The maturity of UK debt is the highest in the G10, but has been falling in recent years. With the UK Debt Management Office aiming to minimize the interest expense paid on debt, but also to lower the volatility of interest expense, we build an optimal issuance model to help explain this reduction in WAM.

Our results show that, overall, the 3-10y maturities offer the best trade-off between low cost and acceptable volatility. In addition, our model shows the DMO should skew towards longer maturities when long-term rates are low and shorter maturities when rates are high and the curve is inverted, as observed in recent years.

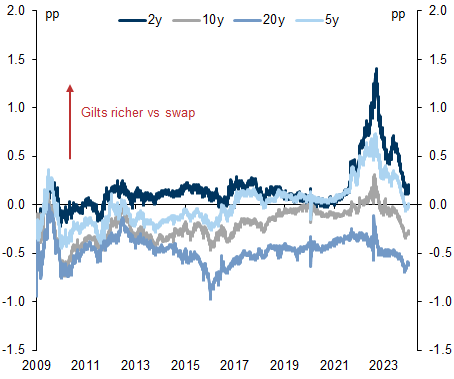

This suggests to us that the DMO will continue to skew issuance towards shorter maturities more than in the past – a point reinforced by the lower domestic demand for duration in the UK curve. This points to ongoing pressure on Gilts vs swaps in the belly of the UK curve.

Shorter WAM Optimal for Gilts

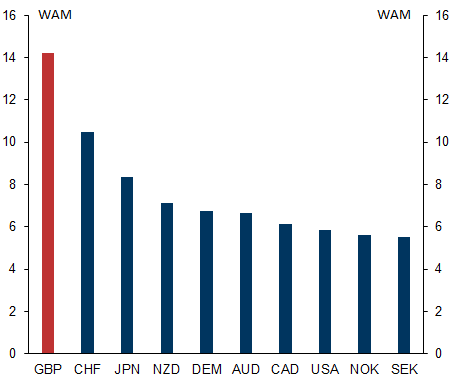

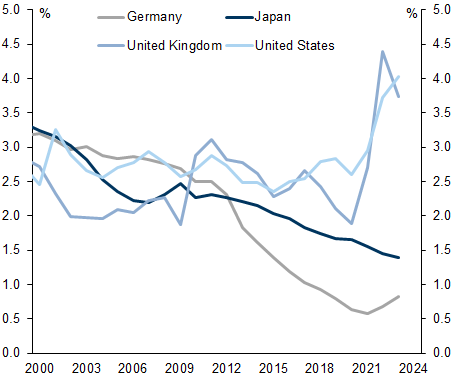

Exhibit 1: The UK has a significantly higher WAM than peers

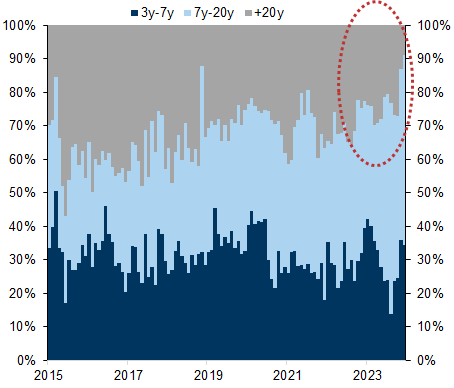

Exhibit 2: UK issuance has recently skewed to shorter maturities

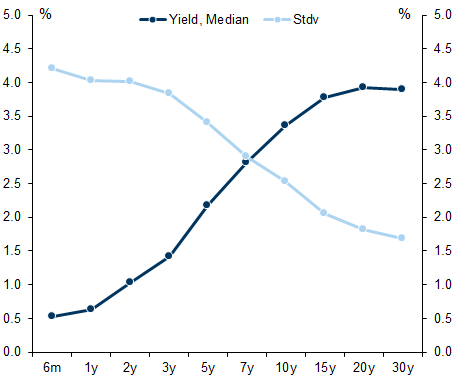

Exhibit 3: While the yield curve is usually upward-sloping, the volatility curve is downward-sloping

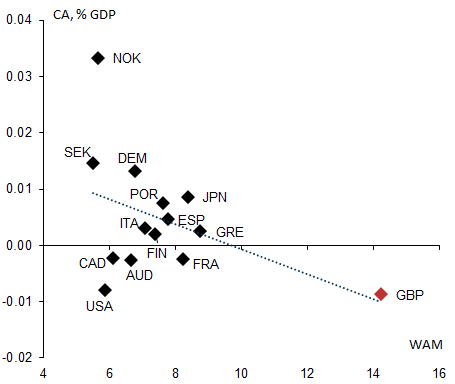

Exhibit 4: Current account deficits associated with higher WAM, but UK an outlier

