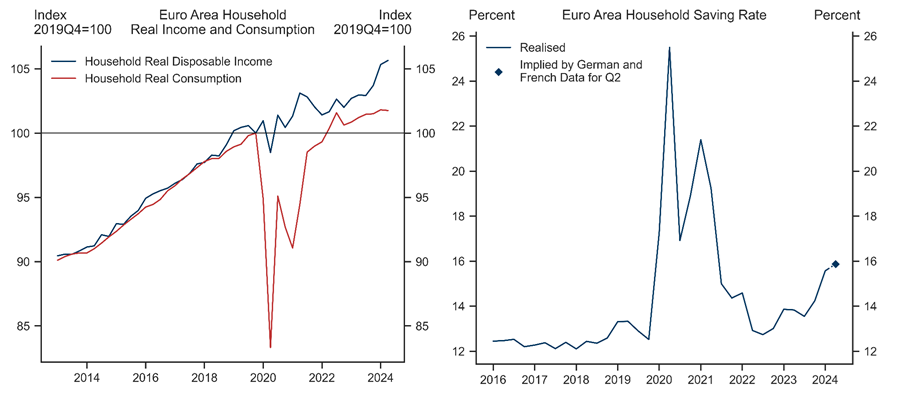

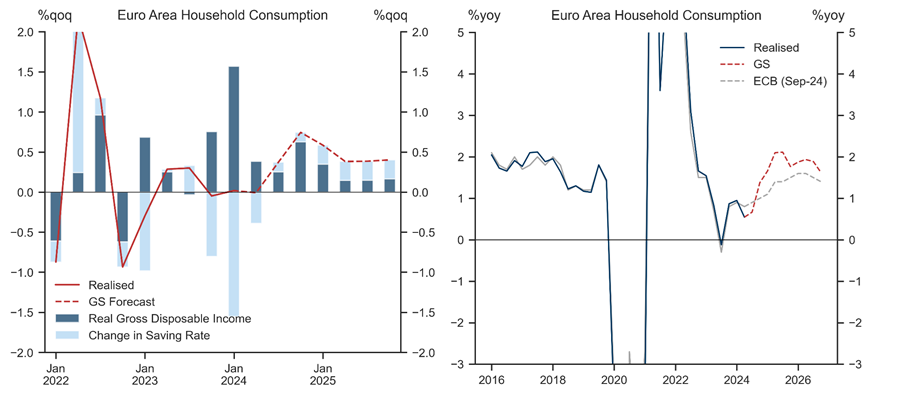

One of the most striking features of this cycle in the Euro area has been the absence of an improvement in household consumption despite the rebound in real income. Or conversely, the household saving rate increased a further 2pp over the last three quarters, well above our and ECB staff expectations. We therefore revisit the outlook for household income, savings, and consumption.

