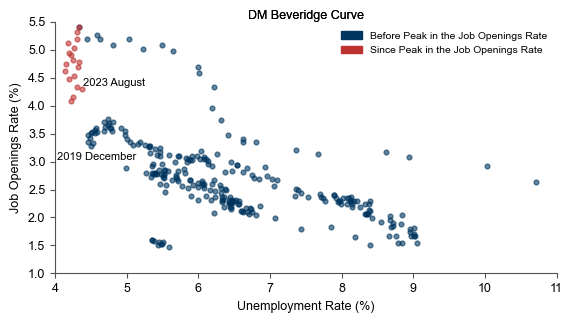

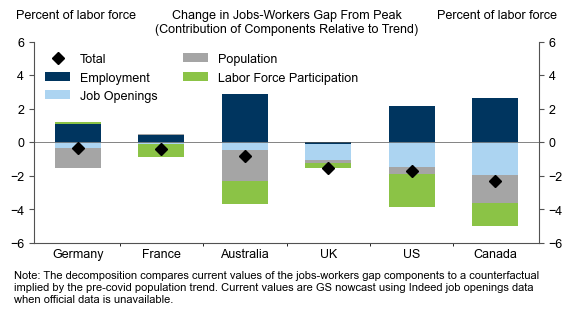

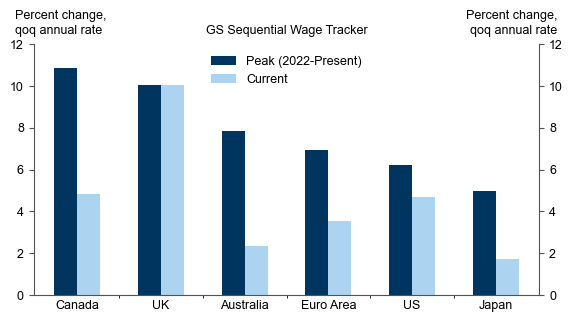

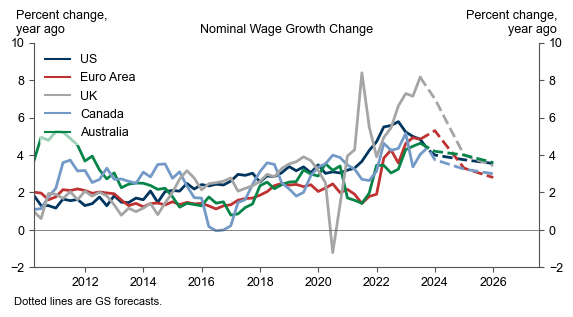

Labor market rebalancing is well underway in DM economies, mostly because of a decline in job openings. This rebalancing has, on average, led our jobs-workers gap to retrace 58% of its overshoot during the pandemic—with notably larger reductions in Canada and the US—and wage growth to step down from its peak pace in DM economies.

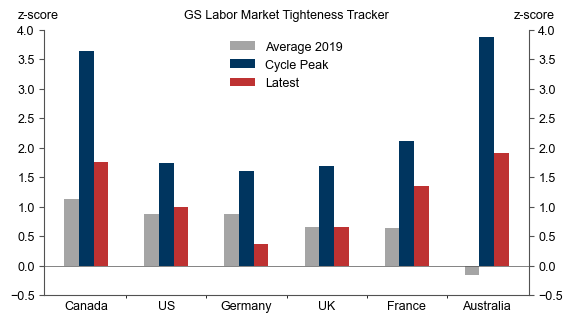

So far, the labor market cooldown has been fairly benign. Despite clear signs of softening—including an uptick in the unemployment rate, slower job growth, and softer survey data—a holistic view suggests most DM labor markets remain tighter than they were in 2019. As a result, DM central banks most likely view the current rebalancing favorably and will not be too concerned about incremental cooling.

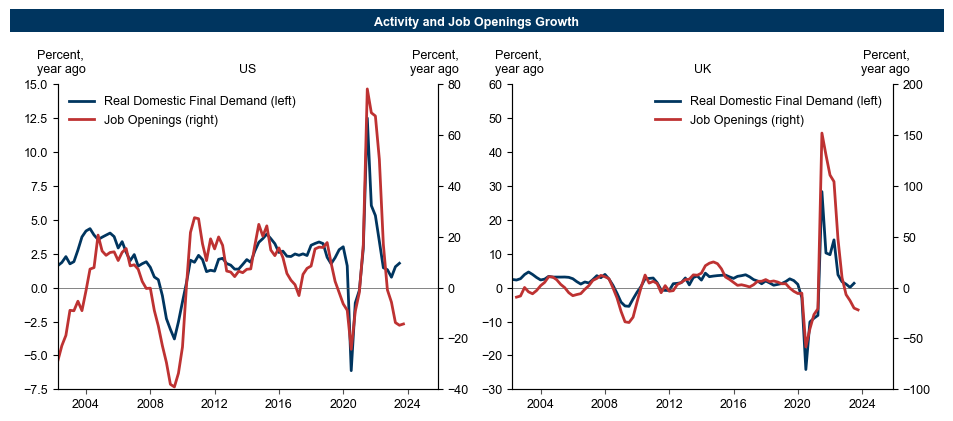

While a more significant labor market deterioration could raise concerns, we see three reasons why DM labor markets are likely to stabilize before slowing too much. First, growth in job openings has historically tracked GDP growth very closely, and our near-trend 2024 growth forecasts coupled with fading recession fears argue against an unnecessarily large pullback.

