The FOMC delivered a 50bp rate cut today, against our expectation of a 25bp cut. We see 50bp as the right move in light of the good inflation news and the risk of further labor market softening. The leadership appears to have pushed through a larger cut even though many participants seemed to indicate that they preferred a smaller cut in their submissions to the dot plot. The rationale for the larger cut and the key theme of the meeting was the shift in focus from inflation risks to employment risks in light of the recent softening in the labor market data.

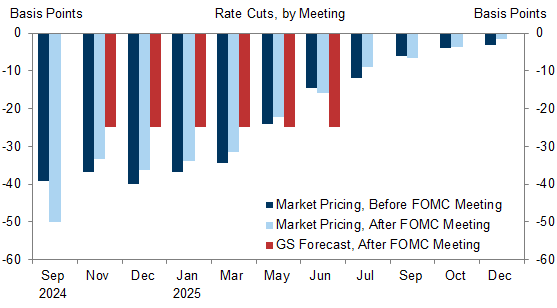

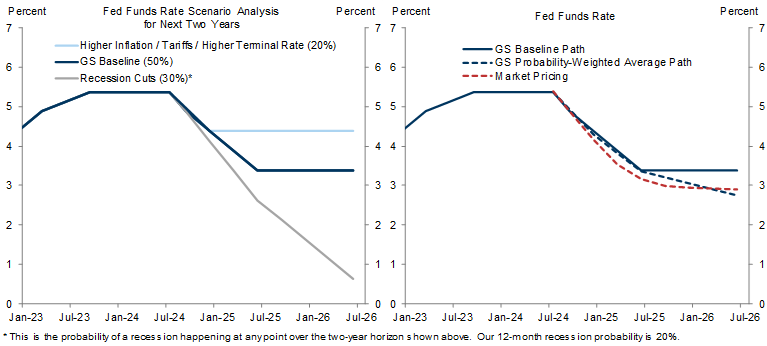

The greater urgency suggested by today’s 50bp cut and the acceleration in the pace of cuts that most participants projected for 2025 makes a longer series of consecutive cuts the most likely path, in our view. We have therefore revised our Fed forecast to accelerate the pace of cuts next year and now expect a longer string of consecutive 25bp cuts from November 2024 through June 2025, when the funds rate would reach our terminal rate forecast of 3.25-3.5% (vs. our previous forecast of consecutive cuts this year but quarterly cuts next year).

We see the choice between a 25bp and 50bp cut in November as a close call. The deciding factor will likely be the next two employment reports, the second of which will come during the blackout period, and in particular the path of the unemployment rate, where twelve of nineteen participants said they see the risks to even their new higher forecasts as tilted to the upside.

September FOMC Recap: Rate Cuts Begin with a 50

David Mericle

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.