Global Views: Too Much of a Good Thing?

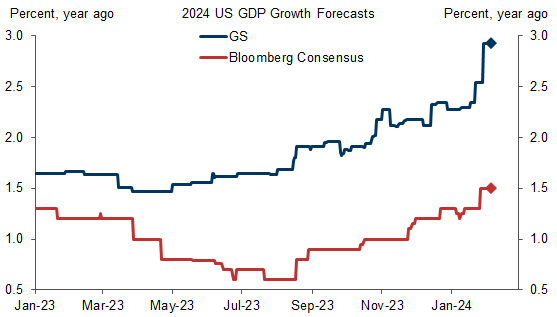

1. Our most out-of-consensus global view over the past 18 months has been that US growth would remain solid alongside declining inflation. Recently, however, some key indicators have been more than just solid, with GDP growing at an annualized rate of 4.1% in 2023H2 and nonfarm payrolls rising 353k in January. Both numbers are well above our estimates of the long-term sustainable trends in real output and employment. This raises the question whether the US economy is now growing too quickly to sustain the disinflationary trend. Are we seeing too much of a good thing?

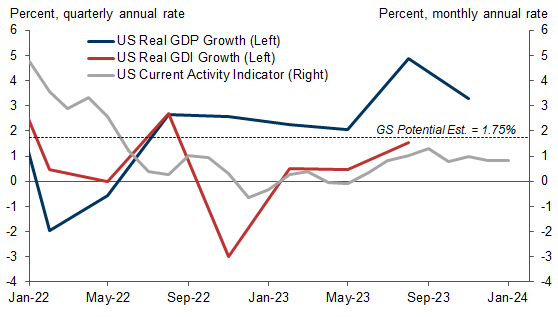

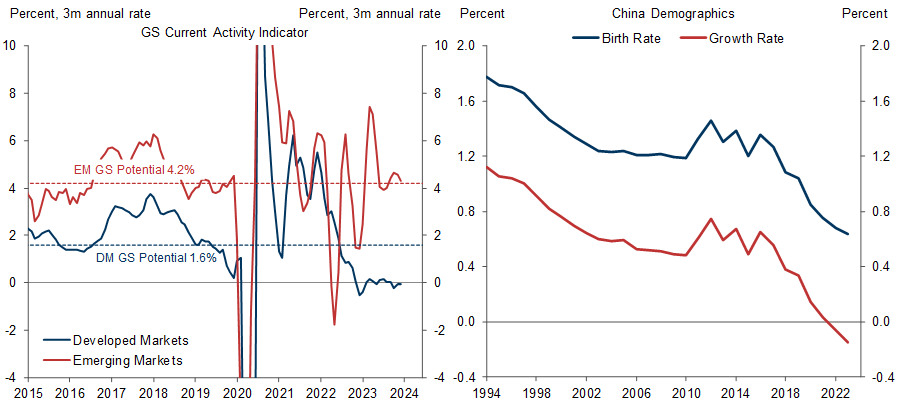

2. We think the answer is no. Beyond GDP, we track two other measures of US growth, namely gross domestic income (GDI)—a conceptually equivalent measure of GDP that is calculated by adding up all income as opposed to all spending in the economy—and our current activity indicator (CAI). None of the three measures is perfect, but both GDP alternatives indicate a more muted growth pace. GDI is not yet available for Q4 but grew just 1.5% in Q3 on a quarter-on-quarter annualized basis and our CAI grew 0.8% in Q4, both considerably below the corresponding GDP growth rates. Based on these indicators, we still think that real output is at most growing modestly above potential, despite the much stronger GDP data.

