Global Views: Inflection Point

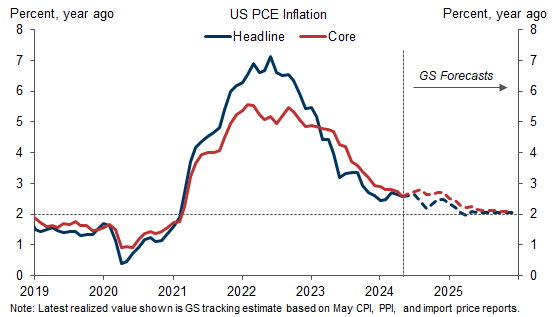

1. Last week’s US inflation data reinforced our view that the Q1 spike was an aberration. With CPI, PPI, and import prices in hand, we estimate that core PCE rose just 0.13% in May. In the remainder of 2024, we expect prints averaging 0.17%, with flat core goods prices and ongoing gradual deceleration in both shelter and non-housing core service inflation. This implies that core PCE will end 2024 at 2.7% year-on-year, a slight increase from May's estimated 2.6% because of adverse base effects but slightly below the latest median FOMC projection of 2.8%. We still expect both headline and core inflation to fall to 2% in 2025.

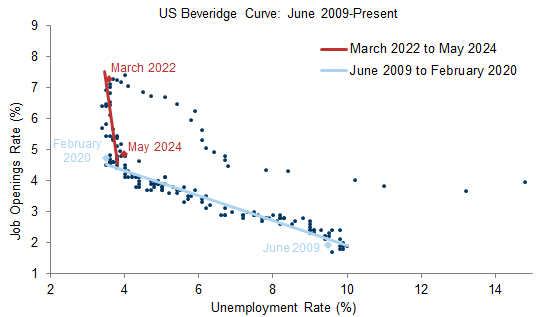

2. The labor market is now fully rebalanced, with the jobs-workers gap—the difference between job openings and unemployed workers—back to its February 2020 level. Contrary to the predictions of some prominent economists but consistent with our own work and that of Fed Governor Christopher Waller, the normalization has occurred in a very benign fashion, with a large decline in the job openings rate and only a negligible increase in the unemployment rate. In the jargon of labor economics, we have moved down the steep post-pandemic Beveridge curve and are back to the flatter pre-pandemic Beveridge curve.

Exhibit 2: A Further Softening in Labor Demand Would Likely Hit Actual Jobs, Not Just Open Positions

We plot the unemployment rate in the current month against the job openings rate in the prior month. Since October 2019, we consider the job openings rate implied by the average of JOLTS, LinkUp, and Indeed.

