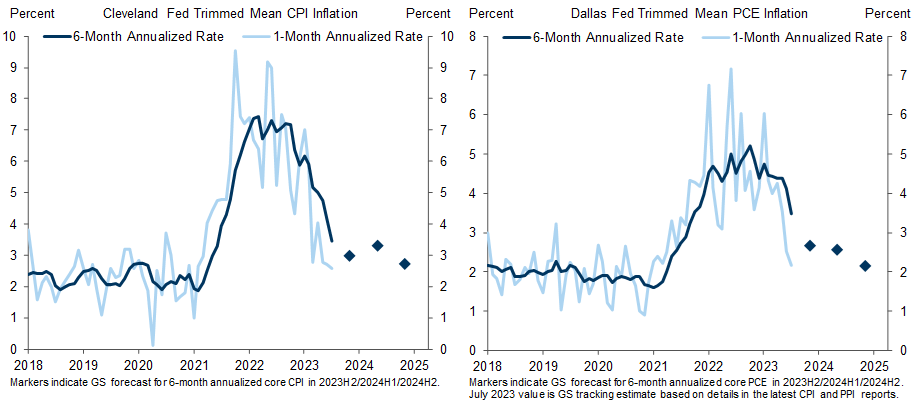

3. With the CPI and PPI in hand, we estimate that the Dallas Fed trimmed-mean PCE grew at an annualized month-on-month rate of 2.2% in July, slightly below June and far below the 5% trend of 2022 and early 2023. In coming months, we expect similar sequential prints, as further moderation in the rental components, large declines in used car prices, and a normalization in electricity prices offset a rebound in airline fares and upward pressure from higher gasoline and diesel prices. All told, the risks to our long-standing forecast that year-on-year core PCE inflation will reach the 2-2½% range by late 2024 are now on the earlier side.

