Global Views: The Data Have Spoken

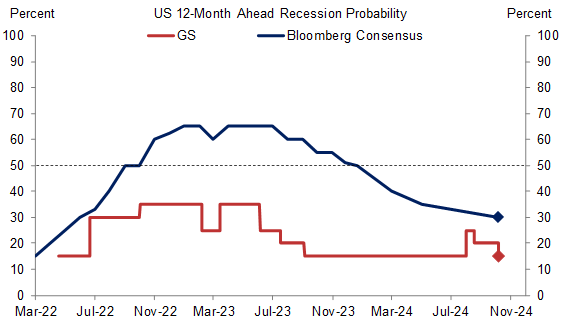

1. We have cut our 12-month US recession probability back to the unconditional long-term average of 15%, where it stood before the jump in the unemployment rate from 4.054% in June to 4.253% in July. The most important reason is that the unemployment rate fell to 4.051% in September, marginally below both the June level and the threshold that activates the “Sahm rule.” Moreover, with nonfarm payroll growth of 254k surprising sharply to the upside, prior months revised higher, and household employment also solid, we now estimate an underlying jobs trend of 196k, well above our pre-payrolls estimate of 140k and modestly above our estimated “breakeven rate” of 150-180k. The upshot is that the fundamental upward pressure on the unemployment rate may have ended via a combination of stronger labor demand growth and weaker labor supply growth (because of slowing immigration).

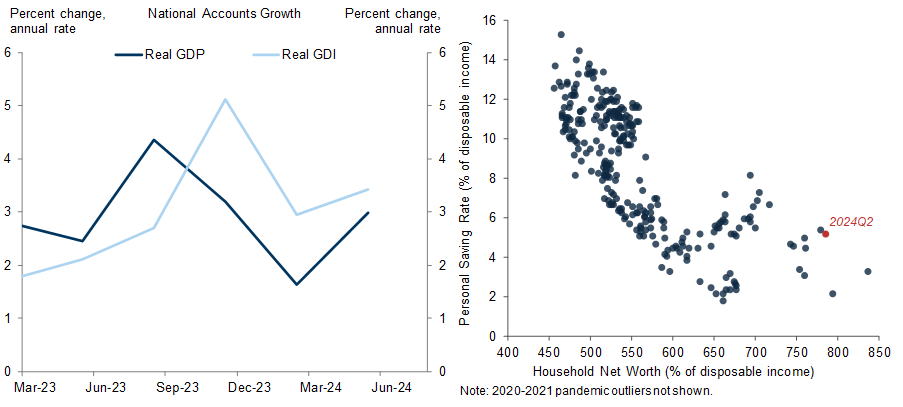

2. This brings the job market signal back into line with the broader growth data. Not only did real GDP grow 3.0% in Q2 and an estimated 3.2% in Q3, but the annual revision to the national accounts in September showed that real gross domestic income—a conceptually equivalent measure of real output—has been growing even faster than real GDP over the last few quarters. The upward revision to income also fed through into an upward revision to the personal saving rate, which now stands at 5%. While this is still modestly below the pre-pandemic average of 6%, the gap is explained by the strength of household balance sheets, notably the increase in the household net worth/disposable income ratio. The revisions to GDI and the saving rate didn’t surprise us, but they strengthen our conviction that consumer spending can continue to grow at solid rates.

