US Quarterly Chartbook

S&P 500 returns +11% in 1Q 2024 as rally broadens beyond mega-cap tech

Table of Contents

- Intro

- The market in 2024

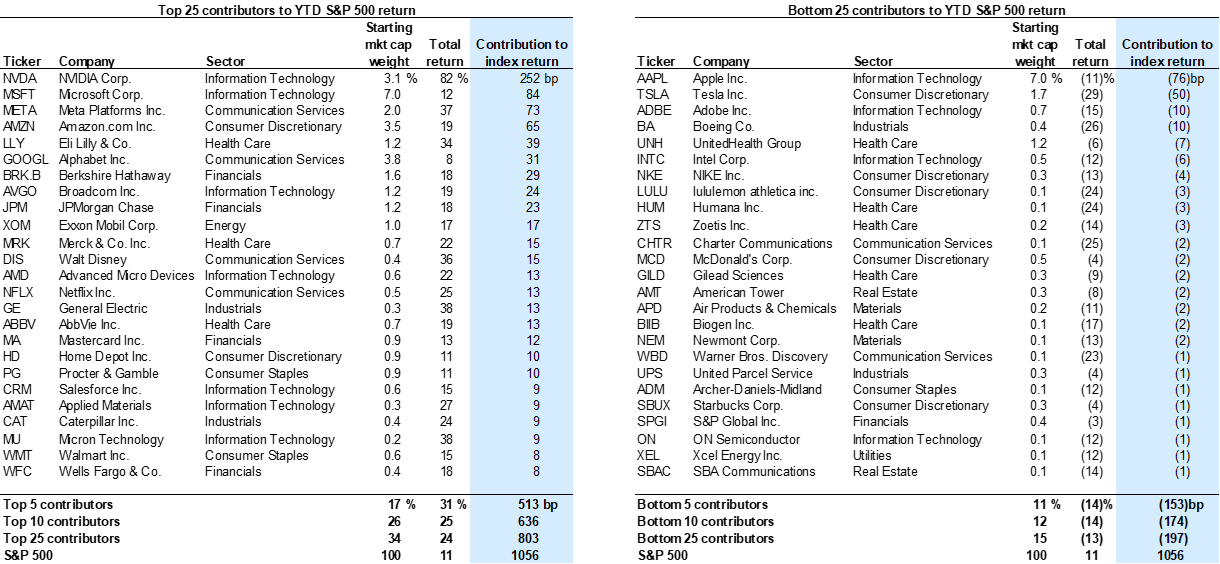

- Tale of the tape: Best and worst S&P 500 index return contributors and performing stocks in 2024

