We wish all of our readers a healthy, happy, and prosperous 2024. In our last Global Economics Analyst of 2023, we use 10 of our favorite charts to illustrate the key global themes that stood out this year and are likely to shape the year ahead.

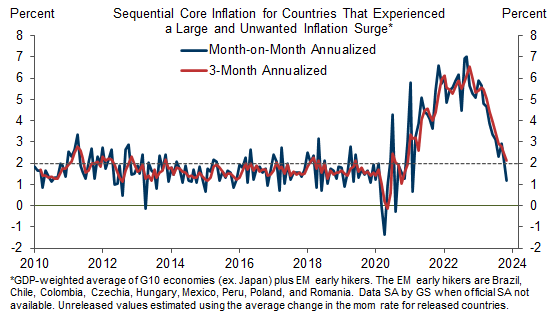

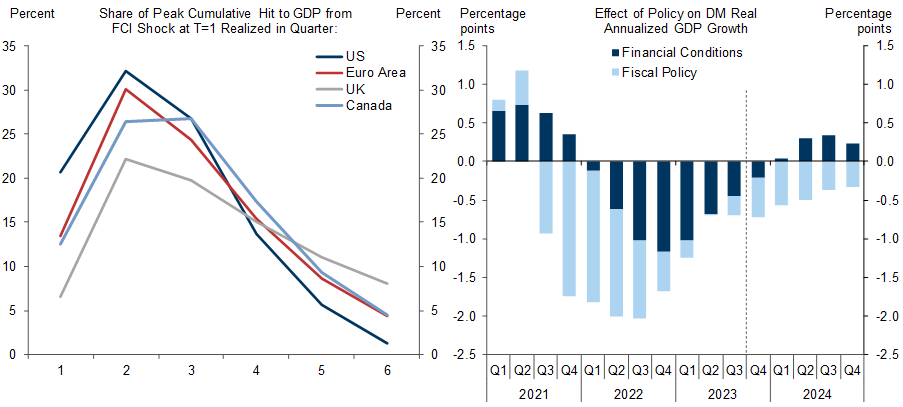

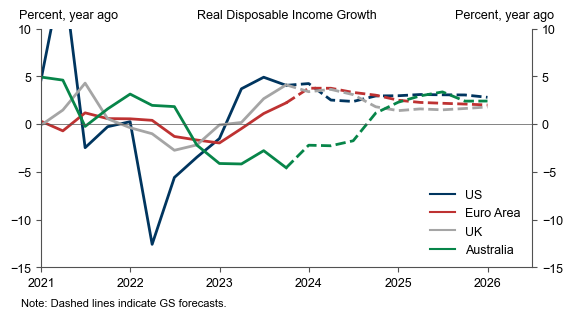

The big surprises of 2023 were the sharp outperformance of global growth—which exceeded expectations by 1pp—and the rapid normalization of inflation in the second half of the year. The upside growth surprise reflected a fading drag from monetary policy tightening (as the lag from changes in financial conditions to growth is much shorter than commonly appreciated), as well as a recovery in income growth that kept consumer spending growth solid.