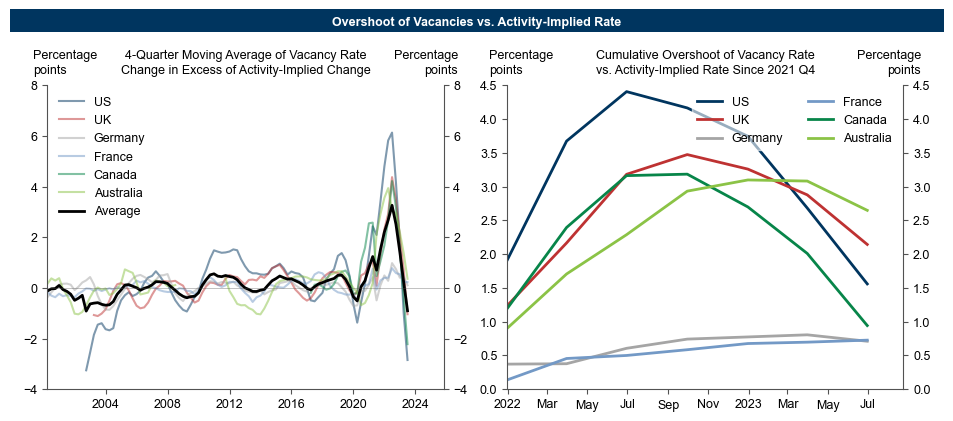

Second, the labor market rebalancing thus far mostly reflects a correction of excessive job posting, as job openings overshot fundamental-consistent levels in 2021-2022 before unwinding in 2023. We suspect that labor markets will stabilize after job opening overshoots fully reverse, provided that growth and inflation dynamics normalize in line with our forecasts.

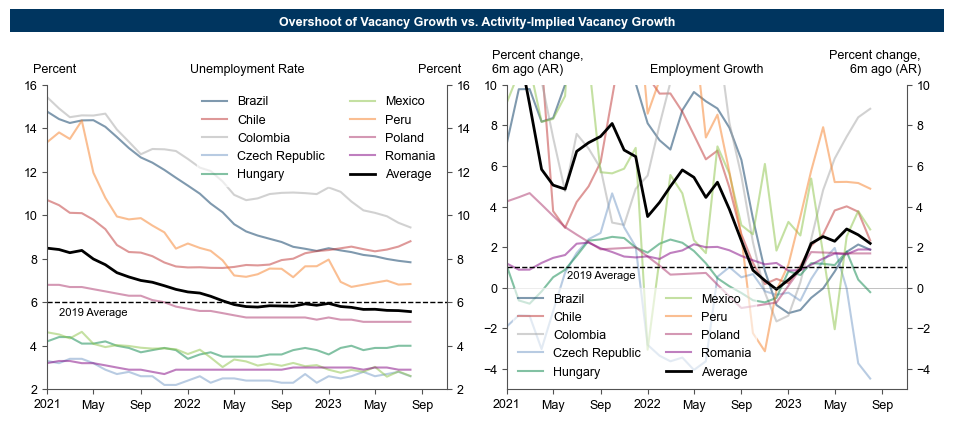

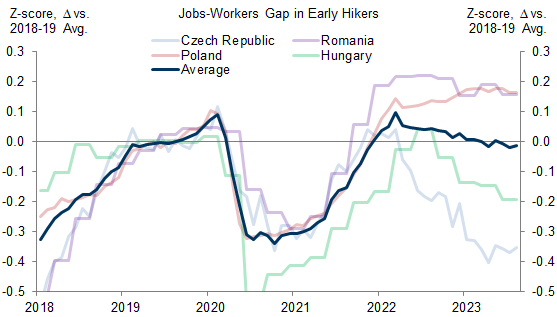

Third, labor markets in the earlier hikers—mostly EM economies where policy and economic dynamics have led DMs by 6-12 months—continue to point toward a sustainable rebalancing process. In these economies, unemployment rates have stabilized at a low level, employment growth has stabilized at an elevated level, and the average jobs-workers gap has been roughly stable at its 2019 level since the start of the year.

