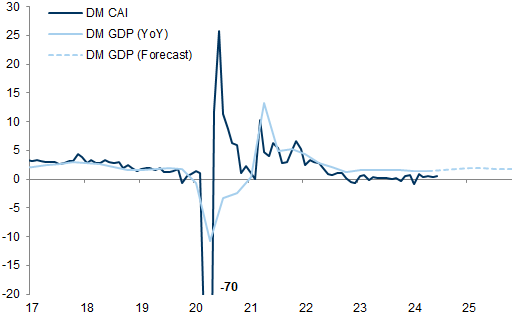

Global growth slowed in Q2 but risky assets performed well, helped by expectations for central bank easing and mega cap tech optimism. Our macro baseline view for 2H remains friendly with a small pick-up in growth, further inflation normalisation and central bank cuts. We continue to think we are in an early late-cycle backdrop, which could last considering a healthy private sector, and as a result both recession and bear market risk have been low.

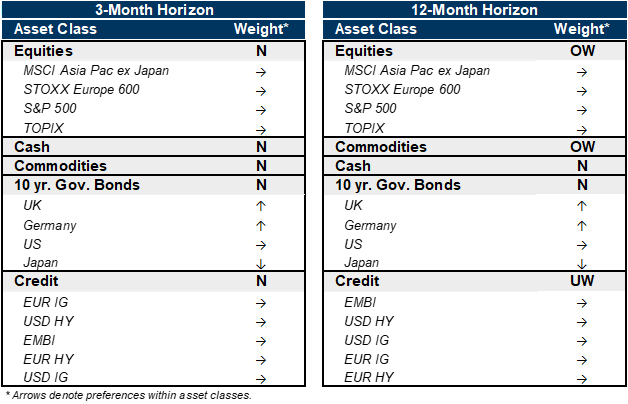

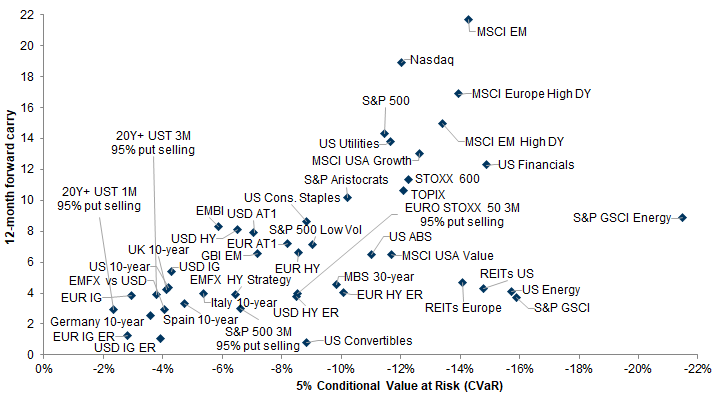

However, after a strong rally in equities in 1H we see risk of a setback in the summer due to the combination of weaker growth data, already more dovish central bank expectations and rising policy uncertainty into the US elections. As a result, we shift Neutral across assets on a 3-month horizon. We remain mildly pro-risk for 12m with an OW equities/commodities, N bonds/cash, UW credit.

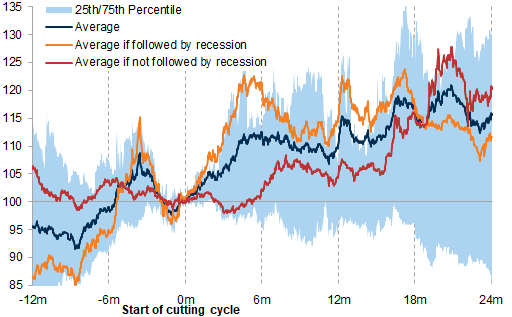

So far 'bad news' has been 'good news' for equities and risky assets more broadly, with more expectations of central bank easing. Fed easing cycles have been generally positive for equities as long as growth was good. But 'bad news' could become 'bad news' if there is less of a buffer from monetary policy or 'bad news' becomes too bad. A much weaker global growth backdrop, disappointing Q2 earnings season and rising US policy uncertainty can weigh on risk appetite.

