- Intro

- 5 key points from the Goldman Sachs Hedge Fund Trend Monitor

- Performance, leverage, and short interest

- Macro vs. micro returns

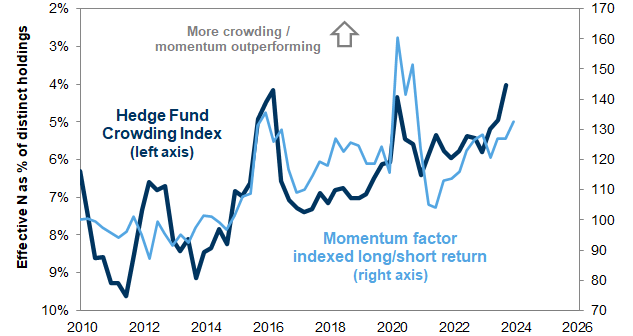

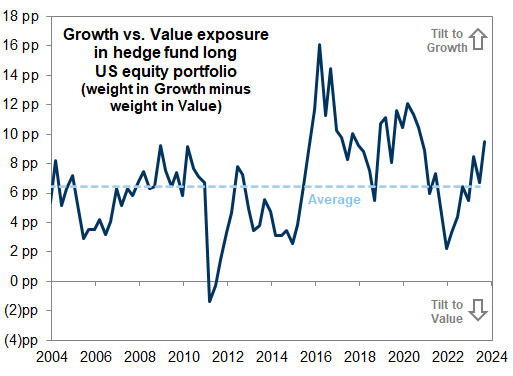

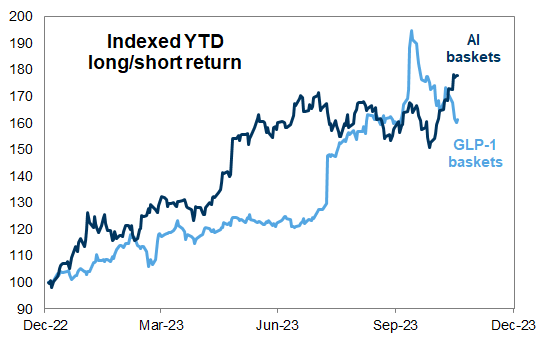

- Thematic and factor rotations: Momentum, Magnificent 7, and small-caps

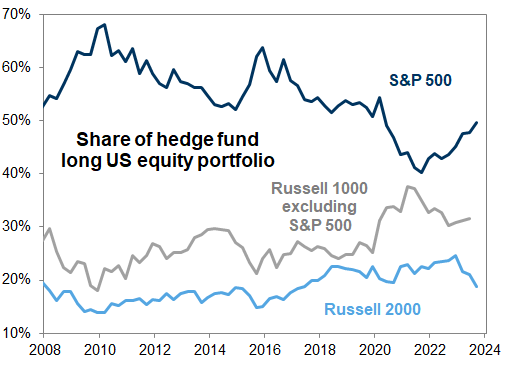

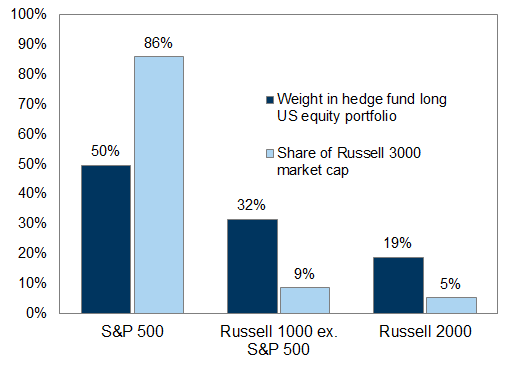

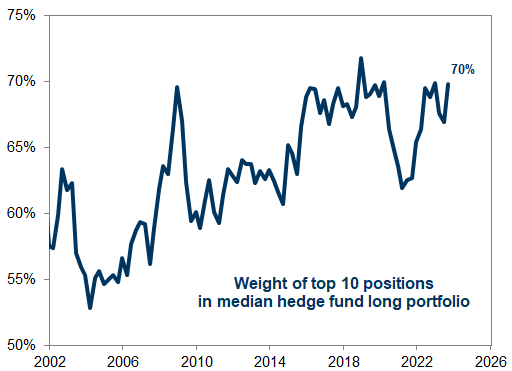

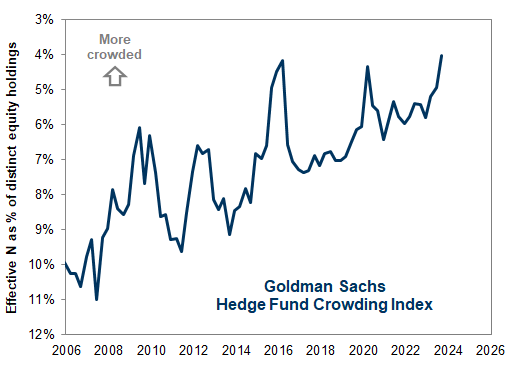