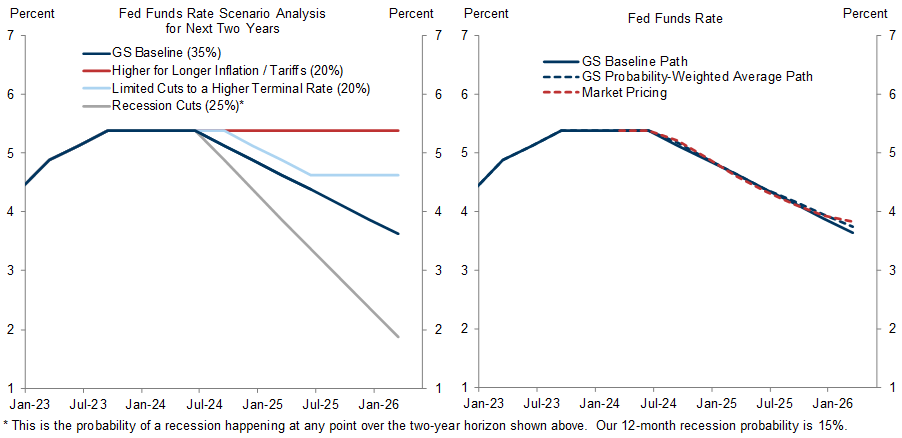

Source: Haver Analytics, Goldman Sachs Global Investment Research

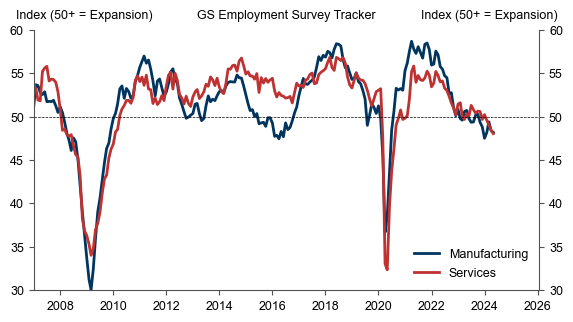

3. If so, the labor market stands at a potential inflection point where a further material softening in labor demand would hit actual jobs, not just open positions, and could therefore push up the unemployment rate more significantly. How well labor demand is holding up is unclear, with mixed signals from the timeliest indicators. On the positive side, nonfarm payrolls grew 272k in the preliminary release for May. On the negative side, both initial and continuing jobless claims have risen in recent weeks—although residual seasonality around Memorial Day may have played a role—and our employment survey tracker has fallen to levels consistent with stagnation or slight contraction.

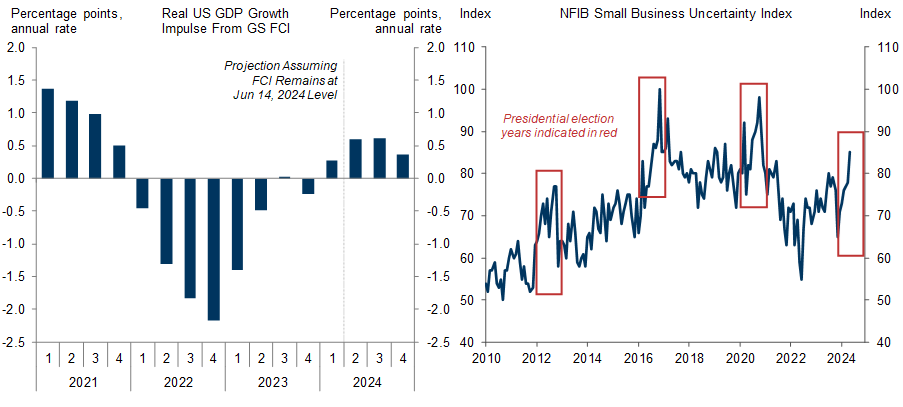

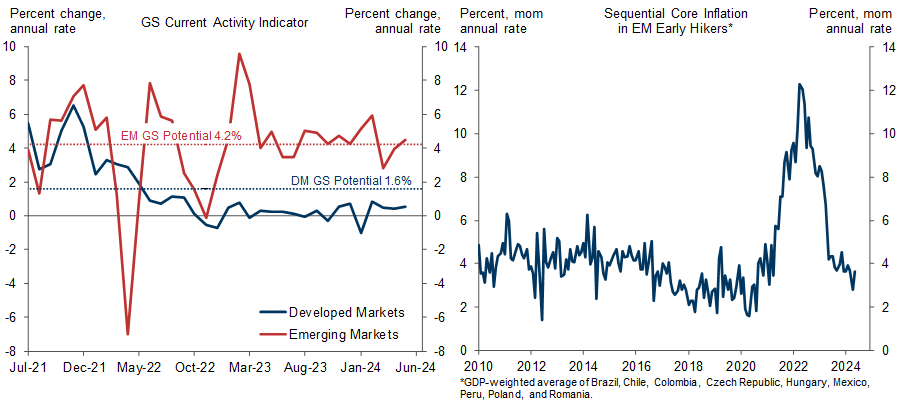

4. Ultimately, the key driver of labor demand is economic activity, and GDP growth has slowed meaningfully from 4.1% in 2023H2 to an estimated 1.7% in 2024H1. Our baseline is a moderate pickup in H2 as the impulse from financial conditions is turning more positive at a time when we expect the drag from inventories and net trade to end. But most of the slowdown is probably here to stay, as real income growth has softened, consumer sentiment has fallen anew, and there are early signs of an increase in election-related uncertainty that could weigh on business investment in coming months.

