Lithium: The short trade must go on

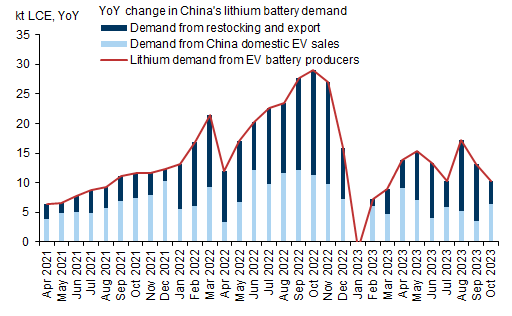

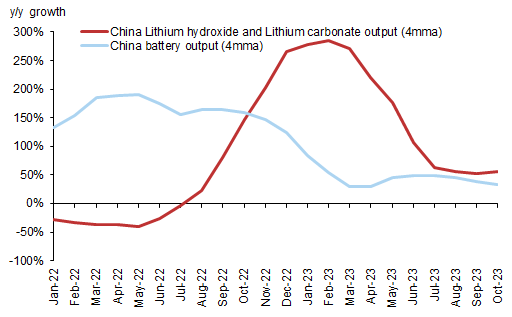

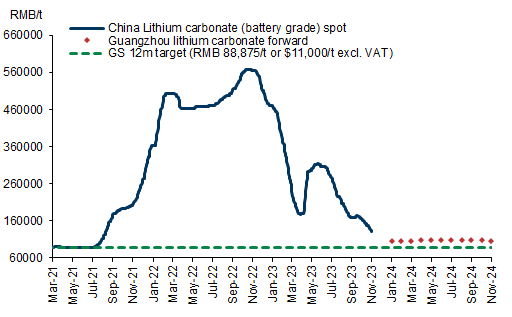

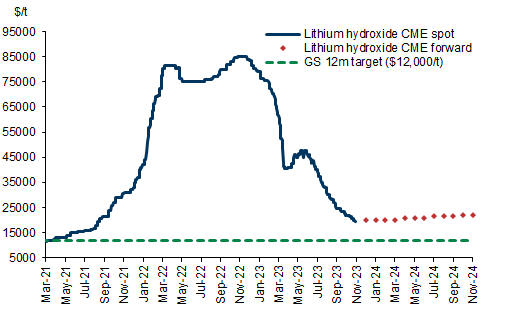

Surplus pressures build. The lithium market has seen a renewed bear market shift with prices falling 19% over the past 4 weeks (and a 73% fall YTD). Indeed, the softening in the lithium market has become incrementally apparent with the slowdown in demand growth now in direct contrast with growing global lithium supply. Chinese EV sales and battery output have continued to rise, but a phase-out of subsidies and supply chain normalisation have weighed on the pace of growth and as a result, Chinese lithium battery demand volume growth has slowed down materially. The rise in chemical output has overtaken the growth in China battery output and China’s imports of spodumene concentrate (+60% y/y YTD) – particularly from Australia and Zimbabwe – have continued to grow sharply. At the same point, there remains little evidence of supply rationing, with only an estimated ~40kt of supply loss over the past 12 months due to cost pressures. However, with the market largely balanced YTD, the full extent of supply led surplus is yet to be realised with prices still 33% above the top-end of the integrated cost curve. We expect the lithium market to be in a 202kt surplus next year – which represents 17% of global demand – and continue to expect prices to trade deeply into the cost curve to balance the market. In this context, we maintain our bearish view on the lithium market and lower our 12m target for China Lithium Carbonate (excluding VAT) to $11,000/t and CME Asia CIF Lithium Hydroxide to $12,000/t (from $15,000/t and $16,500/t respectively previously).

