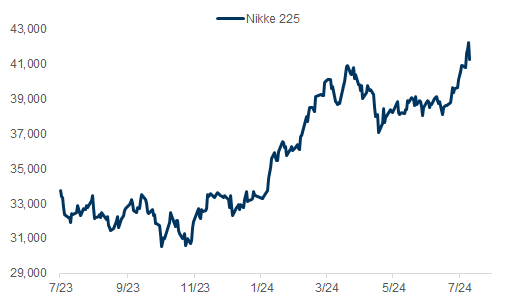

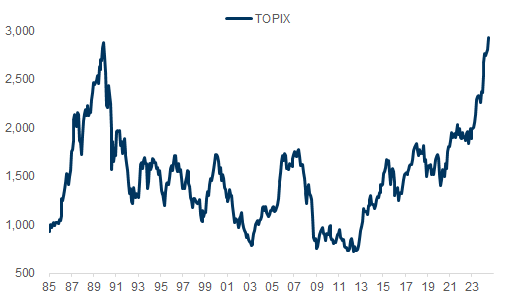

1. TOPIX/Nikkei break out

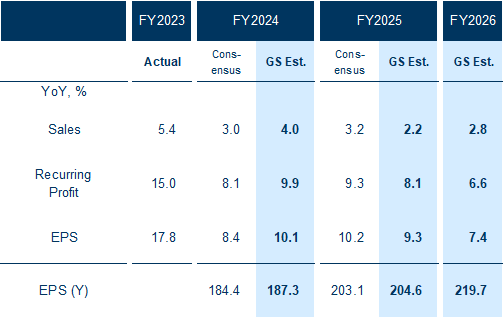

2. Raising our TOPIX EPS forecasts

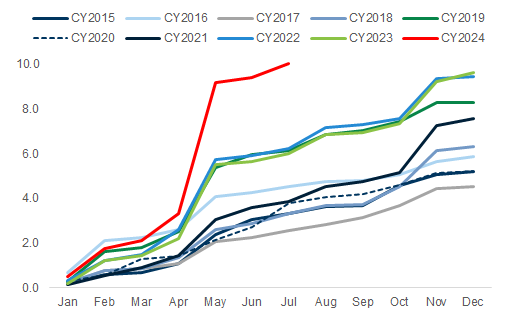

Exhibit 3: TOPIX earnings forecast: We estimate 29% EPS growth over the next three years, following 18% growth in FY2023

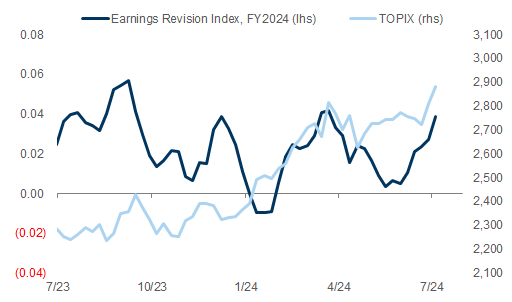

Exhibit 4: Japanese companies' earnings forecasts have been revised upward recently

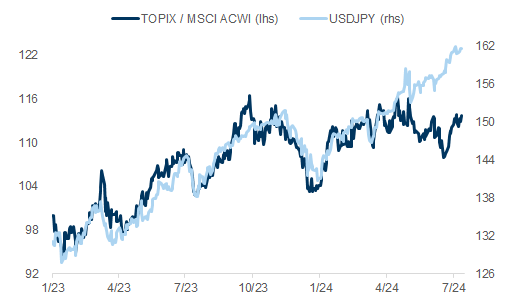

3. Correlation between JPY weakness and Japanese stocks is back

Exhibit 5: The correlation between the weaker yen and higher share prices, which had broken down in 2Q, returned from late June

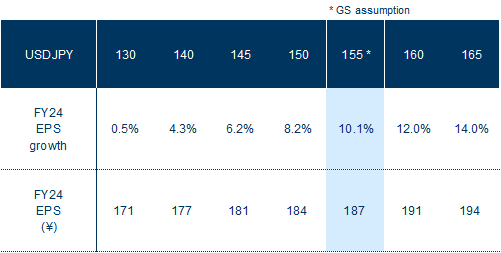

Exhibit 6: Our sensitivity analysis shows that a 10-yen depreciation/appreciation of the yen would increase/decrease profits by 3.5%, but the benefits of yen depreciation are likely to be smaller due to the increasing side effects

