Global Views: Friendly Baseline, Greater Risks

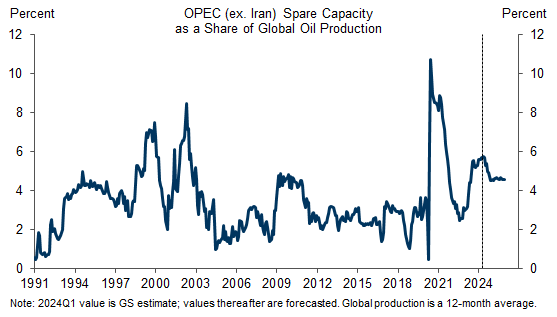

1. Following the Iranian attack on Israel, the risk of escalation in the Middle East has dominated the headlines over the past few days. Although the Biden administration is working hard to convince Israel to forego a large-scale retaliatory strike, the situation remains highly uncertain and further escalation could send oil prices soaring. That said, the risk to prices is somewhat two-sided, as our oil strategists have emphasized that the current Brent level of $90/barrel already incorporates a geopolitical risk premium of $5-10 and that global spare production capacity now stands at nearly 6 mb/d, a generous 5¾% of global production. At this point, we have therefore made no changes to our economic forecasts on the back of the recent escalation.

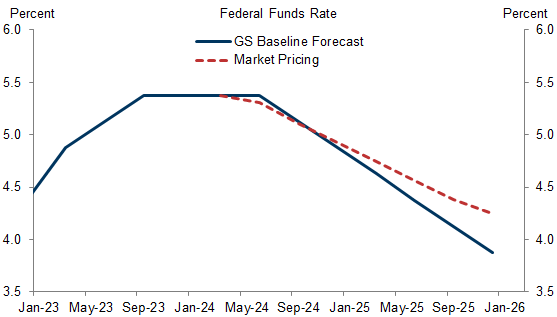

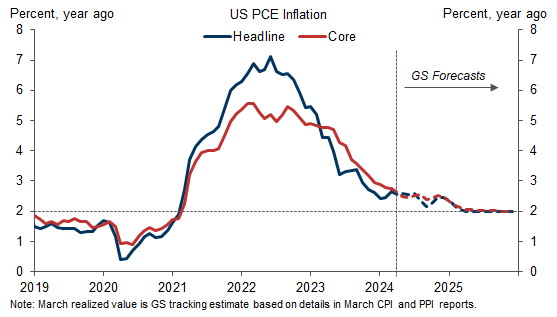

2. Outside geopolitical risks, the dominant market theme has been the higher-than-expected US March CPI. With the PPI and import price data also in hand, we estimate that the core PCE index rose just over 4% (annualized) in the first three months of 2024. This would be the highest 3-month rate since the 4.9% seen in the first quarter of 2023. Barring a meaningful deterioration in the labor market, it probably rules out rate cuts until the FOMC has seen a renewed sequential deceleration for at least a few months. We have therefore pushed back our prior Fed call of quarterly cuts starting in June by one meeting and now see quarterly cuts starting in July, with risks tilted to the later side.