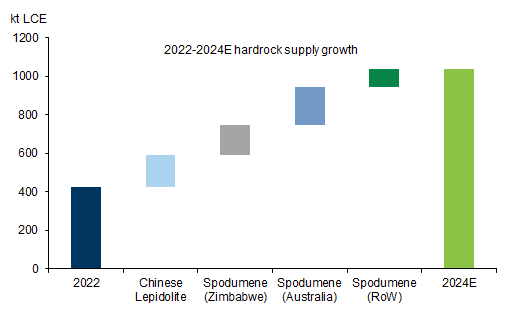

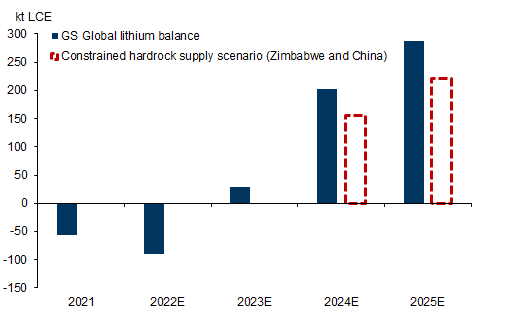

It's all about the costs. Even with a sharp correction in prices, Chinese battery grade lithium carbonate price is still ~$4k/t LCE (or 33%) above the top-end of integrated cash cost curve, but ~60kty of non-integrated production using purchased spodumene is in loss-making. Our China equities team estimates the cash cost of production for integrated Chinese lepidolite is between $8k-12k/t LCE with key cost inflation risk from higher tailings management cost (additional $2k/t LCE). The integrated production using African concentrates (Zimbabwe and Mali) is estimated to range from $7k-$13k/t LCE but faces elevated FX risk. Indeed, the main source of supply rationing has been the elevated cost for non-integrated production, but with the ramp-up in spodumene supply (+200kt YoY in 2024), we expect spodumene prices to continue their decline bringing down the cost of production from purchased spodumene to $14k/t (vs. $21k/t currently) on our estimates. The global hardrock supply – mostly concentrated in Australia – is set to increase by 280kt LCE over 2024 to represent ~80% of global supply growth. To stress test our balance, we build a constrained hardrock supply growth scenario based on capacity at risk from either tailings management (Chinese lepidolite) or road congestion/infrastructure bottleneck (African spodumene). In a highly constrained scenario, we estimate the market would still be in a substantial surplus (155kt vs 202kt surplus in base case for 2024).

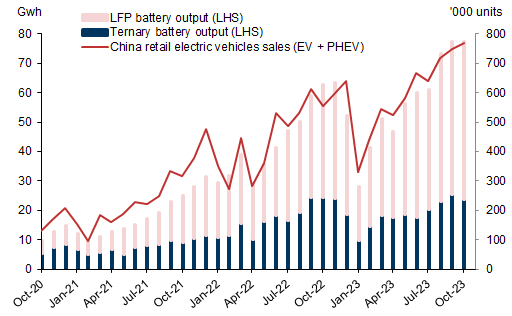

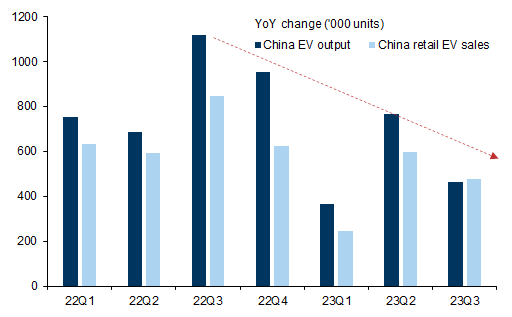

A new era of EV demand. The normalisation of EV supply chain has been a key contributor towards the fundamental shift in battery metals demand this year. Most battery materials and components are seeing a softening in their balance as our batteries analysts note while ‘greenflation’ concerns are now abating. The accelerated supply expansion and battery capex surge from past 18 months has pushed China’s battery balance into a surplus, which in turn has weighed on restocking demand for lithium, in our view. The supply chain normalisation combined with phase-out of national subsidies in China has also weighed on the pace of growth of EV demand. China’s EV output has grown by +1.82mil units YTD (vs. +2.9mil units in year-Oct’22) and whilst EV penetration has continued to grow, China’s retail EV sales volume growth has fallen considerably (+1.5mil units y/y YTD vs +2.3mil units y/y year-to-Oct'22) pointing towards a normalisation in supply chains. In the West, we remain optimistic on long-term EV adoption due to improving EV economics, rising consumer preference and regulatory support. However, in the near-term, our US auto analysts highlight that EV sales could grow more slowly due to sluggish demand and lack of sufficient EVs that meet consumer needs in terms of price and range. Whilst near-term EV demand has faced hurdles, our long-term demand estimates have risen on rising average US battery size, higher EV sales and energy storage.

Exhibit 1: Chinese EV sales and battery output have continued to rise, albeit at a slower pace of growth...

