China Matters

The Tale of 2023 in 10 Charts

Table of Contents

As the year draws to its end, we compile 10 sets of charts to showcase key themes of 2023 for the Chinese economy. From becoming the largest auto exporter in the world to ceding the "most populous country" title to India, and from the record high youth unemployment rate to the first ever negative print for inward FDI, 2023 has no doubt been a memorable year for China macro. We wish our readers a very happy holiday, and we look forward to another eventful year of 2024.

The Tale of 2023 in 10 Charts

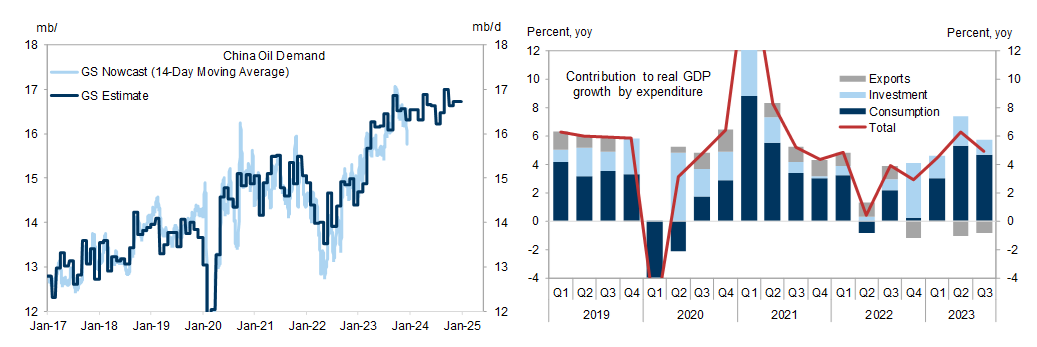

Although China's reopening in 2023 did not generate as robust economic growth as anticipated by investors at the beginning of the year, China's oil demand did show a significant jump after reopening. During the first three quarters of the year, final consumption expenditure accounted for 83% of the 5.2% real GDP growth, with services spending outperforming - significant evidence of the reopening boost to the economy.

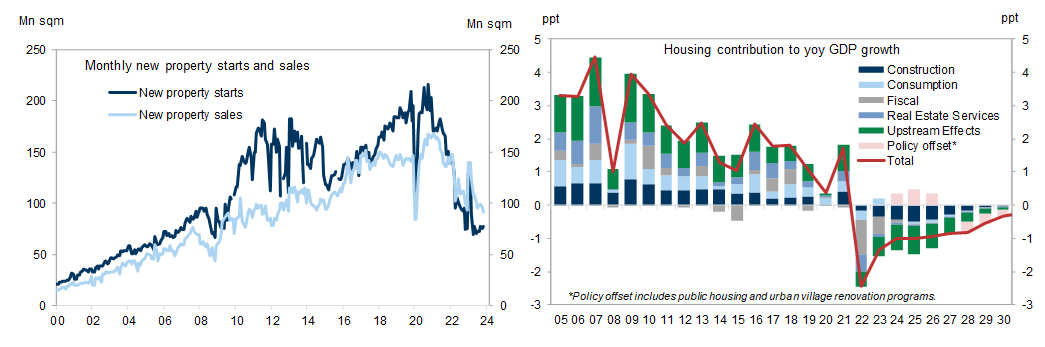

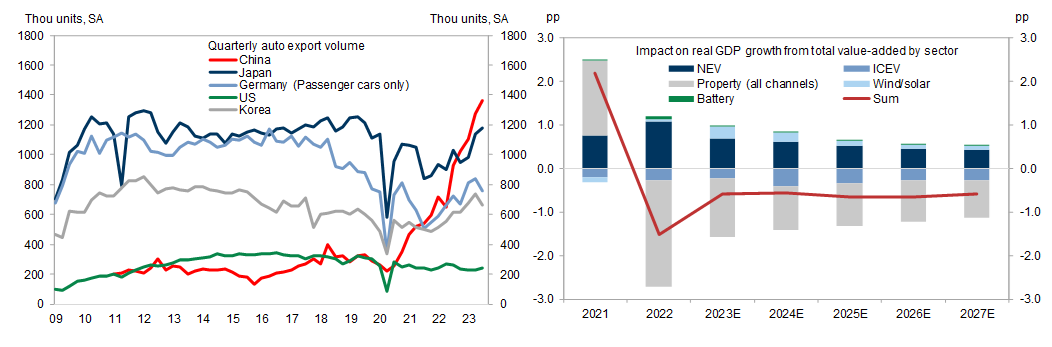

Much of the weakness in the economy this year was due to the unprecedented property downturn. Although housing starts have fallen by two-thirds from the peak and should be close to the trough, property's drag to GDP growth is likely to continue over the next few years as the total number of new homes under construction lags housing starts.

