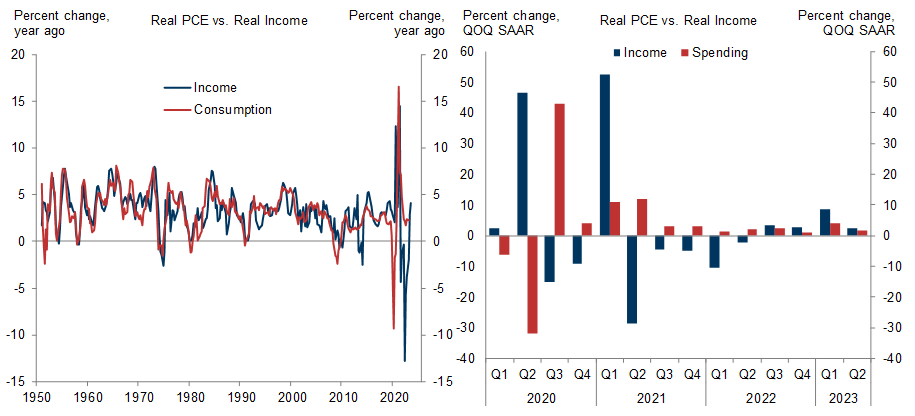

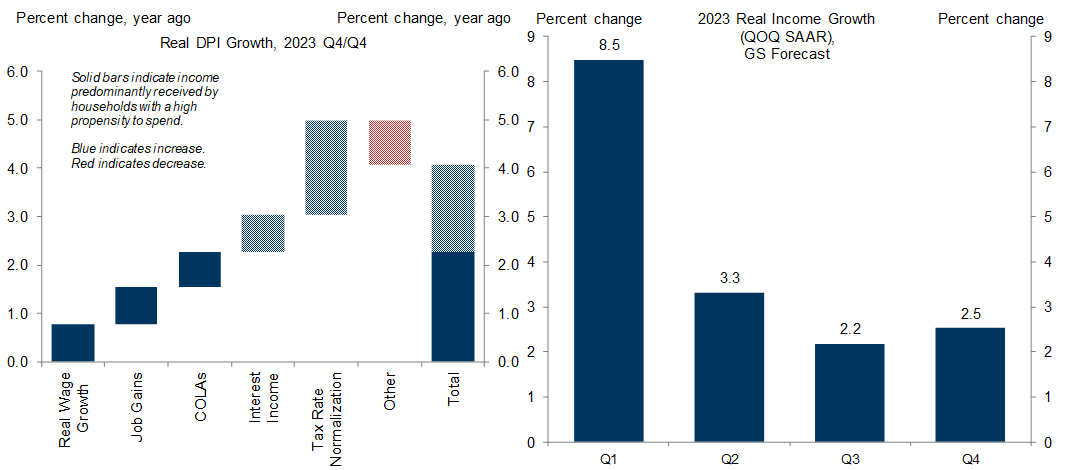

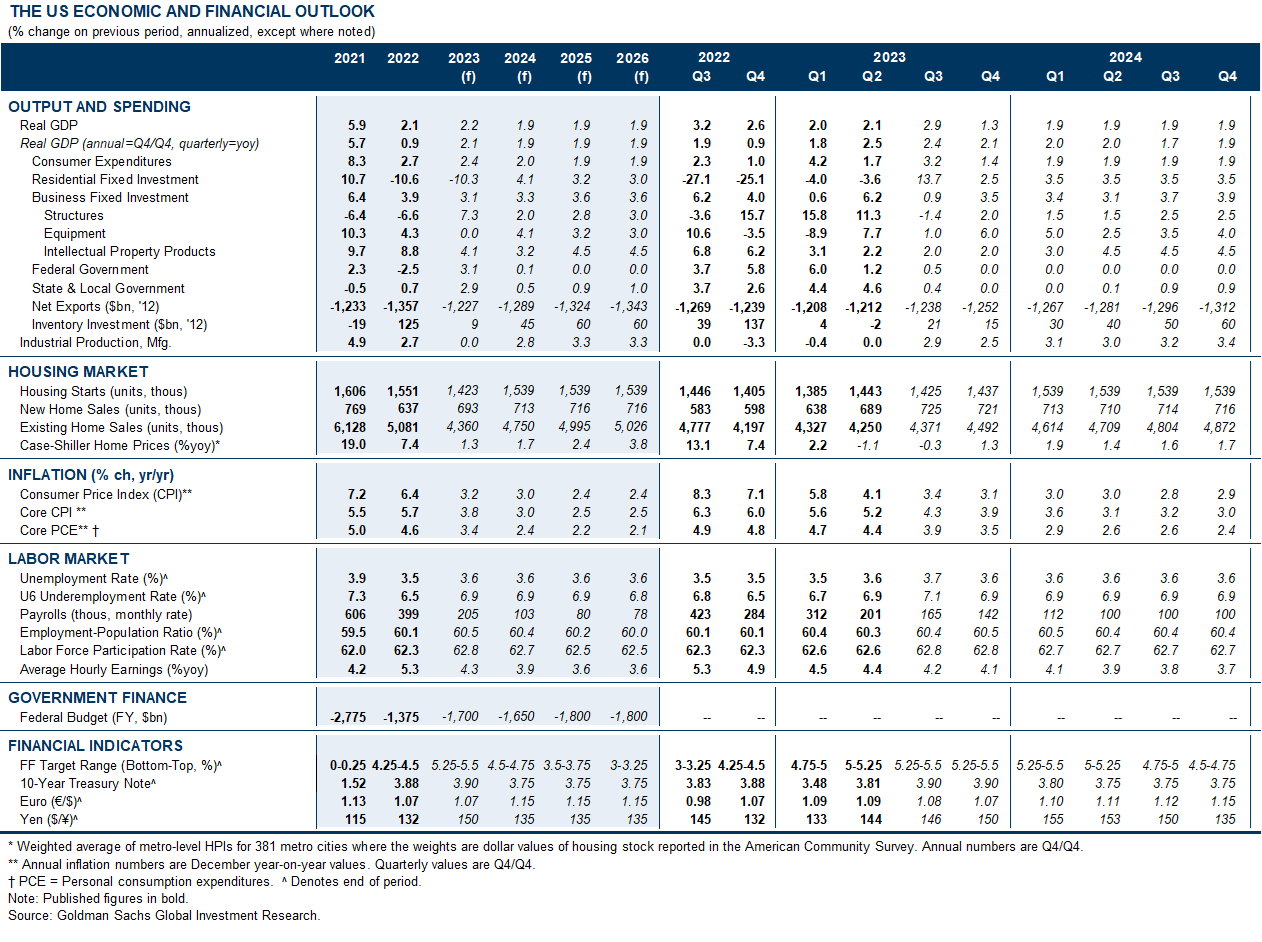

GDP growth has outperformed in 2023 on the back of strong consumer spending, itself driven by an acceleration in real income growth to around 4% (Q4/Q4 basis; GS forecast). Whether spending continues to grow at a robust pace depends heavily on the income outlook, so in this US Economics Analyst we update our income forecasts and argue that the US consumer will likely outperform again in 2024.

