Global Views: The Great Disinflation

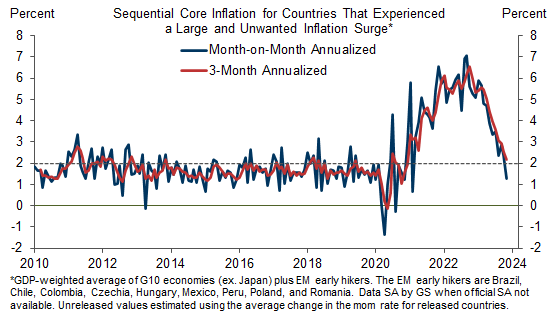

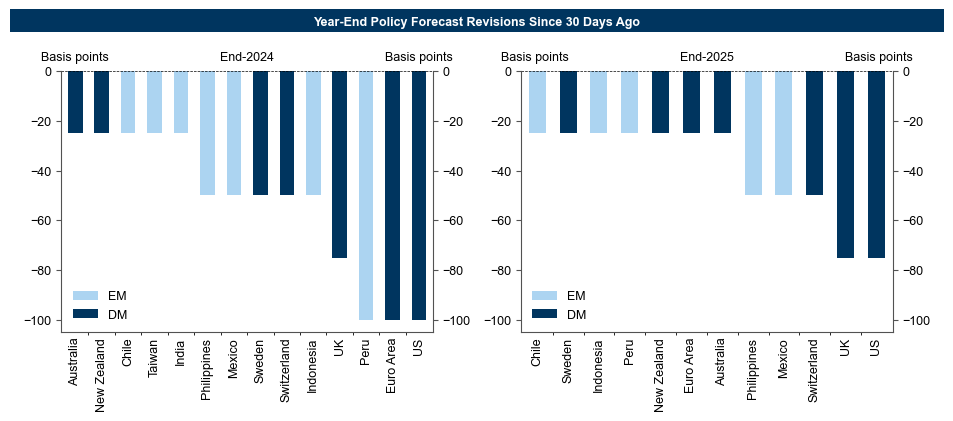

1. Global inflation continues to plummet. Averaging across the broad group of economies that saw a large and unwanted post-covid price surge—the G10 excluding Japan plus the EM early hikers—we estimate that core inflation ran at a sequential annualized pace of 2.2% over the past three months and just 1.3% in November. We therefore now see earlier and more aggressive rate cuts from several major DM central banks.

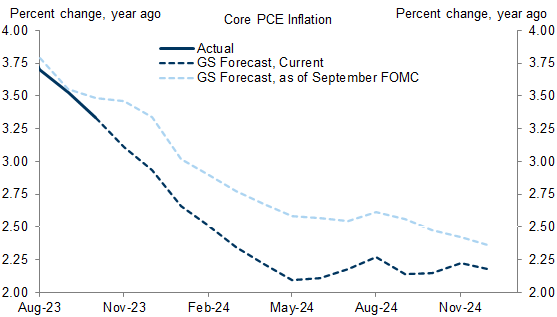

2. The shift in monetary policy expectations has been particularly abrupt in the US. At the December 13 FOMC press conference, Chair Powell said that the committee would want to cut “well before” inflation falls to 2% year-on-year, which we interpret as a threshold of around 2.5% with an expectation of ongoing declines. While this was not dramatically different from Powell’s guidance at previous meetings, it came on the back of CPI and PPI releases for November which suggest that core PCE inflation should hit that 2.5% threshold as soon as February 2024 before falling further to 2.1% in May. Since the February print will be largely forecastable based on the CPI and PPI releases in mid-March, we now expect the first cut at the March 20-21 FOMC meeting.

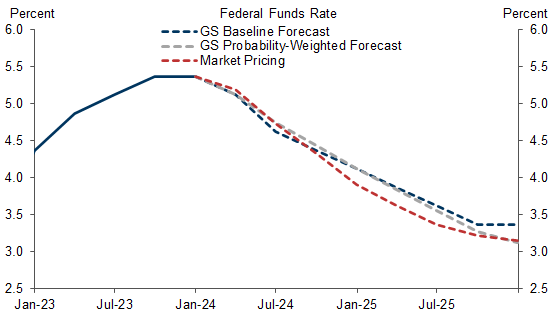

3. We see the committee delivering at least three back-to-back 25bp cuts, probably in March, May, and June. Such an adjustment would resemble the 1995, 1998, and 2019 episodes, and anything less would raise the question “why bother?” But 75bp in cuts would still leave the funds rate at 4½-4¾%—a level 200bp above the FOMC’s median estimate of the longer-term funds rate—at a time when year-on-year core PCE inflation is close to 2%. We have therefore penciled in two further quarterly cuts in the second half of 2024, for a total of five cuts in 2024, as well as three quarterly cuts in 2025 that take the funds rate down to 3¼-3½% in September 2025.

