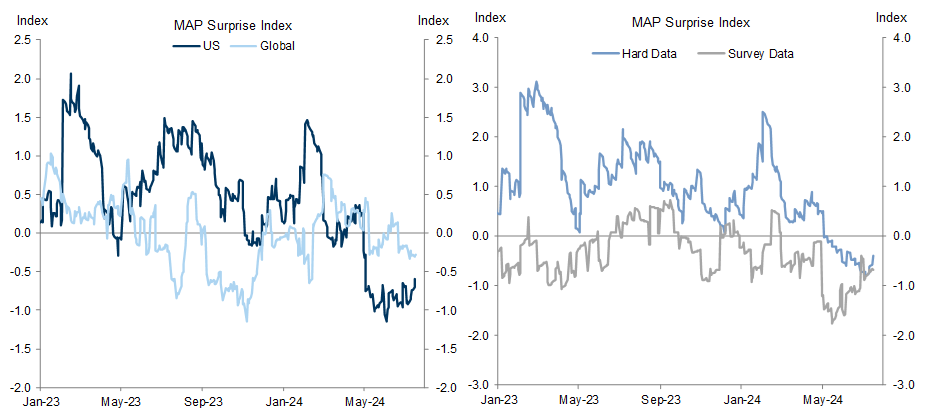

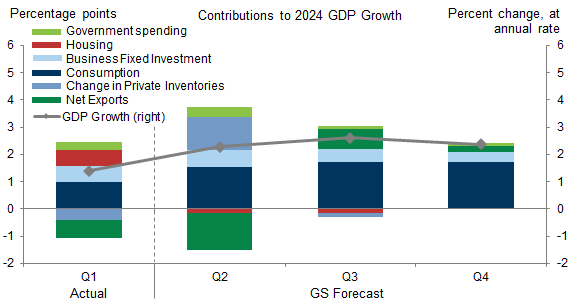

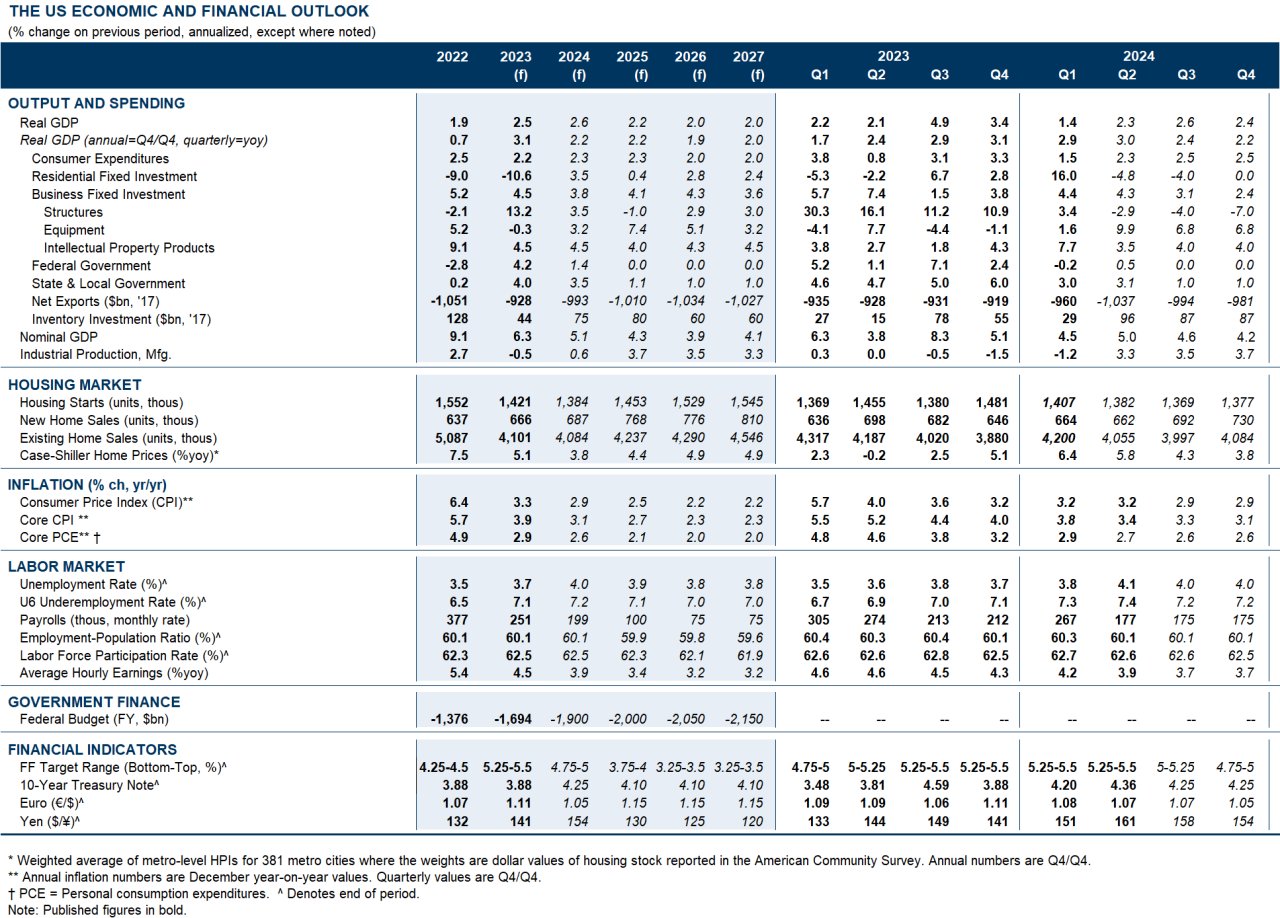

Until last week, US activity data had surprised mainly to the downside in recent months, fueling concern that the economy was slowing too quickly. But last week’s retail sales and industrial production reports brought welcome relief, and we are now tracking Q2 GDP growth at 2.3%. Our estimate implies that GDP grew at a 1.9% annualized pace in 2024H1 and domestic final sales grew at a 2.3% pace, easily beating gloomy consensus expectations at the start of the year and falling only a touch short of our own initial forecast.

