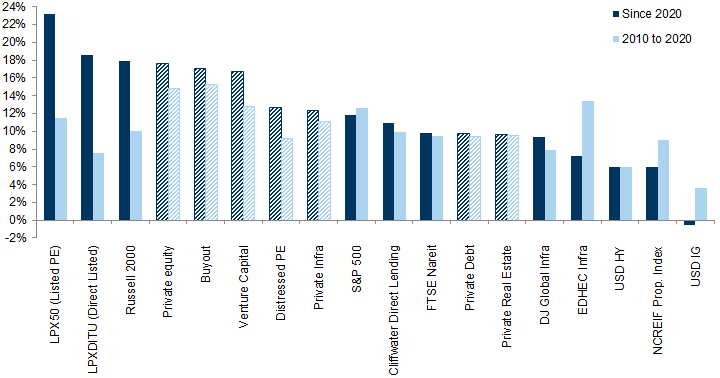

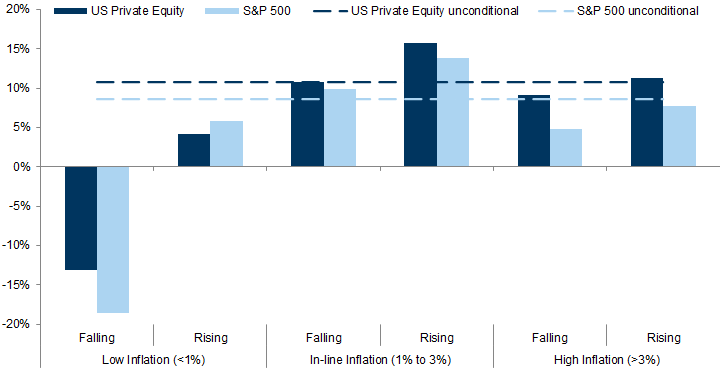

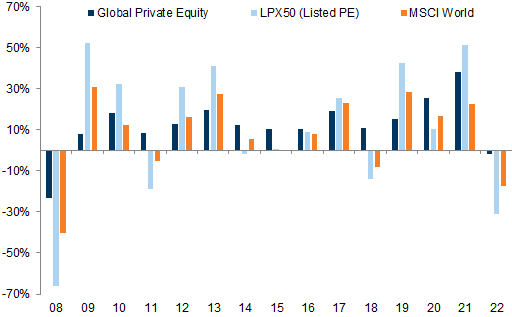

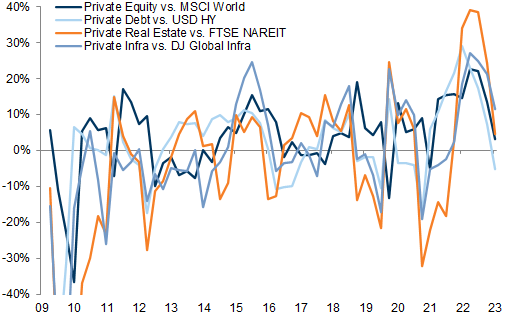

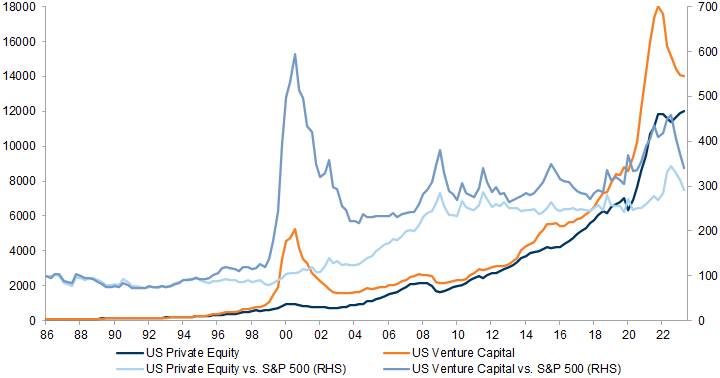

Is there a performance gap between public and private markets? Yes. But while private markets, especially private equity, have outperformed public markets only marginally post GFC, the performance gap has widened significantly post-Covid and tends to be larger in periods of elevated inflation.

