Global Views: Soft Landing Summer

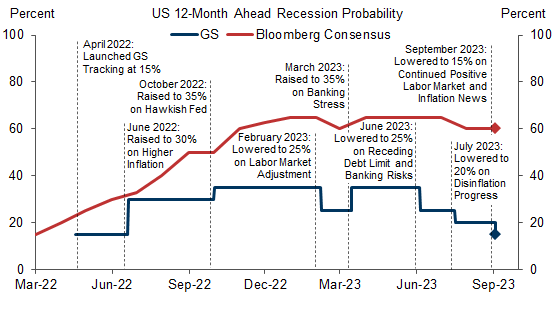

1. The continued positive inflation and labor market news has led us to cut our estimated 12-month US recession probability further to 15%, down 5pp from our prior estimate and equal to the unconditional average recession probability of 15% calculated from the fact that a recession has occurred roughly once every seven years since WW2. Our estimate is far below the Bloomberg consensus, which remains stuck at 60%. (The less timely surveys conducted by the Wall Street Journal and Blue Chip Economic Indicators show slightly lower numbers.) We are also substantially more optimistic than most other forecasters in terms of our baseline GDP growth forecast, which averages 2% through the end of 2024.

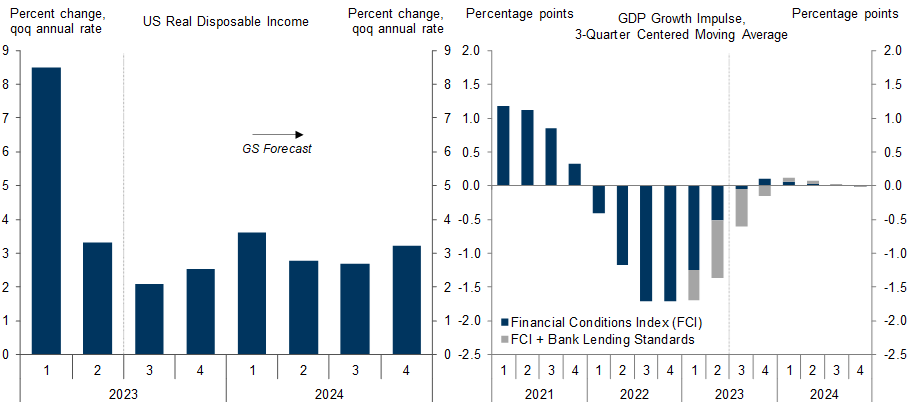

2. The strength in Q3 GDP tracking likely overstates the economy’s true momentum, given the still-soft business surveys and the much slower growth in real gross domestic income (which seems to be continuing in Q3 based on the July personal income data). In addition, there are some fundamental reasons to expect a deceleration in Q4, including the resumption of student loan payments and a near-term hit to housing from the recent increase in mortgage rates. But we expect the slowdown to be shallow and short-lived. First, real disposable income looks set to reaccelerate in 2024 on the back of continued solid job growth and rising real wages. Second, we still strongly disagree with the notion that a growing drag from the “long and variable lags” of monetary policy will push the economy toward recession—in fact, we think that the drag from monetary policy tightening will continue to diminish before vanishing entirely by early 2024.