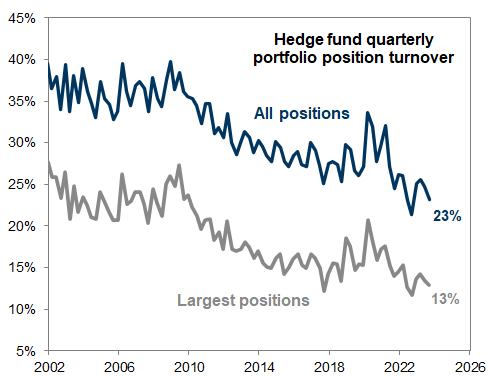

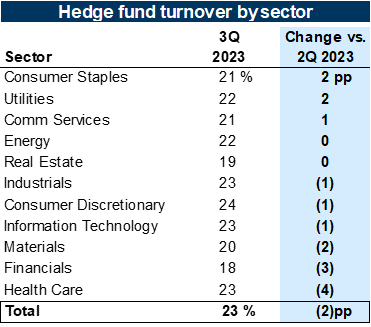

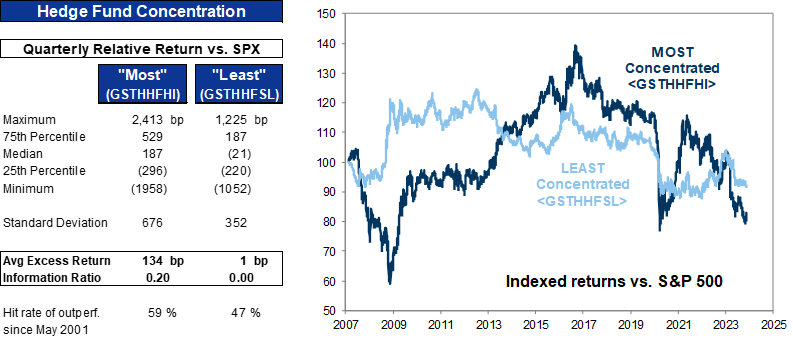

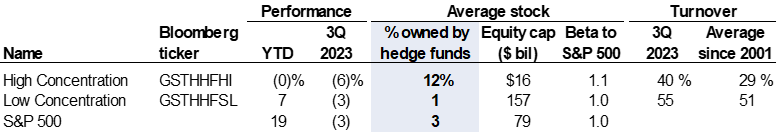

- Concentration, crowding, and turnover

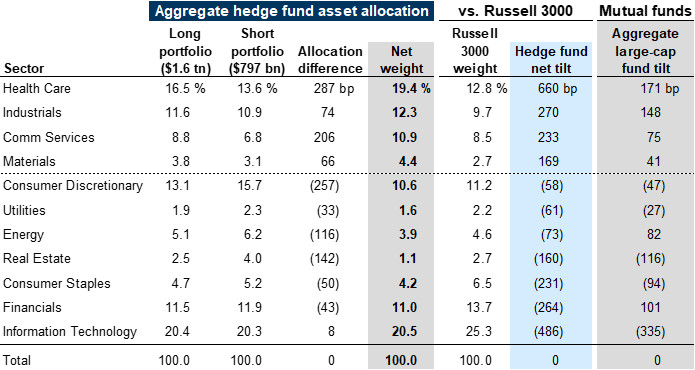

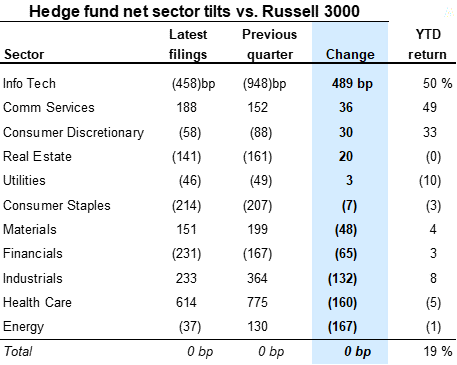

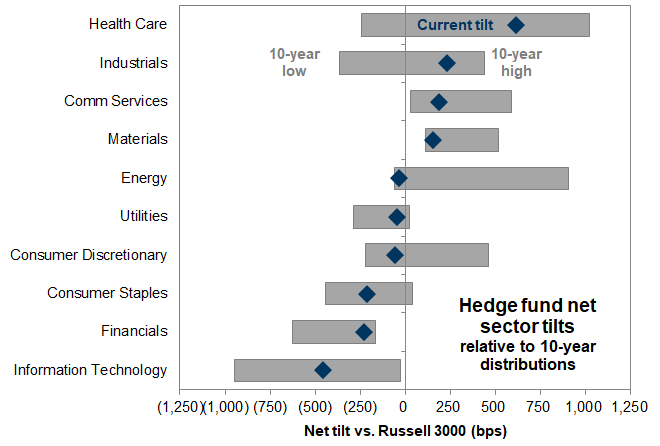

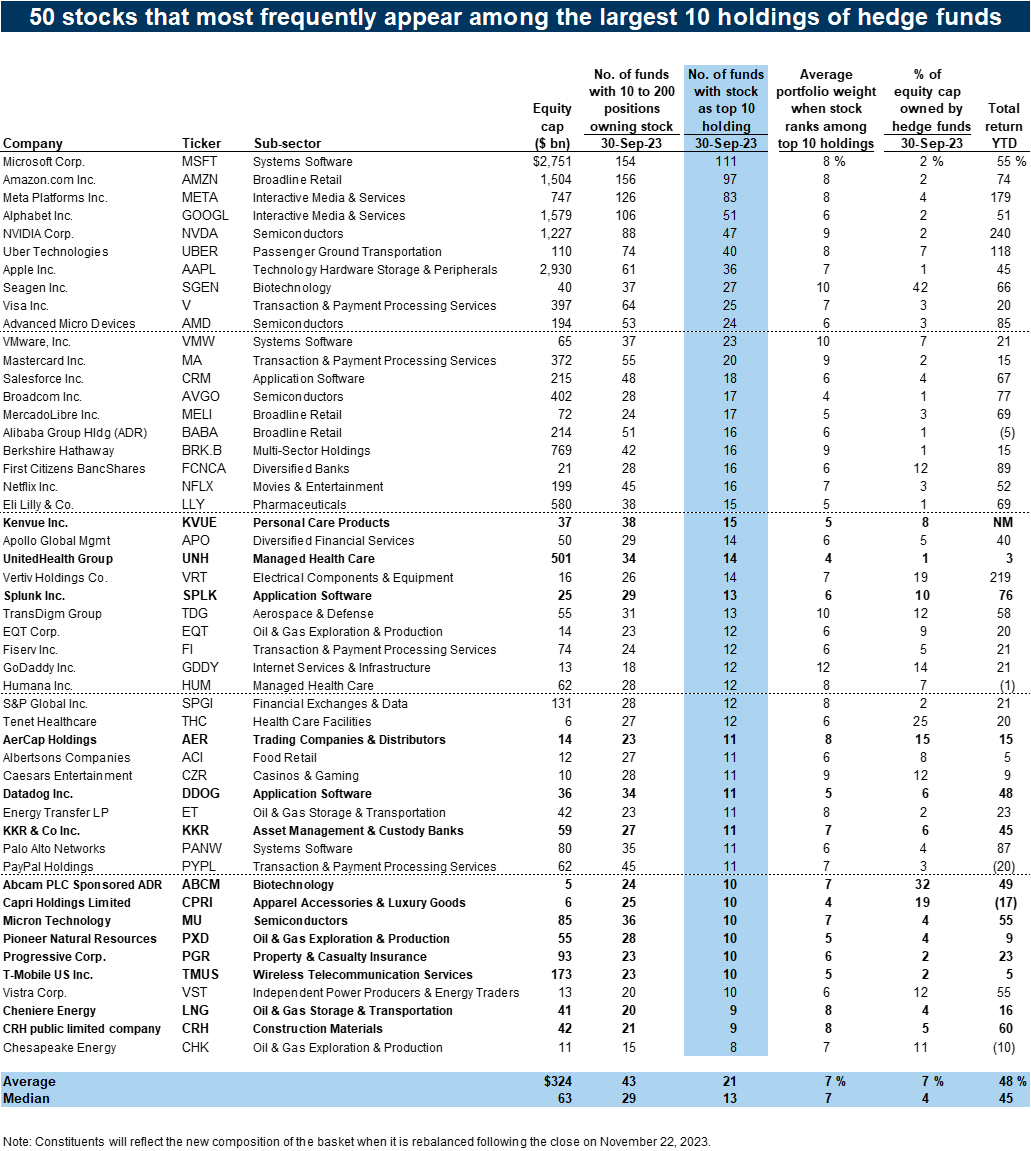

- Sector positions

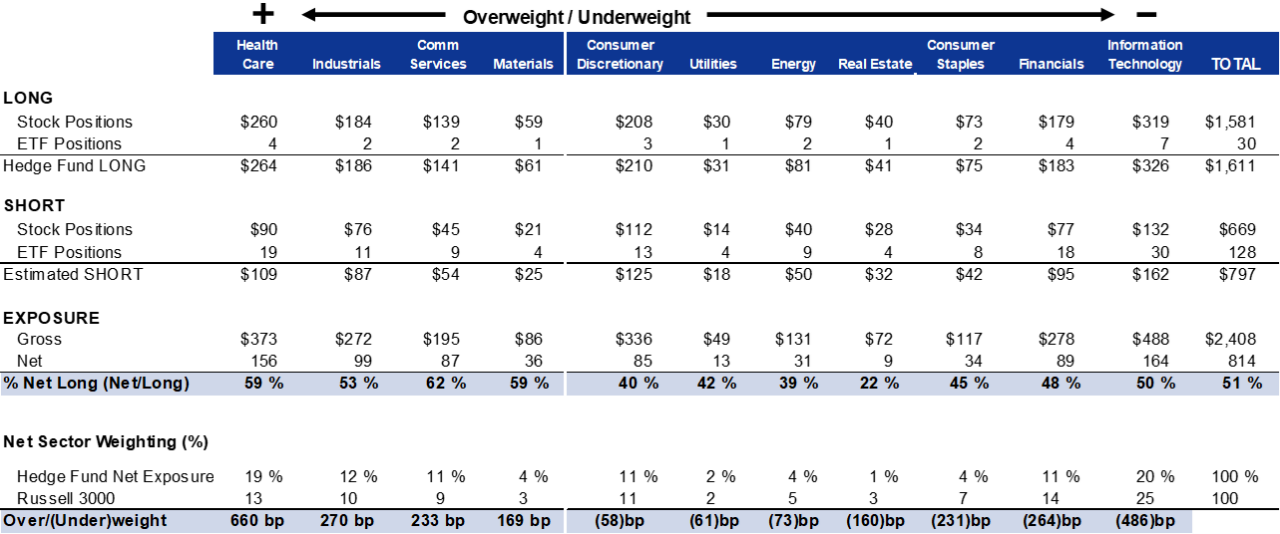

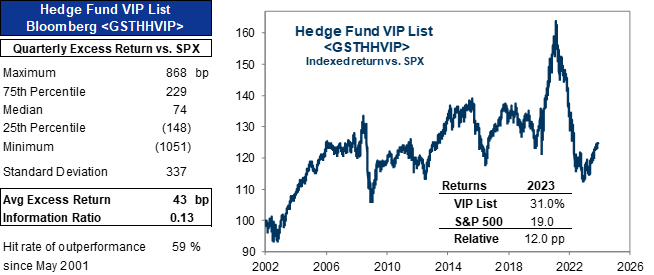

- The Hedge Fund VIP List: "The stocks that matter most"