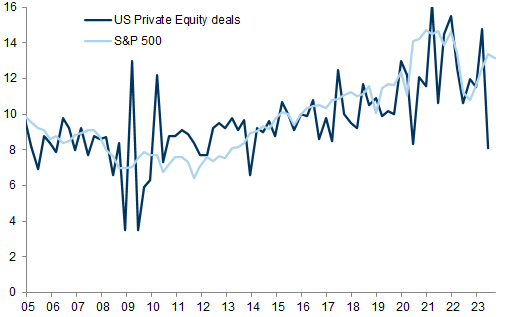

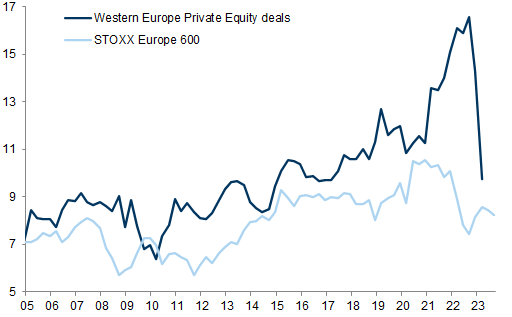

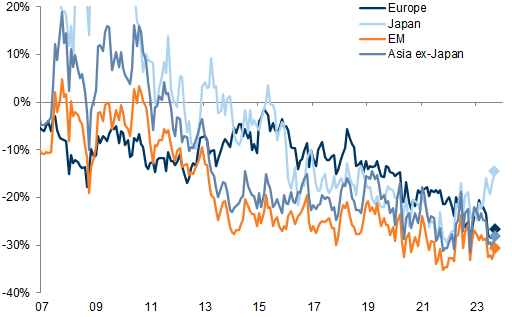

What about a valuation gap? The valuation gap is currently particularly large in Europe. Generally, valuation levels in private equity deals follow the same trajectory as the public stock markets, but disconnects can arise, as has been the case recently.

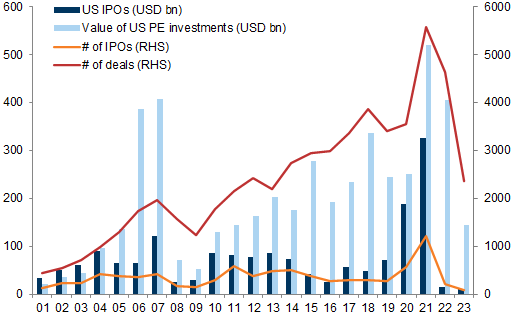

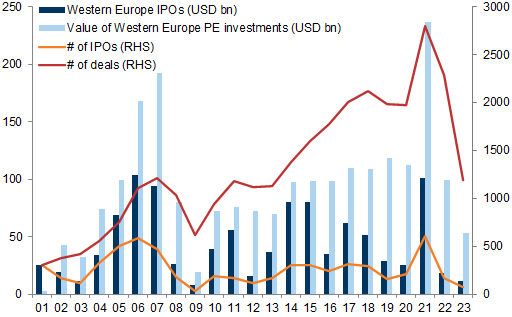

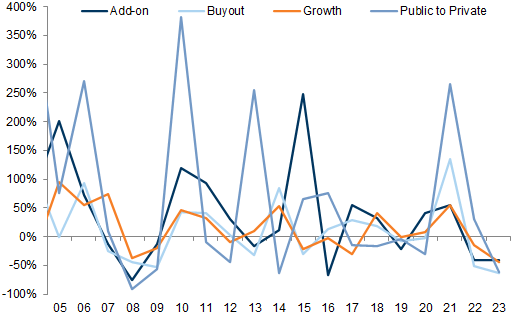

What could a revival of the IPO market mean for private equity? Private markets activity has been resilient through the shutdown of the IPO market, but historically the two have been closely correlated. A re-opening of capital markets should therefore contribute to a friendlier backdrop for private investments, especially buyouts and growth.

