Taiwan: Stronger-than-Expected Q2 GDP on Sharp Gains in Domestic Demand

Bottom line: Taiwan’s real GDP rose 2.2% qoq sa (non-annualized; sa by GS) in Q2, accelerating sharply from 0.3% the previous quarter. Contribution from domestic demand rose to 4.5pp, recording the strongest momentum since Q4 2009, on a sharp 3.3% gain in private consumption as well as a 12.5% surge in investment including inventories. Drag from net exports widened further to -2.4pp on moderation in exports momentum. On a year-on-year basis, real GDP rose 5.1% in Q2, above Bloomberg consensus and our forecast. While we are revising down our Q3 growth forecast to -1.1% on a likely pullback in consumption and investment, our full year growth forecast is raised by 0.7pp to 4.0% (vs. Bloomberg consensus: 3.8% prior to the release) on the upside surprise in Q2 GDP.

Asia-MAP score: +5 (5, +1)

5 out of 5 for relevance to growth

+1 on a scale of -5 to +5 for surprise relative to consensus

Key numbers:

Q2 GDP: +5.1% year-on-year; GS forecast: +3.5% yoy, Bloomberg consensus: +4.8% yoy; Previous: +6.6% yoy

Main points:

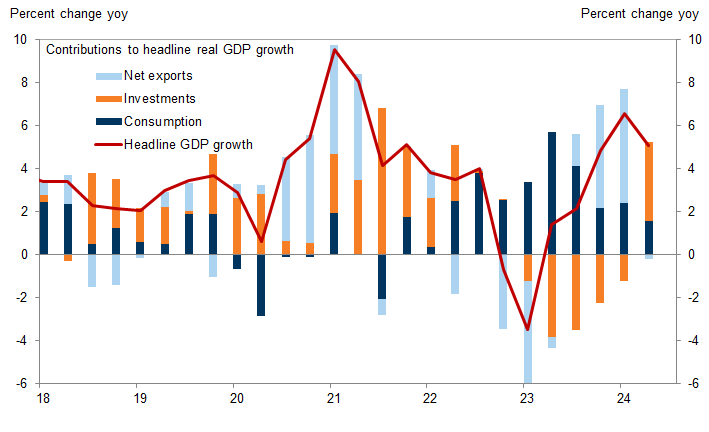

1. Taiwan’s real GDP rose 2.2% qoq sa (non-annualized; sa by GS) in Q2, accelerating sharply from 0.3% the previous quarter. On a year-on-year basis, real GDP rose 5.1% in Q2 in its advance data release, with the growth moderating somewhat from 6.6% the previous quarter on high base effects (Exhibit 1). The outcome was above Bloomberg consensus of 4.8% yoy and our forecast of 3.5% yoy.

2. The upside surprise was driven primarily by stronger-than-expected acceleration in domestic demand relative to our forecast. Its contribution to headline sequential growth jumped to 4.5pp from 0.9pp the previous quarter, recording the strongest momentum since Q4 2009. Private consumption accelerated to 3.3% qoq sa (non-annualized; sa by GS), driven by gains in labor income and rapid increases in housing prices. In addition, while the component breakdown is not available in the advance GDP release, spending abroad by Taiwanese residents likely strengthened meaningfully, with aggregate GDP offset by imports, as highlighted by the DGBAS press release. Furthermore, investment including inventories accelerated sharply to 12.5% from 1.7% the previous quarter. Further breakdown for investment is also not available, but the DGBAS highlighted broad gains across construction, equipment investment and intellectual property products. The press release also highlighted inventory accumulation from the manufacturing sector.

3. Conversely, the drag from net exports widened to -2.4pp from -0.6pp the previous quarter. Exports momentum moderated after a rebound to 2.9% the previous quarter but stayed slightly stronger than expected at 1.3% in Q2. In reflection of the strong domestic demand, imports including overseas consumption accelerated to 6.5% from 5.2% the previous quarter.

4. We are lowering our growth forecast for Q3 to -1.1% qoq sa from +0.2% previously. We now expect a modest 0.5% pullback in private consumption on flat employment as well as removal of the positive wealth effects that boosted consumption in Q2, in part affected by the central bank's recent tightening of prudential measures. We also expect a 5.0% contraction in investment after the surge in Q2, but forecast strong annual growth of around 5%, consistent with the updated capex spending outlook from Taiwan's tech sector for the year. After reflecting the upside surprise to the Q2 outcome and downside revision to the Q3 forecast, our annual forecast is raised 0.7pp to 4.0% (vs. Bloomberg consensus: 3.8% prior to the release).

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.