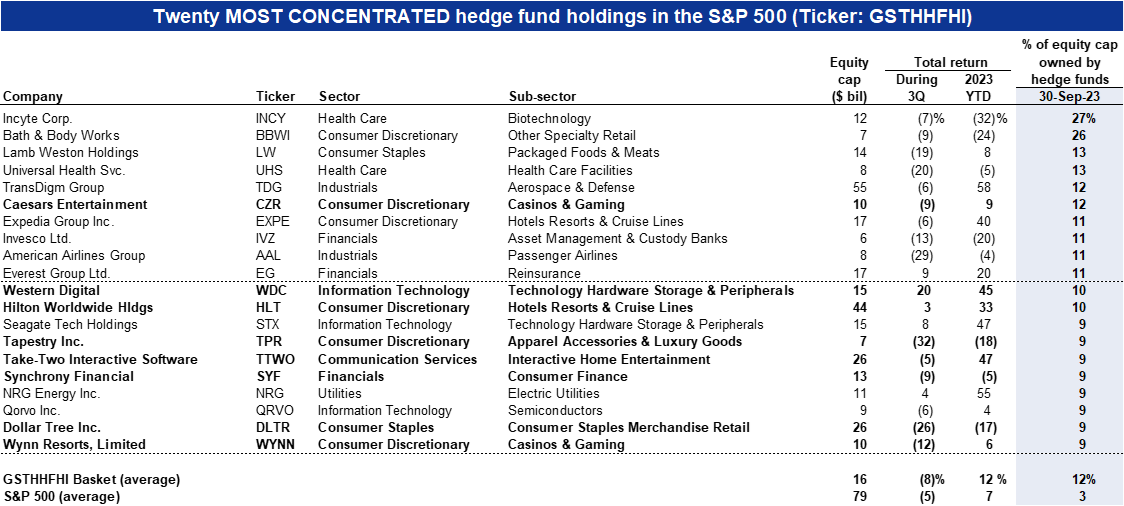

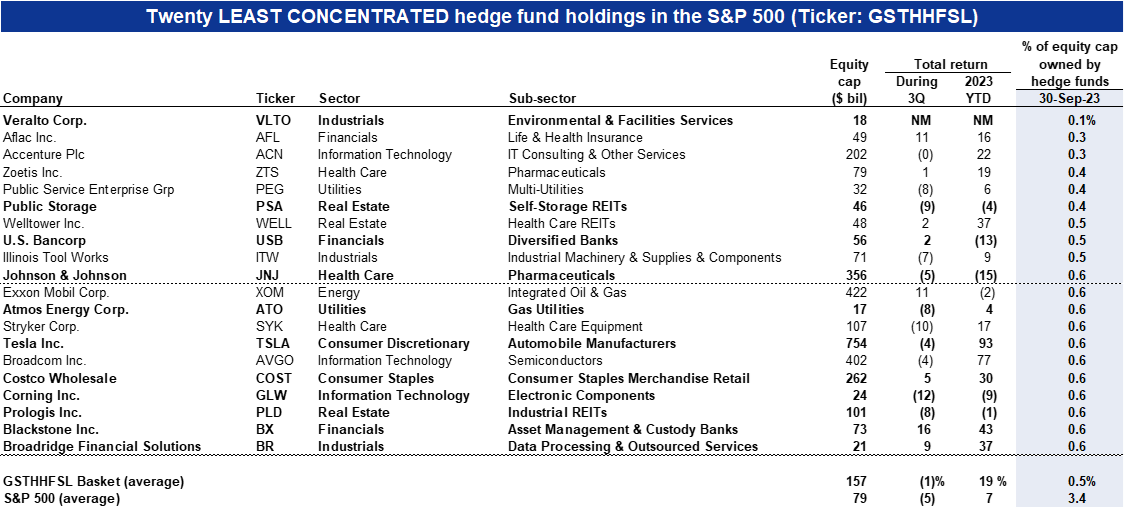

- The most concentrated hedge fund positions

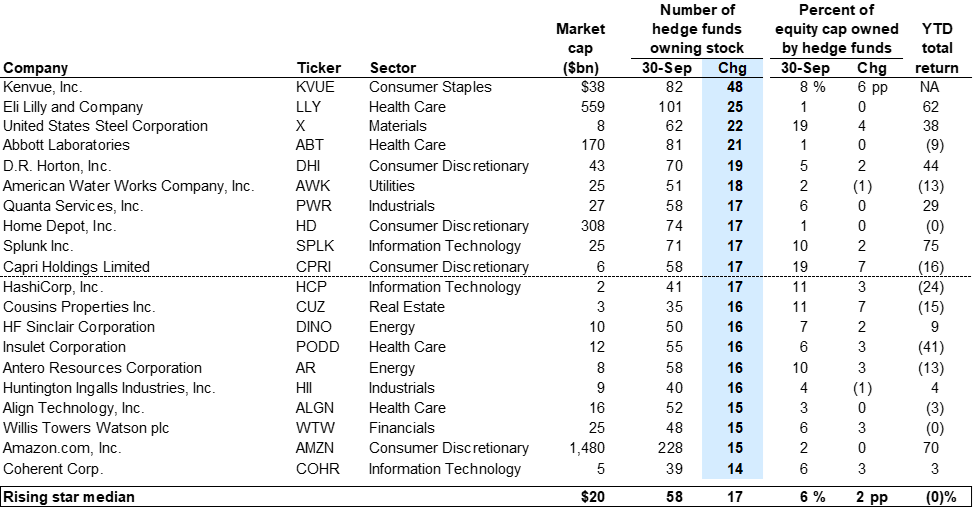

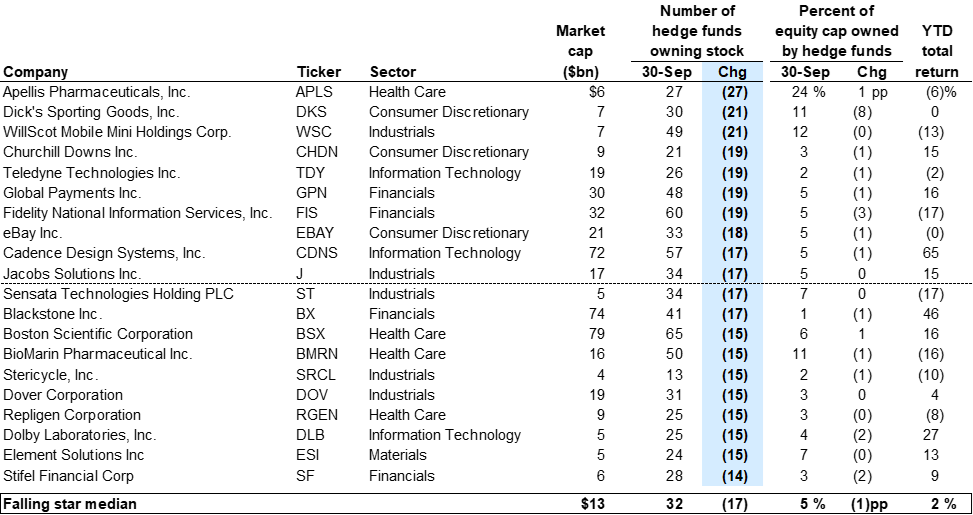

- Rising and falling stars

- ETF ownership