5. The FOMC dot plot surprised hawkishly, with a median of only one projected cut in 2024, but we feel good about our forecast of two cuts (in September and December). First, the one-cut message was not a strong one, with eight officials (probably including the leadership) projecting two cuts. Second, Chair Powell noted repeatedly that the projections were “conservative”—i.e., stale—as few participants changed their submissions after the benign CPI reported on the second day of the meeting. And third, if we are really back on the pre-pandemic Beveridge curve, Fed officials should—and probably would—ease sooner rather than later in response to meaningful weakness in GDP growth or labor demand.

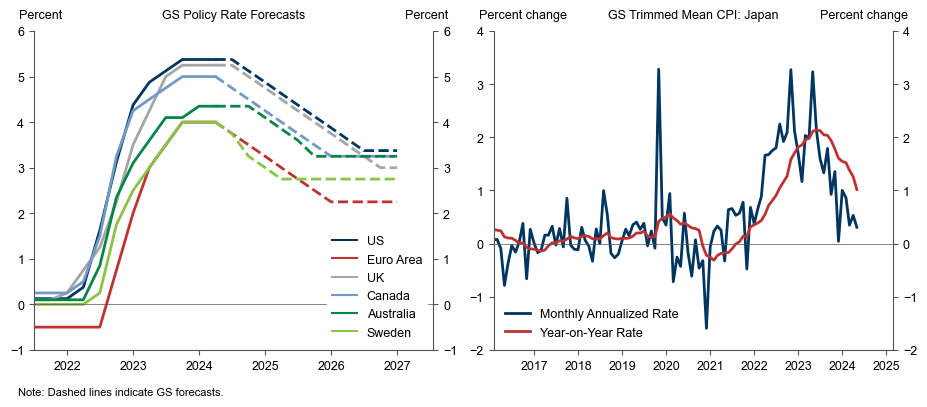

6. Four G10 central banks—the ECB, Bank of Canada, Riksbank, and Swiss National Bank—have now begun to cut rates, with the Bank of England on August 1 and the Fed on September 18 probably next. In almost all cases, the pace is likely to be gradual with 25bp cuts every other meeting barring meaningful downside growth and employment surprises. One possible exception is the Bank of Canada, where disinflation has been particularly rapid in recent months and where we could see a second consecutive cut on July 24 if the next two releases are similarly benign. The outlier is the Bank of Japan, where we expect the next 15bp hike on July 31. However, the recent weakness in sequential measures of core inflation in Japan bears watching, as it could delay subsequent normalization steps.

Exhibit 6: G10 Cutting Cycles Getting Underway; Softer Japan Inflation Could Slow the Pace of Hikes

GS trimmed mean CPI uses the Dallas Fed's method and excludes the bottom 24% and top 31% most extreme price changes from the headline CPI basket.

Source: Haver Analytics, Goldman Sachs Global Investment Research

7. The fundamental picture in the emerging world hasn’t changed much. The Chinese economy remains bifurcated between strength in exports and weakness in housing and credit, coupled with very low inflation. Elsewhere, growth is mostly solid while inflation has fallen back to pre-pandemic levels. Nevertheless, the elections in Mexico, India, and South Africa have triggered a significant unwind in FX carry trades and pressure on local rates markets. If the turbulence abates only slowly, as our strategists expect, it could also impede the normalization of monetary policy, although the fundamental case for lower rates in the medium term remains strong.

8. Our economic views—further disinflation and broadening rate cuts—remain supportive for asset prices. This is incorporated in the constructive views of our rates, EM, credit, and equity strategists. However, political risk is rising, not only in EM but also in DM. The biggest upcoming events are the first Biden-Trump debate on June 27 and the two rounds of the French parliamentary election on June 30 and July 7. Depending on the outcome, the Biden-Trump debate could focus markets more on the impact of higher tariffs on growth, inflation, and interest rates. In the French election, the key question is whether the extreme right wins “only” a relative majority (our baseline) or an absolute majority, which would likely result in more radical policies on immigration and Europe.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.