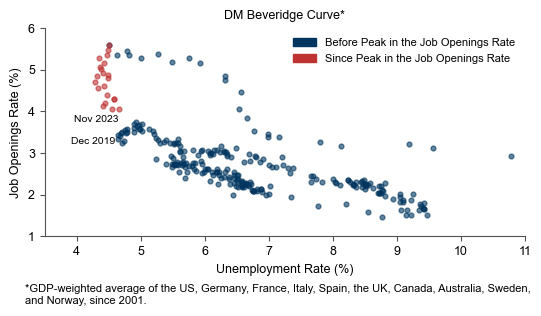

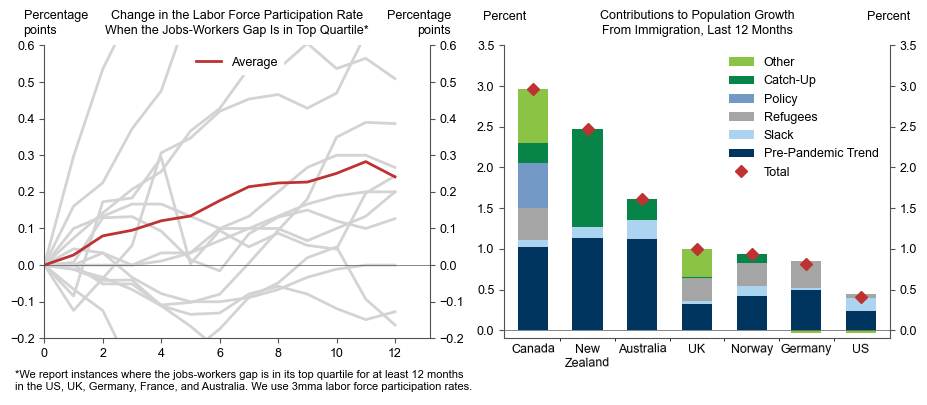

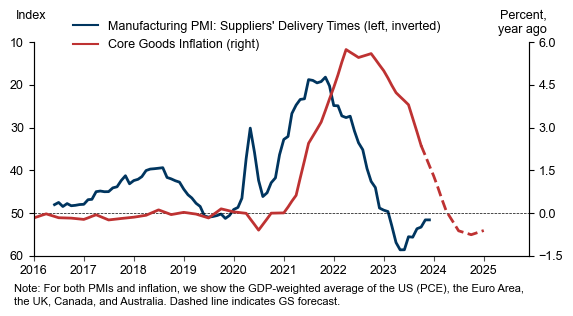

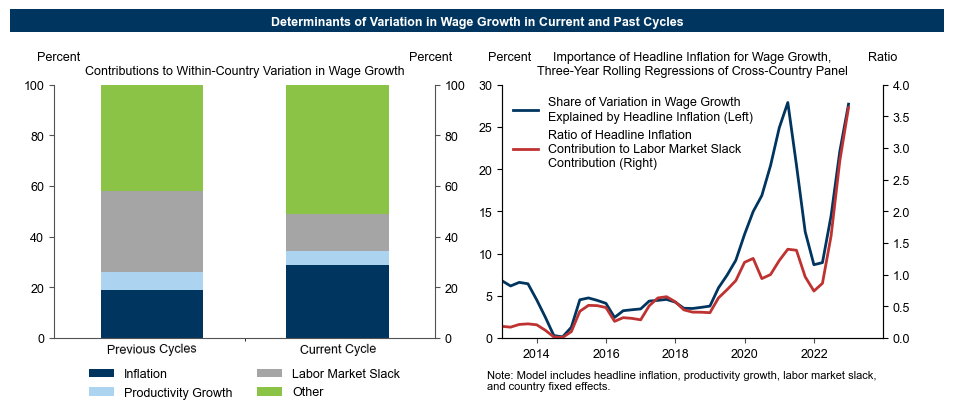

The progress on inflation despite firm growth underscored the unique nature of this cycle. Labor market rebalancing progressed smoothly as excess job openings unwound—despite unemployment rates remaining low—while labor supply beat expectations (both due to favorable hiring prospects and an immigration rebound). Combined with improving global supply conditions (which lowered core goods and headline inflation), this softened the upward pressure on wage growth, which should settle at a sustainable level in the year ahead.

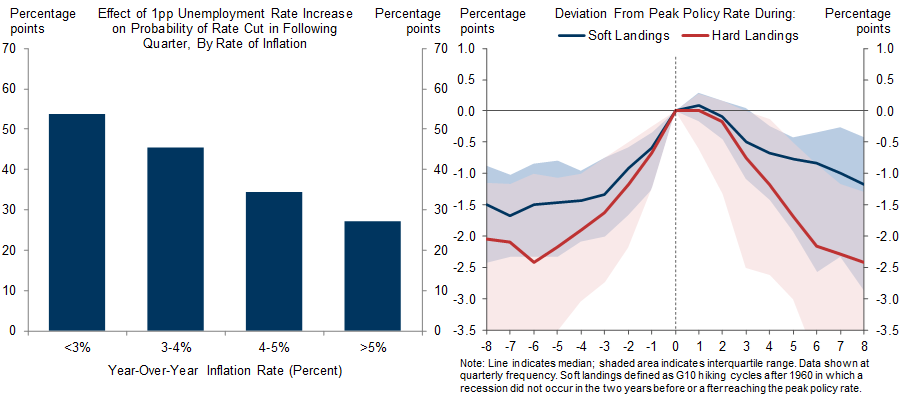

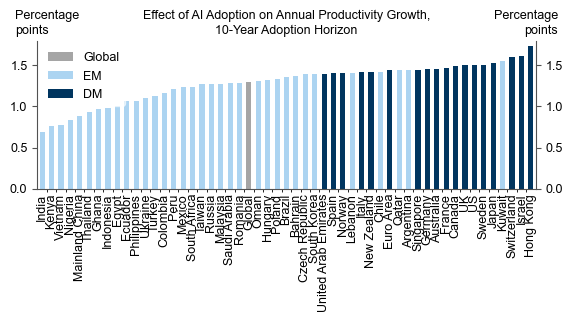

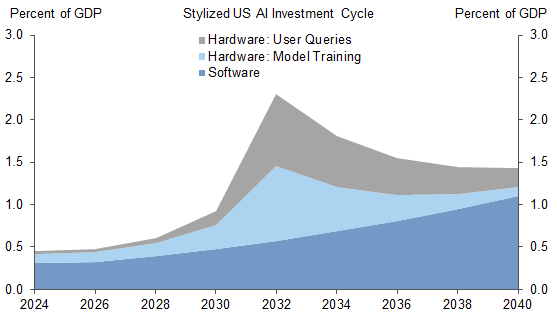

As inflation nears the finish line, the bar to cut rates has fallen, and central banks should begin to normalize policy next year. As the “soft landing” plays out and economic conditions return to something resembling normal, we remain focused on longer-term drivers of the economic outlook, including the upside growth potential from generative AI.

Top 10 Charts of 2023

Global Economics Team

Bonus Charts

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.