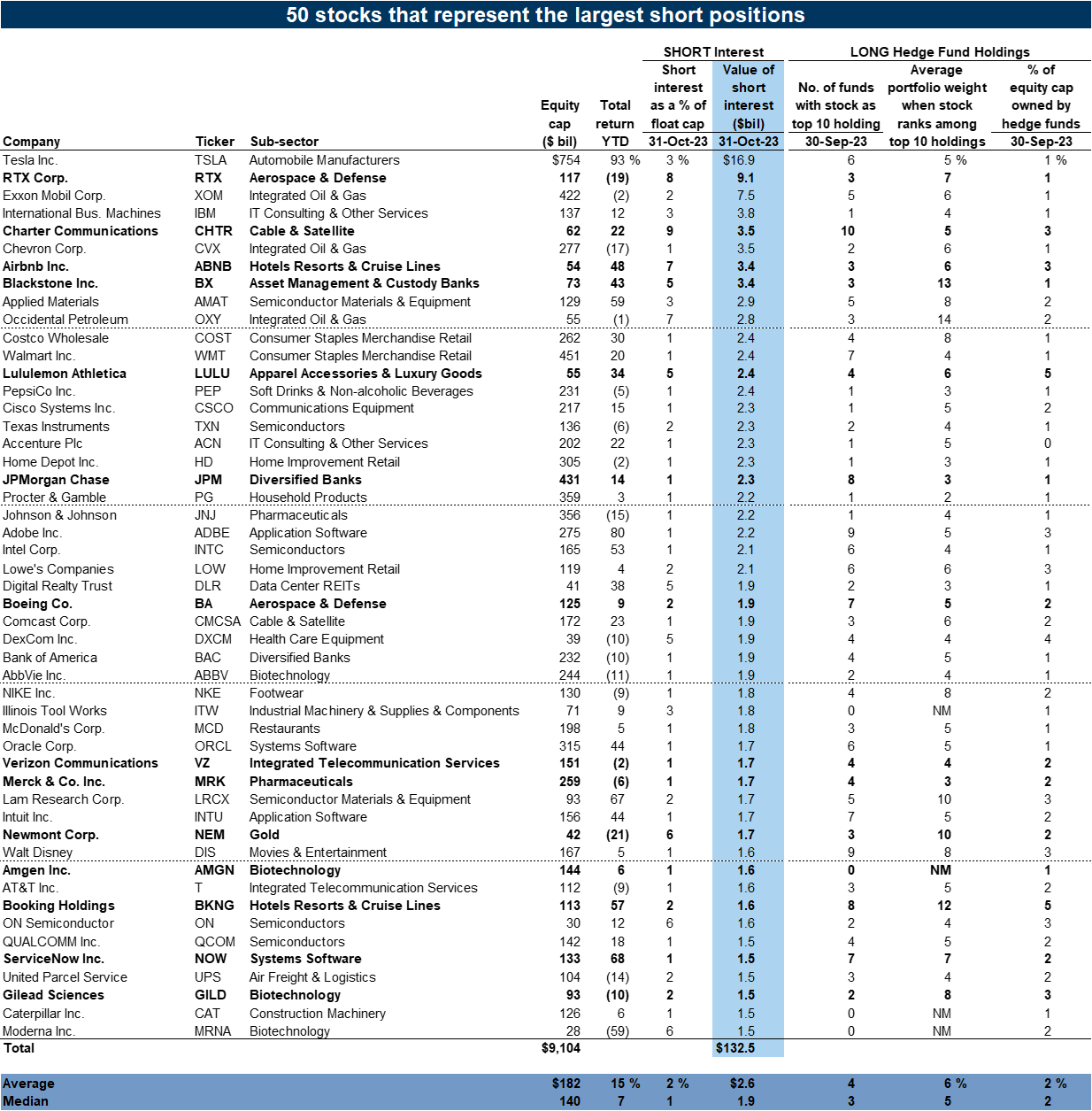

- The Very Important Short Position List

- Appendix A: Hedge fund data tables

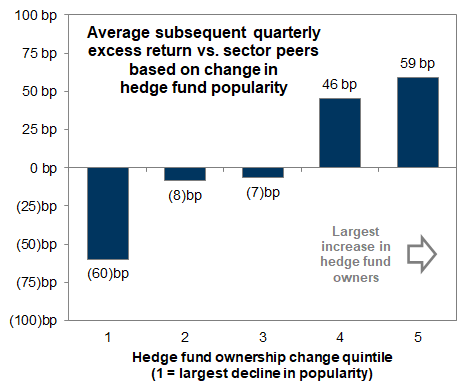

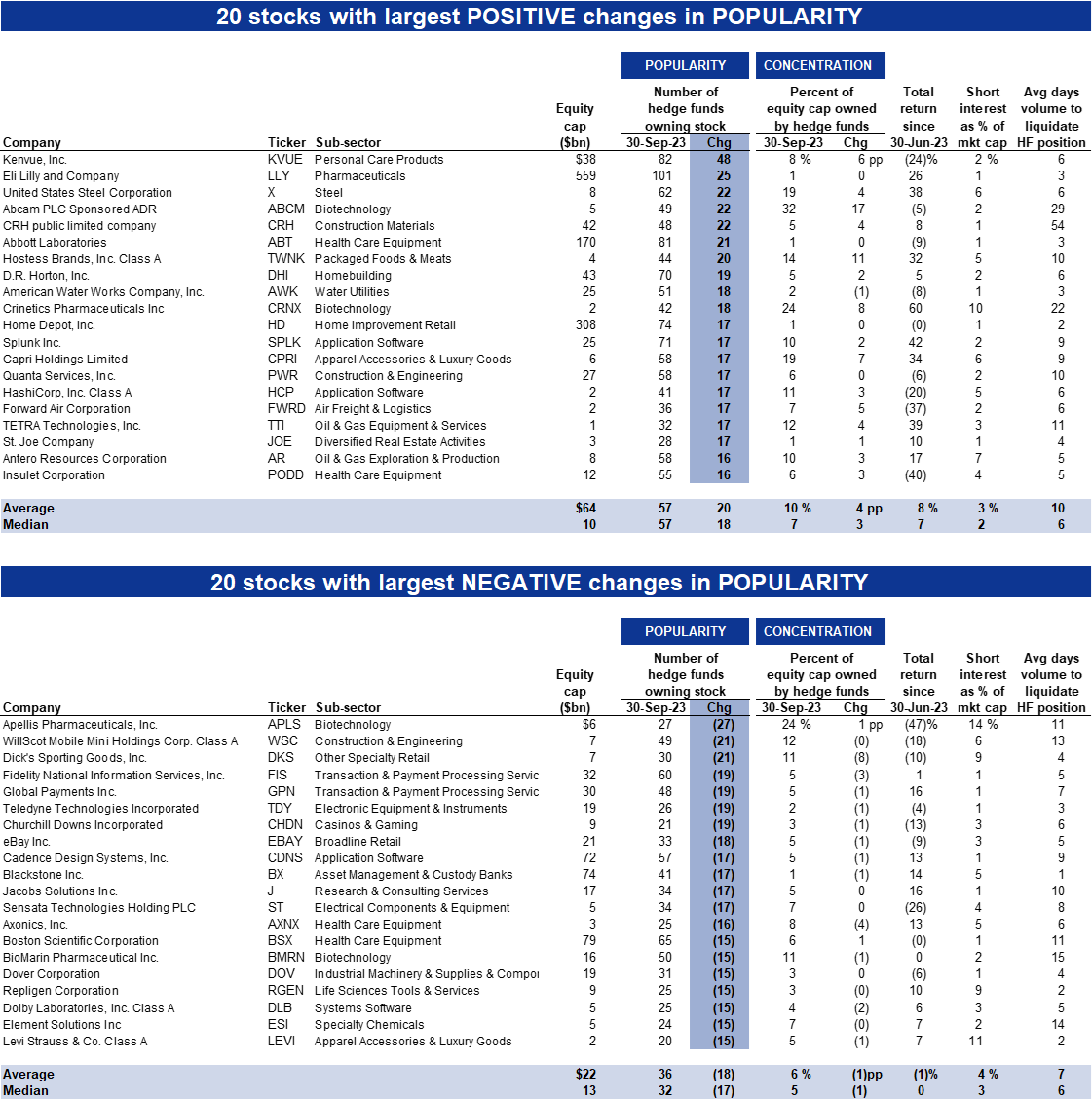

- Change in popularity: Largest increase and decrease in number of hedge fund owners