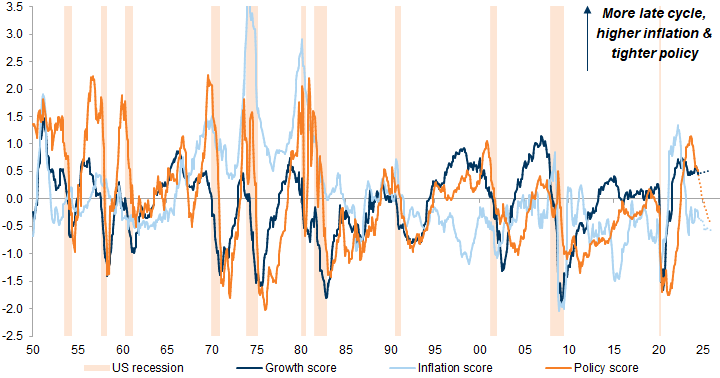

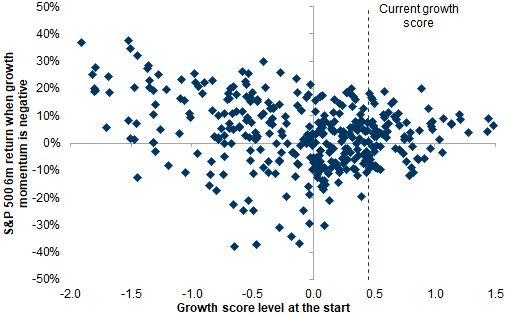

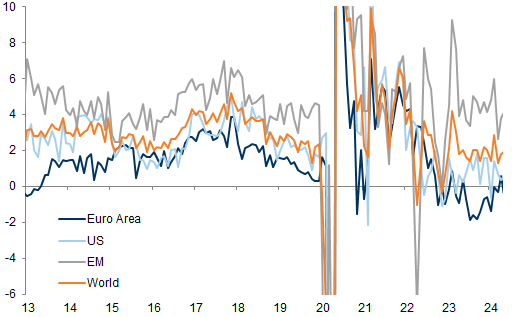

Still, we see more risk of a correction rather than a bear market for 2H. Only when our cycle growth score shifted below zero, which has historically been mostly around recessions, did equities have drawdowns in excess of 20%. With only some growth slowdown, a healthy private sector and a buffer from central bank easing, equity drawdown risk should be limited.

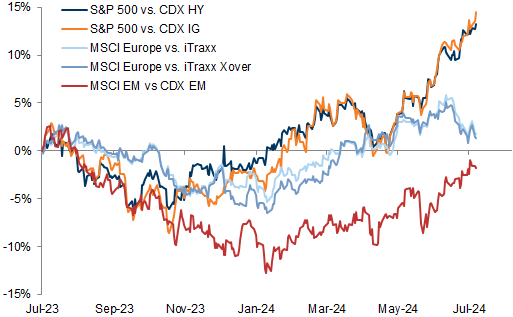

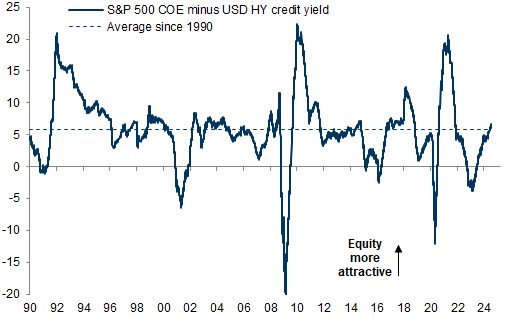

While we do not see much equity valuation expansion from here in our base case, central bank cuts, continued AI optimism and a potential growth re-acceleration in 2H could support multiples, especially for laggards. Credit valuations are a more binding constraint and we think the sector composition is worse than for equities due to a larger weight in leveraged cyclical/value sectors.

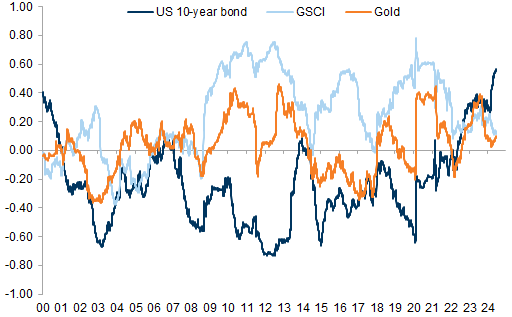

We think the equity/bond correlation will be less positive with continued inflation normalisation and bonds should buffer severe growth shocks. For additional diversification in a late-cycle backdrop and with rising policy uncertainty, we remain OW commodities on a 12m horizon and we recommend selective option overlays.

2H Outlook: Shifting neutral into the summer but we remain mildly pro-risk for 12m

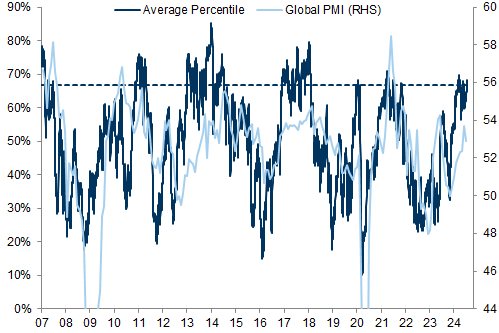

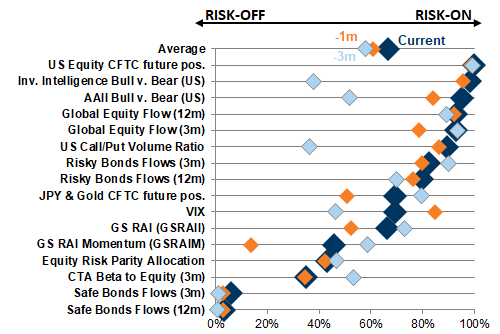

Exhibit 2: Aggregate positioning and sentiment indicators are again quite bullish

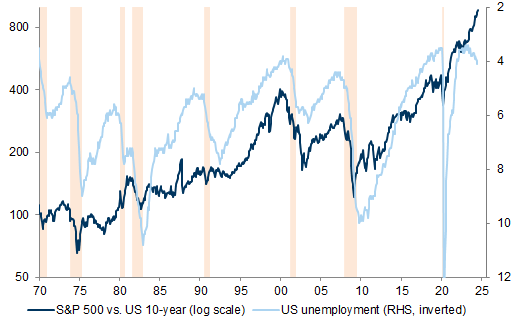

Exhibit 3: Percentiles of sentiment indicators are elevated

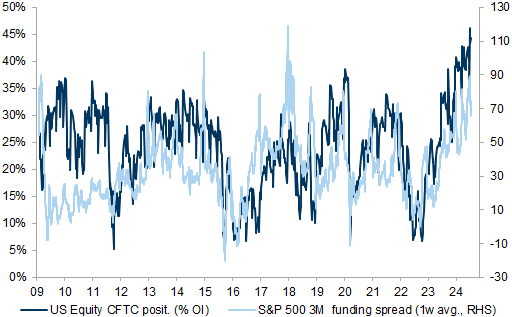

Exhibit 4: Equity futures positioning remains elevated with S&P 500 funding spreads elevated

