Global Views: Controlled Descent

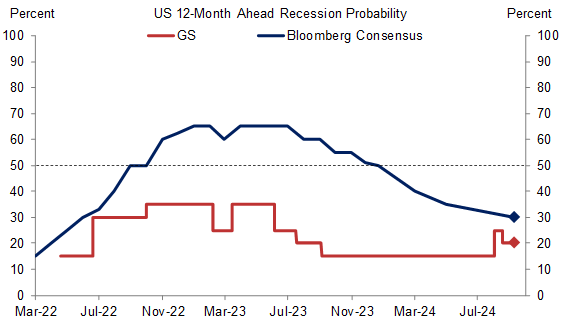

1. While Friday’s US jobs report fell modestly short of expectations, it showed a rebound from last month, with a 142k increase in nonfarm payrolls and a small dip in the unemployment rate to 4.2%. A downside surprise was the 24k manufacturing jobs decline, which mirrored the weakness in the ISM manufacturing survey earlier in the week. But most other recent activity indicators—including the nonmanufacturing ISM, initial jobless claims, and personal consumption—have continued to look solid and our Q3 GDP tracking estimate remains at 2.5%. We left our risk of recession over the next 12 months at 20%, halfway between the 15% we were using just prior to the weaker-than-expected July jobs report and the 25% we estimated right after.

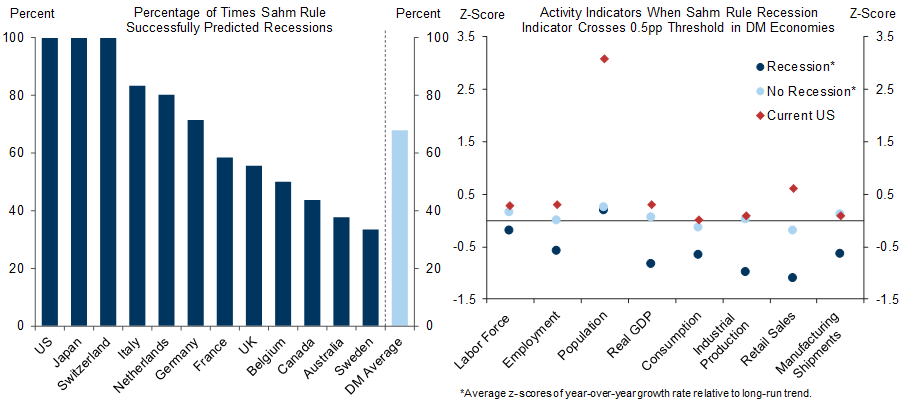

2. A cross-country perspective supports our relatively sanguine US recession risk estimate. Across G10 economies, breaching the Sahm rule threshold—a 0.5pp increase in the 3-month average of the unemployment rate within a 12-month period—has only reliably signaled recession when other indicators such as employment growth, GDP, and retail sales were weak, not when they were still reasonably strong as currently in the US. The analysis is consistent with our assessment that the increase in US unemployment since April 2023 mostly reflects strong labor supply and continued expansion, not weak labor demand and a high risk of recession.

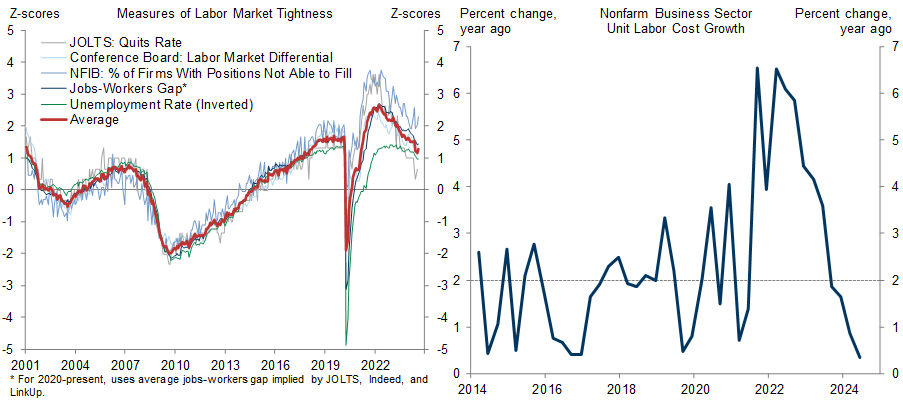

3. Core CPI inflation came in at a higher-than-expected 0.28% in August. However, the implications for the US disinflation process are limited because the entire surprise can be explained by strength in owners' equivalent rent (OER), a poorly measured category which receives a much lower weight in PCE than in CPI. In fact, our preliminary estimate of August core PCE inflation is 0.20%, which is a touch lower than before the CPI release and keeps our Q4 year-on-year forecast at 2.6%, two tenths below the FOMC median as of June. Broad goods price measures are now stable or declining, rent and OER inflation should still come down over time, and the rebalancing in the labor market has pushed down wage and unit labor cost growth to rates consistent with convergence of inflation to the Fed's 2% target in 2025.