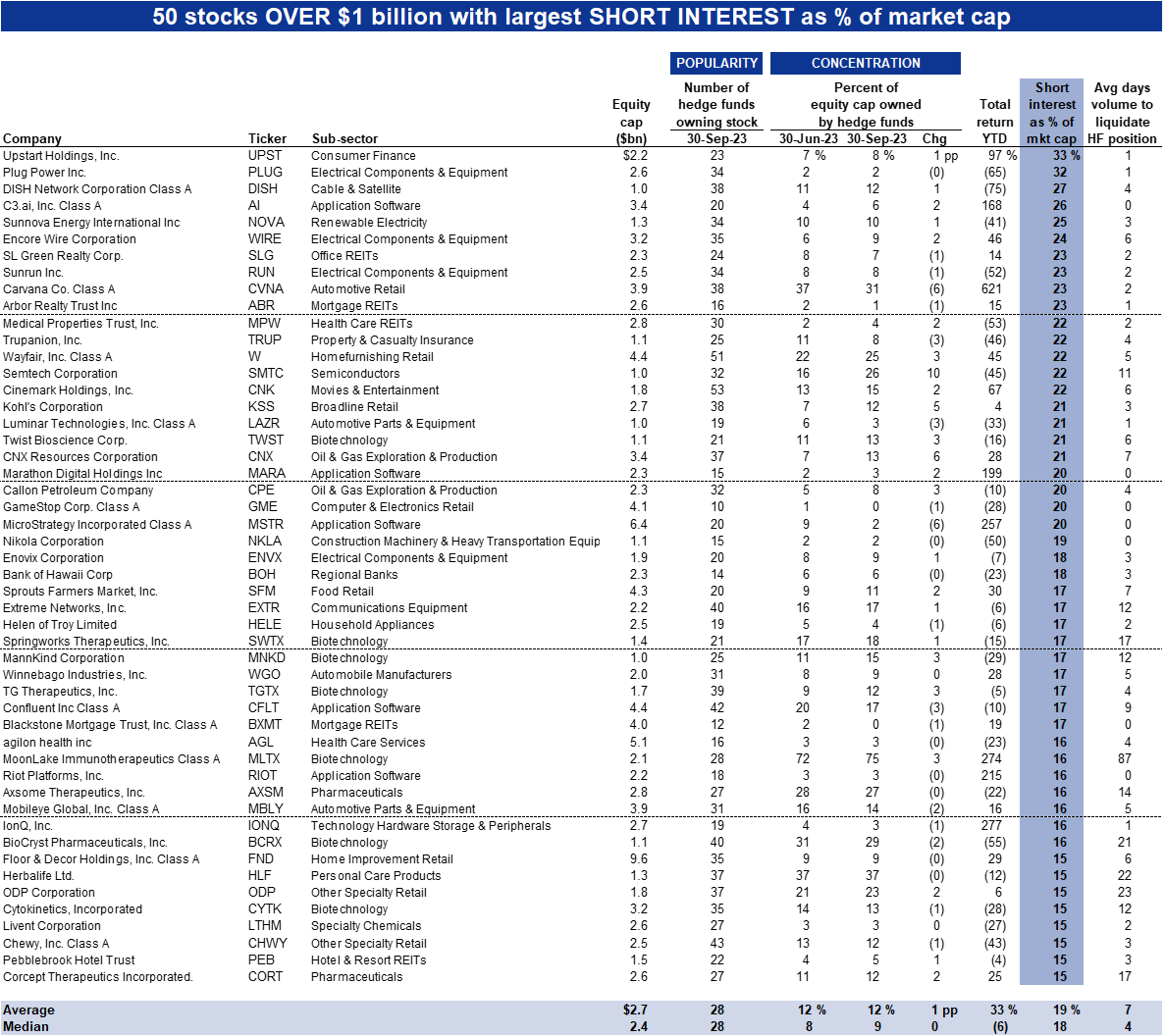

- Concentrated shorts: Highest short interest outstanding as a percentage of market cap