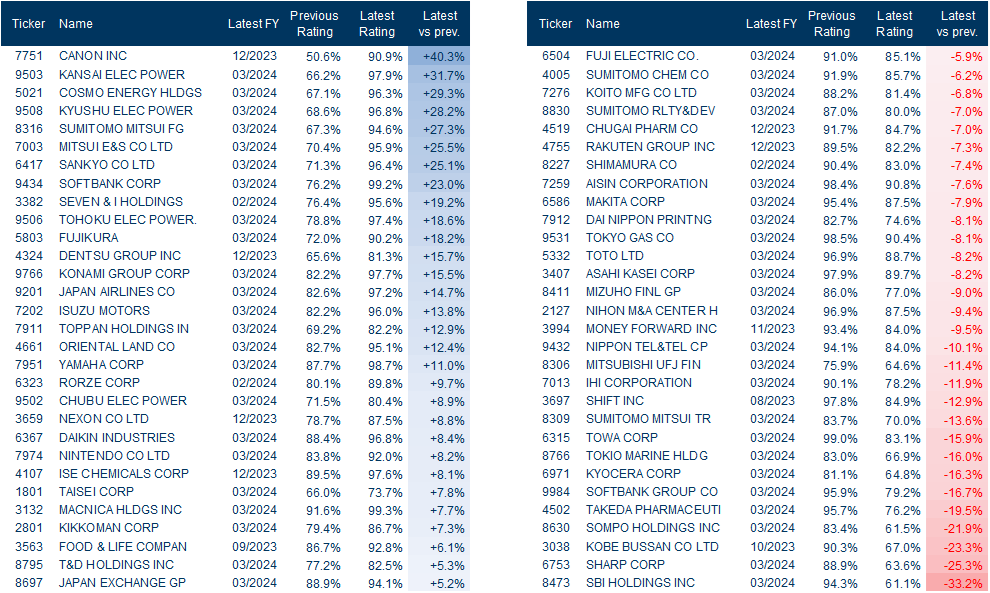

4. Positive micro developments

Share buyback announcements remained brisk after increasing sharply in April-May, with Recruit announcing a ¥600 bn buyback program this month, bringing the overall total for the year to over ¥10 tn, which already exceeds last year's level.

AGMs have become more live, with the percentage of votes supporting CEO/director nominations fluctuating significantly depending on how management's performance is viewed. Since the unwinding of cross-shareholdings will reduce the number of stable shareholders, we think shareholder meetings could become even more lively going forward. We plan to look at AGMs in more detail in a future report.

TOPIX review (new rules for TOPIX constituents): The Tokyo Stock Exchange has announced new rules related to the forthcoming TOPIX review. The number of constituent companies is expected to decline to about 1,200, increasing pressure on companies to achieve profit growth and valuation expansion.

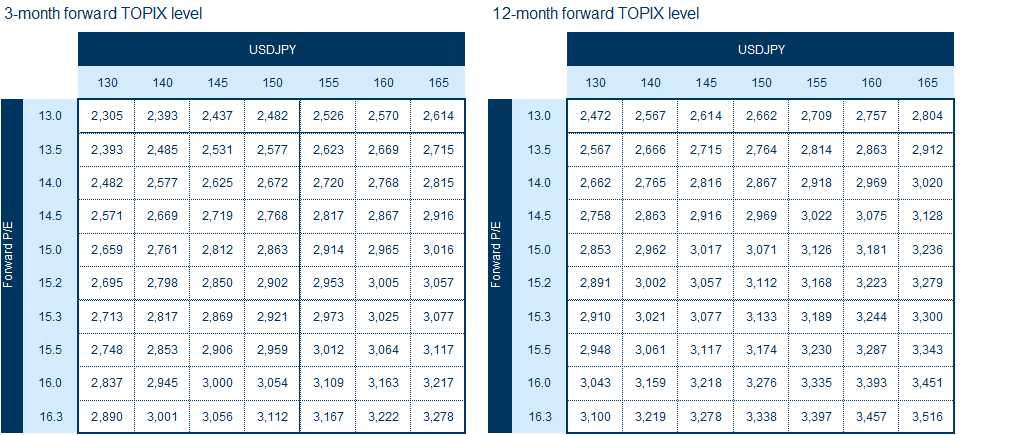

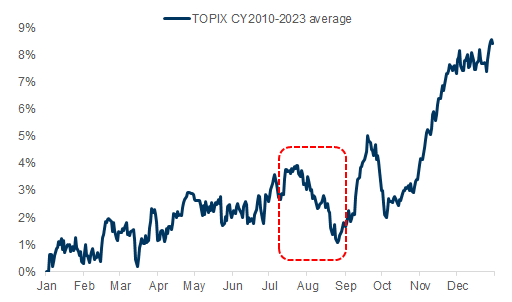

5. Thoughts on TOPIX P/E range

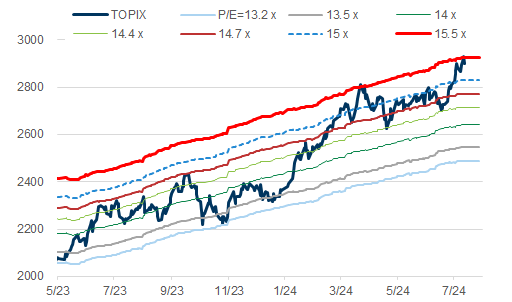

Exhibit 9: TOPIX has reached the upper end of our assumed P/E range (15.0-15.5x)

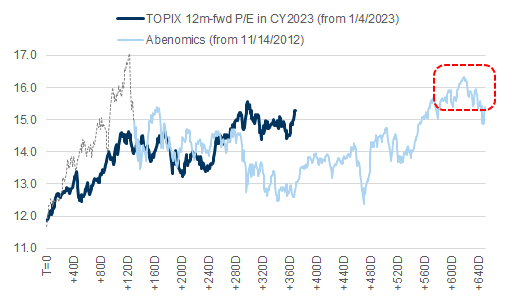

Exhibit 10: Excluding the initial overshoot, the peak P/E during Abenomics was 16.3x

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.