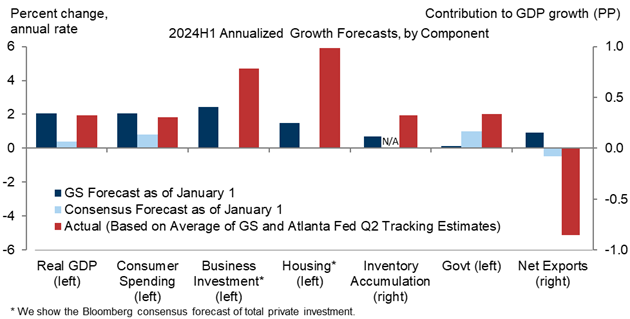

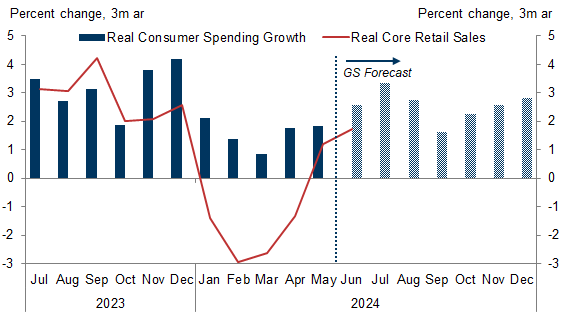

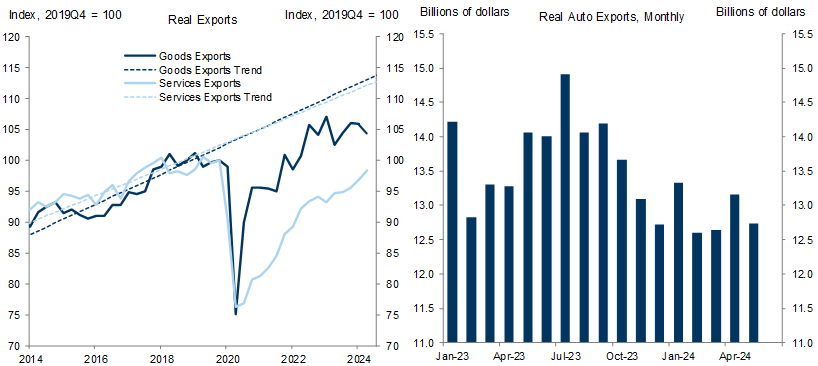

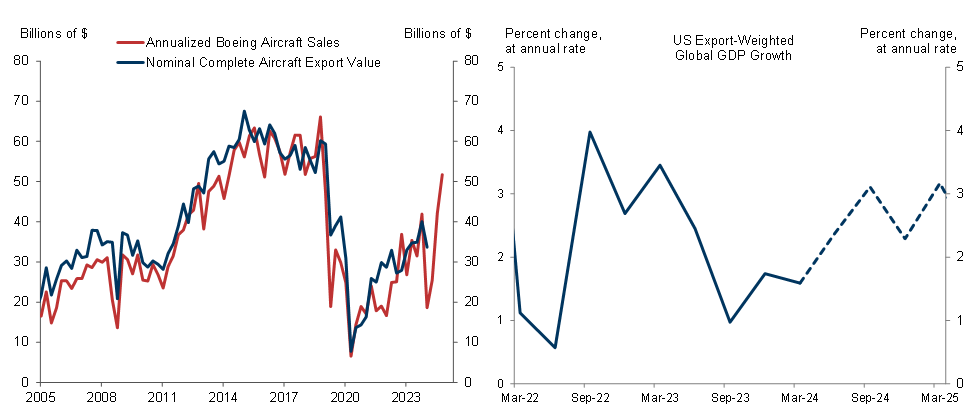

What surprised in the first half of 2024? Consumer spending has been on a rollercoaster, due in part to fluctuations in disposable income and seasonal adjustment challenges, but is now on track to grow about 1.8% in 2024H1, just a few tenths below our forecast at the start of the year. Investment—including residential, business, and inventory investment—surprised to the upside, though housing slowed in Q2 after a Q1 spike driven by a dip in mortgage rates. Net exports surprised to the downside, due in part to continued weakness in goods exports, which have stagnated at levels well below the pre-pandemic trend even as imports have recovered.

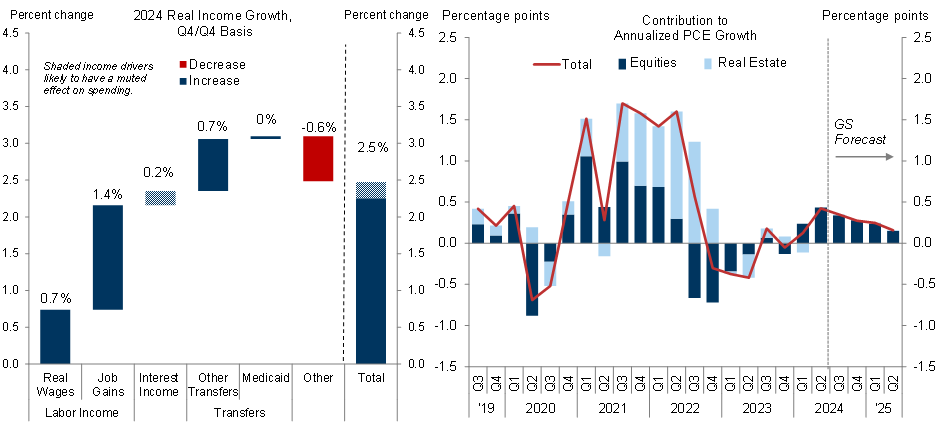

What is likely to change in the second half of 2024? We forecast 2.6% GDP growth in 2024Q3 and 2.4% in 2024Q4, for an average pace of 2.5% in 2024H2. Underpinning this is our expectation that consumer spending will continue to grow at a robust pace, supported by solid real income growth powered by a strong labor market as well as a positive wealth effect from recent increases in stock prices. Our slightly stronger growth forecast for Q3 reflects a rebound in the net trade contribution driven by softer imports and higher aircraft and other exports.