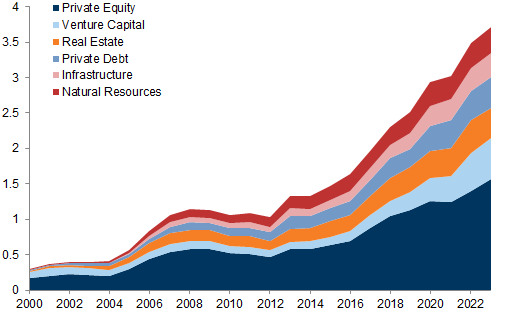

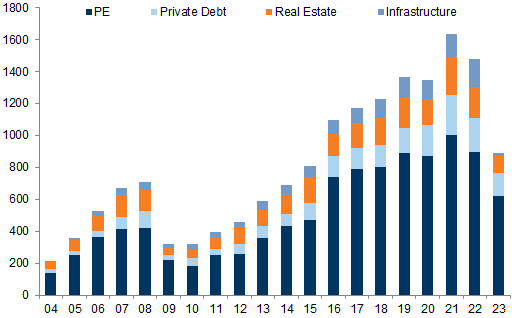

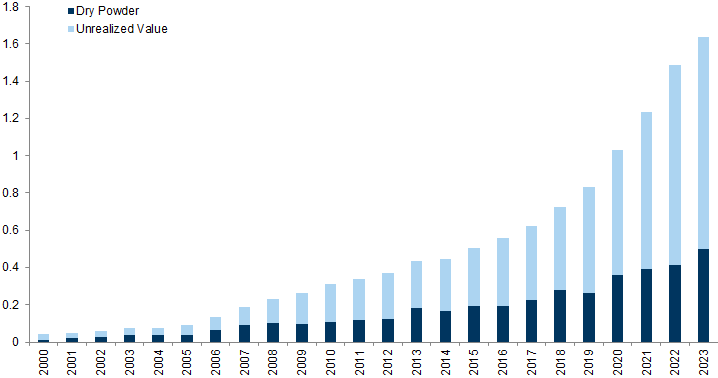

Where is money flowing in private markets? The post-Covid era has seen an unprecedented accumulation of capital across private strategies that have surpassed $13trn AuM. While private equity continues to account for the largest share of AuM, venture capital and private debt posted record growth rates.

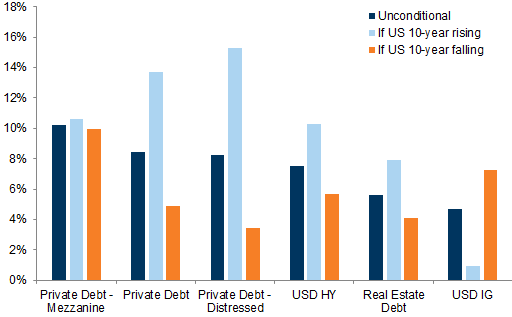

With growing focus on carry, how attractive is private credit? We think private credit can navigate a 'higher for longer' rates environment well given that the direct relationship between lenders and borrowers can provide higher flexibility. Private credit also benefits from a floating rates structure (in most cases) and can help reduce duration in a portfolio context.

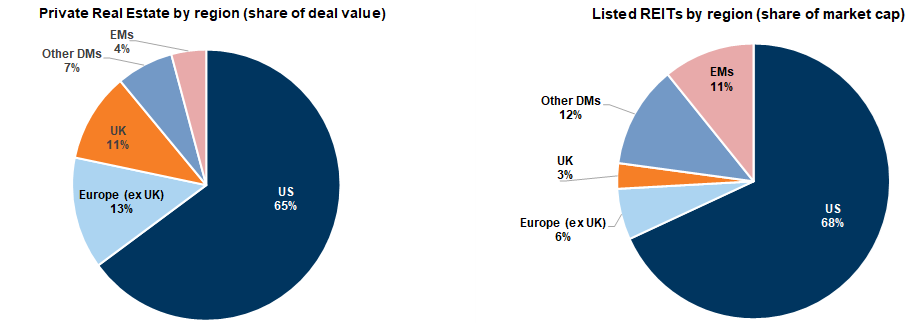

How is private real estate faring considering the stress in public markets? Private real estate has weathered the public market stress relatively well. While listed real estate has de-rated sharply and trades at attractive valuations, private real estate might still offer opportunities for broader diversification and reliable income streams in multi-asset portfolios, but investors need to accept higher leverage than in public.