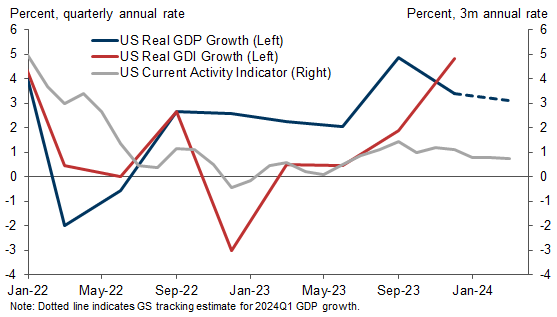

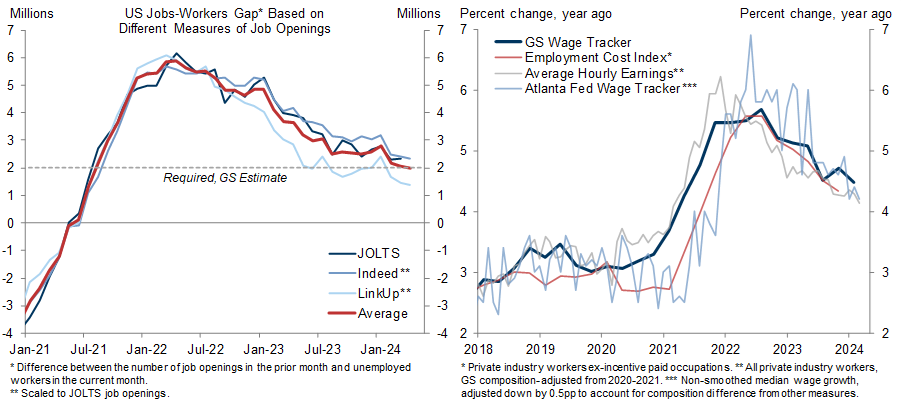

3. The US economy should be able to weather a later-than-expected start to monetary easing. Although GDP growth has slowed from the sizzling 4.1% pace of 2023H2, we still estimate a solid 3.1% gain in Q1, led once again by strength in personal consumption. Similarly, the labor market news remains mostly favorable, with a 303k increase in nonfarm payrolls and a small drop in the unemployment rate to 3.8% in March. Underneath the surface, gross hiring has slowed despite the sharp increase in immigration and labor force growth. But the jobless claims, JOLTS, Challenger, and WARN notice data all suggest that layoffs likewise remain muted. On balance, this is an encouraging combination for the sustainability of the recovery, although it does mean that new entrants into the workforce may have to search longer before they find a job.

4. Despite the recent upside inflation surprises, we think the broader disinflationary narrative remains intact. One key reason is that the labor market continues to rebalance nicely. Our jobs-workers gap is down to 2.0 million, the quits rate is below pre-pandemic levels, and the wage news remains favorable. As of March, average hourly earnings and the Atlanta Fed wage growth tracker are consistent with year-on-year wage growth of just over 4%, and we expect the more reliable employment cost index to show a similar pace for Q1. Over the next year, we see wage growth converging to 3.5%, the pace we estimate is consistent with 2% assuming a productivity trend of 1.5% and stable profit margins.

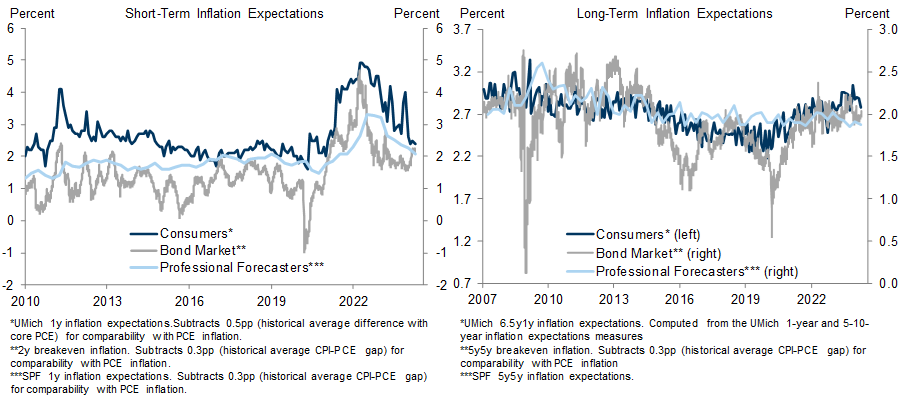

5. Another reason for comfort is that inflation expectations remain well-anchored despite the more adverse inflation headlines. Although short-term breakeven inflation compensation in the bond market has increased on the back of higher oil and gasoline prices, consumer surveys of 1-year inflation expectations remain at or near a 3-year low and all measures of long-term inflation expectations—household surveys, economist surveys, and breakevens—look consistent with 2% inflation.

6. Lastly, much of the inflation pickup reflects an unusually large number of special factors, including the January effect, an increase in owners’ equivalent rent in January that was probably spurious, and an increase in imputed financial services inflation that is partly driven by strong stock market performance. Even with these special factors, the year-on-year rate of core PCE inflation has come down further over the last few months to an estimated 2.8% in March. As the special factors unwind, we expect sequential inflation to slow anew. Although the drop in the year-on-year rate will likely stall around 2½% in the second half of 2024, we expect renewed declines in early 2025, with convergence to 2% later that year.