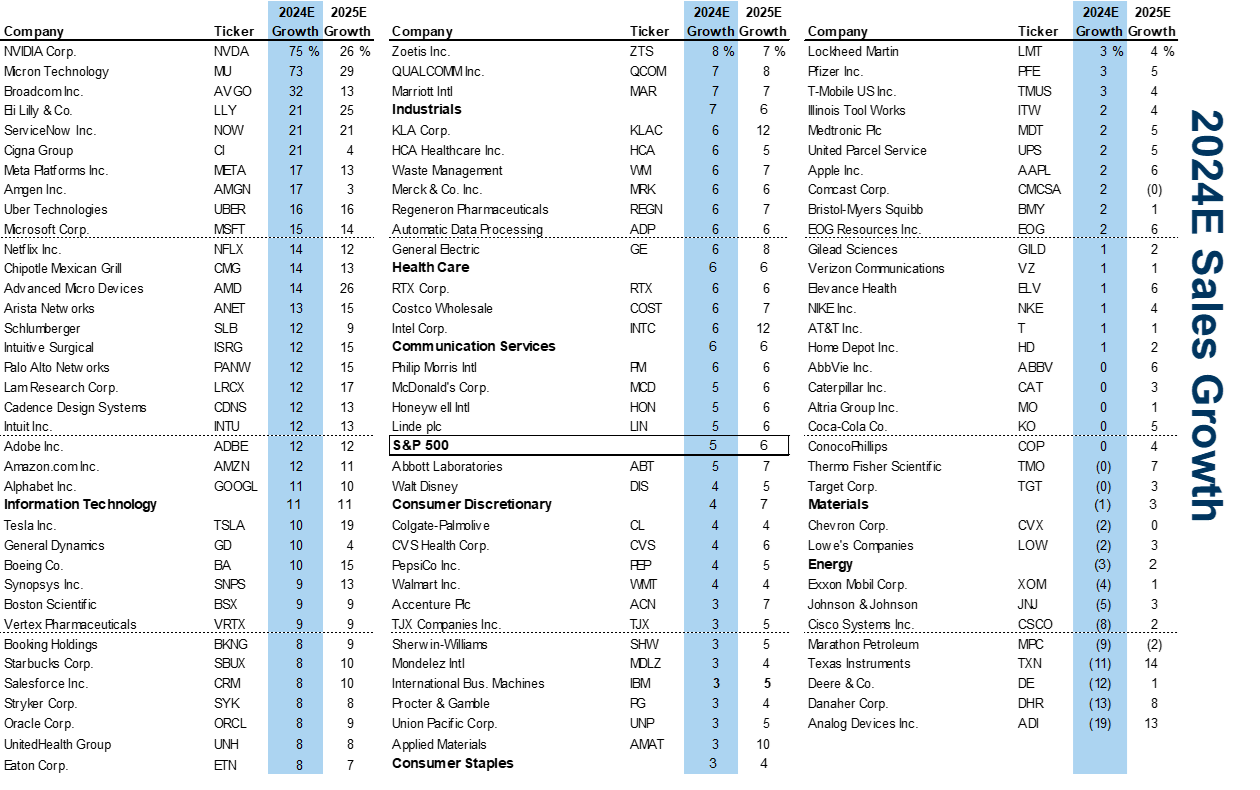

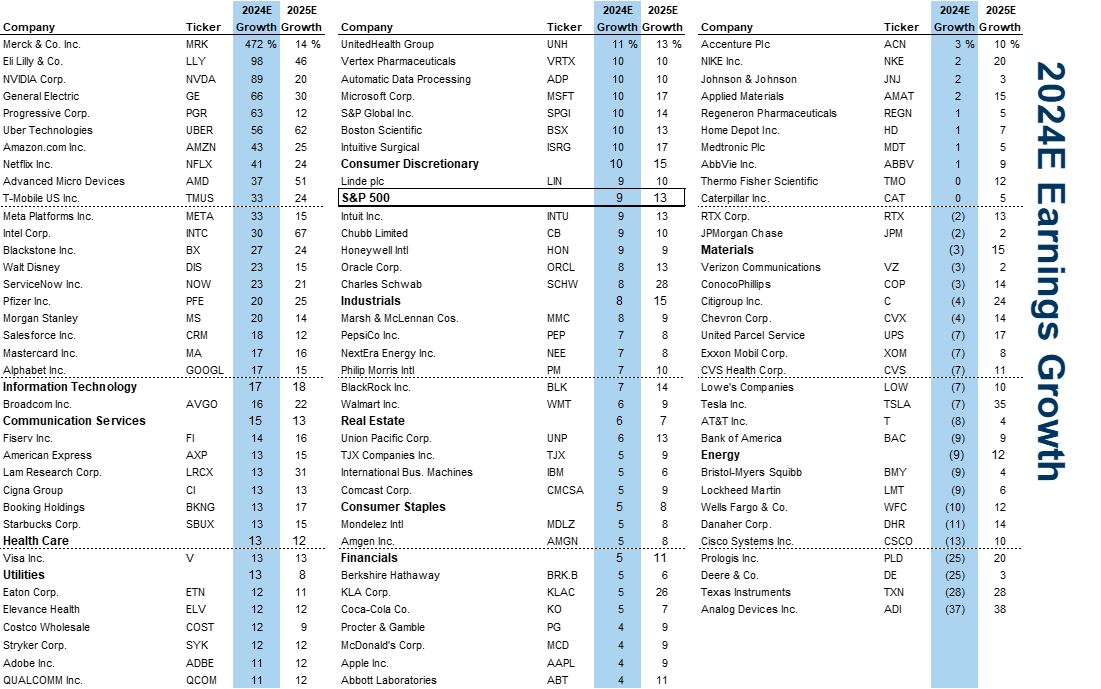

- Where to find sales and EPS growth in 2024