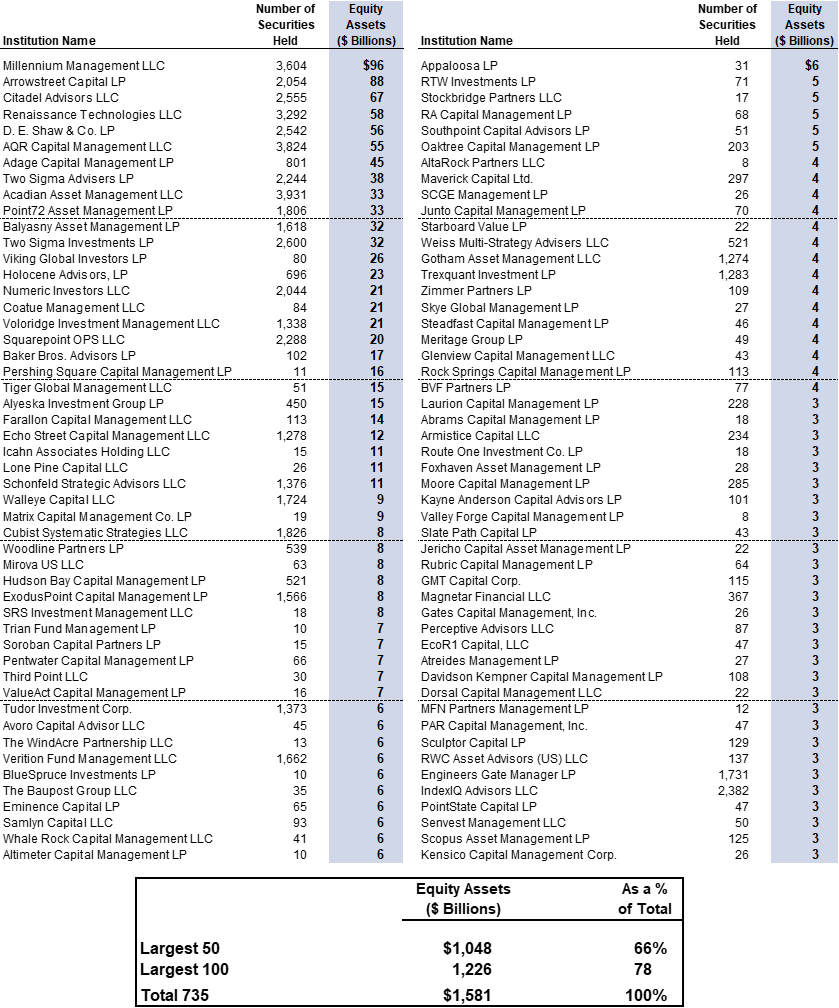

- Appendix B: 100 largest hedge funds in our analysis ranked by equity assets

- Appendix C: Drawbacks of our hedge fund holding analysis

5 key points from the Goldman Sachs Hedge Fund Trend Monitor

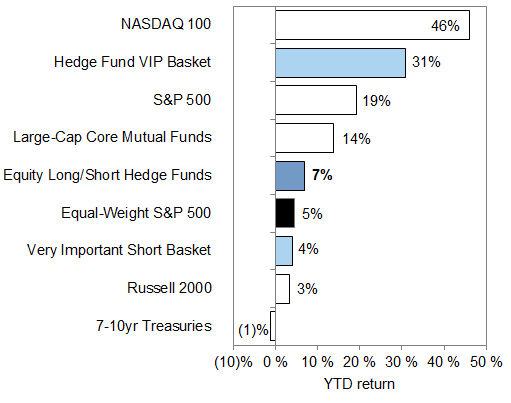

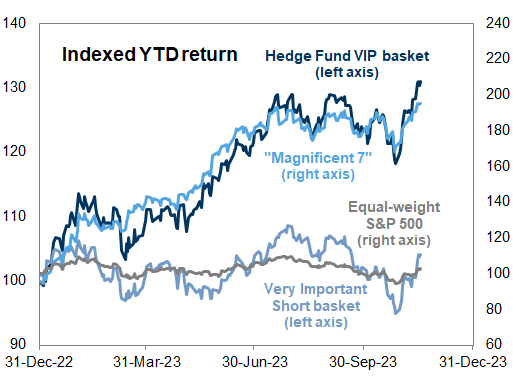

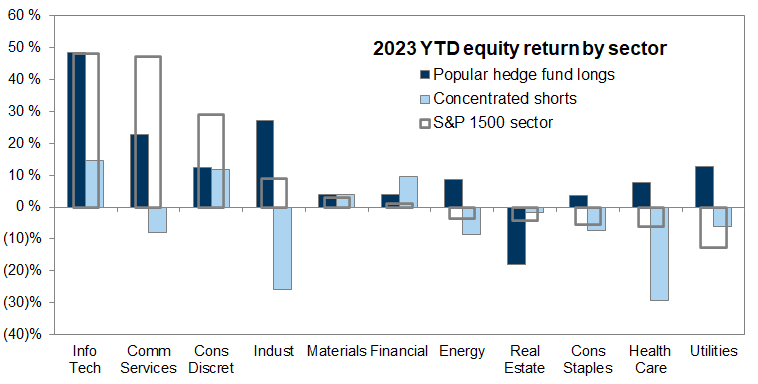

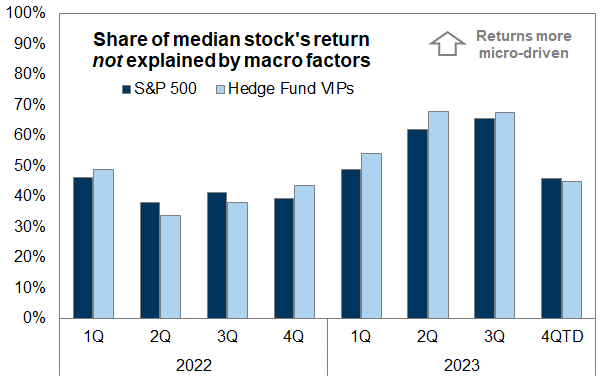

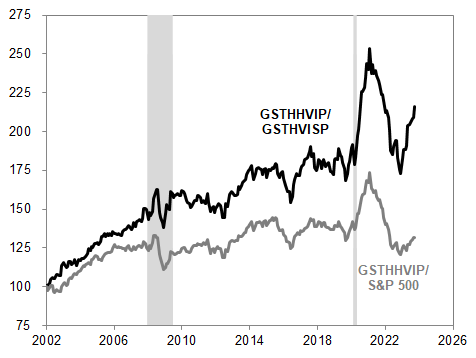

PERFORMANCE: The most popular hedge fund long and short positions have supported returns despite a deteriorating stock-picking environment Our Hedge Fund VIP list of the most popular long positions (ticker: GSTHHVIP) has returned +31% YTD, handily outperforming the S&P 500 (+19%), the equal-weight S&P 500 (+5%) and the most shorted stocks (GSCBMSAL, +0%). This outperformance has persisted despite the market volatility in recent months, with popular long positions outperforming concentrated shorts in most sectors. However, the improvement in the alpha-generation backdrop that took place earlier in 2023 has reversed, with the "micro" share of stock returns declining in 4QTD.

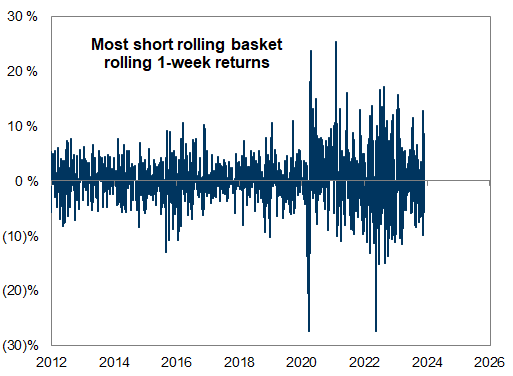

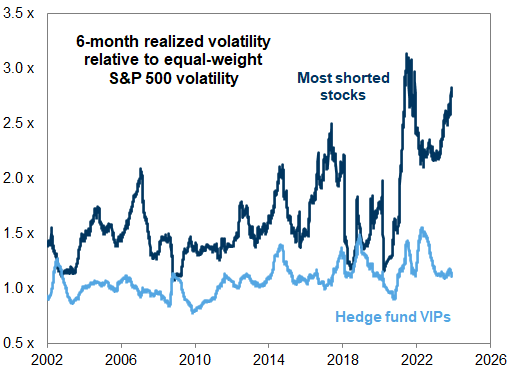

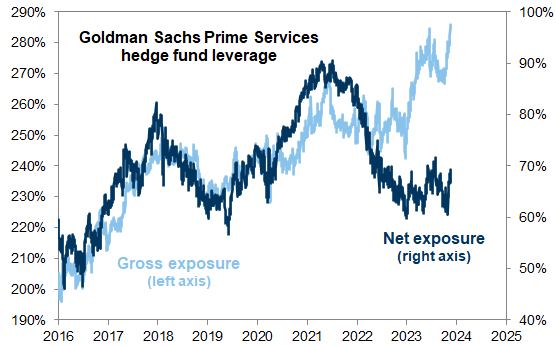

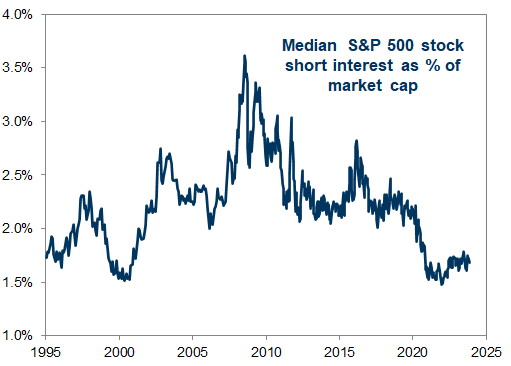

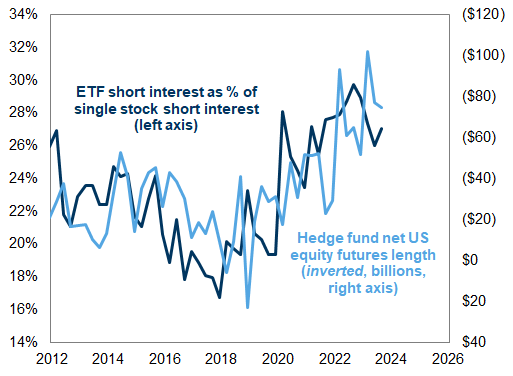

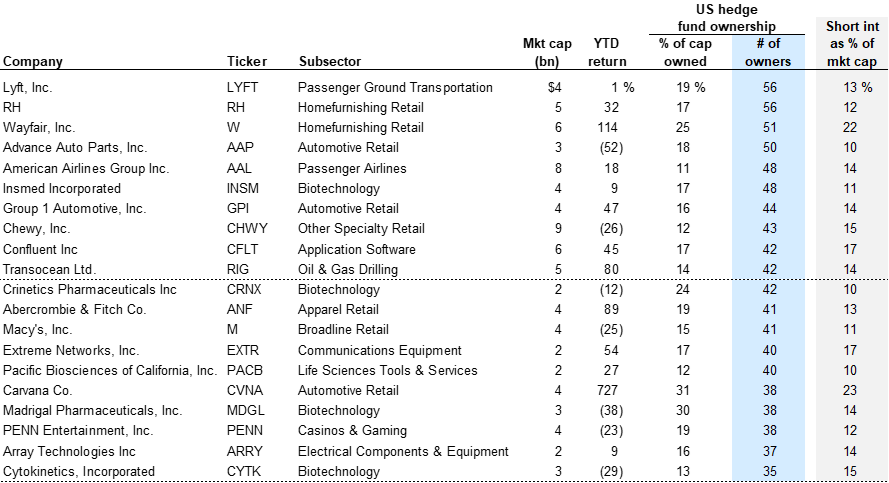

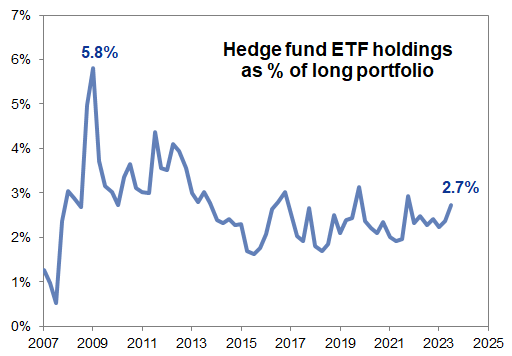

LEVERAGE AND SHORT INTEREST: Hedge funds have lifted net exposures modestly while maintaining record gross leverage. Elevated gross exposures help explain the extreme recent volatility of heavily shorted stocks. However, short interest in the typical stock remains low as funds have increasingly hedged using macro products like ETFs and futures rather than single stock shorts.