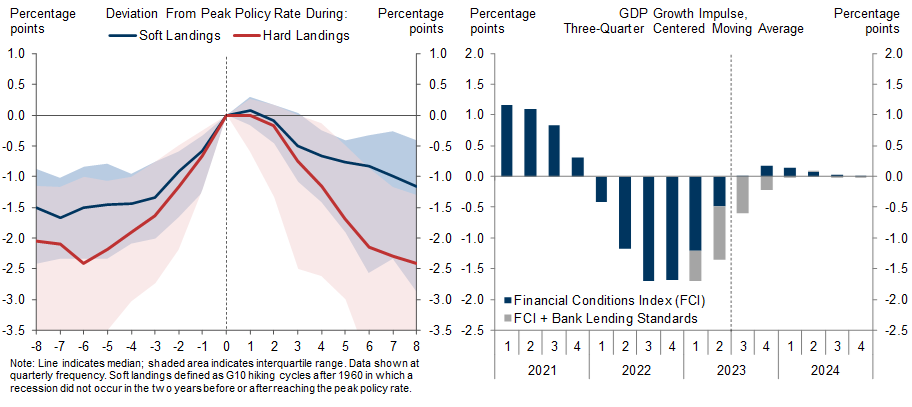

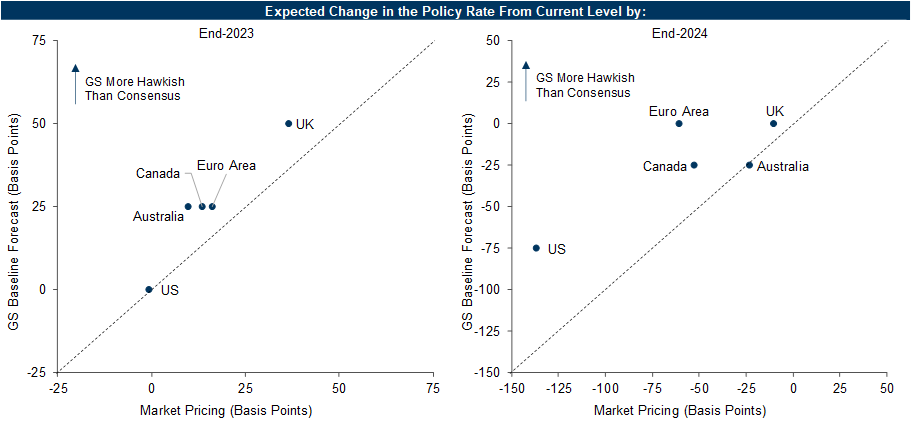

4. The disinflation of the past few months has made us more confident that Fed officials are done hiking rates. However, our funds rate forecast for 2024 remains somewhat above market pricing. First, our analysis of historical soft landing episodes in DM economies shows that they typically feature only limited rate cuts. Second, we expect growth of close to 2% in 2024 on a Q4/Q4 basis as the drag from tighter monetary policy diminishes further and fiscal policy remains broadly neutral despite the discretionary spending caps and the resumption of student loan payments. If so, Fed officials may well hold off on rate cuts until inflation has fallen substantially further or they see more tangible signs that the expansion is at risk.

5. We expect a further large core inflation slowdown in the Euro area and even the hard-hit UK over the next 6-12 months. But for now, both service prices and wages are still growing too rapidly for comfort in both economies. Consequently, the central banks probably still have some additional work to do, with one more 25bp hike from the ECB and two more hikes from the BoE. We also expect one more 25bp hike in both Canada and Australia and both forecasts are slightly hawkish relative to market pricing, although we have revised down our terminal rate forecast in Australia amidst weaker consumer spending growth.

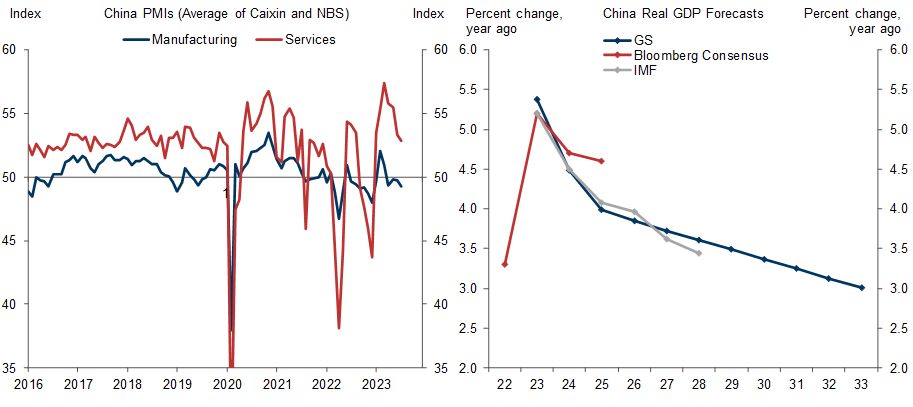

6. The economic news out of China remains sluggish, with declining PMIs, deflation in producer and (headline) consumer prices, and credit concerns around property developer Country Garden. Tactically, we expect somewhat stronger sequential growth in H2 as policymakers have started to add stimulus and the inventory cycle is set to turn from a sharp headwind into a modest tailwind. But our longer-term views are below consensus. First, the room for catch-up growth is diminishing as China becomes richer. Second, exports won't be a meaningful tailwind the way they were in the decades before the GFC and during the covid crisis. And third, the combination of deteriorating demographics and excessive levels of property activity carries echoes of Japan’s experience thirty years ago.

7. Despite broadly encouraging economic data, US risk assets have struggled in recent weeks, in part because of the backup in long-term yields. However, our rates strategists think this move has run its course because investors may be overestimating the near-term impact of increased Treasury supply and because additional action from the BoJ—whose tweaks to its yield curve control policy triggered the initial selloff—seems unlikely. Meanwhile, our commodity strategists view the risks to oil prices as more balanced following the rebound of the past two months. While global oil demand now stands at an all-time high and should edge up further on the back of a resilient world economy, OPEC spare capacity has risen significantly over the past year, international offshore projects are rebounding, and US production cost inflation has slowed. A stabilization of long-term rates and oil prices around current levels would reinforce our view that the runway for a soft landing is in sight, and should support risk assets in coming months.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.