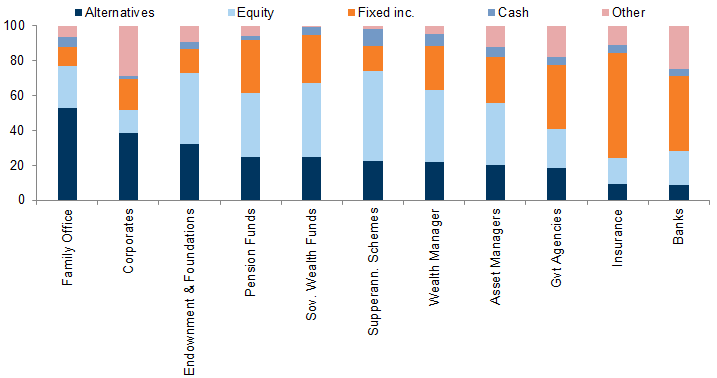

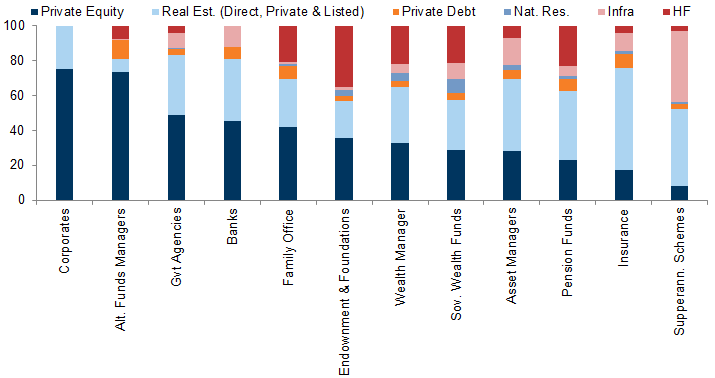

Who are the biggest investors in private markets? Portfolio composition varies materially across investor types, but family offices tend to run the largest allocation to private assets, followed by some large, long-term focused institutional investors such as sovereign wealth funds, endowments and pension funds.

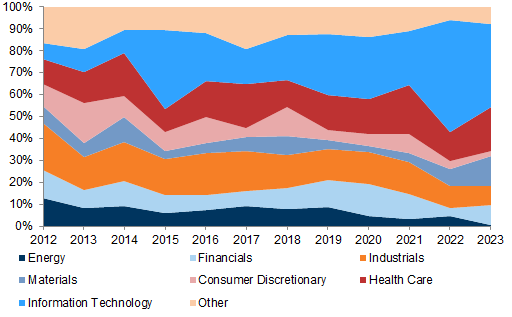

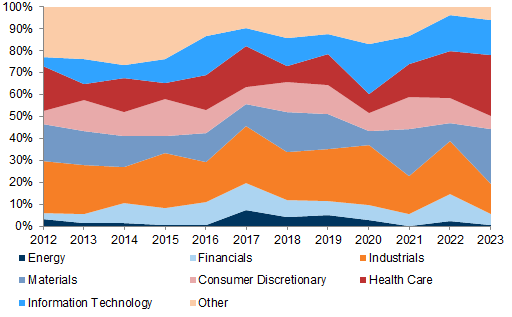

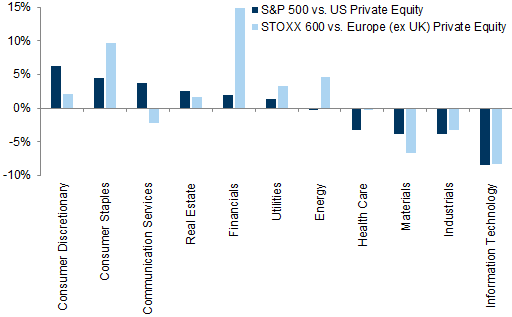

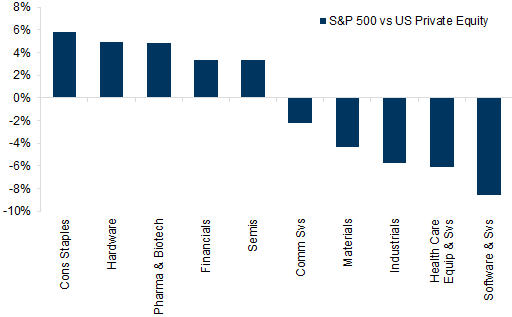

Which companies are private investors buying? The sector composition of the private equity universe has historically been fairly balanced and boasts more cash-generative, real economy companies. That said, over the past few years, Tech companies have become one of the preferred targets, not only in the US but also in Europe.