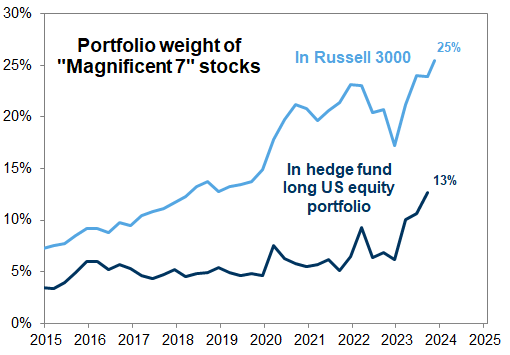

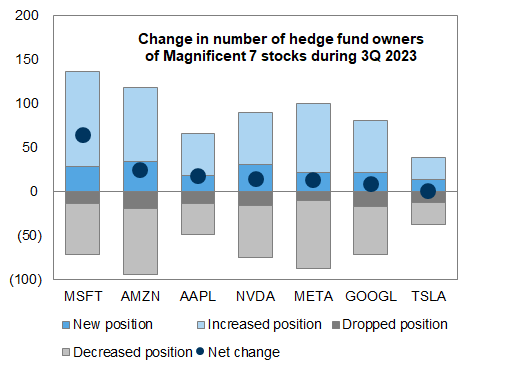

MAGNIFICENT 7: Funds bought mega-cap tech during 3Q, lifting their exposures to the "Magnificent 7" to a new high. The mega-cap tech stocks account for 13% of the aggregate hedge fund long portfolio, twice their weight at the start of 2023 but only half the stocks' weight in the Russell 3000. Except for TSLA, each of the seven rank among the top 10 members of our Hedge Fund VIP list. MSFT and AMZN have been the top two VIPs for nine consecutive quarters.

HEDGE FUND VIPS: The mega-caps remain the most popular hedge fund long positions. The top 6 stocks this quarter (MSFT, AMZN, META, GOOGL, NVDA, UBER) also ranked as the top 6 last quarter. The VIP list contains the 50 stocks that appear most often among the top 10 holdings of fundamental hedge funds. The basket has outperformed the S&P 500 in 59% of quarters since 2001 with an average quarterly excess return of 43 bp. 14 new constituents: ABCM, AER, CPRI, CRH, DDOG, KKR, KVUE, LNG, MU, PGR, PXD, SPLK, TMUS, and UNH.