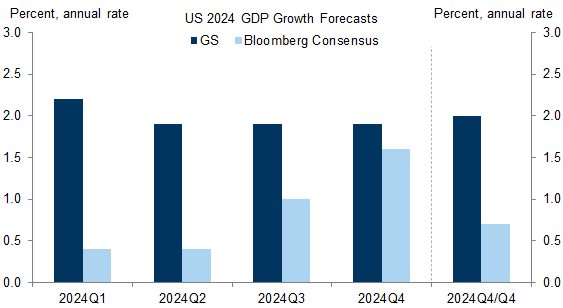

4. Our funds rate view is at least as aggressive as market pricing over the next few quarters because the inflation outlook is so supportive, in part because a further slowdown in the rental components is likely to shave off nearly ½pp over the next year. Beyond mid-2024, however, our forecast is slightly above market pricing because we have become even more optimistic about growth and employment. We now expect real GDP to grow 2.0% in 2024 on a Q4/Q4 basis and see the unemployment rate edging down to 3.6% by 2024Q4. This argues for slower cuts, and any further upside surprises relative to this above-consensus forecast might persuade the committee to pause even with inflation near the target and the funds rate still at levels deemed “restrictive”.

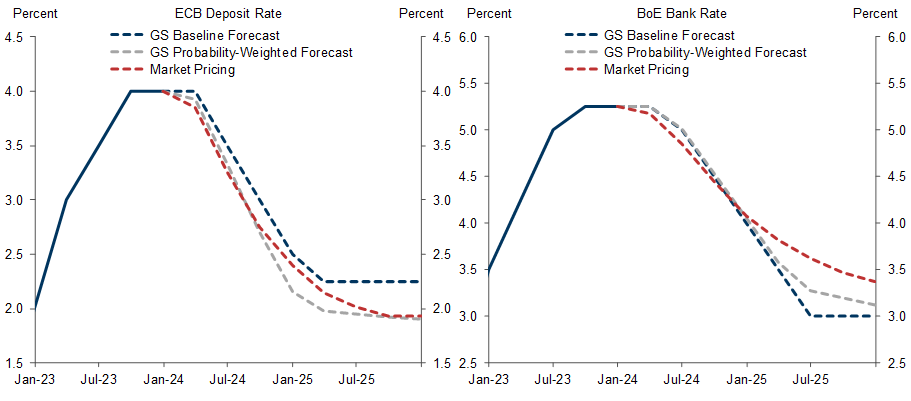

5. At the margin, the somewhat hawkish tone at Thursday’s ECB meeting reinforced our view that rate cuts in Europe are more likely to start in April than in March. Whatever the precise date, however, the argument for a long string of consecutive 25bp cuts is stronger in Europe than in the US because the inflation data have been even softer and growth remains substantially weaker. We therefore expect 175bp of back-to-back cuts from 4% now to 2.25% in early 2025; this is close to current market pricing on a probability-weighted basis. In the UK, the cuts are likely to start later because the starting point for inflation is higher. Nevertheless, we have brought our forecast for the first cut in Bank Rate forward from August to June and expect 225bp of consecutive cuts from 5.25% now to 3% in mid-2025, below market pricing.

6. The inflation surprises—and thus the changes to our monetary policy views—have been smaller elsewhere. Nevertheless, we have shaved our policy rate forecasts for a range of other central banks, especially in EM economies where a friendlier Fed is likely to relieve pressure on exchange rates. This applies in Latin America, where we now see a lower rate profile in Mexico, Peru, and Chile, and to a lesser degree in Asia, where we have pulled forward our rate cut expectations in India, Taiwan, and Indonesia. We now also see the Reserve Banks of both Australia and New Zealand cutting somewhat earlier than before.

7. China has also seen disinflation, but from a much lower starting point. CPI inflation surprised on the downside in November, and core inflation remains below 1% year-on-year. The real economic signals are mixed at best, as both exports and industrial activity picked up in November but more domestic indicators such as retail sales and property prices remain weak. Although policymakers are likely to ease gradually further, we don’t think this will be sufficient to prevent ongoing deceleration in GDP growth from 5.3% in 2023 to 4.8% in 2024, as well as sluggish core CPI inflation of just 0.8% in 2024. In other words, China will probably continue to look like an economy in need of much more significant stimulus.

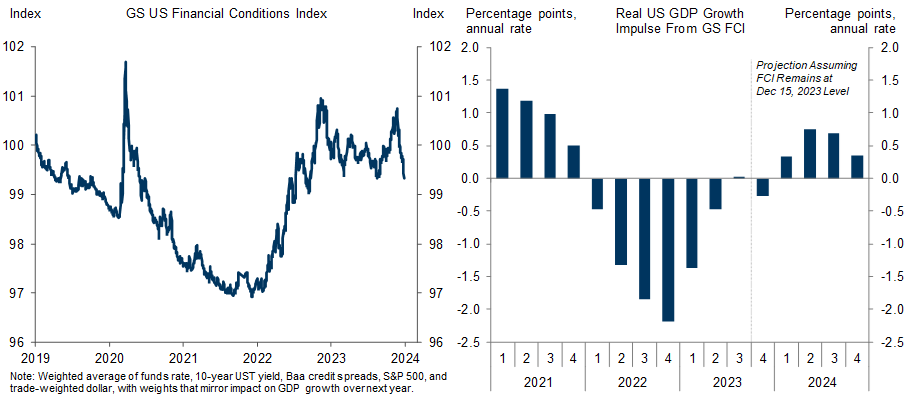

8. The combination of solid growth, sharply declining inflation, easier monetary policy, and lower long-term rates is exceptionally friendly for risk asset markets, and both our equity and credit strategists have therefore upgraded their return forecasts materially. If we are right about the economic outlook, the recent easing in financial conditions has further to run, which would reinforce the positive FCI growth impulse for 2024 and could result in further upward revisions to our already above-consensus growth forecasts.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.