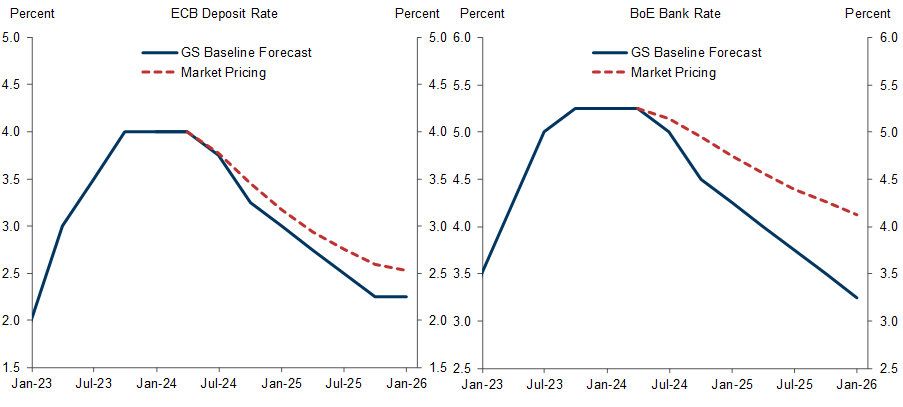

7. Last week’s press conference confirmed that the first ECB cut is very likely to occur at the June 6 meeting. Given the considerably weaker European growth performance relative to the US, we still expect the first three cuts to be consecutive, taking the deposit rate to 3.25% by September. However, we now see the Governing Council switching to a quarterly pace of cuts thereafter. We have similar forecasts for the UK and Canada, with a start to the easing cycle in June, three consecutive cuts to start off, and then a switch to a quarterly pace in Q4. Our forecasts are below market pricing across all three central banks.

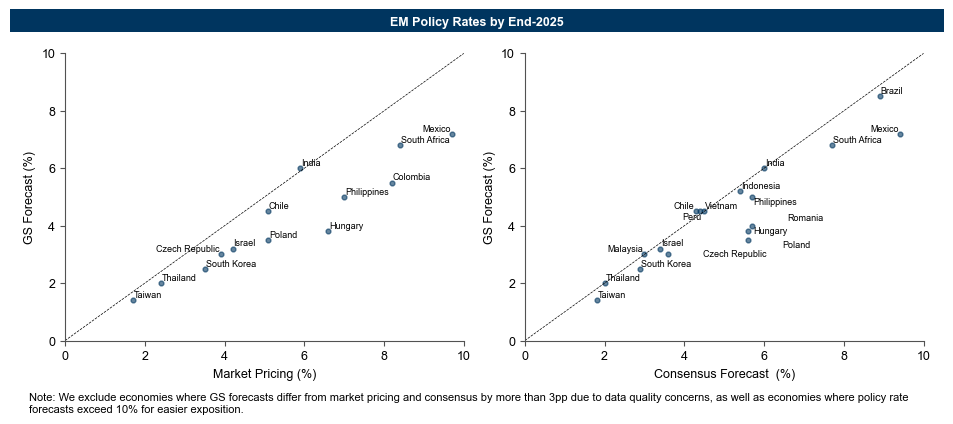

8. Our monetary policy forecasts are even further below market pricing across most of the emerging world. If inflation settles in the 2-4% range that prevailed before the pandemic, as we expect, many EM central banks will find themselves with real policy rates at extremely restrictive levels unless they deliver large nominal rate cuts. While real rates may indeed linger in restrictive territory for a while as central banks aim to snuff out any lingering instability in inflation expectations and support their currencies in a higher-than-expected US rate environment, we think markets are (too) generously priced for these upside risks. We are particularly optimistic in Central and Eastern Europe, in part because our greater confidence about imminent ECB cuts partly offsets the impact of later Fed cuts on the willingness of CEE central banks to ease.

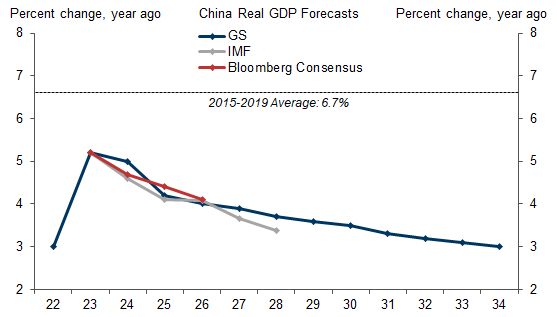

9. China grew substantially faster than expected in Q1, consistent with our above-consensus 2024 growth forecast. However, the monthly data, especially on industrial production, suggest only limited follow-through beyond Q1. We therefore remain comfortable with our 2024 GDP forecast of 5.0% and expect growth to decelerate in subsequent years on the back of headwinds from ongoing weakness in property markets, local government debt, and a shrinking population. On a related note, our below-consensus inflation forecast implies only a gradual return to the 1-2% range over the next couple of years.

10. Our baseline forecasts—solid global growth, falling inflation, and lower policy rates—still imply a constructive backdrop for risk asset markets. However, the combination of delayed monetary easing, high valuations, increased geopolitical risks, and an impending US presidential election suggests that the investing environment is likely to remain choppier than it has been for most of the past year. Thus, our equity strategists expect only muted price returns and our credit strategists see spreads treading water in the remainder of 2024, while our commodity strategists are emphasizing the upside opportunities in industrial and precious metals as well as the hedging value of long oil positions.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.