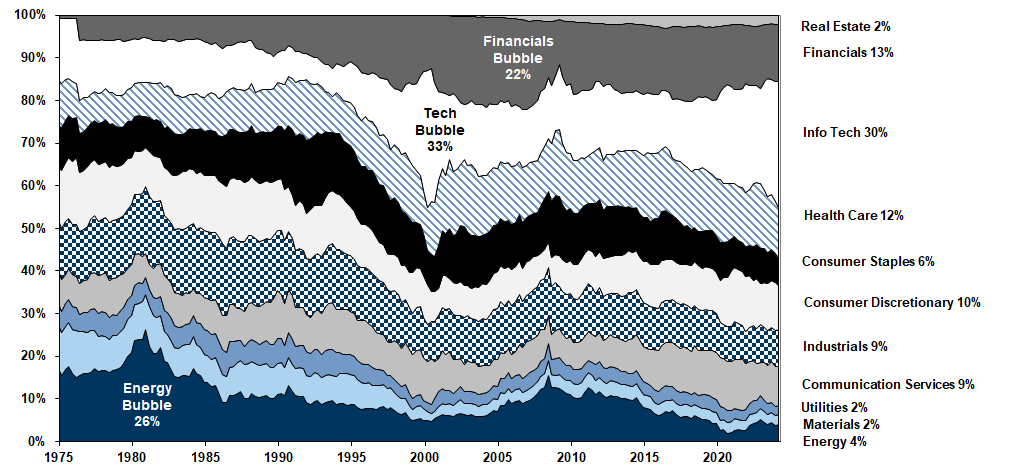

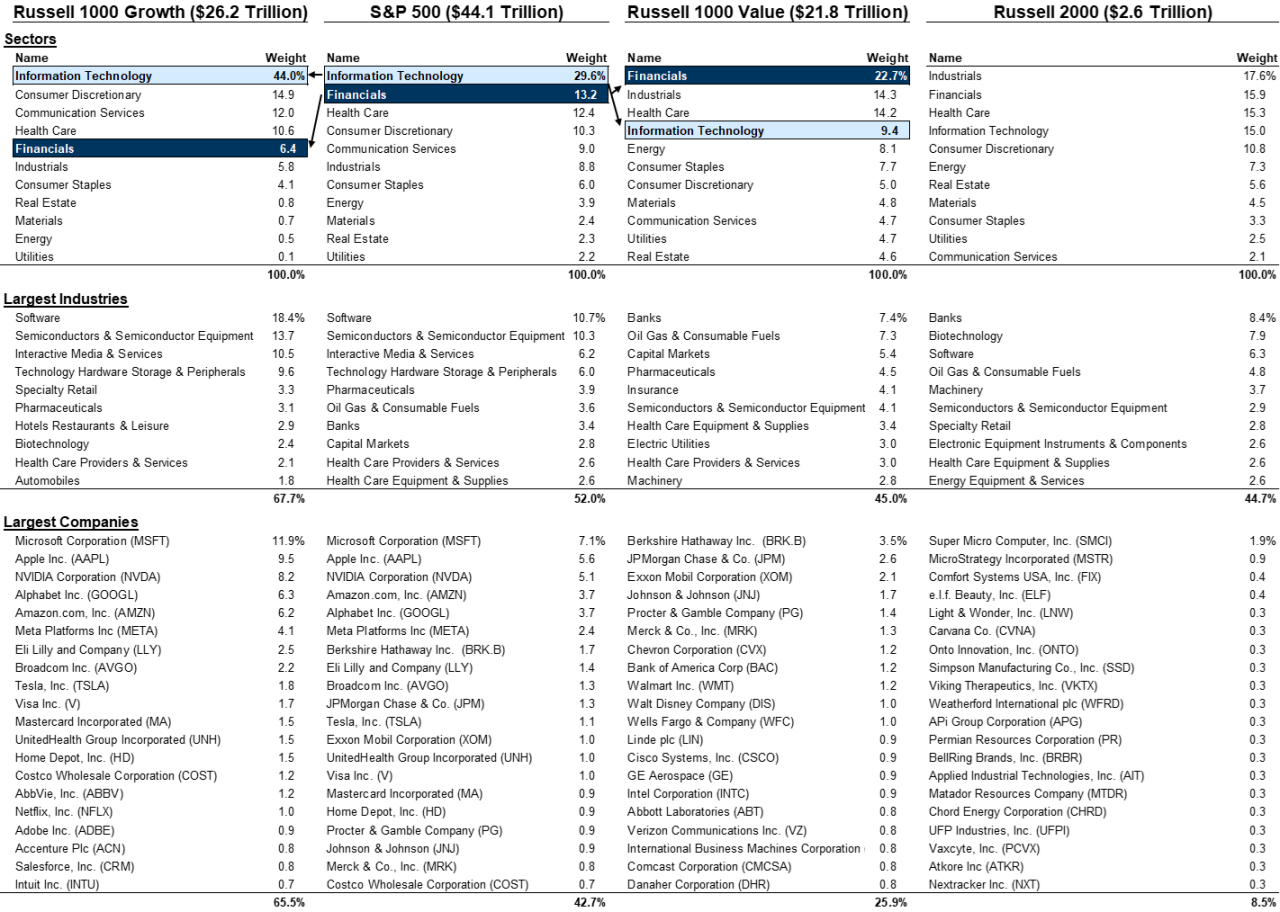

- Sector capitalization of the S&P 500 has shifted significantly over time...