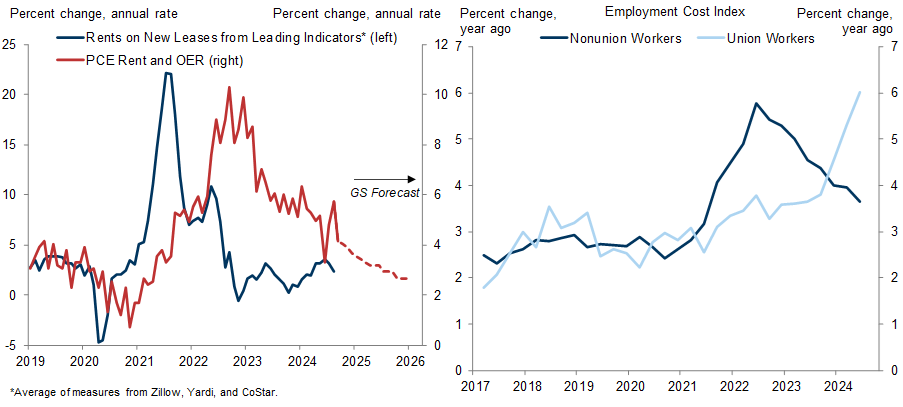

3. The strong activity data and the recent rebound in oil prices on Israel/Iran escalation fears have not shaken our conviction in further (core) PCE disinflation. After a period of slightly higher gains, the alternative rent indicators have turned down again, reinforcing our forecast that rent and OER will continue to decelerate. And while average hourly earnings grew a faster-than-expected 0.4% in September, broader signals remain encouraging. Our wage tracker stands at 4.0% year-on-year, but the employment cost index shows that much of the remaining overshoot relative to our 3.5% estimate of the rate compatible with 2% core PCE inflation is related to unionized wages, which tend to lag broader trends. On a related note, the preliminary resolution of the East and Gulf Coast port strike has eliminated one near-term upside price risk.

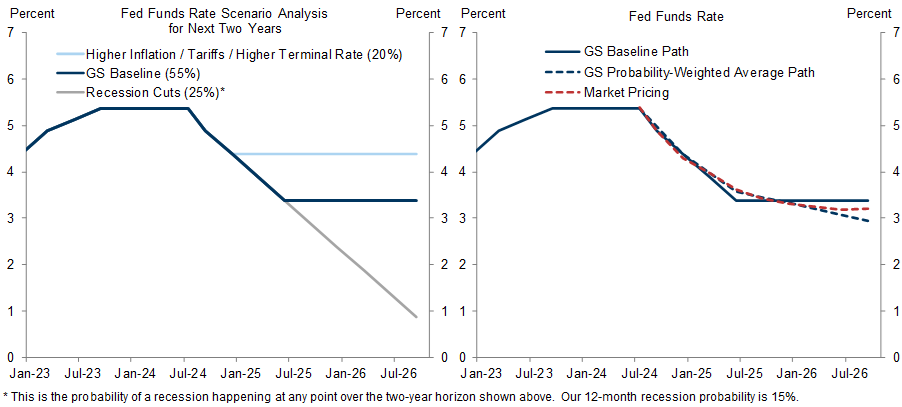

4. If Fed officials had known the subsequent data, they probably would have opted for a 25bp cut on September 18. But that doesn’t mean the 50bp cut was a mistake. We think the FOMC was late to start cutting, so a catch-up that brings the funds rate closer to the levels of around 4% implied by standard policy rules makes sense even in hindsight. However, the recent numbers do strengthen our conviction that the next few meetings (including November 6-7) will bring smaller 25bp cuts. While markets have fully repriced to that view as well, the upward pressure on rates further out the curve could extend as the market-implied terminal funds rate remains slightly below our 3¼-3½% forecast, the risk of recession has fallen further, and the term premium might well grind higher, barring an overdue but unlikely US fiscal adjustment.

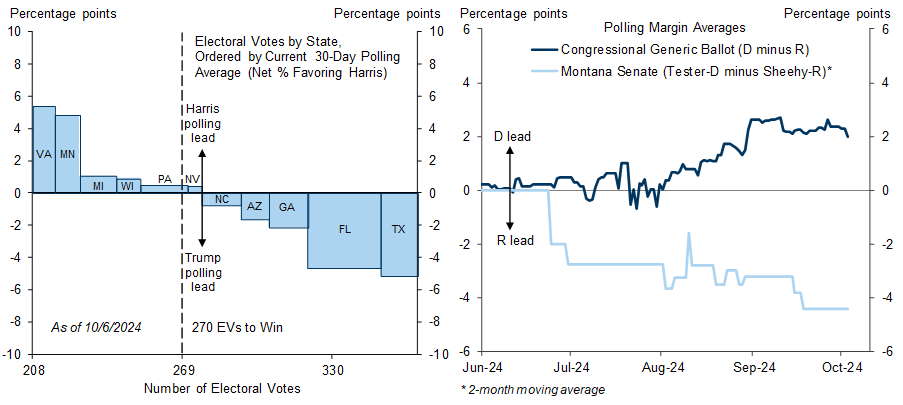

5. Going into the final month of the campaign, the US presidential election remains too close to call, with the average poll over the past month showing Vice President Harris ahead of former President Trump by less than 1pp in Pennsylvania, the likely tipping-point state. While the presidential contest has changed little on net over the past two months, the probability of divided government has risen. In the Senate, a Republican pickup is certain in West Virginia and increasingly likely in Montana, which would give Republicans a 51-49 majority assuming no other changes in party control. By contrast, Democrats seem to have the upper hand in the House based on both prediction markets and the generic congressional ballot. Divided government would reduce the potential for dramatic economic policy changes, which markets may find comforting at a time when the US economy is doing so well.

