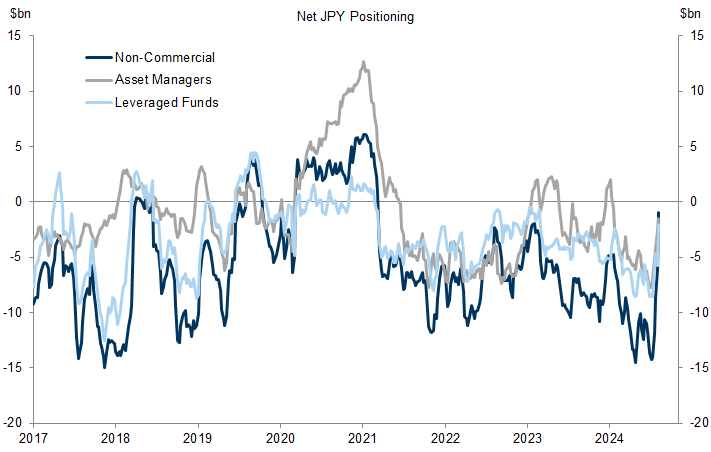

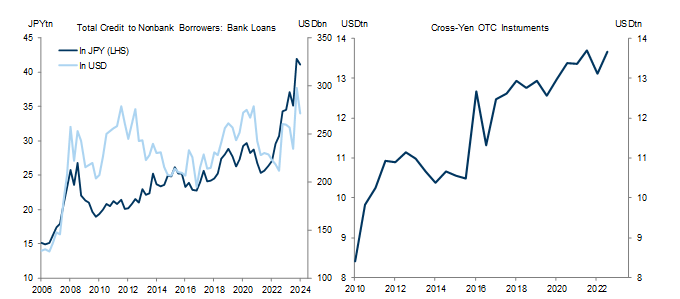

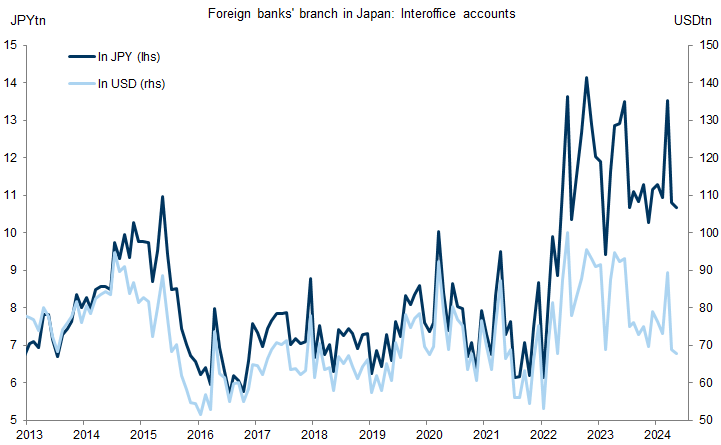

The recent sharp appreciation of the Yen coinciding with a spike in cross-asset volatility has heightened the focus on the “Yen carry trade” and the broader financial market implications from further unwinds. Limited data availability presents a challenge to confidently assessing “how much is left,” but substantial holdings among longer-term investors leave room to run. That said, subsequent unwinds should be broadly slower-moving as, based on futures positioning alone, roughly 90% of speculative shorts appears already undone.