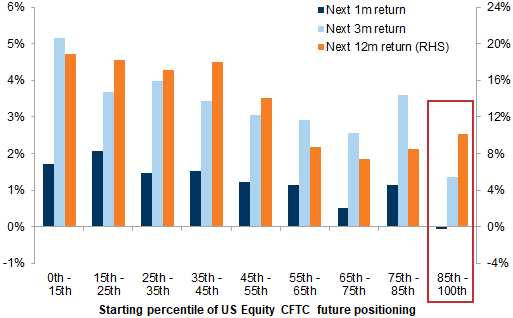

Exhibit 5: From elevated levels of S&P 500 futures positioning, near-term returns are negatively skewed

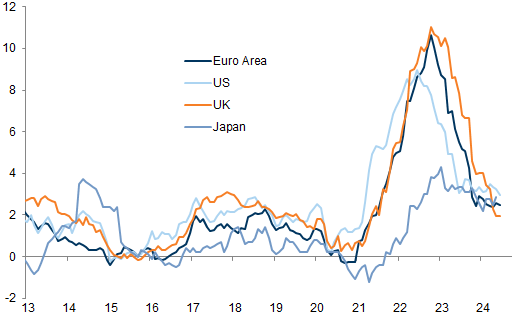

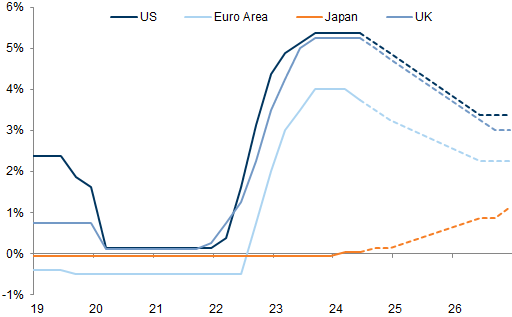

Exhibit 6: We expect growth to remain strong with further inflation normalisation and material policy easing

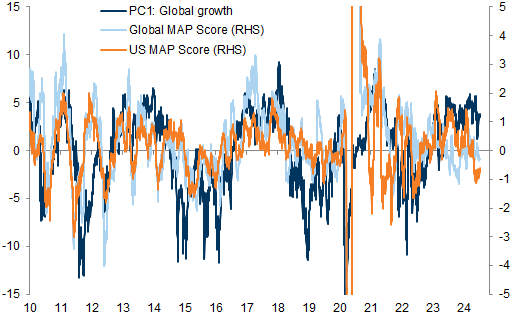

Exhibit 7: Global macro surprises have been more negative since Q2

Exhibit 8: Equities have outperformed bonds despite a rise in the unemployment rate

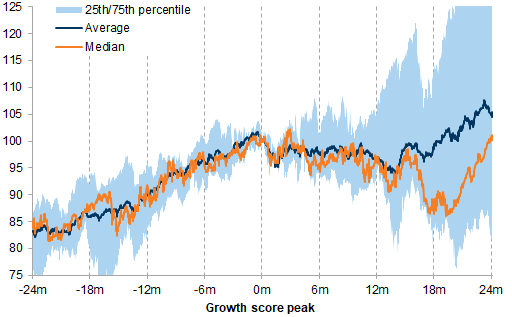

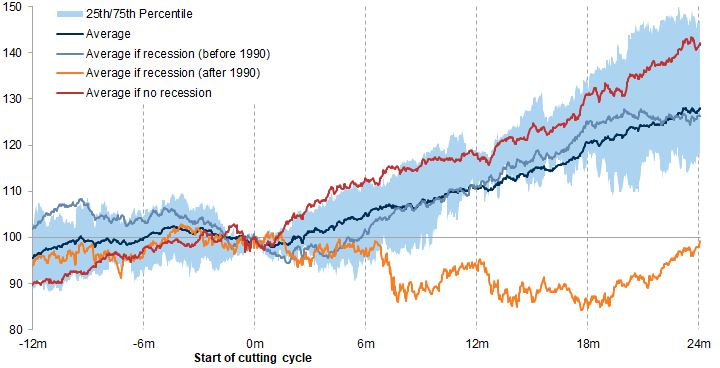

Exhibit 9: Equities tend to consolidate late cycle but performance dispersion is large

Exhibit 10: Unless the growth score drops below zero, equity drawdown risk is relatively limited