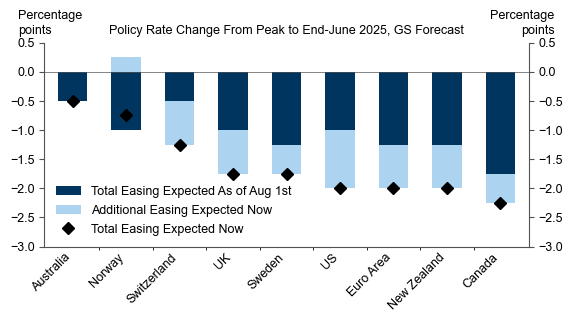

6. The Fed’s 50bp cut has helped unclog the global monetary easing cycle. In G10, we now expect the ECB and the Bank of England to join the Bank of Canada and Sweden’s Riksbank in delivering consecutive 25bp cuts. The outlook has also shifted down under, where we now expect the RBNZ to deliver two 50bp cuts starting this Wednesday and where the RBA has begun to pivot in a more dovish direction; we see the first cut in February 2025, with risks tilted to an earlier start in November 2024. The obvious outlier is Japan, where additional policy normalization remains a BoJ goal—though one that is vulnerable to downside inflation surprises.

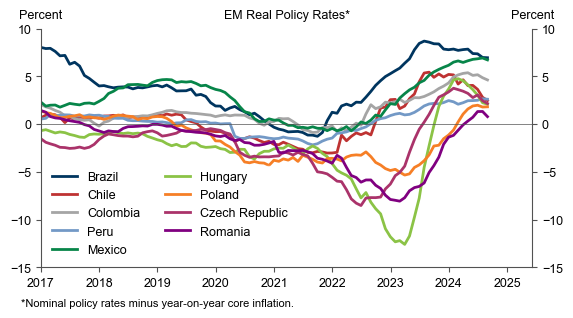

7. The Fed’s pivot is even more important for EM central banks because of their perennial focus on the dollar exchange rate. Nevertheless, most EM rates curves are not pricing very aggressive easing cycles. We see the greatest opportunities for markets to discount more substantial cuts in Mexico, Poland, Hungary, South Korea, and India. Mexico offers a combination of a 10.5% nominal policy rate, core inflation closing in on the 3% target, and an MPC that might shift to a 50bp cutting pace at the November meeting. By contrast, Brazil remains firmly in hiking mode for now, and we expect the policy rate to peak near 12%. Assuming the central bank succeeds in re-anchoring inflation expectations and the currency, Brazil could offer compelling opportunities for investors in early 2025.

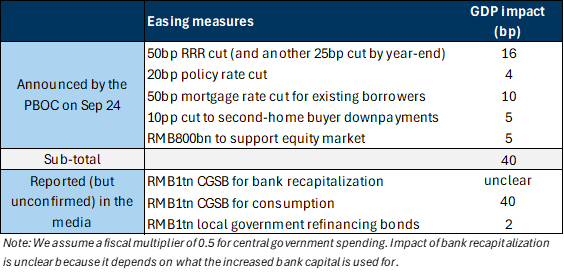

8. The most aggressive monetary policy response to the Fed's pivot has come from China. At first glance, this seems surprising because China continues to employ capital controls that should provide a greater degree of monetary policy independence, i.e. Fed policy should matter less than elsewhere in EM. However, China also has the greatest need for easier policy because of the ongoing cyclical weakness, which recently caused us to downgrade our 2024 GDP growth forecast to 4.7% and to continue to project an even more lackluster (by Chinese standards) 4.3% in 2025. How much this shift will add to growth depends importantly on the fiscal boost that has yet to be spelled out. At this point, our China team estimates a 0.4pp boost from the monetary policy measures. Fiscal policy will add more, but the precise impact will depend on the size and form of the fiscal package to be announced.

9. Although markets have already taken a lot of credit for the good economic news, returns are likely to remain positive if our baseline economic forecasts materialize. Our US equity strategists have lifted their earnings forecasts and now see the S&P 500 rising to 6000 at yearend, while our Asia equity strategists think the China rally can extend as policymakers roll out further stimulus measures in coming weeks. Our rates and credit strategists are closer to shore and project a combination of gradually higher long-term rates and gradually tighter spreads into yearend. Finally, our oil strategists still expect Brent crude to remain between $70 and $85/barrel—though they are wary of Israel/Iran escalation that could result in temporary spikes well beyond that range.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.