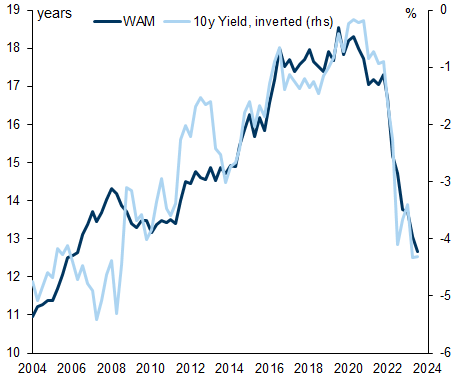

Exhibit 5: WAM has an inverse relationship to yields

Exhibit 6: Inflation-linked debt drove up UK interest costs despite high WAM

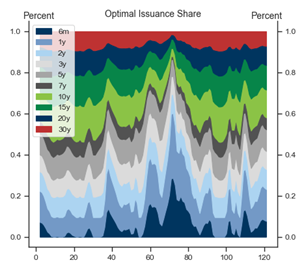

Exhibit 7: When the volatility penalty is low, issuance abruptly skews to short maturities

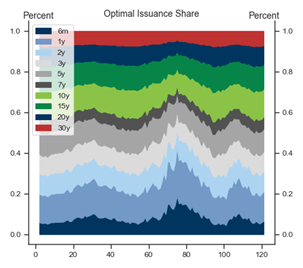

Exhibit 8: With a larger volatility penalty, issuance is more stable across maturities

Appendix

The model is based on a model developed by members of the TBAC committee, which has featured in multiple TBAC presentations. It consists of a macro model that simulates the economy, a rates model that, given the state of the economy, derives the yield curve, and a debt dynamics block, which keeps track of all instruments outstanding, to facilitate the rollover of maturing instruments.

The macro model is estimated using our economists' estimates for the unemployment gap, potential growth and a stylized Taylor rule. Potential growth evolves stochastically, driving the neutral rate r* and real growth. From this, we derive the unemployment gap and inflation – we use CPI rather than RPI – and Bank Rate.

At each step of the simulation, we roll our estimates 20y forward, to get an expected policy rate path. For the rates model, we build the yield curve by using the average expected Bank Rate until maturity, plus the term premium for each maturity. We endogenize the 2- and 10-year term premium as a function of inflation and the unemployment gap – in a "booming economy" the term premia will cause the yield curve to be upward-sloping, whereas a recessionary state causes the yield curve to invert. All other term premia are non-linearly interpolated by fitting a polynomial.

Using the yield curve, we optimally choose the issuance, fulfilling the financing needs that arise due to the interest expense, the refinancing need of maturing debt, and the primary surplus, which is a function of the unemployment gap. At each step, bonds are issued at each bucket, keeping track of each issuance to note the future refinancing needs and the WAM of outstanding debt.

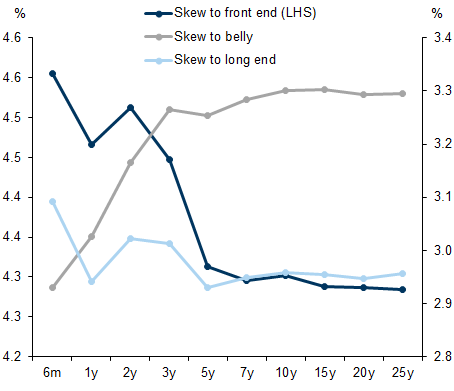

The optimization relies on a parameter reduction: instead of choosing freely the total issuance per bucket, we define four "kernels", vectors that define the issuance across the buckets. The first kernel is a vector of percentages across the buckets, which thus sums to one and reflects a reasonable historic distribution among the buckets. Each of the other kernels sums to zero and reflects a skew towards the front, belly, or long end, respectively. We attach weights to these kernels, which are the free parameters to be chosen, except for the base-weight, which equals the financing need in that period. This guarantees that the full financing condition is met and that issuance equals the deficit, as the base kernel comprises shares that sum to one, while the remaining kernels represent the 'tilt' towards short, medium or long maturities and sum to zero.

At each step of the simulation, we simultaneously estimate the macro model, the rates and the fiscal block. Taking the financing need and the yield curve, we optimally choose the weights on the three kernels, imposing the full financing condition. A penalty function on volatility penalizes deviations in current period interest expense from a 20y-forward looking median interest expense path. This penalty, which can be set arbitrarily, not only reduces the volatility in interest expense, but also ensures a smooth issuance profile from period to period, and guarantees a minimum issuance at each period at each bucket.

- 1 ^ In practice, liquidity considerations are important - when issuance needs increase suddenly, it is common to see substantial increases in short-maturity issuance, including Bills. This may often coincide with low front-end rates.

- 2 ^ This is not directly comparable given our model does not consider bond maturities beyond 30 years. As a result, we just highlight the indicative message here that the model skews shorter than observed behaviour, rather than a literal comparison.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.