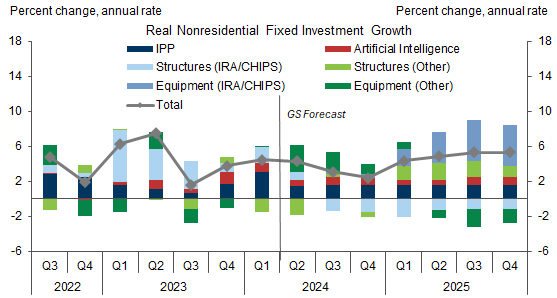

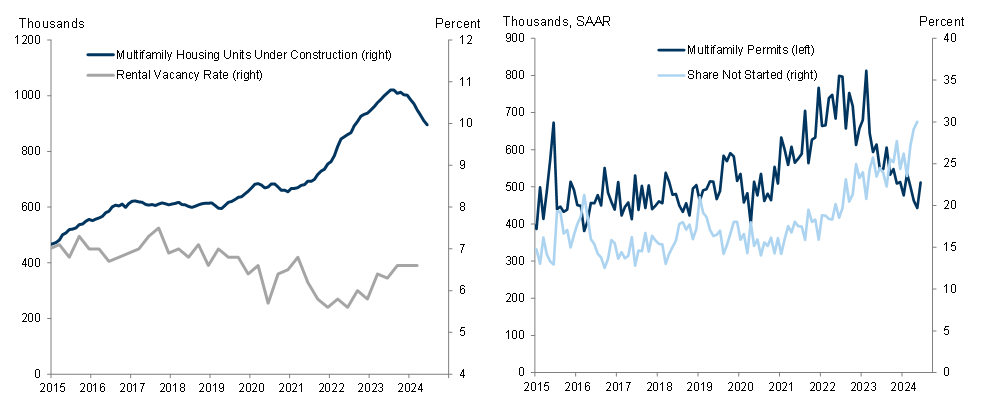

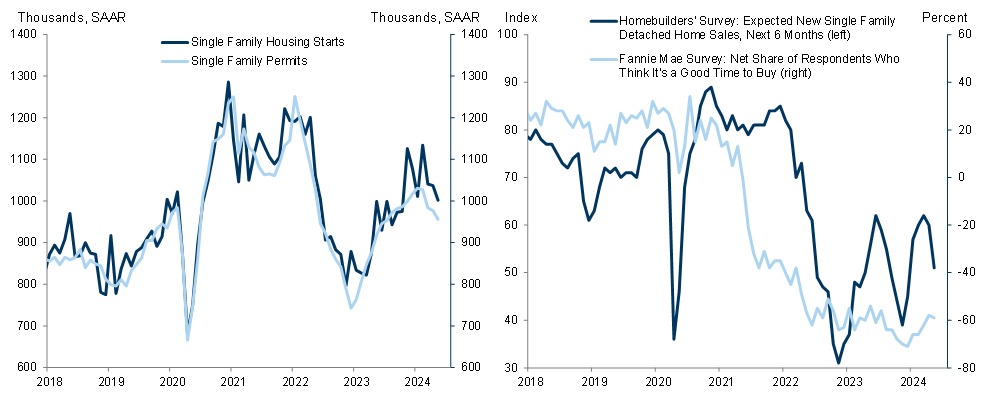

We see a more mixed picture and more uncertainty on the investment side in the second half. We expect business investment growth to slow to a 3% pace in 2024H2 because the factory-building boom catalyzed by CHIPS Act and Inflation Reduction Act subsidies has peaked, though investment in equipment for those factories and for AI should pick up. We expect residential investment to tick down slightly in 2024H2 because the surge in apartment construction in recent years has led builders to hit the brakes on multifamily construction, and while more single-family supply is still badly needed, building permits have dipped and recent survey data point to modest further weakness in the near term as potential buyers wait for rates to fall.

Our forecast of a growth pick-up from 1.9% in 2024H1 to 2.5% in 2024H2 would put 2024 Q4/Q4 GDP growth at 2.2%. While our forecast remains more optimistic than the consensus forecast of 1.6%, it is roughly in line with our estimate of short-term potential GDP growth, which is currently being boosted by additional labor supply from above-trend immigration.

A Mid-Year Temperature Check on Growth

What surprised in the first half of 2024?

A Slightly Stronger Second Half

Above Consensus, but in Line with Short-Term Potential Growth

David Mericle

Jessica Rindels

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.