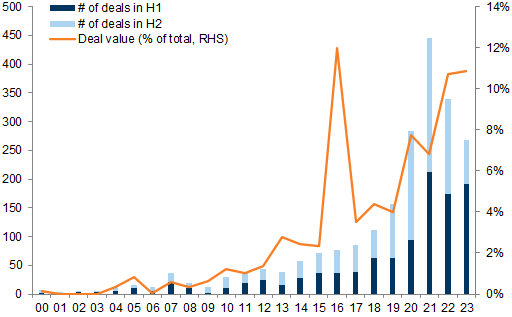

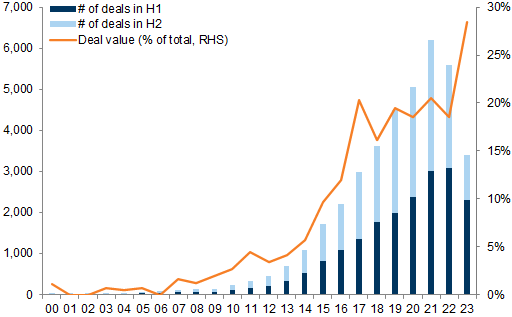

Is AI driving another strong Tech wave in private equity activity? Yes. The number of global private equity deals in AI has kept up with H1 last year (which was the second-best year after the record 2021) and the total value of AI-related deals has fallen by much less than the aggregate across sectors.

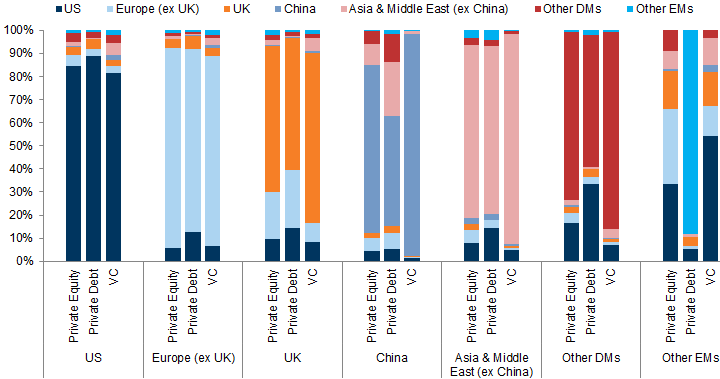

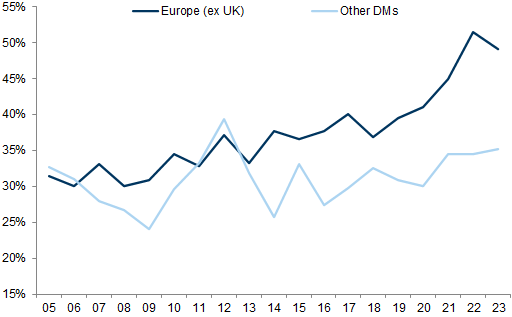

Is there a case for an increase in cross-border transactions given the US vs. RoW valuation gap? Yes. Private markets investments generally show a strong domestic bias, especially for investors based in developed markets. That said, a rebound in M&A activity could support more cross-border transactions as non-US assets trade at historical discounts to the US.

Private Markets Investigator: 10 Questions for Multi-Asset Investors

(1) Is there a performance gap between public and private markets?

Exhibit 1: Private markets, especially PE, have outperformed public markets since 2020

Exhibit 3: After the GFC, 2022 was the first year to record negative global private equity returns

Exhibit 4: The private/public performance gap had grown particularly large in Real Estate and Infrastructure into the start of the year

(2) What about a valuation gap?

Exhibit 5: With the rebound in valuations, public markets trade at higher multiples vs. private in the US

Exhibit 6: The private/public valuation gap is structurally larger in Europe

(3) What could a revival of the IPO market mean for private equity?

Exhibit 7: In 2022, IPO activity collapsed in the US, while buyout deals held up better

Exhibit 8: The gap was large also in Europe

Exhibit 9: There has been a sharp deceleration in private equity activity

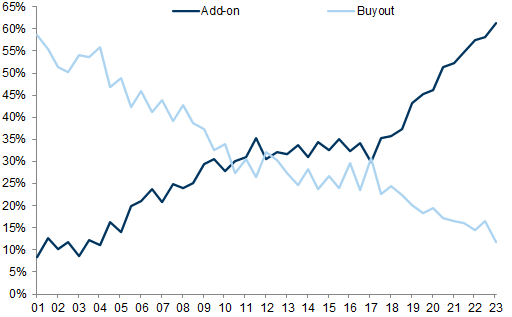

Exhibit 10: Add-ons have become the most popular investment option and higher rates have likely exacerbated the trend

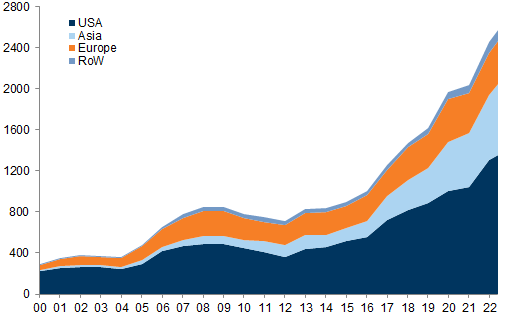

(4) Where is money flowing in private markets?