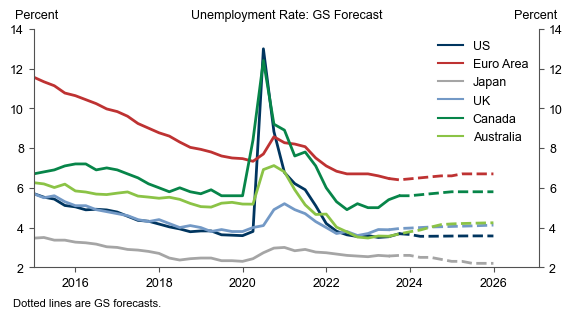

This evidence points toward a continued gradual rebalancing and subsequent stabilization in DM labor markets. We therefore continue to forecast that unemployment rates will remain near their current levels as wage growth gradually decelerates through end-2024.

A Temperature Check on DM Labor Markets[1]

Exhibit 1: Job Openings Have Declined Without a Significant Increase in the Unemployment Rate

Some Signs of Labor Market Softening

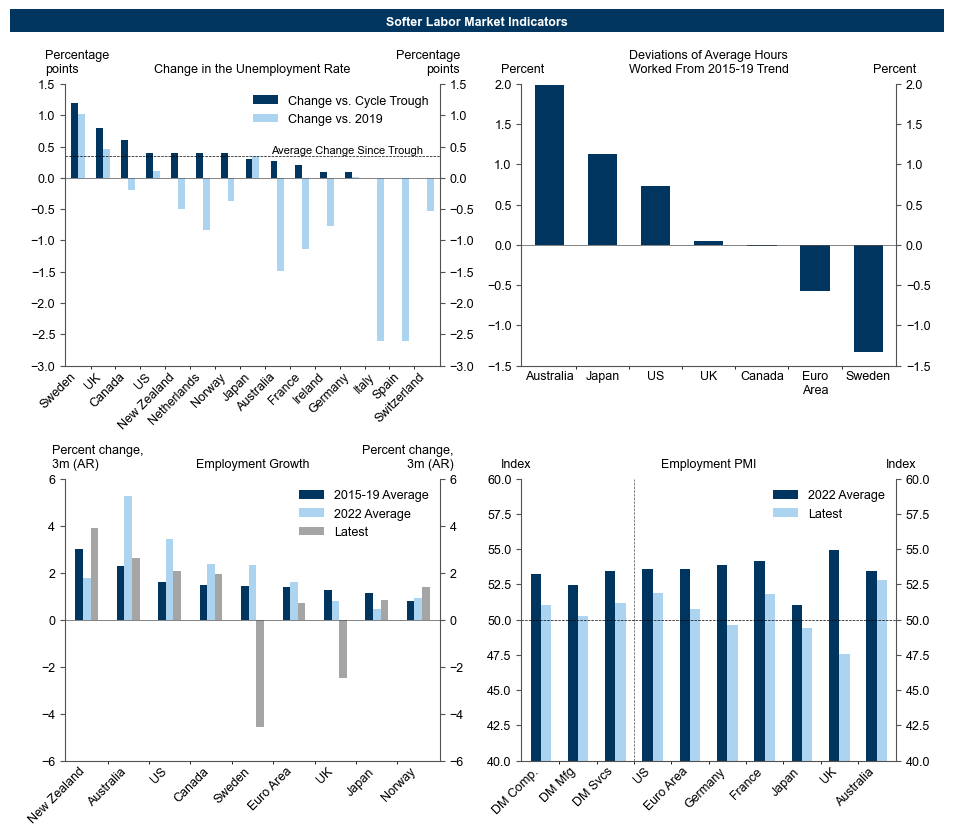

The unemployment rate has, on average, increased by 0.3pp from its trough, but remains near or below its 2019 level (and central bank estimates of NAIRU) in all DM economies aside from Sweden and the UK (top left chart, Exhibit 4). Furthermore, in most DM economies this increase in unemployment reflects an uptick in labor supply rather than an increase in layoffs.

Average hours worked have eased from their cycle peak in most DM economies—including by 4.3% in Sweden, 1.4% in the US, and 1.3% in Canada—but these declines mostly reflect a reversal of pandemic overshoots (themselves largely driven by changes in the composition of employment), and hours worked generally remain above their pre-pandemic trend (top right chart, Exhibit 4). A notable exception is the Euro Area, although our European economists note that some of this weakness reflects structural changes in the post-pandemic labor market that are likely to prove persistent.

Job growth has meaningfully slowed from its rapid pace in 2022, but generally remains above its pre-pandemic pace (bottom left chart, Exhibit 4).

The employment component of PMIs has generally eased from its 2022 level, but remains in expansionary territory in most economies outside of the UK, Japan, and Germany (bottom right chart, Exhibit 4).

Exhibit 5: A Holistic View Suggests Labor Markets Mostly Remain Tighter Than in 2019

Stabilization Ahead

Exhibit 7: Recent Rebalancing Mostly Reflects an Overshoot in Job Openings That is Now Reversing

Reiterating Our Positive Labor Market Outlook

Exhibit 11: We Expect Wage Growth to Moderate Gradually

Joseph Briggs

Giovanni Pierdomenico

- 1 ^ We would like to thank Chelsea Song, intern on the Global Economics team, for her contribution to this report.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.