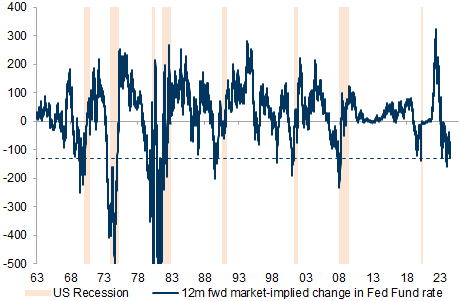

Exhibit 11: Markets are again pricing more Fed cuts in the next 12 months

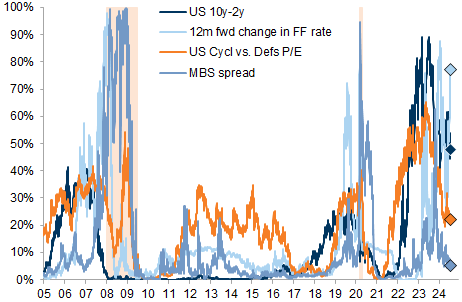

Exhibit 12: Other latent recession indicators have mostly priced out risk YTD

Exhibit 14: Bonds yields tend to decline but less so if growth remains strong

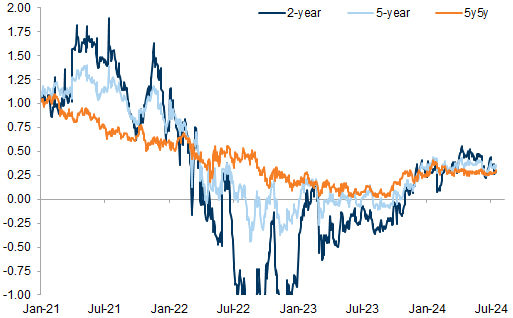

Exhibit 15: The US yield curve generally steepened around the start of Fed cutting cycles

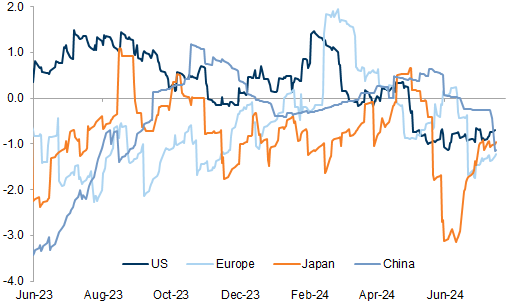

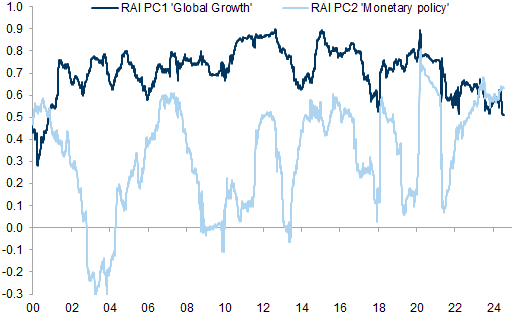

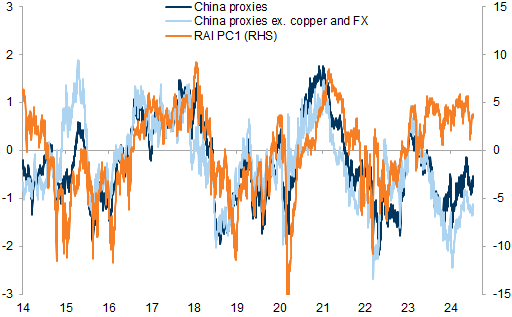

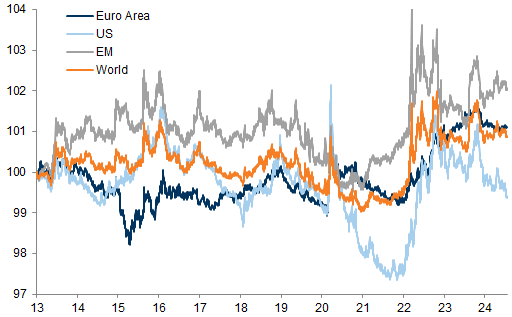

Exhibit 16: Growth optimism across assets has started to decline with more negative macro surprises

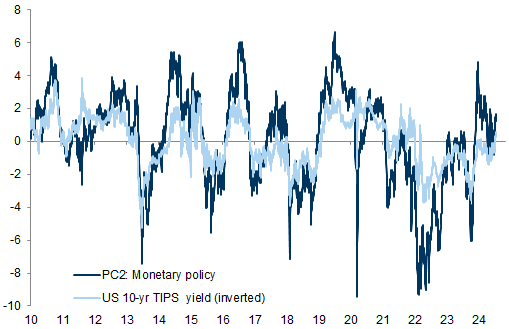

Exhibit 17: RAI PC2 has declined alongside rising real yields since the beginning of the year

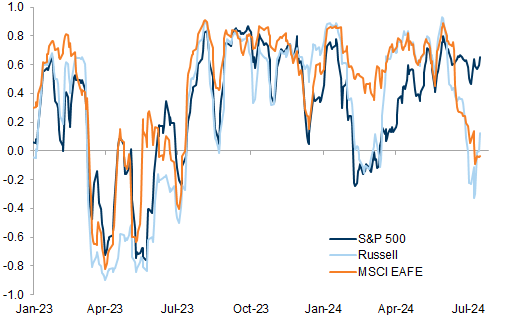

Exhibit 18: S&P 500 sensitivity to monetary policy shifts has been more important than to growth optimism

Exhibit 19: Equity/bond correlation has started to decrease

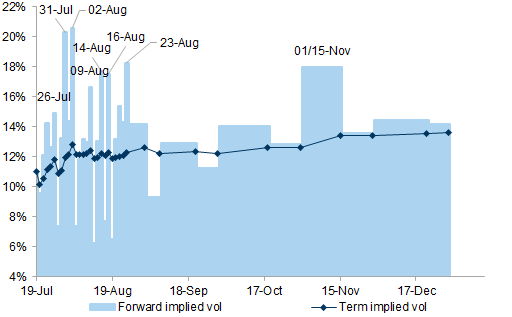

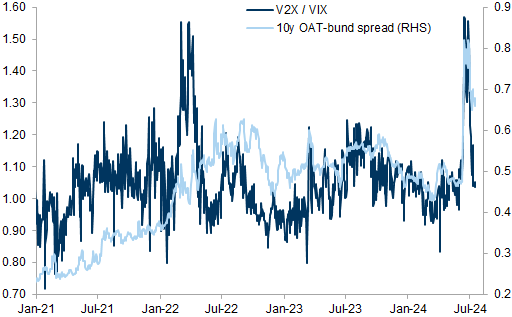

Exhibit 20: Implied volatility is still pricing rising risks into the US elections