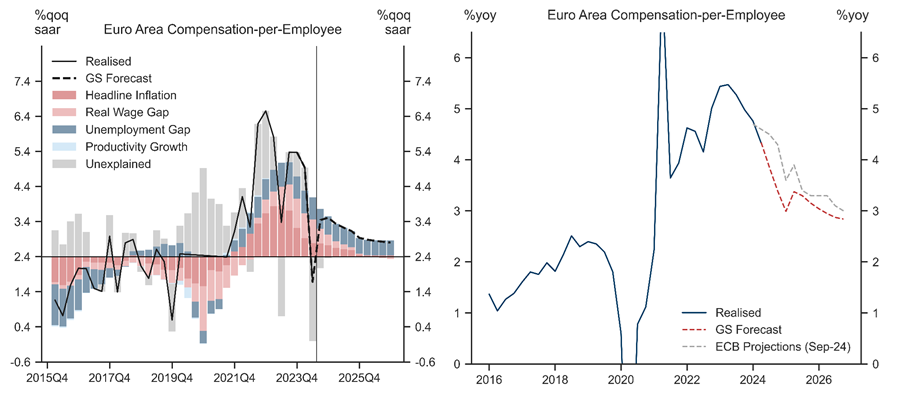

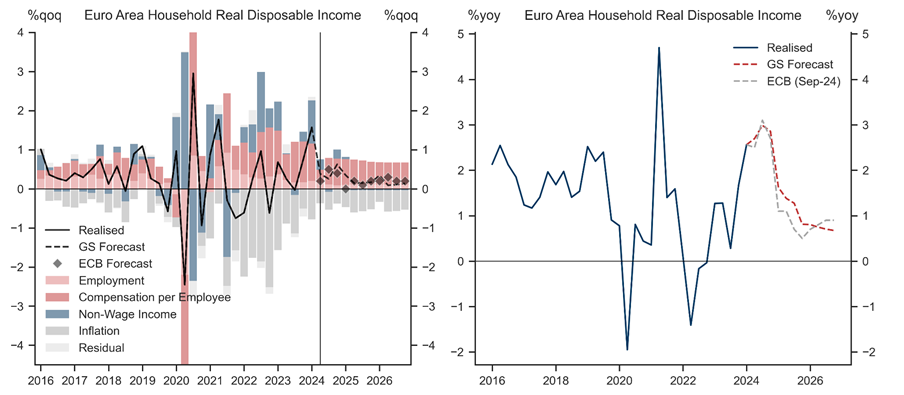

We expect real disposable income growth to decelerate to trend by early 2025, as the catch-up of household real income completes. Non-wage income—which includes sources of income such as profits, net transfers, interest receipts, and dividends—made a significant contribution to income growth in Q1, but we are pencilling in more conservative assumptions going forward. Our base case is still that the process of rebalancing labour and capital income concludes without derailing the return of inflation to target or of employment growth to trend.