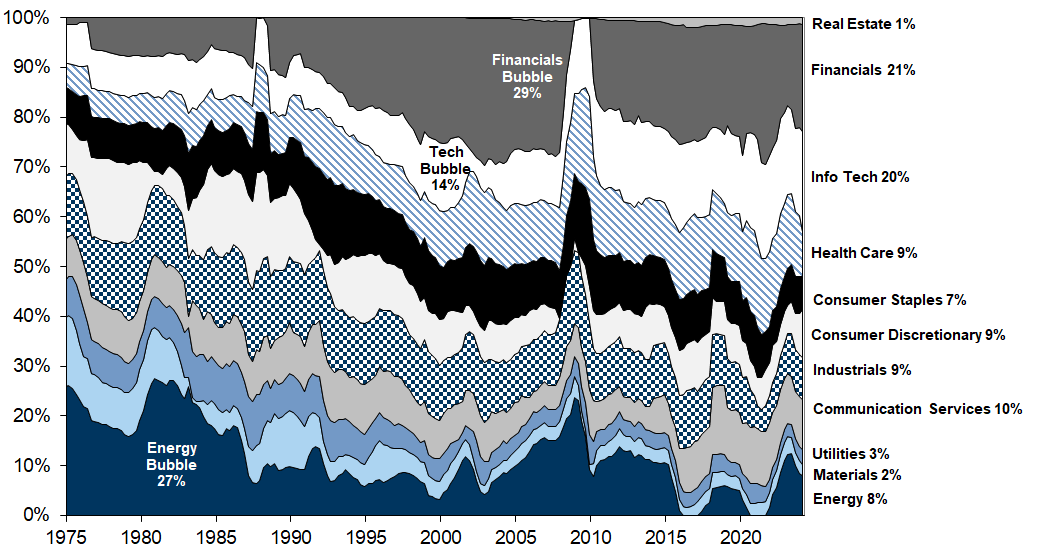

- ...but has not always correlated with the proportionate contribution to net income