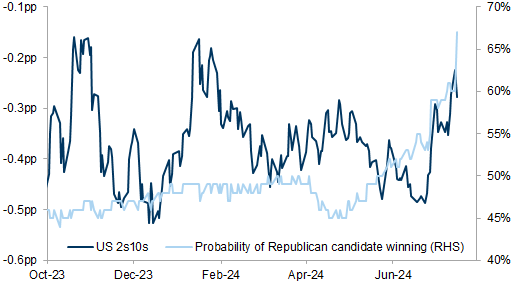

Exhibit 21: US yield curve has steepened with a rising probability of a Republican win

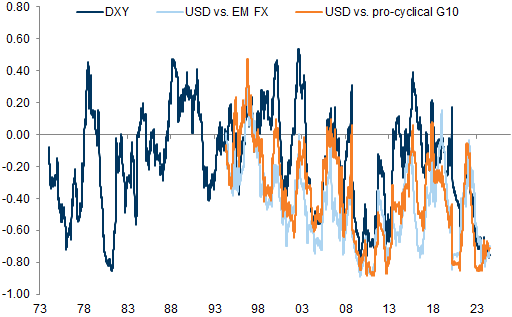

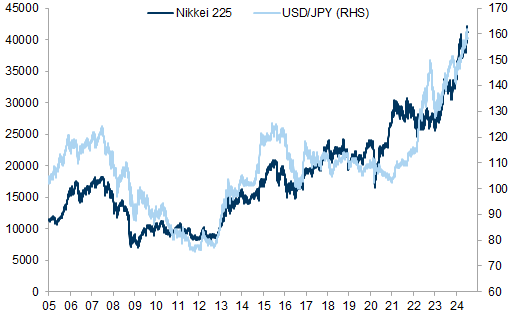

Exhibit 22: The Dollar remains a key hedge for rate shock risk in multi-asset portfolios

Exhibit 23: US traded inflation has increased vs. EMU

Exhibit 24: European political risk premium has declined again

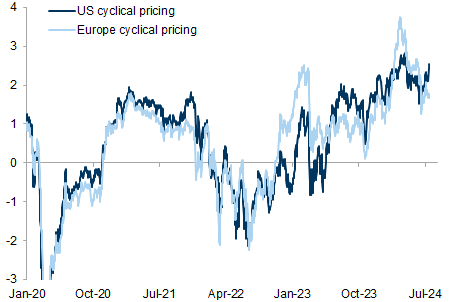

Exhibit 25: Procylical pricing across assets has declined more in Europe recently

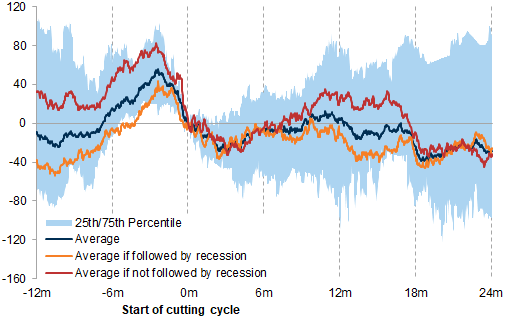

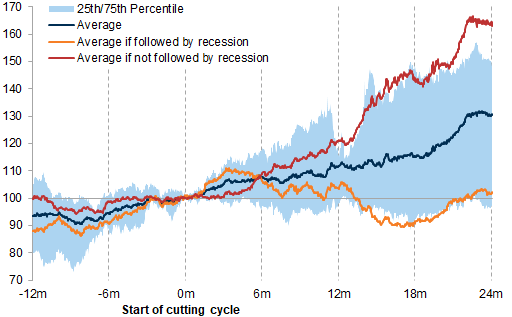

Exhibit 28: Commodity performance around Fed cutting cycles is particulary sensitive to growth

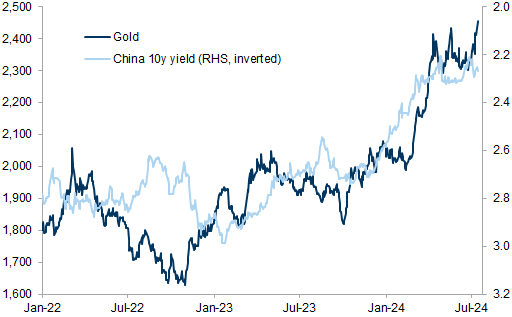

Exhibit 29: Commodities can help diversifiy in the event of a rate shock and policy risks

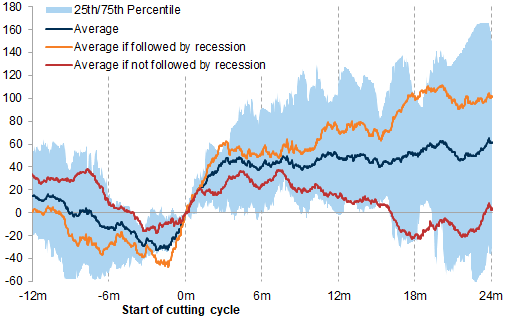

Exhibit 30: Fed cutting cycles can be very supportive for Gold if followed by weaker growth