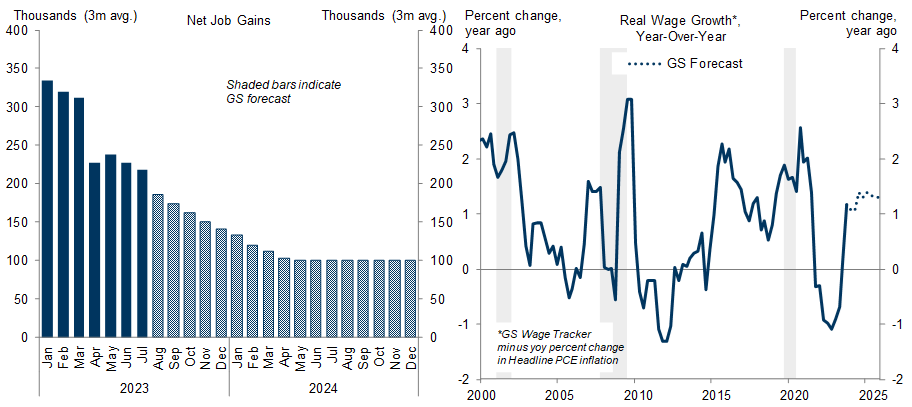

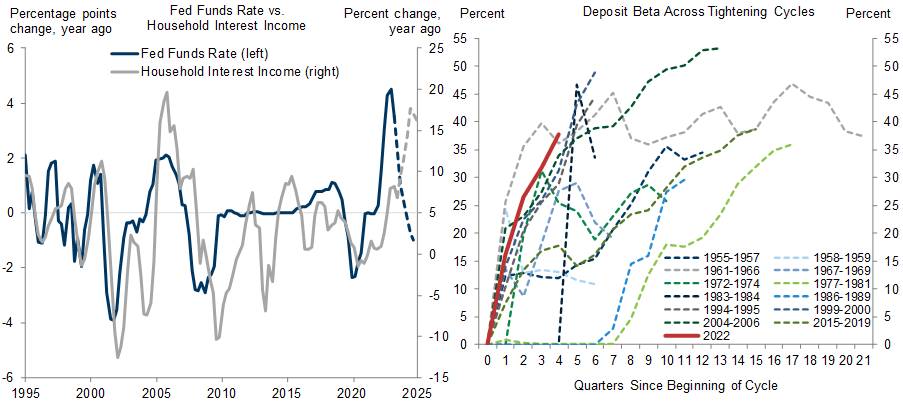

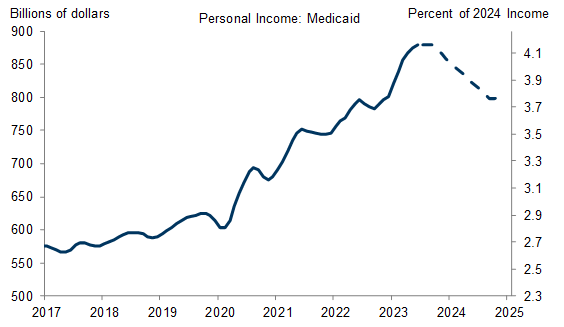

Several of the drivers of income growth in 2023 are likely to repeat in 2024. Continued job gains and positive real wage growth should continue to boost real income, and household interest income should increase as yields on interest bearing assets rise to reflect past rate increases. And while transfer income faces a headwind from declining Medicaid coverage following the end of pandemic-related eligibility expansion, the spending impact from coverage loss will likely be modest.

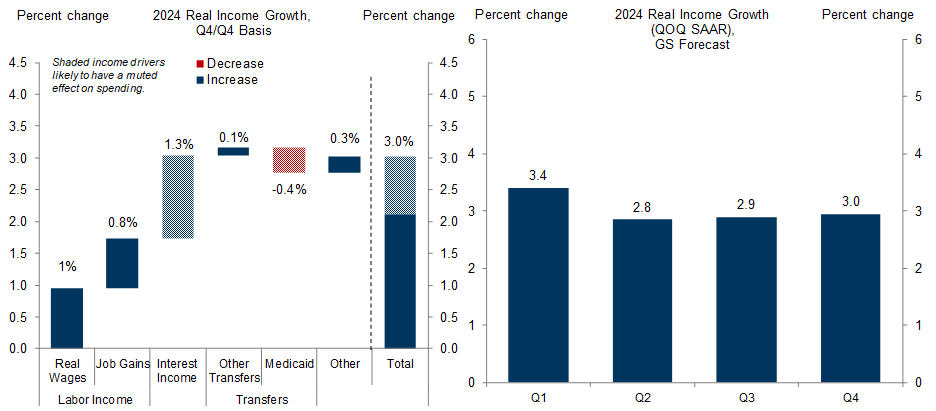

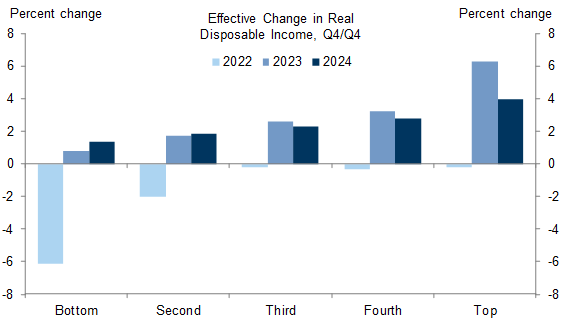

After incorporating these drivers into our forecast, we expect real income will grow by 3% in 2024 on a Q4/Q4 basis. While this pace of income growth would normally imply 2-3% real spending growth, the spending response will likely be smaller than normal because some drivers—namely rising interest income—will mostly benefit higher-income households that have a lower propensity to spend. Indeed, we forecast almost 4% real income growth for households in the top income quintile, vs. 1½% in the bottom quintile.