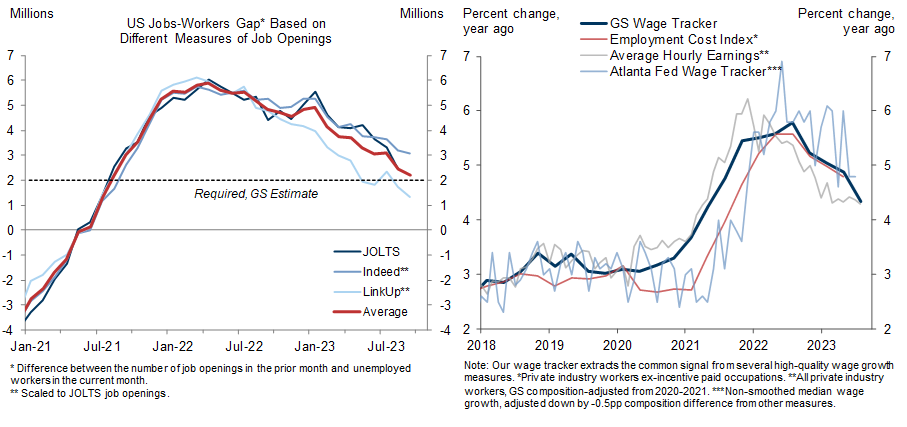

3. We are unconcerned about the 0.3pp increase in the unemployment rate to 3.8% in August because it was entirely driven by an increase in labor force participation, the employment/population ratio remained stable at a cycle high, and the first estimate of payroll growth picked up to 187k despite a roughly 50k drag from the Yellow bankruptcy and the Hollywood strike. Despite this strength, rebalancing in the labor market is well advanced as both our jobs-workers gap and the quits rate have essentially returned to their pre-pandemic levels. It is also encouraging that average hourly earnings rose just 0.2% in August, although a further decline in our wage tracker from the current year-on-year rate of 4.4% to around 3½% is probably needed to make Fed officials fully comfortable.

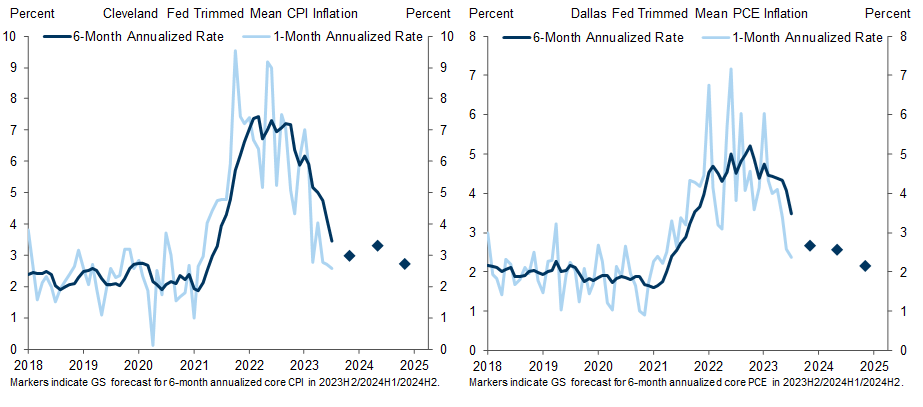

4. Some of the recent weakness in core CPI and (to a lesser degree) core PCE inflation reflects residual seasonality in areas such as airfares and hotel accommodation that depressed prices sequentially in the summer and will boost it in the fall. These are not the only distortions. The peculiar treatment of health insurance in the CPI—which is based on health insurers’ profit margins—has been depressing core CPI inflation since last fall but will boost it starting in October. Conversely, the peculiar measurement of financial services inflation in the PCE index—which is partly based on stock prices—has been boosting core PCE inflation in recent months but will probably turn more neutral soon. Fortunately, these distortions largely occur in the “tails” of the price distribution, so statistical measures of underlying inflation that systematically exclude outliers can cut through them. And both on a CPI and PCE basis, trimmed-mean inflation—our favorite statistical measure of underlying inflation—sends a highly encouraging signal, with a sharp slowdown to the 2-2½% range in recent months. Thus, underlying inflation may already be near the Fed’s target, despite the ups and downs of commodity prices, traditional ex food and energy inflation, and the core services ex housing CPI or PCE measures (which by construction assign larger weights to these poorly measured components and are therefore even more distorted).