Exhibit 11: The private market complex ended 2022 with a record of around $4trn in dry powder

Exhibit 12: Europe first and Asia more recently have seen a significant increase in dry powder

Exhibit 13: YTD flows into private market funds are down more than 40% vs. the 2021 highs

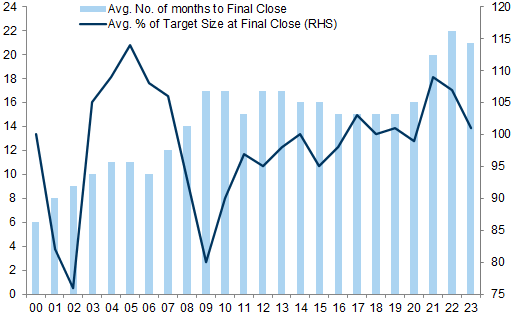

Exhibit 14: It takes longer for private equity funds to reach fundraising targets, but they still manage to do so

(5) With growing focus on carry, how attractive is private credit?

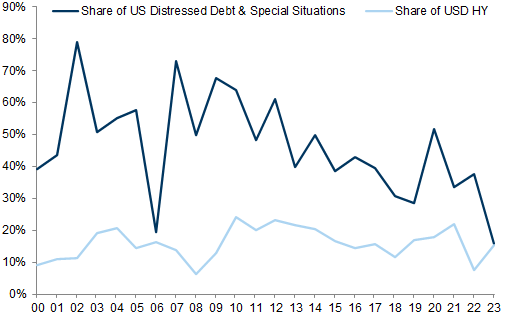

Exhibit 16: Private credit can outperform in a rising rate environment

Exhibit 17: The share of US distressed and special situation debt in private is well below the average since the GFC

(6) How is private real estate faring considering the stress in public markets?

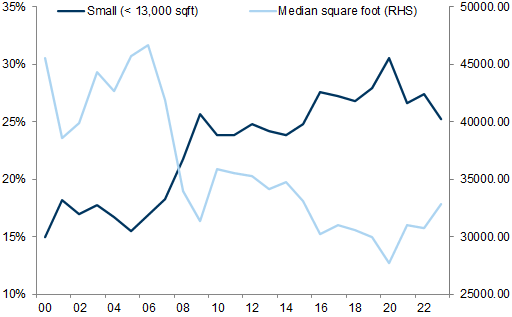

Exhibit 19: The share of deals on smaller properties has increased post-GFC

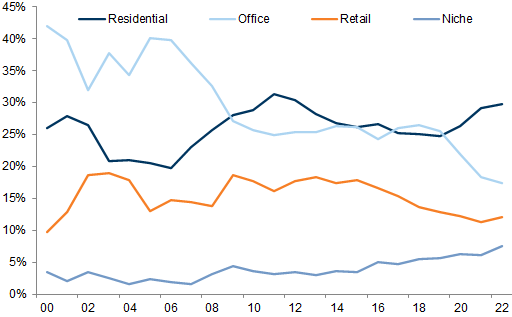

Exhibit 20: Deals in residential real estate have picked up relative to offices since Covid-19

(7) Who are the biggest investors in private markets?

(8) Which companies are private equity funds buying?

Exhibit 23: The sector composition of US PE has been relatively stable over time

Exhibit 24: The European PE market is more skewed to industrials and healthcare

Exhibit 25: Compared with listed equities, US private equity is more skewed to Tech, Europe to Healthcare

Exhibit 26: Us private equity Tech sector is much more skewed to software, the S&P 500 to hardware

(9) Is AI driving another strong Tech wave in private equity activity?

Exhibit 27: Private equity deals in AI are close to record highs in terms of share of total deal value

Exhibit 28: Record share of AI deals in the VC space

(10) Is there a case for an increase in cross-border transactions given the US vs. RoW valuation gap?

Exhibit 31: European countries' cross-border flows have increased

Exhibit 32: Non US markets trade at historical discounts vs. the US

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.