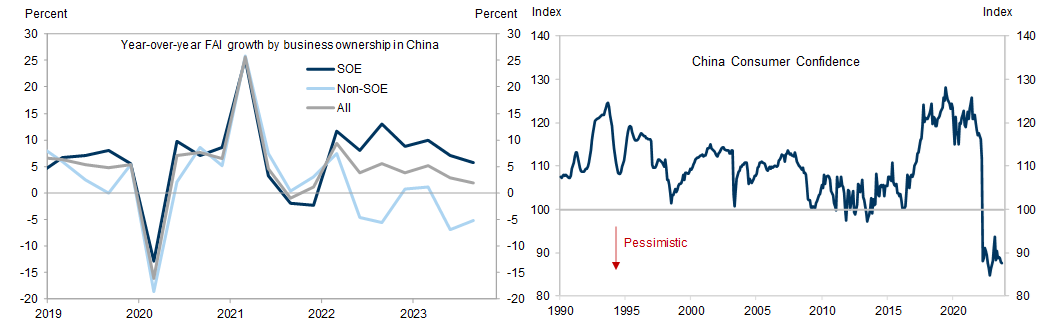

Partially because of the property slump, private investment has been exceedingly weak in China. Another contributing factor is the lack of confidence among businesses and consumers. While consumer confidence plunged in April 2022 amid the Shanghai lockdown, it has remained depressed despite this year's reopening.

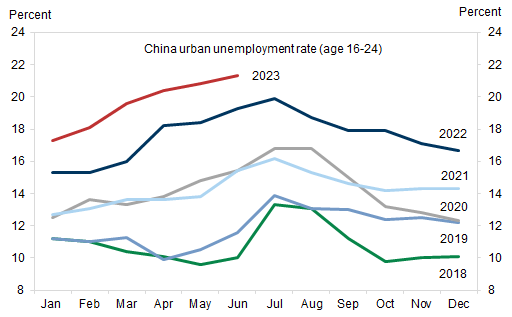

China's youth unemployment rate was one of the most discussed topics of 2023. After showing that the unemployment rate among 16-24 year olds reached 21.3% in June this year, the NBS suspended the publication of the series, citing methodology issues and placing the series under statistical review.

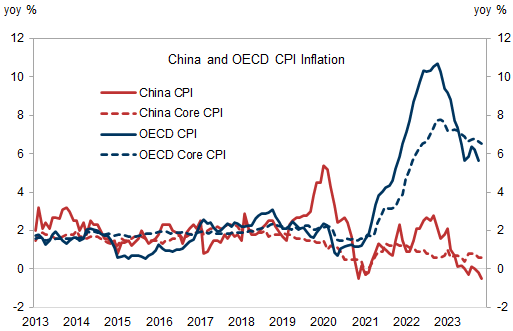

While the rest of the world was trying to rein in high inflation in 2023, the Chinese economy faced significant deflationary pressures. In November, headline CPI dropped 0.5% yoy and PPI inflation was -3.0% yoy. With still weak demand relative to overcapacity issues in many sectors, we expect CPI inflation to be 0.5% next year and PPI deflation to continue (-0.3% in 2024).

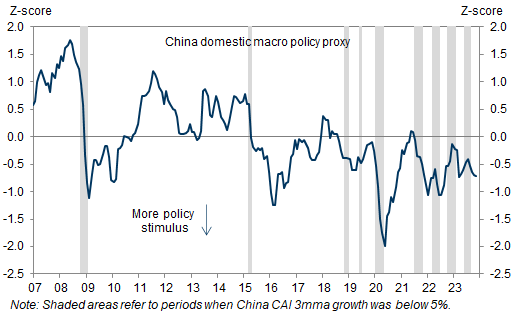

Because of the outsized role of the government in the economy, China's macroeconomic policy stance has always been a key focus for China watchers. Despite the strong headwinds faced by the Chinese economy over the past two years, policymakers have acted rather conservatively in stimulating the economy, believing that many problems are structural and do not warrant aggressive countercyclical measures.