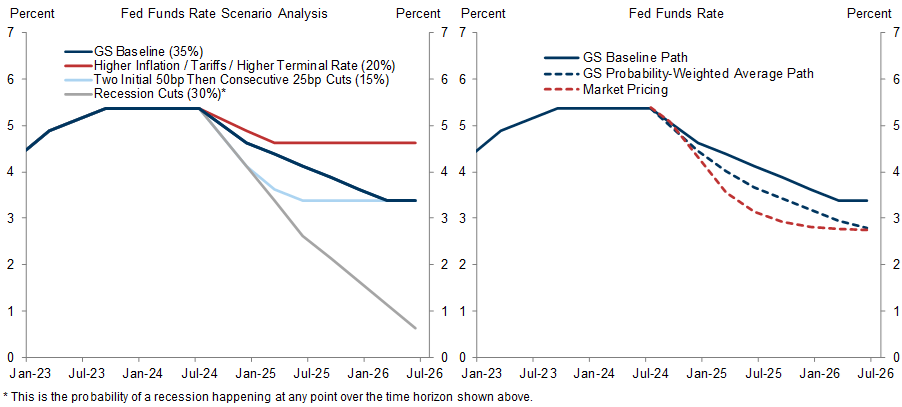

4. We continue to expect three rate cuts of 25bp each at the remaining 2024 FOMC meetings. Our confidence that the upcoming cut on September 18 will be modest in size has grown following the latest data, as well as Fed commentary just before the start of the blackout period emphasizing that "cuts will be done carefully." Our forecast for the terminal funds rate remains at 3.25-3.5%, with risks in both directions. A deeper trough is possible if the economy weakens more sharply and/or inflation undershoots the 2% target. But there is also an upside scenario in which the Fed pauses after the first few cuts because inflation proves stickier, perhaps because of higher tariffs. In our view, markets are putting too much weight on the first risk scenario and not enough on the second.

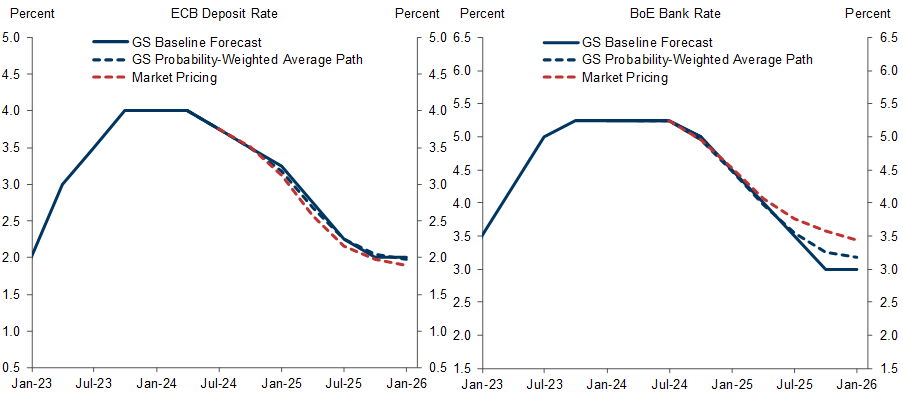

5. We have downgraded our Euro area growth outlook on the back of weakness in the manufacturing sector, especially in Germany, and greater skepticism that the 15% household saving rate will come down anytime soon. Despite continued strength in real household income growth, this means GDP growth of only 1% over the next year, below our previous forecast of nearly 1½% as well as the Bloomberg consensus. After the widely expected 25bp cut this week, we still see the ECB standing pat in October because the somewhat sticky recent inflation data seems to have strengthened the hawks’ resolve to move slowly. But as inflation comes down further and growth continues to struggle, we now see sequential cuts from December and have also shaved our forecast for the terminal rate by 25bp to 2%. Likewise, we now expect the Bank of England to move to consecutive cuts starting at the November MPC meeting; we have left the terminal rate unchanged at 3%, below market pricing.

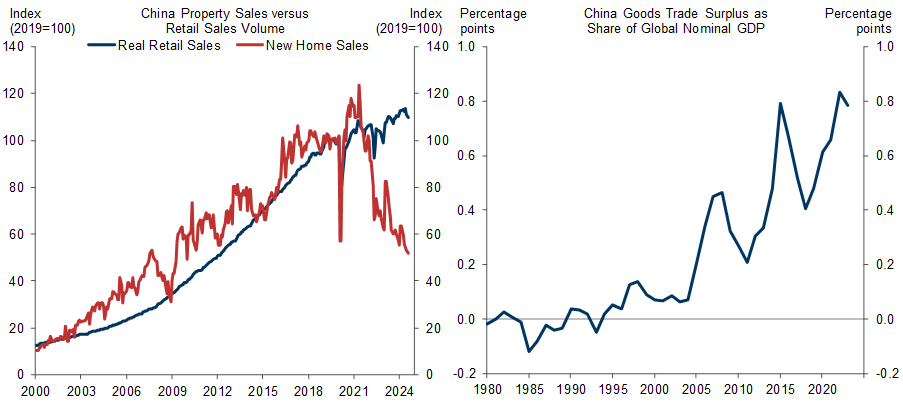

6. China remains a highly bifurcated economy. Domestic demand is stagnant, for all the well-known reasons including the property bust and a weak labor market. But real exports are up 14% over the past year, a pace that is all the more impressive when contrasted with the continued lackluster performance of manufacturing elsewhere. The looming issue—which our China economics team has discussed at length—is that China’s trading partners are unlikely to tolerate sustained further expansion in the goods trade surplus, which already stands at 0.8% of global GDP (one of the highest in world economic history). If they respond by increasingly closing their borders to Chinese-made goods, China’s policymakers will have to find ways of boosting domestic demand to keep growth from slowing ever further and deflation from worsening.

7. The near-term outlook for financial market returns is not stellar. The big difference with previous US rates market rallies over the last 18 months is that the Fed really will cut soon. But market pricing remains quite aggressive, and this is keeping our rates strategists from a truly bullish stance. While our equity strategists project modestly positive price returns through yearend, the next two months look more challenging given negative seasonality, an approaching election, and lingering growth worries. And although last week’s OPEC meeting brought an extension of voluntary production cuts, our oil strategists still see risks as tilted to the downside of their $70-85/barrel Brent price range because demand out of China remains weak and OPEC production increases are probably still coming toward yearend. This leaves credit, from which our strategists expect steady if unexciting excess returns—assuming we are right that the global economy stays out of recession.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.