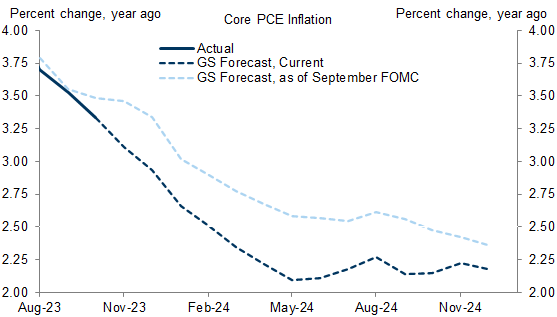

The FOMC delivered a dovish message at its December meeting, but we learned more about the inflation outlook today than about the FOMC’s reaction function. The soft PPI report on Tuesday morning combined with downward revisions to prior months implies that core PCE inflation was only 0.07% month-on-month and—as Chair Powell noted in the press conference—only 3.1% year-on-year in November. By some measures, the trend is already at or near 2%.

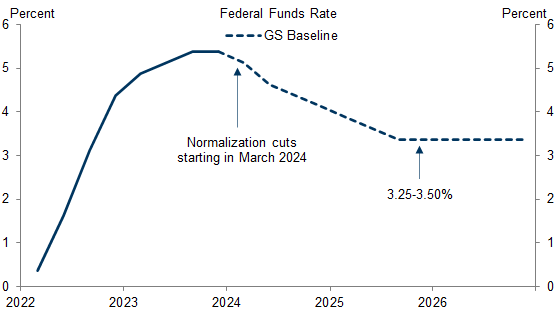

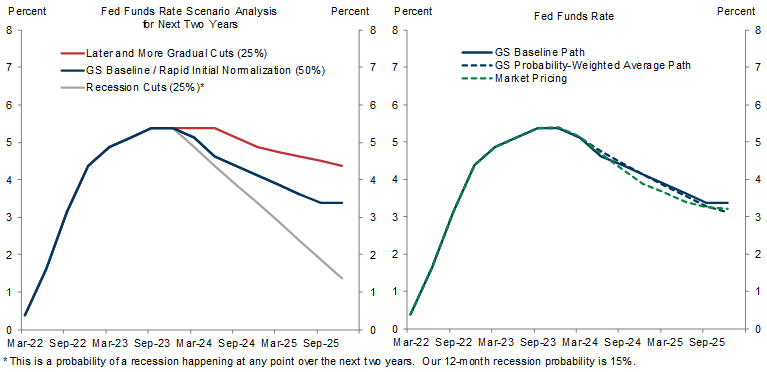

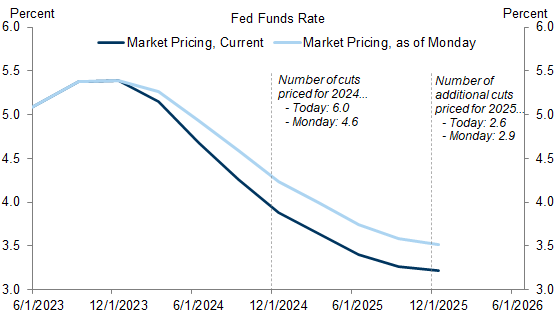

In light of the faster return to target, we now expect the FOMC to cut earlier and faster. We now forecast three consecutive 25bp cuts in March, May, and June to reset the policy rate from a level that the FOMC will likely soon come to see as far offside, followed by quarterly cuts to a terminal rate of 3.25-3.5%, 25bp lower than we previously expected. We are quite uncertain about the pace, in part because it will depend on how financial conditions respond to rate cuts. Our revised probability-weighted Fed forecast is similar to both our baseline and market pricing.

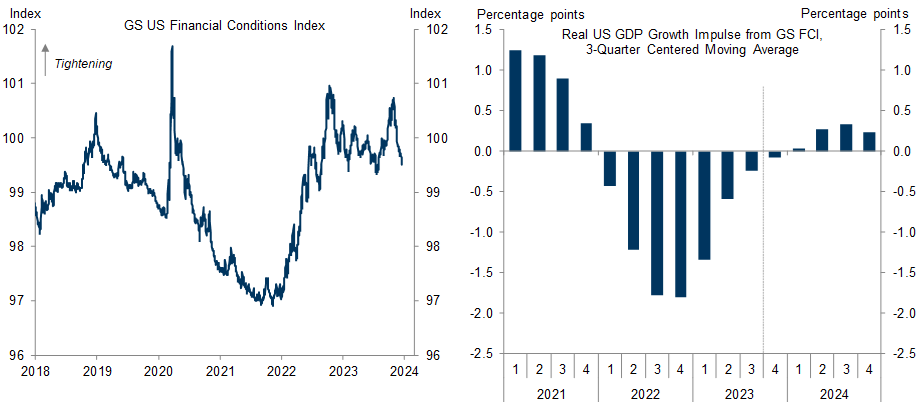

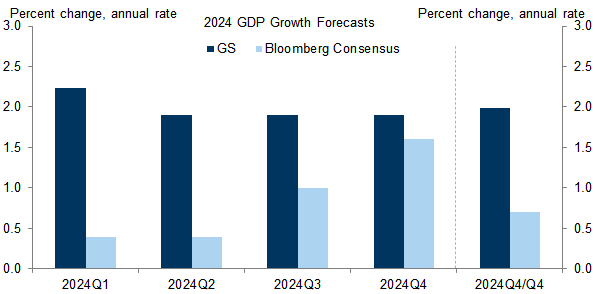

Financial conditions eased further today, and we are more confident that the large easing since October will prove durable now that the lower inflation path makes substantial rate cuts more likely next year. As a result, we are taking more of the easing on board in our economic forecast and bumping up 2024 Q4/Q4 GDP growth by 0.2pp to 2%, about double the consensus forecast and above the FOMC’s 1.4% forecast. We do not see our above-consensus growth forecast as incompatible with faster cuts because inflation is likely to be the main driver of cuts and Powell noted that FOMC participants are “very focused” on the risk of staying too high for too long.

December FOMC Recap: A Faster Return to the 2% Target Means Faster Cuts

David Mericle

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.