Since the turmoil in the banking system subsided earlier this year, deposit outflows have stabilized and bank lending growth has stopped declining. Nevertheless, lending growth remains slower than at the start of the year, and the renewed rise in long-term interest rates could reignite concerns about banks’ balance sheets. In this US Daily, we leverage the latest bank-level data from regulatory call reports to investigate the drivers behind the recent slowdown in bank lending and assess banks’ balance sheet health.

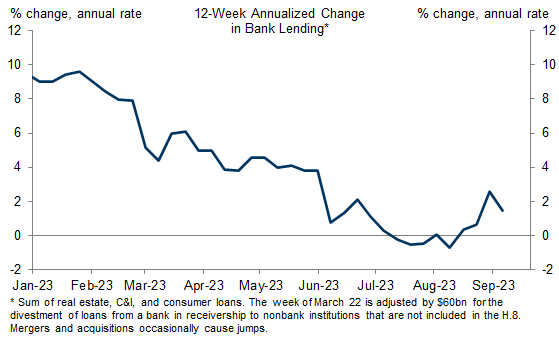

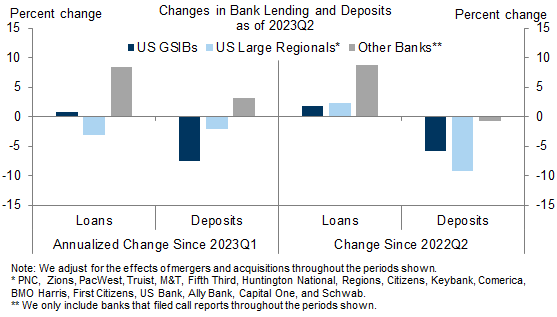

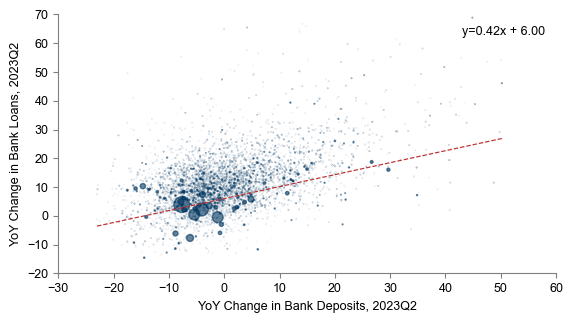

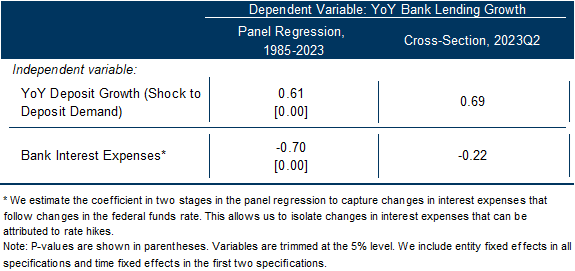

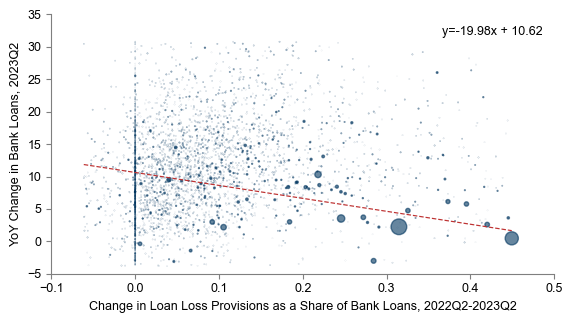

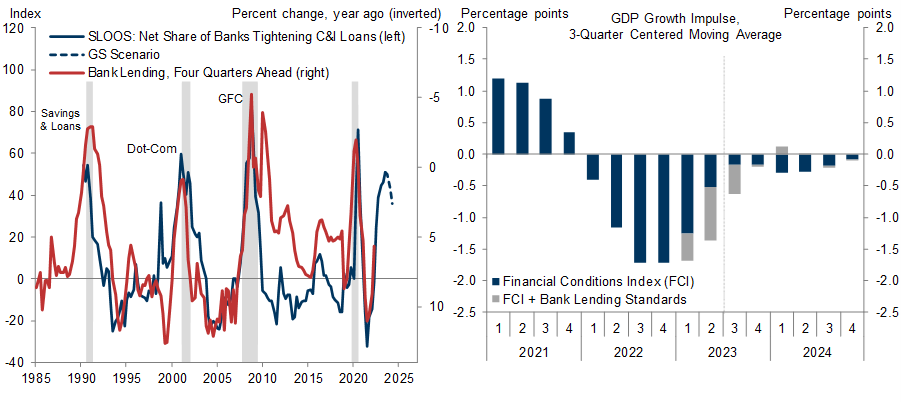

Nominal bank lending growth has slowed from 10% to 2% since the start of this year on a 3-month annualized basis, for two main reasons. First, deposit outflows and higher deposit rates have led banks to reduce lending to a degree roughly in line with the usual historical relationships. Second, recession fears have likely led banks to reduce lending, and we find that banks that built up more provisions for loan losses over the last year have slowed lending by more.

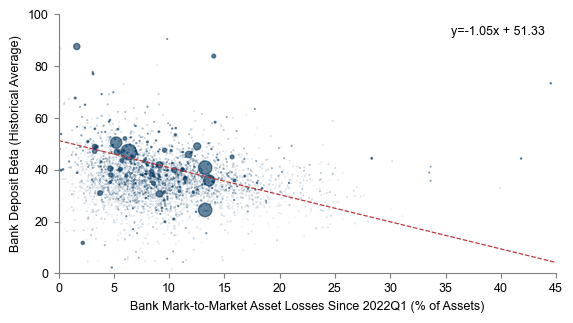

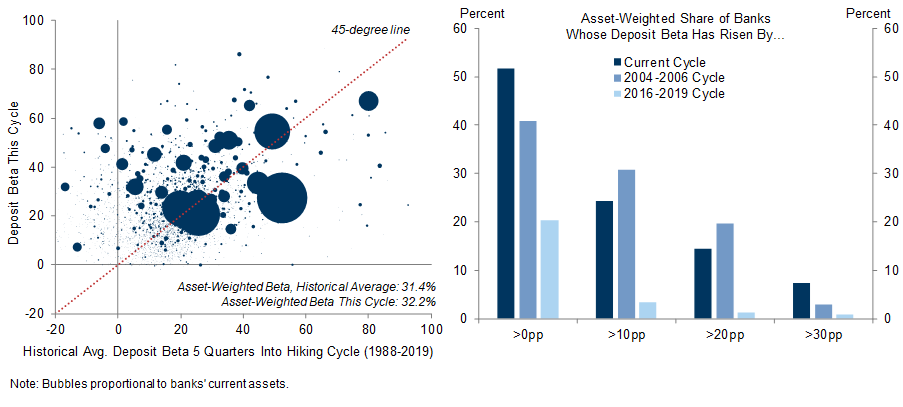

The recent rise in long-term interest rates could bring back the concerns from this spring about mark-to-market losses on banks’ asset portfolios. Historically, banks have hedged their interest rate risk by matching the interest rate sensitivity of their interest income and interest expense (the deposit beta). Reassuringly, we find that this has remained the case this cycle and that deposit betas are only modestly higher now than at similar points in past hiking cycles for most banks.

Going forward, we expect the drag on growth from tighter bank lending standards to fade because we expect bank lending standards to remain roughly unchanged in Q3—as fading recession fears and modestly higher bank stock prices roughly offset higher interest rates—and to start to normalize gradually next year. We expect the tightening in financial conditions and lending standards to generate a roughly 0.2pp drag on GDP growth next year, down from around 1pp in 2023 and 1.2pp in 2022.

A Status Check on Bank Lending and Bank Balance Sheets

What is driving the slowdown in bank lending?

Will higher rates bring back concerns about bank balance sheets?

Exhibit 6: Banks Whose Asset Portfolios Are Most Sensitive to Higher Interest Rates Also Have the Most Sluggish Depositors, Allowing Them to Benefit from Low Funding Costs Relative to Market Interest Rates

Manuel Abecasis

- 1 ^ Loans in the banking system amount to around 70% of deposits.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.