Exhibit 31: Gold has benefitted mainly from China demand YTD

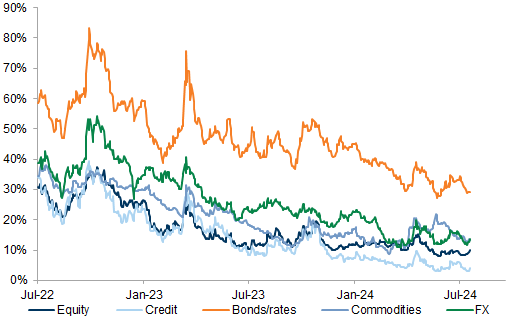

Exhibit 35: Implied volatility across assets is low and has declined YTD

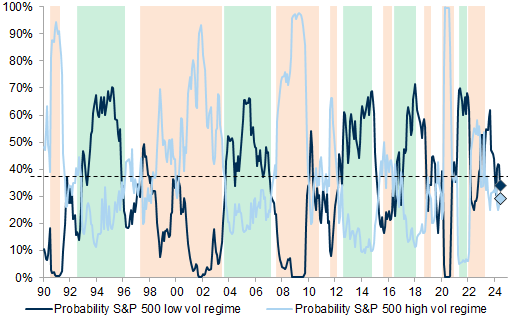

Exhibit 36: The likelihood of an S&P 500 low vol regime has declined

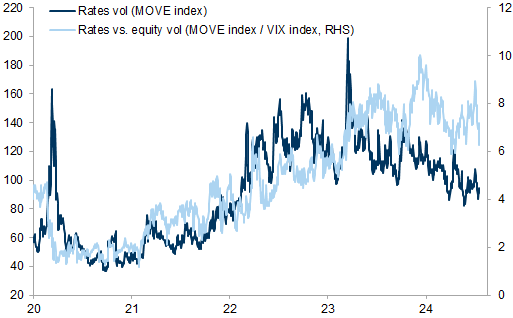

Exhibit 37: Rates vol has declined again vs. equity vol

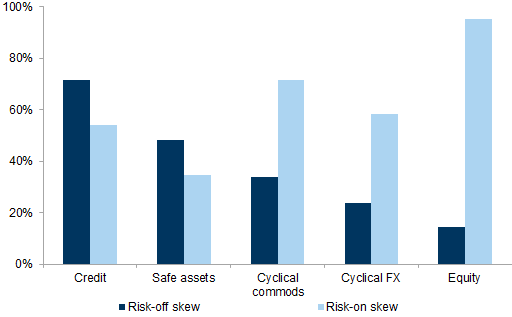

Exhibit 38: Risk-off skews remains unusually low in equities

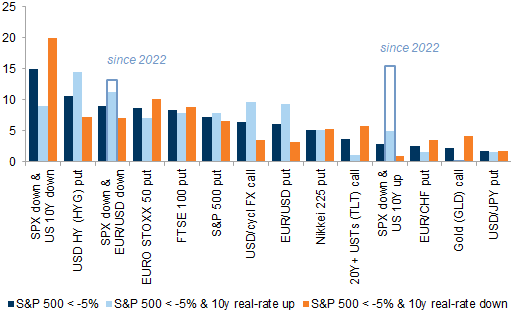

Exhibit 39: Value in equity down, rates or FX down hybrids and European equity puts