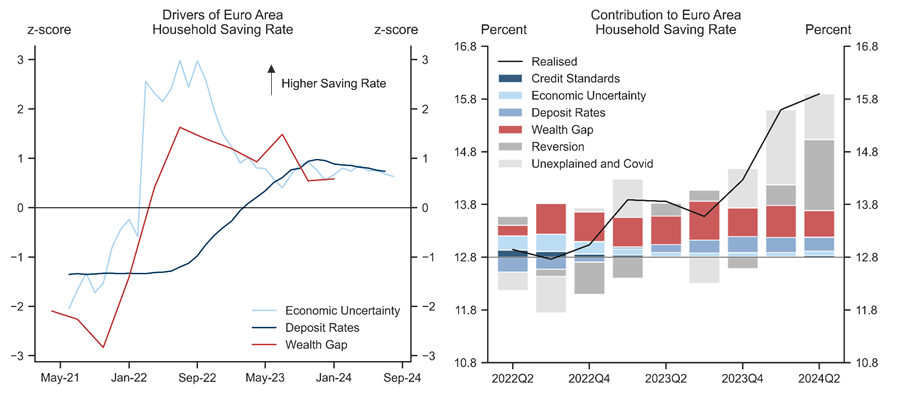

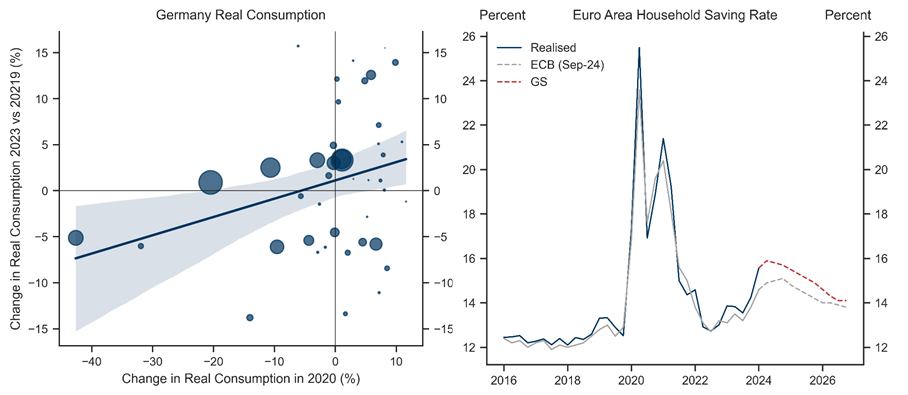

The increase in the household saving rate in the first half of this year is hard to explain in our standing framework, as the fundamental drivers we consider—economic uncertainty, deposit rates, and the gap of wealth-to-income to trend—all either stabilised or improved. We see several potential explanations for the recent increase in the household saving rate, including sticky consumption behaviour, changes in the composition of income, a higher sensitivity to deposit rates, and post-pandemic habit-resets. Taken together, we now expect the saving rate to more gradually decline to a higher terminal level.

Our revised forecasts for income growth and the saving rate imply a small sequential pick-up in consumption in the second half of the year, before returning to trend in early 2025. Our forecast is above the ECB staff projections over the next few quarters, as we expect slightly higher income growth and an earlier decline in the saving rate. Our forecast for GDP growth is below trend in the second half of 2024, given significant weakness in other components.

Euro Area—Consumption to Recover More Gradually

Real Income Growth Past the Peak

Slower and Shallower Saving Rate Decline

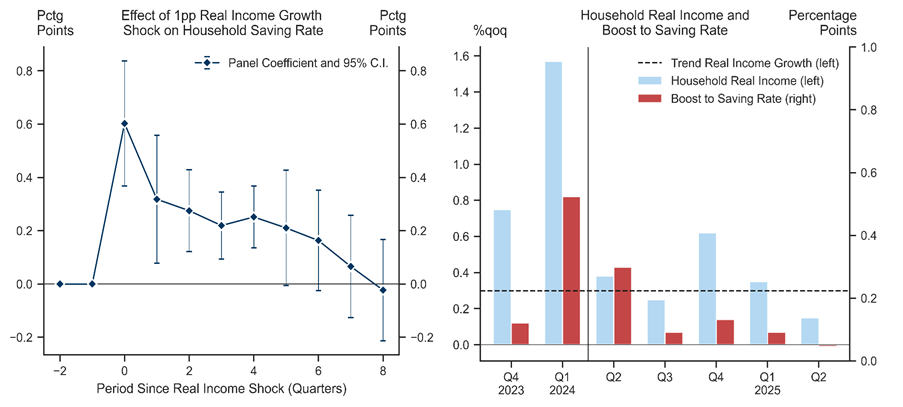

Exhibit 5: Sticky Household Consumption Behaviour Could be Temporarily Boosting the Saving Rate

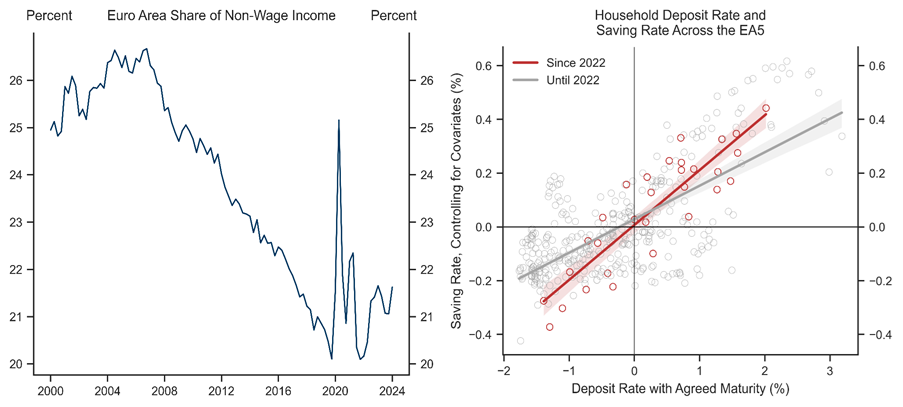

Exhibit 6: The Composition of Income and a Higher Sensitivity to Deposit Rates are Likely Pushing the Equilibrium Saving Rate Higher

Consumption to Recover More Gradually

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.