Source: Goldman Sachs Global Investment Research, CAAM, CPCA, Wind

Exhibit 2: ... Phase-out of subsidies and supply chain normalisation has weighed on pace of EV demand this year

Source: Goldman Sachs Global Investment Research, CAAM, CPCA, Wind

Exhibit 3: Weak battery supply chain activity has halved the lithium demand growth on average this year

Source: Goldman Sachs Global Investment Research, Wind, SMM

Exhibit 4: We expect a continued dominance of supply over demand until substantial supply ratioining emerges

Source: Goldman Sachs Global Investment Research, SMM

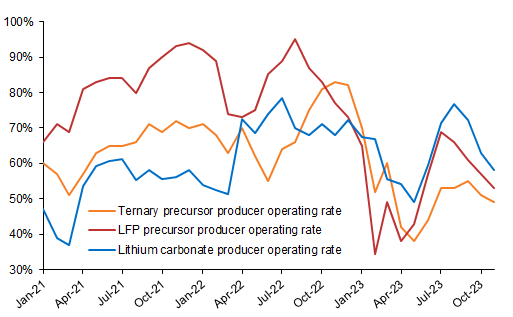

Exhibit 5: Lithium consumers' operating rates have fallen more than the producers in the recent months

Source: Goldman Sachs Global Investment Research, SMM

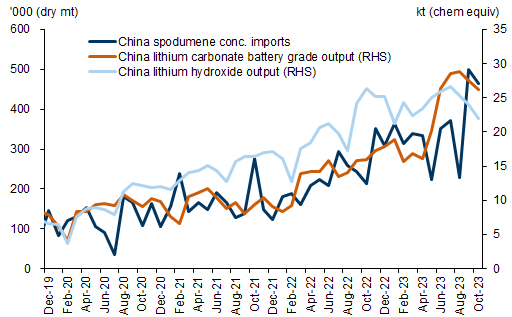

Exhibit 6: Global lithium supply has continued to grow as spodumene projects ramp-up globally

Source: SMM, Goldman Sachs Global Investment Research

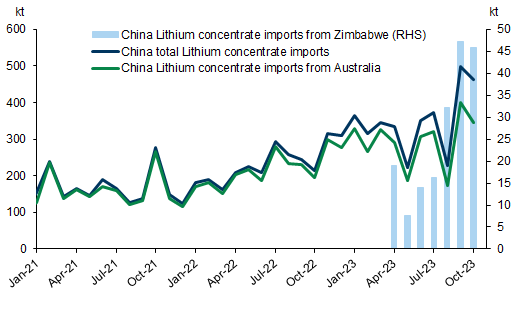

Exhibit 7: Chinese spodumene imports have risen sharply in the past few months as Zimbabwe supply ramps-up

Source: Goldman Sachs Global Investment Research, SMM

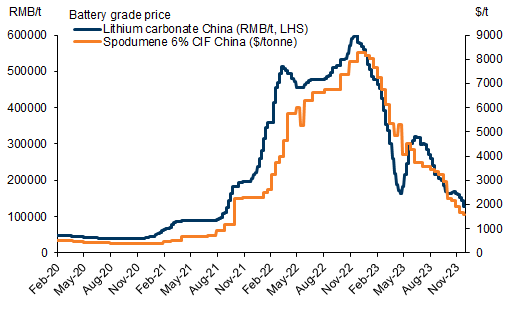

Exhibit 8: Spodumene price is catching up with the correction in chemical prices as hardrock supply ramps up

Source: Fastmarkets, Goldman Sachs Global Investment Research

Exhibit 9: We estimate global hardrock supply – mostly concentrated in Australia – to increase by 613kt LCE over 2022-24

Source: Goldman Sachs Global Investment Research, Woodmac, BNEF

Exhibit 10: Stress-testing our balance against potential hardrock supply growth constraints re-affirms our surplus expectations

Source: Goldman Sachs Global Investment Research, SMM, Woodmac

Exhibit 11: We continue to expect prices to trade deeply into the cost curve to balance the market...

Source: Goldman Sachs Global Investment Research, SMM, Wind

Exhibit 12: .. and see substantive downside against the forwards which remain in contango

Source: Goldman Sachs Global Investment Research, Fastmarkets, Bloomberg

The authors would like to thank Alissa Gorelova for her contributions to this report. Alissa is an intern within the Commodities team.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.