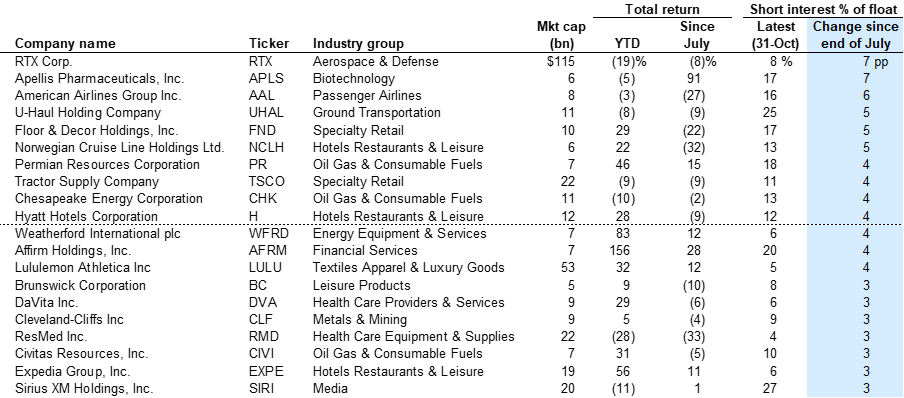

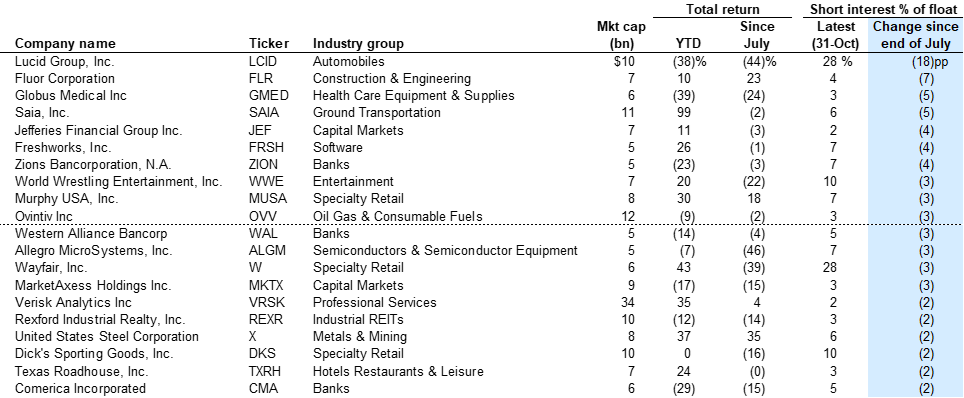

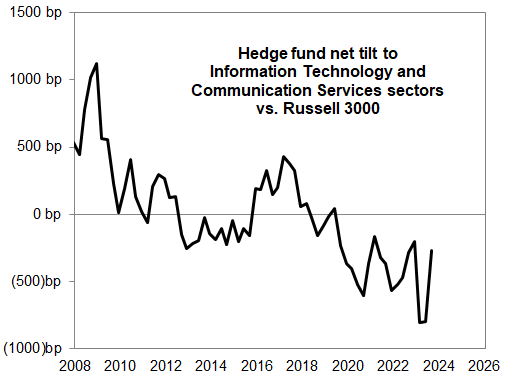

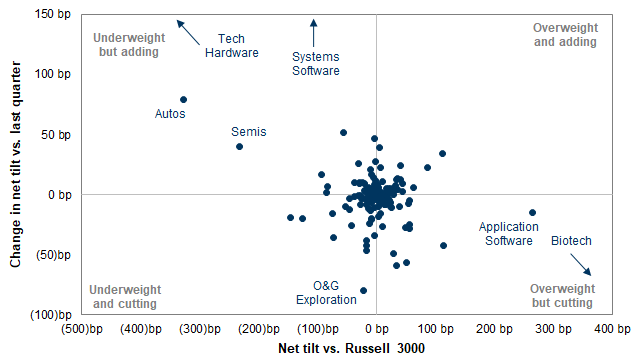

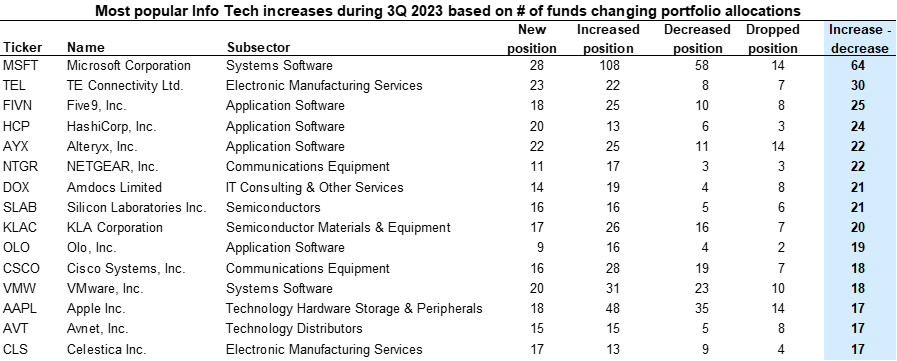

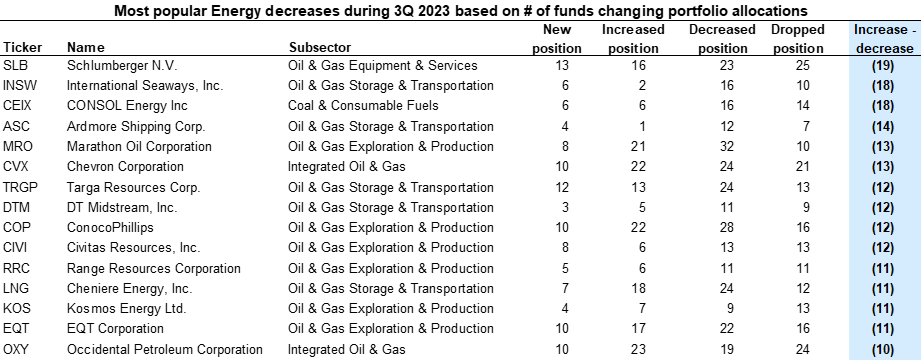

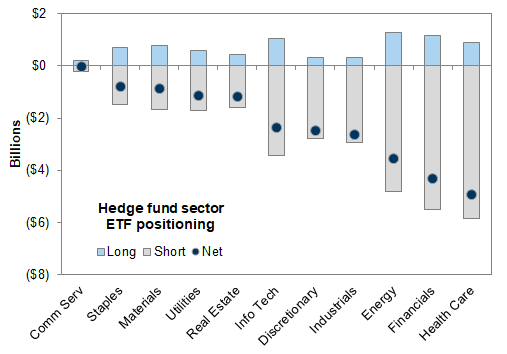

SECTORS: Hedge funds added heavily to Tech last quarter, with broad-based increases across industries. Funds sold Health Care, but it remains the largest sector overweight relative to the Russell 3000. Funds also sold Energy, where tilts are close to the lowest since before the GFC. The consumer remains a point of debate, with consumer firms heavily represented on our list of "controversial" stocks with high ownership and high short interest (Exhibit 15). CZR, DLTR, HLT, SYF, and WYNN joined our High Hedge Fund Concentration basket (Exhibit 39). Similarly, funds remained underweight Financials and JPM and C fell out of our VIP list, but CMA, JEF, MKTX, WAL, and ZION ranked among the stocks with the largest decrease in short interest during the last few months.

Performance, leverage, and short interest

Exhibit 2: GS Prime Services estimates a 7% YTD return for US long/short equity hedge funds

Exhibit 3: The most popular hedge fund positions have fared well YTD

Macro vs. micro returns

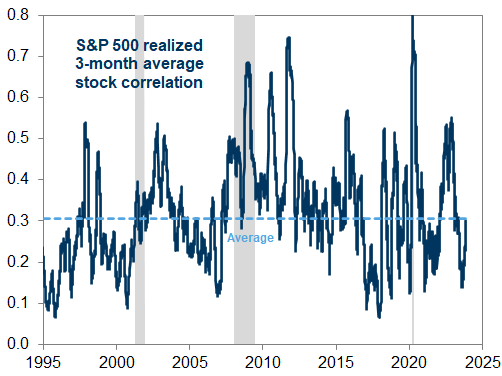

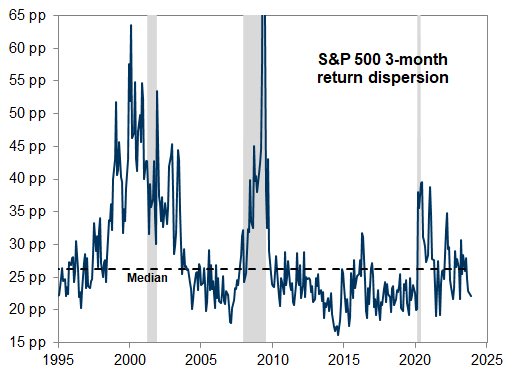

Exhibit 12: The trend toward increasingly micro-driven stock returns has reversed QTD

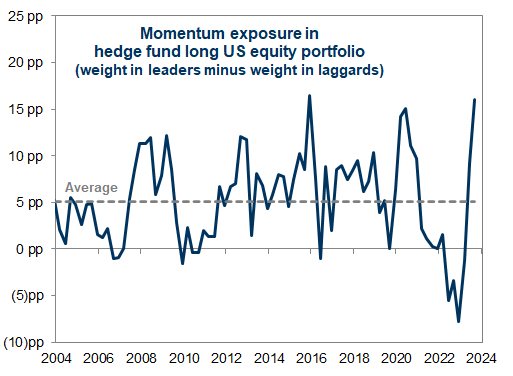

Thematic and factor rotations: Momentum, Magnificent 7, and small-caps

Concentration, crowding, and turnover

Sector positions

The Hedge Fund VIP List: "The stocks that matter most"

GSTHHVIP: The 50 stocks that matter most to hedge funds

Exhibit 36: Very Important Positions (VIP) for hedge funds

The most concentrated hedge fund positions

Goldman Sachs S&P 500 hedge fund concentration baskets

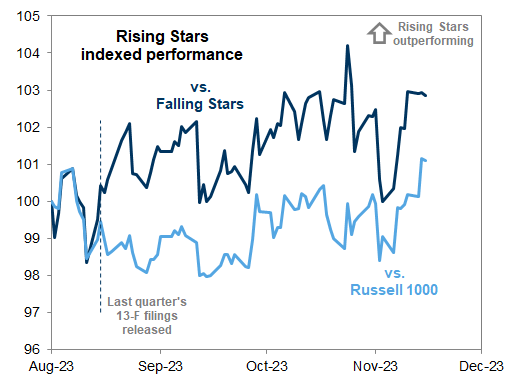

Rising and falling stars

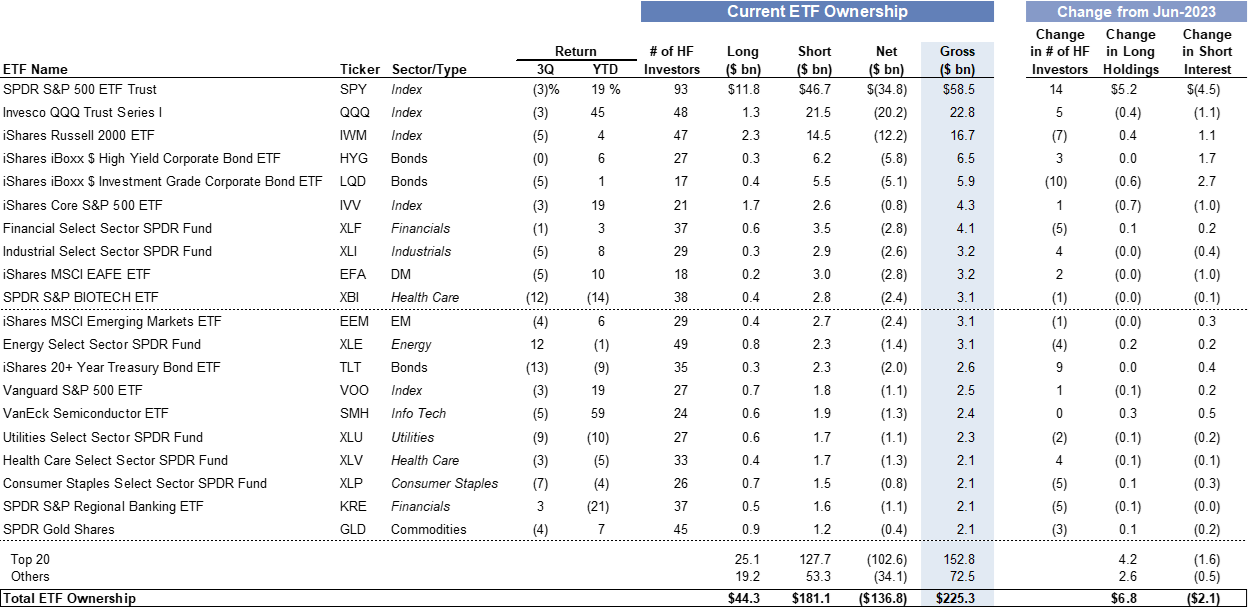

ETF ownership

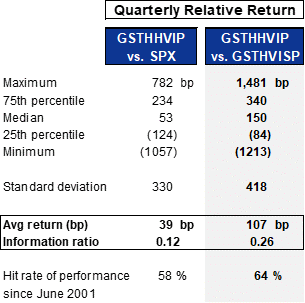

The Very Important Short Position List

GSTHVISP: 50 stocks representing the largest short positions

Appendix A: Hedge fund data tables

Appendix C: Drawbacks of our hedge fund holding analysis

Data limitations

Lack of international holdings

Incomplete reporting of short positions

Timeliness

- 1 ^ Hedge Fund Crowding Index is measured as the effective N (calculated as 1/Σ[weight2]) divided by the number of distinct equities in the aggregate portfolio of hedge funds with between 10 and 200 individual equity positions.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.