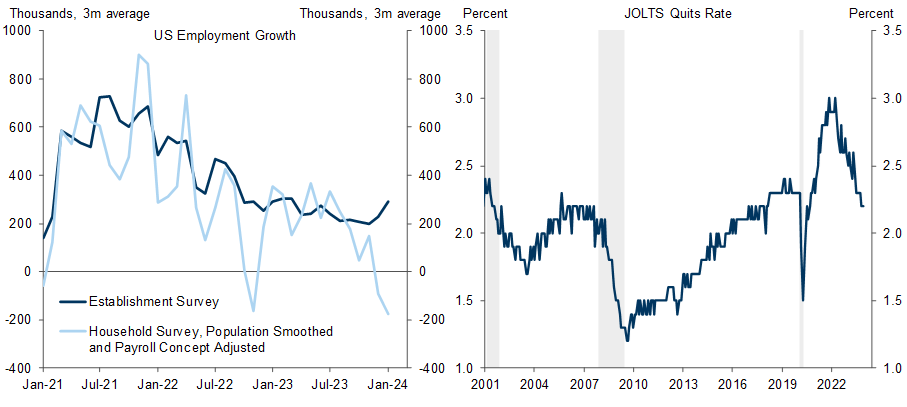

3. We would also heavily discount the 353k January payroll gain because it was boosted by seasonal factors that anticipate larger start-of-year job separations than what is likely in the current low-turnover labor market with its subdued rates of hiring and separations. The flip side is likely to be relatively weak payroll growth in the spring, when the seasonal factors build in a hiring spree that may likewise fail to materialize. Labor market indicators that are not susceptible to this one-time boost paint a more stable picture. Despite strong payroll growth, the unemployment rate has been flat at 3.7% recently as labor supply has been firm and employment in the household survey continues to underperform employment in the establishment survey. Moreover, broader measures of labor market balance such as the quits rate and our jobs-workers gap have continued to trend down despite the payroll strength.

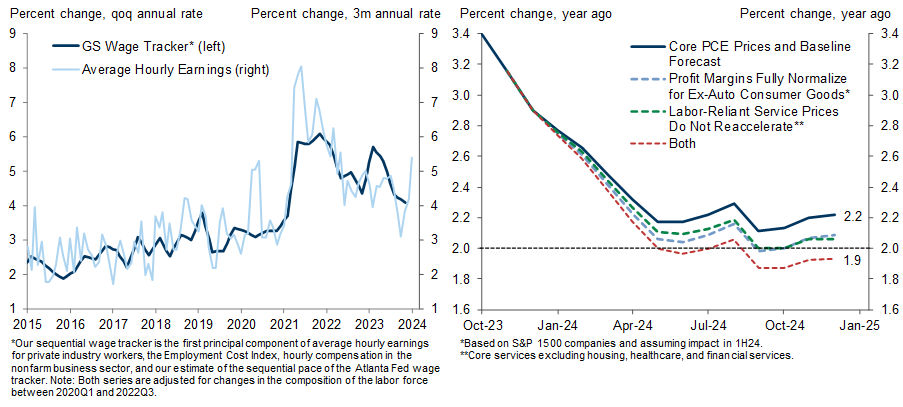

4. The news on wage and price inflation remains broadly favorable. We would fade the 0.6% rise in average hourly earnings in January because it was likely distorted by a weather-related drop in the workweek. (AHE is calculated as the ratio of weekly earnings to weekly hours, which rises if workers are paid for a 40-hour week but don’t show up for a day or two because of a snowstorm.) We put more weight on the slowdown in the employment cost index in 2023Q4, which has brought our sequential wage tracker down to 4.1%, just 0.6pp above the 3½% pace that we think is consistent with sustained price inflation of 2%. Meanwhile, core PCE inflation has run at annualized rates of 1.5% over the past three months and 1.9% over the past six months, both below the Fed’s 2% target. The next couple of weeks could look less friendly, as we may see modest upward revisions to the CPI and PCE seasonals and expect a stronger month-to-month core PCE gain of 0.34% because of another “January effect.” Nevertheless, we still expect the year-on-year rate of core PCE inflation to fall further to 2.2% in Q2, and the risks to this forecast are tilted to the downside.