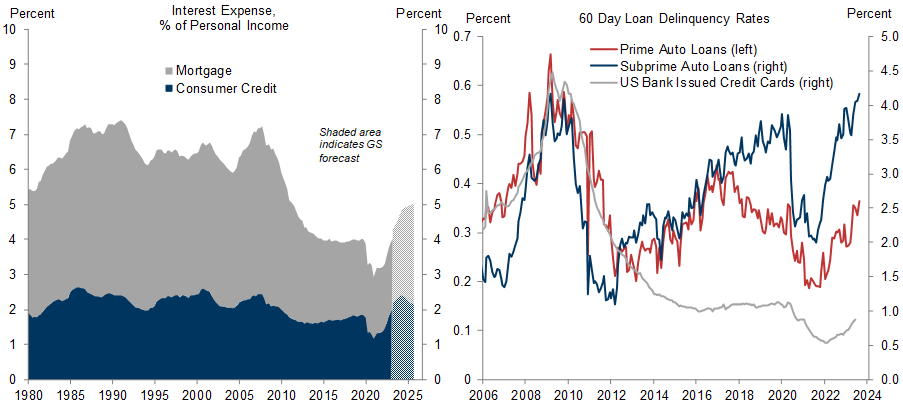

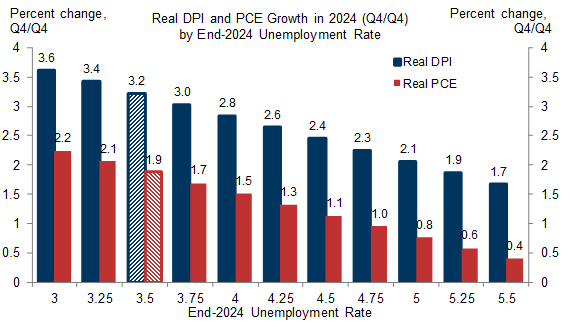

We see several other reasons why spending growth will underperform income growth in 2024. Rising interest expenses not included in the disposable income calculation will likely effectively subtract ½pp from income growth through end-2024. And while household balance sheets remain strong overall, balance sheets of lower-income households have likely weakened, and we expect that the saving rate will rise from a quite low 3.5% today to over 5% by the end of next year. That said, our scenario analysis suggests that real spending will likely grow above or close to its potential pace unless the labor market deteriorates more than we anticipate.

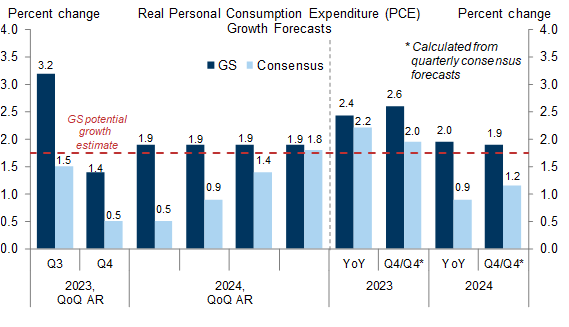

Taken together, we expect that income growth will remain a tailwind to spending in 2024, albeit a smaller one than in 2023. Provided that job and real wage growth don’t significantly underperform our forecasts, we expect that the US consumer will outperform consensus expectations, and forecast 1.9% real spending growth in 2024 in both yoy (vs. 0.9% consensus) and Q4/Q4 (vs. +1.2%) terms.

The US Consumer: Still Strong in 2024

Income Drivers in 2024 Will Look Somewhat Similar to 2023

Forecasting 3% Real Income Growth

Risks to Income and Spending

The 2024 Spending and Growth Outlooks

Joseph Briggs

- 1 ^ Finkelstein, Amy, Nathaniel Hendren, and Erzo FP Luttmer. "The value of Medicaid: Interpreting results from the Oregon health insurance experiment." Journal of Political Economy 127.6 (2019): 2836-2874.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.