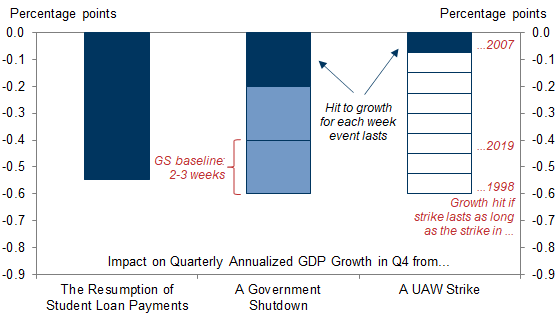

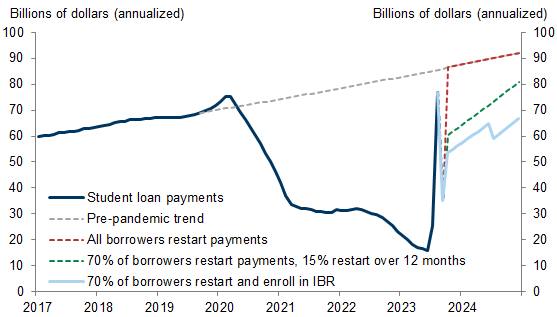

Three developments are set to temporarily slow growth in Q4. First, we expect the resumption of student loan payments to subtract 0.5pp from quarterly annualized GDP growth. However, the risks lean toward a smaller effect, as some borrowers might not resume payments right away and some are likely to qualify for the Biden Administration’s income-based repayment plan.

Second, the federal government looks more likely than not to temporarily shut down. A government-wide shutdown would reduce quarterly annualized growth by around 0.2pp for each week it lasted after accounting for modest private sector effects. Our baseline is that a shutdown could last for 2-3 weeks, although a shutdown is not a foregone conclusion and the timing is uncertain.

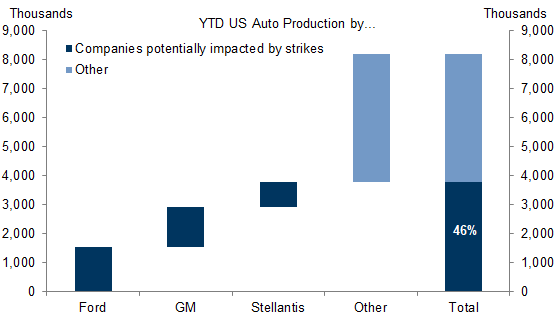

Third, we estimate that reduced auto production from a potential UAW strike would reduce quarterly annualized growth by 0.05-0.10pp for each week it lasted, if all three companies currently undergoing contract negotiations are impacted. In both the case of a government shutdown and the case of a UAW strike, growth would rise by the same amount it declined in the quarter following their end.

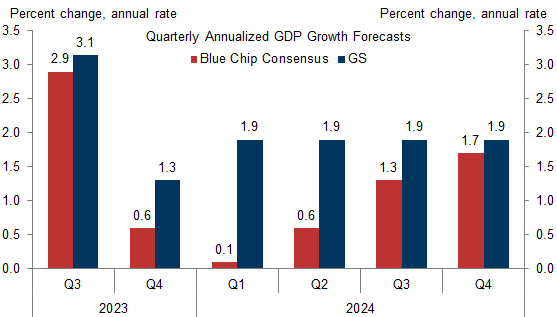

Taken together, we expect quarterly annualized GDP growth to slow from +3.1% in Q3 to +1.3% in Q4 (vs. consensus of +2.9% and +0.6%). We expect the slowdown to be shallow and short-lived, with GDP growth rebounding to +1.9% in Q1 (vs. consensus of +0.1%) as these temporary drags abate and income growth reaccelerates on the back of continued solid job growth and rising real wages.

The Q4 Pothole: Student Loans, Shutdown, and Strikes

Ronnie Walker

Alec Phillips

- 1 ^ If all three companies are impacted by strikes, we estimate this would lower the level of GDP by 0.2-0.3% for the duration of a strike. We divide 0.2-0.3% of GDP by 13 weeks and then multiply by 4 to find the effect on the qoq annualized growth rate.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.