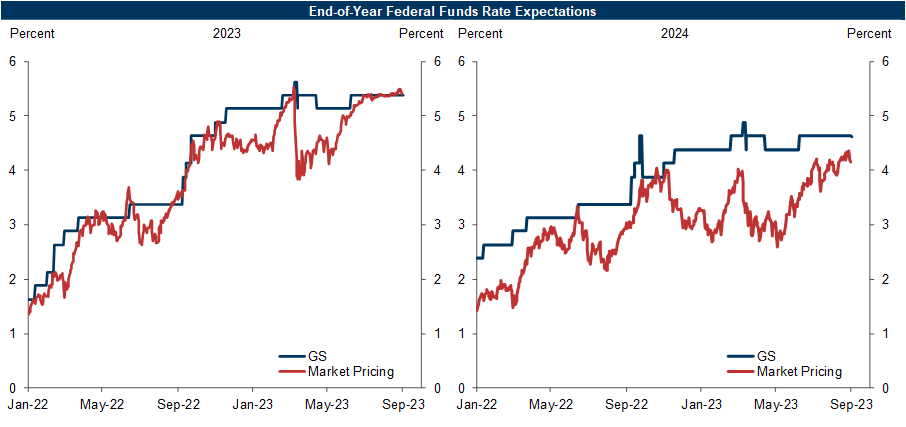

5. On net, our confidence that the Fed is done raising rates has grown in the past month. We view Chair Powell’s promise at Jackson Hole to “proceed carefully” as a signal that a September hike is off the table and the hurdle for a November hike is significant. Moreover, the combination of a higher U3 unemployment rate, slower wage growth and—most importantly—lower core inflation should help the more hawkish FOMC participants get comfortable with the notion that they can keep the funds rate at its current level while assessing whether further hikes are needed. And if the committee skips not only September but also November, the hurdle for restarting the hikes at a later point would probably rise, all else equal. That said, Fed officials are unlikely to move quickly toward easier policy unless growth slows more than we are forecasting in coming quarters. We therefore expect only very gradual cuts of 25bp per quarter starting in 2024Q2.

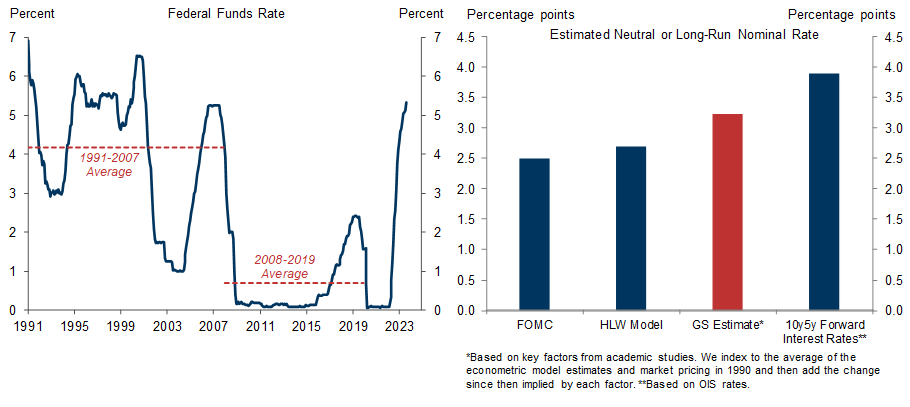

6. We don’t relish the next stage of the monetary policy debate because the question of where interest rates will settle in long-term “equilibrium” is so difficult to answer. The link between the funds rate and financial conditions—i.e., the financial variables that actually matter for economic activity and ultimately inflation—is simply too loose to back out an estimate of r* with error bands that are sufficiently narrow to be useful. Our expectation is that the 1991-2007 period, when the nominal funds rate fluctuated between 1% and 6½%, will prove to be a better template than the post-2008 period, when the Fed found it difficult to get much above 2%. Beyond that general notion, however, we expect financial conditions and the economic data to be more helpful for pinning down a path for the funds rate than hazy estimates of r*.