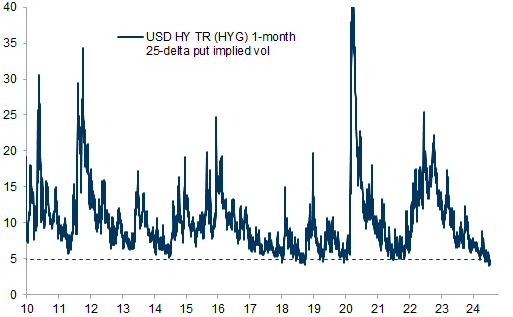

Exhibit 40: Implied volatility of USD HY credit (HYG) is close to all-time lows

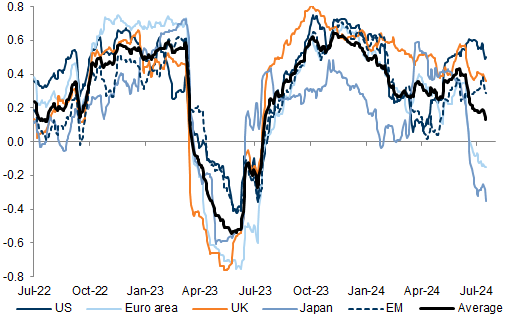

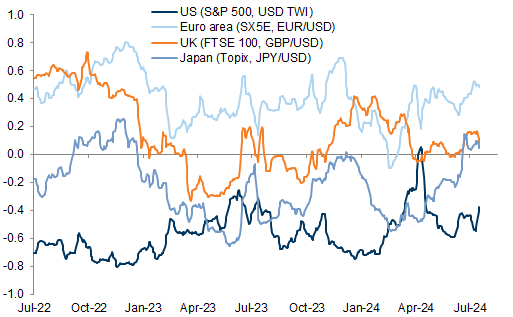

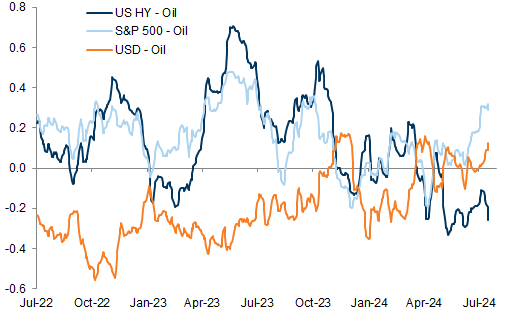

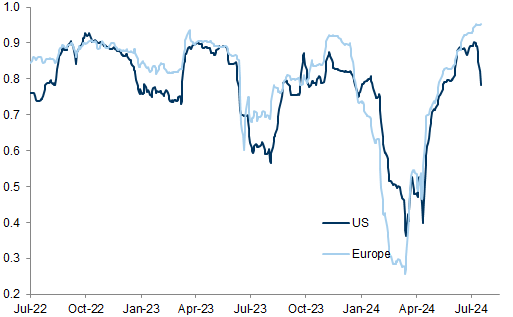

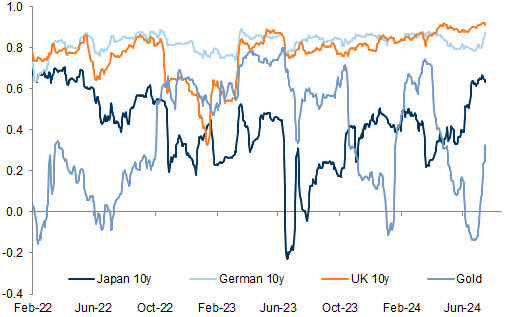

Cross-asset correlation: Equity/bond correlations have declined again

Exhibit 41: 3m rolling equity/bond correlation of weekly returns

Exhibit 42: 3m rolling equity/FX correlation of weekly returns

Exhibit 43: 3m rolling commodity price correlation of weekly % changes with different assets

Exhibit 44: 3m rolling equity vol/CDS correlation of weekly level changes

Macro monitor: US FCI easing and negative macro surprises

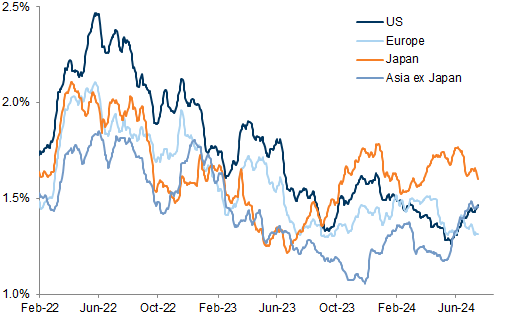

Exhibit 47: Current Activity Indicators (CAI)

Exhibit 48: Financial Condition Indices (FCI)