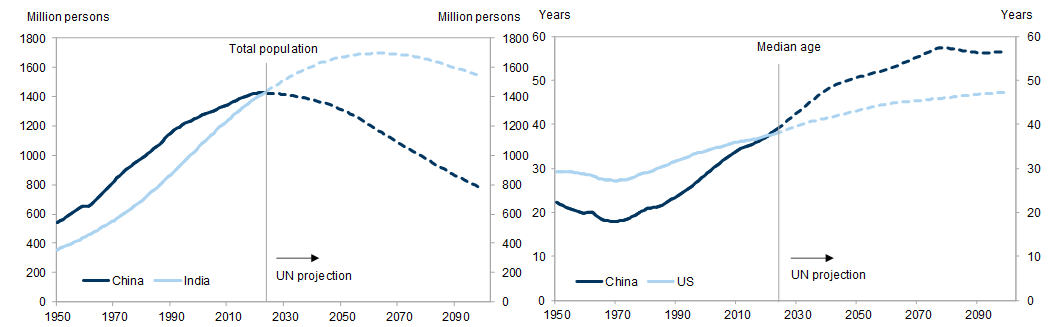

2023 is the year when India overtook China to become the world's most populous country. Demographic concerns, as China's total population is projected to decline from 1.4bn to less than 800mn by the end of the century and China's elderly population (60+ years old) is projected to exceed 500mn by 2050, have started to impact investors' views on China's long-term growth outlook.

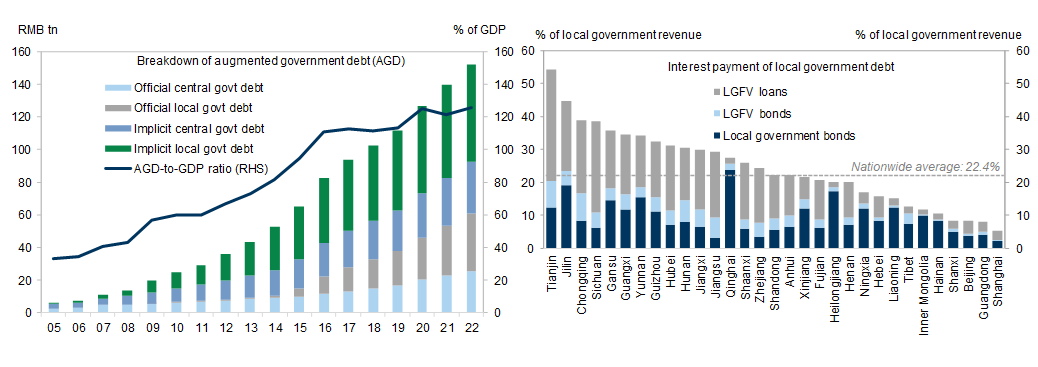

Negative headlines about default risks of some local government financing vehicles (LGFV) in Yunnan heightened market concerns over China's local government implicit debt which drove the sharply rising augmented government debt in China post-GFC. Although policymakers have started coming up with plans to address local government implicit debt issues and to reduce financial risks, we think the problem is simply too big and too complex to be resolved quickly and smoothly.

On a positive note, China surpassed Japan to become the world's largest auto exporter in 2023, a remarkable development considering the fact that China was still an auto importer five years ago. However, despite the government's push to accelerate manufacturing upgrading and "New Three" production (electric vehicles, batteries, and renewables), we think these are unlikely to fully offset the drag from the property downturn over the next few years.

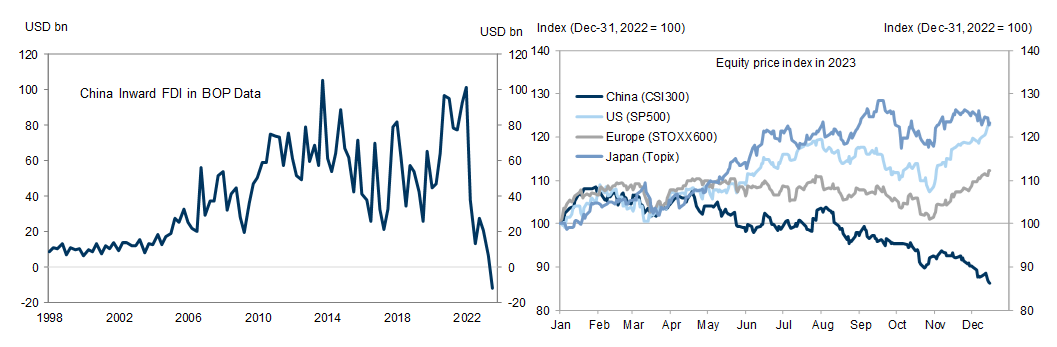

Amid weak domestic demand, rising concerns over China's medium-to-long term growth outlook, and elevated interest rate differentials between ex-China and China, China's inward FDI went negative for the first time on record in 2023Q3. Significant underperformance of the stock market contributed to equity outflows. As a result, China's Broad Balance of Payments (BBOP) featured strong current account but weak financial account in 2023.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.