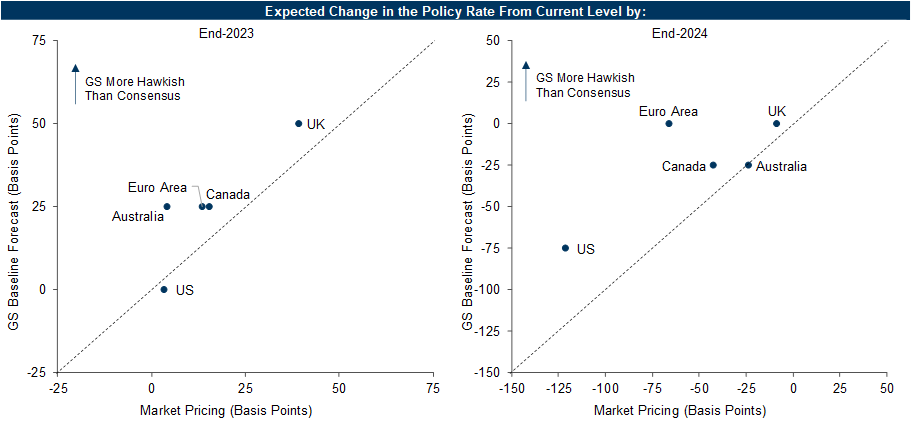

7. We remain comfortable with our soft-landing views for most DM and EM economies. That said, the recent economic news in Europe has been considerably less encouraging than in the US, both on growth and inflation. We have revised down our GDP forecasts for the Euro area and now essentially project stagnation in H2, but still narrowly see the European Central Bank delivering a final 25bp hike at the September meeting. Across the Channel, the combination of slightly better growth and meaningfully greater inflation pressures than in the Euro area is likely to persuade the MPC to deliver two more 25bp hikes, probably in September and November. Elsewhere in the Anglosphere, we expect both the BoC and the RBA to deliver one final 25bp hike before the end of the year, partly driven by continued upside surprises in the housing market that are likely to have adverse implications for shelter inflation in both economies.

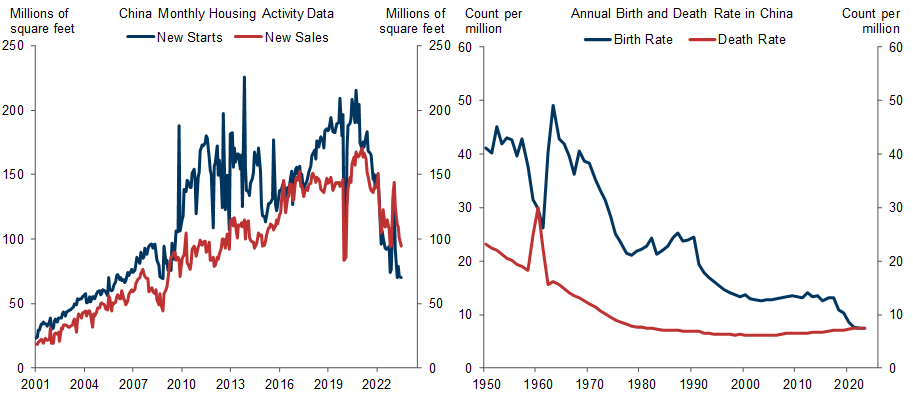

8. The economic news out of China remains mixed, with small gains in both manufacturing PMIs in August set against continued housing weakness. We recently published a comprehensive summary of our views on the Chinese property market outlook and its broader implications. Although housing starts have already fallen 60% from the 2020 peak, we expect the impact of housing on growth to remain negative to the tune of 1-1.5pp (annualized) in 2023-2024, with gradually smaller numbers in subsequent years. We think the risk of a “sudden stop” is low as the banks have significant capacity to absorb losses and policymakers remain committed to avoiding a Lehman-type event. However, we see a significant risk of “Japanification,” especially if the government’s attempts to boost birth rates and stave off the rapid population decline projected by demographers remain ineffective.

9. After climbing the wall of worry for most of 2023, equity markets have lost momentum in the last month despite the positive economic news. The reason probably lies in the twin constraints of high valuations and rising Treasury yields. These could loosen if earnings start to move up more significantly and/or our rates strategists’ forecast of modest declines in long-term yields plays out. That said, our equity strategists’ forecasts imply that the bulk of this year’s soft landing and AI rally has probably been realized at this point. Along similar lines, our credit strategists expect both IG and HY bonds to deliver modest further excess returns in what is likely to be a broadly stable spread environment, while our FX strategists predict shallow dollar depreciation into yearend. Lastly, oil prices have converged to the bullish views of our commodity strategists, who are now calling for a broadly sideways move in the remainder of 2023.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.