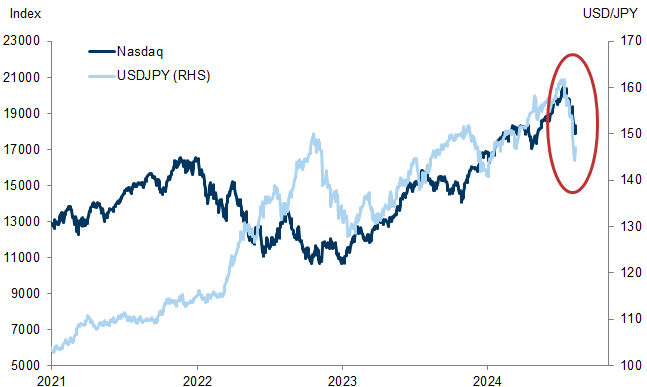

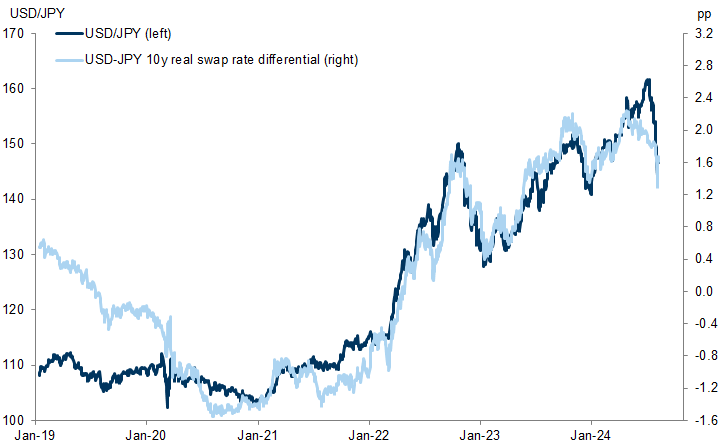

Despite the sharp unwinds, we believe that coincidental timing of disappointing earnings and a “perfect storm” of JPY-positive factors—including softer macro data, Yen supportive intervention, and a surprise BoJ hike—best explains the unusually tight correlation between the sell-offs in USD/JPY and the Nasdaq over the past few weeks, rather than deep leverage from the carry trade.

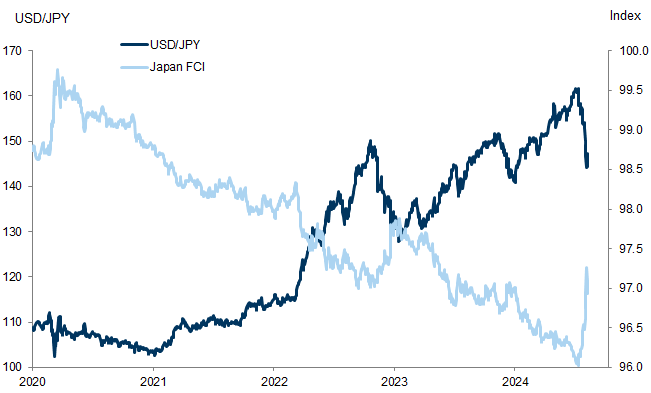

Regardless, if Japan sees a renewed sharp tightening in financial conditions, it could complicate the domestic inflation outlook and thus the BoJ’s plan to continue hiking rates—but not the Fed’s readiness to cut. Deputy Governor Uchida’s remarks last week demonstrate the BoJ is willing to adjust policy in response to market volatility to avoid rapid and significant Yen appreciation that would jeopardize progress towards their inflation goal.

Though we have not flipped to being Yen bulls, the carry unwinds “still left” will probably reinforce any periods of Yen appreciation. Moreover, the marginally higher probability of a US recession (our economists now have it at 25%) increases the attractiveness of the Yen as a portfolio hedge. For that reason, we prefer looking for tactical opportunities in other crosses, including short EUR/USD.

The Yen Carry Trade—A Roadblock to BoJ Hikes, Not Fed Cuts

Why the Yen Carry Seems Scary

Estimating the Carry Trade

Shorter-term positioning

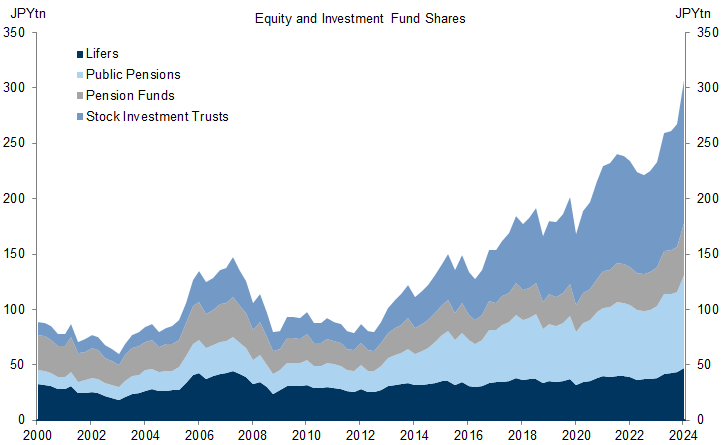

Longer-term positioning

Our Outlook for the Yen

- 1 ^ We focus on equities since unhedged bond holdings should be less of a concern as the gains from lower US yields offset the FX-related losses.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.