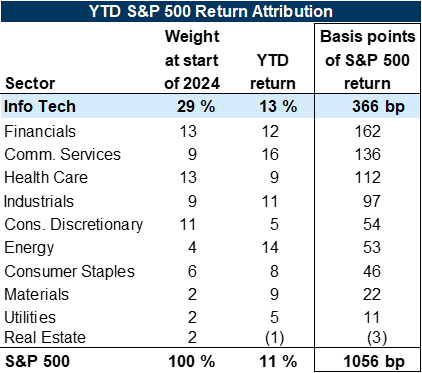

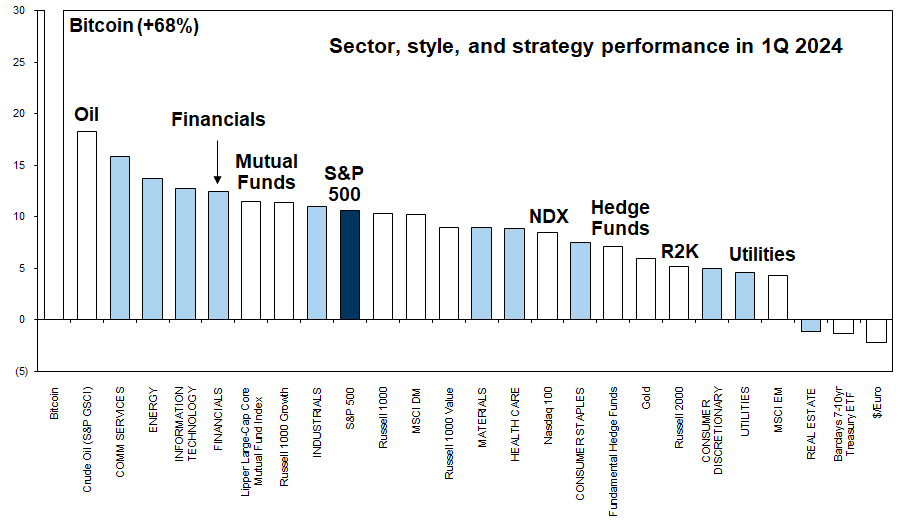

The S&P 500 returned 11% in 1Q 2024 reaching a new all-time high and posted the strongest 1Q return since 2019. While strong performance by several of the largest mega-cap tech stocks (MSFT, NVDA, AMZN, GOOGL, META) helped lift the index, market breadth improved in 1Q and the equal-weight S&P 500 also rose (+7%). Components of the YTD return included +295 bp from better earnings expectations, +721 bp from a 7% expansion in the forward P/E multiple to 21x, and +40 bp from dividends. The index was led by Comm. Services (+16%) while Real Estate (-1%) fared the worst. Underneath the surface Cyclicals outperformed Defensives by 5 pp in 1Q as the market continued to price an optimistic growth outlook amid firm economic data. In 2024, we expect S&P 500 EPS will rise by 8% but the index will remain flat at 5200 as the P/E multiple contracts slightly from its current level.

2024E Sales Growth: Fastest mega cap sales growth: NVDA, MU, AVGO, LLY, NOW

2024E Earnings Growth: Fastest mega cap EPS growth: MRK, LLY, NVDA, GE, PGR

Largest S&P 500 stocks by equity cap: MSFT, AAPL, NVDA, AMZN, GOOGL

Lowest Valuation S&P 500 stocks by P/E (NTM): VTRS, UAL, GM, AAL, EG

Lowest Valuation S&P 500 stocks by EV/EBITDA (LTM): WBD, APA, UAL, VLO, BG

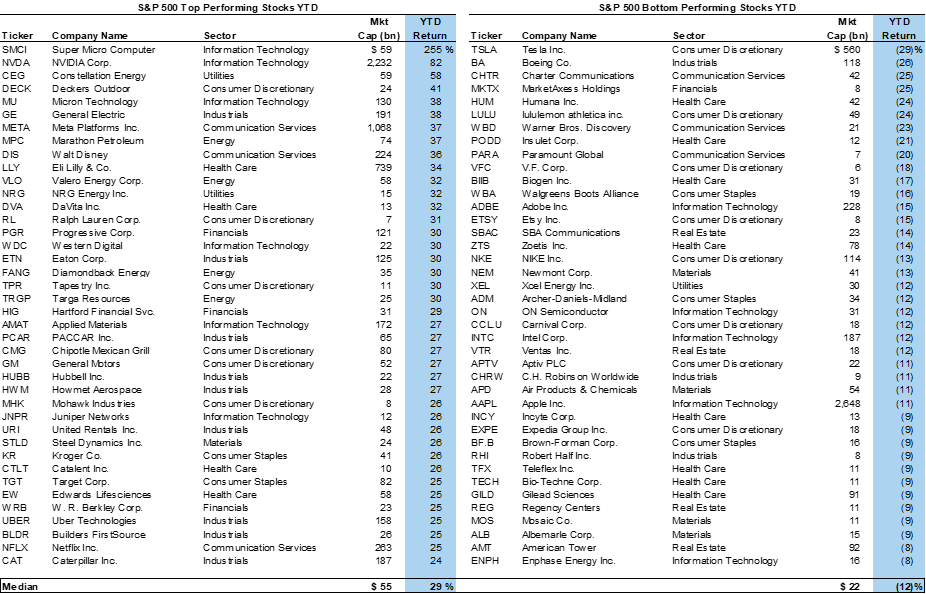

Best YTD performance: SMCI, NVDA, CEG, DECK, MU

Worst YTD performance: TSLA, BA, CHTR, MKTX, HUM

Tale of the tape: Best and worst S&P 500 index return contributors and performing stocks in 2024

Where to find sales and EPS growth in 2024

Where to find sales growth in 2024

Where to find EPS growth in 2024

...but has not always correlated with the proportionate contribution to net income

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.