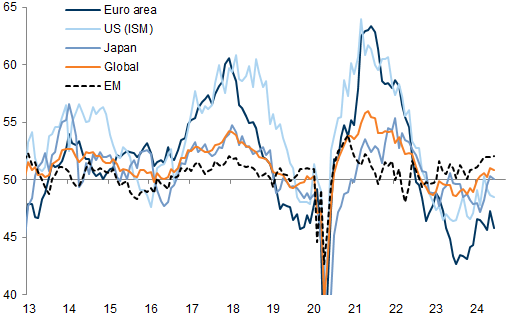

Exhibit 49: Manufacturing PMIs

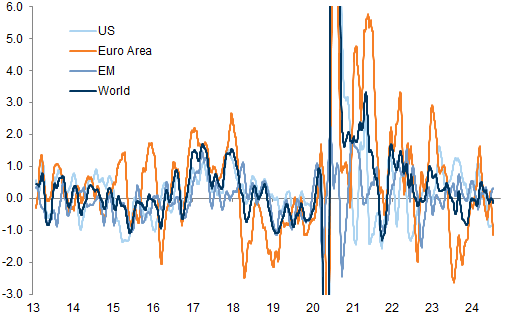

Exhibit 50: Macro-data Assessment Platform

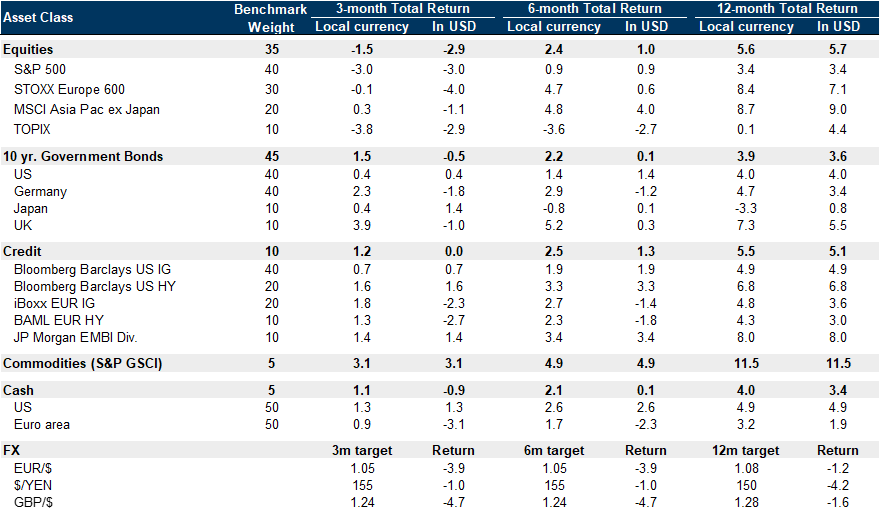

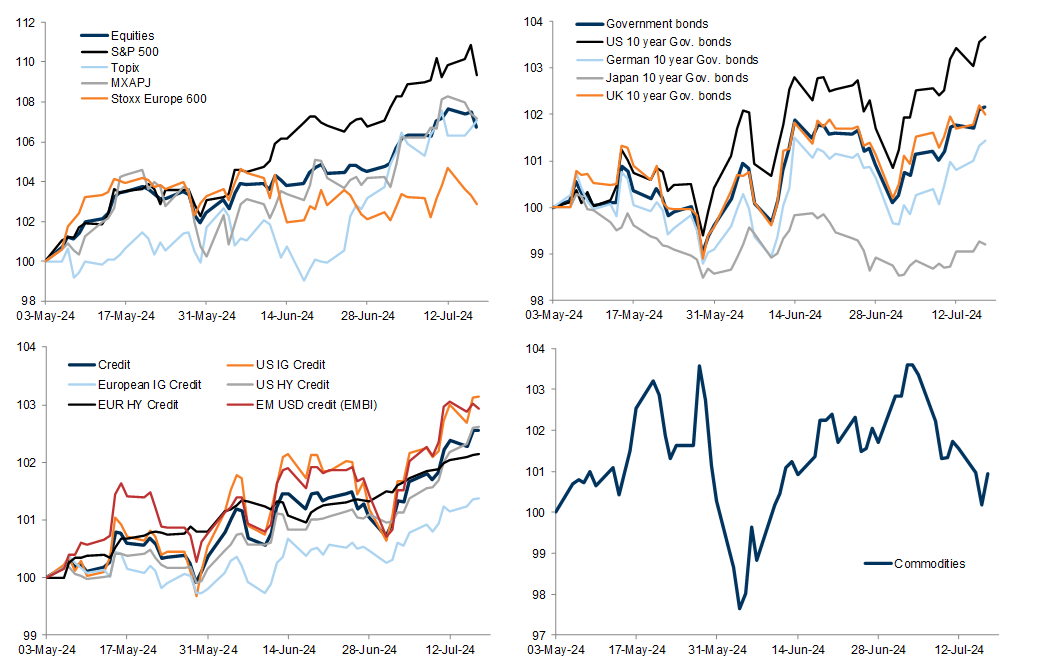

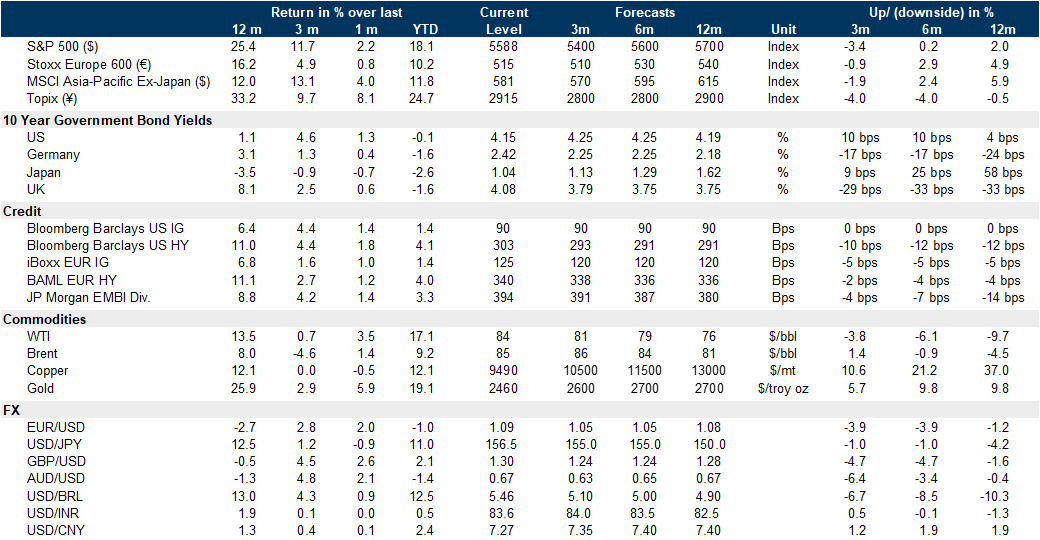

Asset class forecast returns and performance since last GOAL

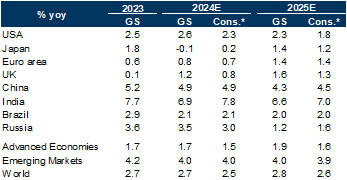

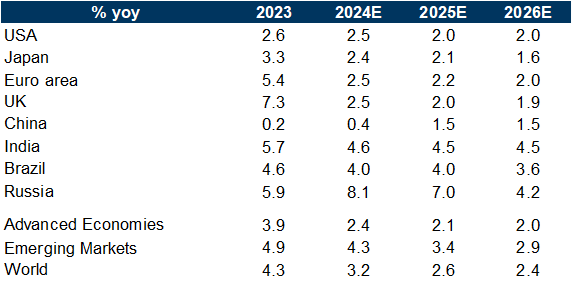

Key macro forecasts

Exhibit 56: DM GDP growth vs. GS CAI and GDP forecasts

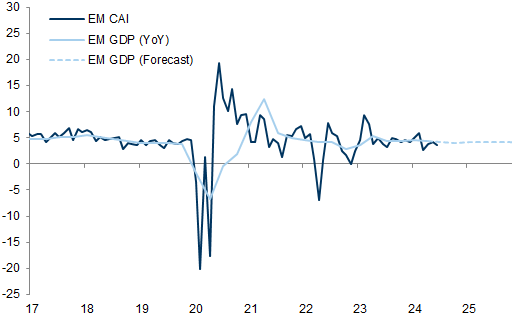

Exhibit 57: EM GDP growth vs. GS CAI and GDP forecasts

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.