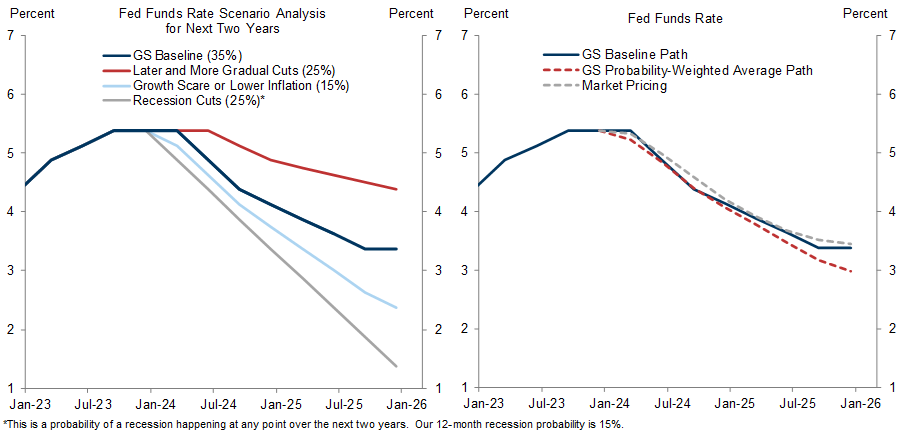

5. This means that year-on-year core PCE inflation will probably be closer to 2% than we had expected by the time of the first rate cut, which we now forecast on May 1 (with the risks skewed toward June). In turn, this points to a potentially faster rate cut cycle. We therefore still project five cuts this year and three cuts next year, which would take the funds rate down from 5.25-5.5% now to 3.25-3.5% in September 2025. Risks to this call are two-sided. Slower progress on inflation—perhaps driven by renewed supply-chain damage in the wake of the Middle East conflict or upward revisions to the CPI data—could keep the committee on hold for longer or slow down the pace of easing. Conversely, a drop in core PCE inflation below 2% or a noticeable deterioration in the labor market could trigger a move to 50bp cuts given the elevated starting point for the nominal and real funds rate.

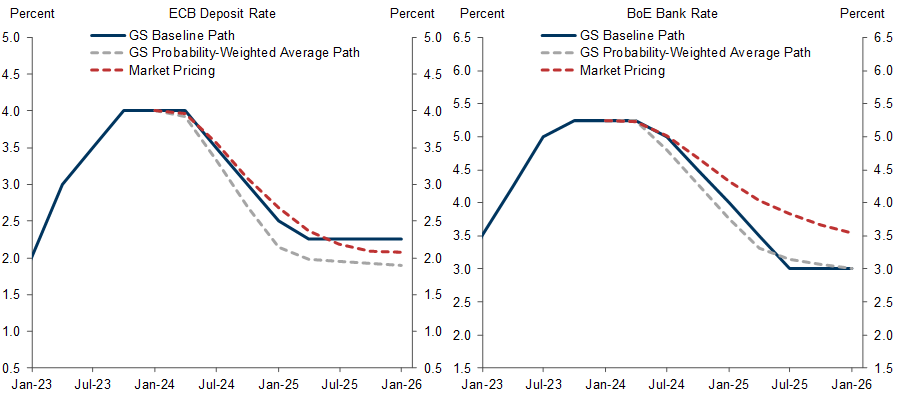

6. Despite slightly higher-than-expected inflation in the last month or two, both the ECB and the BoE are likely to start easing soon. Bundesbank President Nagel’s remark last week that the ECB had “tamed the greedy inflation beast” sounds consistent with our forecast of a cut on April 11. And while we were surprised that two BoE MPC members again dissented in favor of a hike, the committee’s decision to put Bank Rate “under review” also opened the door to a cut, probably on May 9. In both cases, we have greater conviction than in the US that rate setters will move at consecutive meetings until monetary policy is back to neutral, with cuts from 4% to 2.25% in the case of the ECB and from 5.25% to 3% in the case of the BoE. We also see a low hurdle for 50bp cuts, and our probability-weighted call is below market pricing for both central banks.

7. Our views skew optimistic for much of the emerging world. Core inflation has fallen almost as fast as it had risen earlier and is now down to pre-pandemic levels on a 3-month annualized basis. This has triggered a turn to rate cuts in several economies—especially in Latin America and Central/Eastern Europe—and has helped ease financial conditions. Consequently, growth in EM is now running considerably further above the rates seen in DM than before the pandemic. The main outlier to the downside is China, where sentiment remains very negative. The reason is not so much the near-term economic indicators, which have been broadly stable, but longer-term concerns about the direction of economic policy as well as structural headwinds from property market weakness, local government debt, and demographics—with last year’s drop in the birth rate further below replacement levels the latest cause for concern.

8. Our market views remain broadly optimistic. While Fed cuts are likely to arrive at least somewhat later than we had anticipated before Wednesday’s FOMC press conference, the direction of travel remains clear and the pace of easing might be somewhat faster than we had thought earlier. We therefore don’t expect markets to pull back much further on their pricing of Fed rate cuts, barring significant upside surprises in the upcoming inflation data. Combined with our dovish views on the ECB and BoE, this implies modest downside for US and European rates in coming months. Meanwhile, global growth is on a good path, with manufacturing showing early signs of recovery after a lengthy malaise, which supports the constructive views of our equity, credit, and commodity strategists.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.