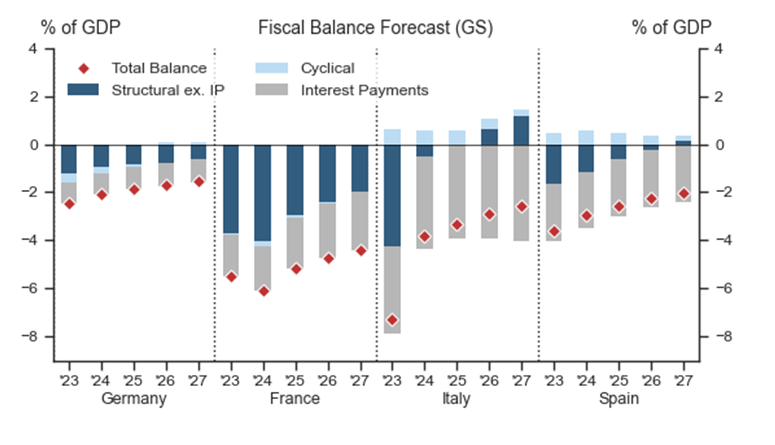

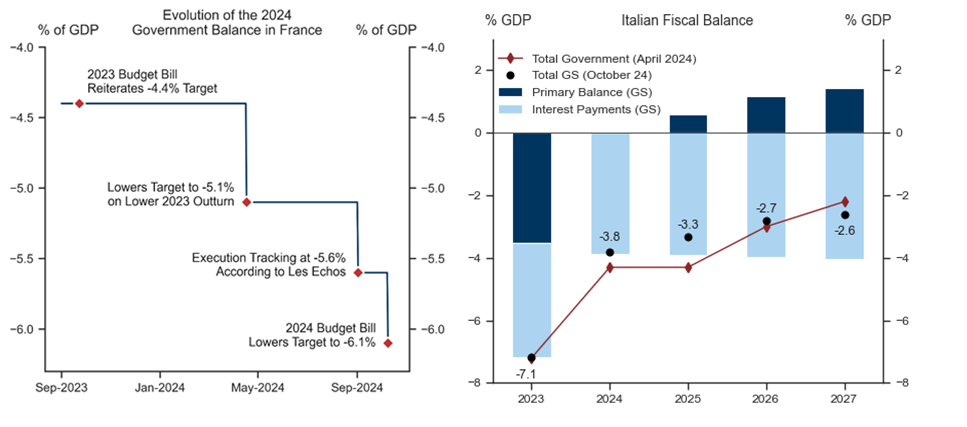

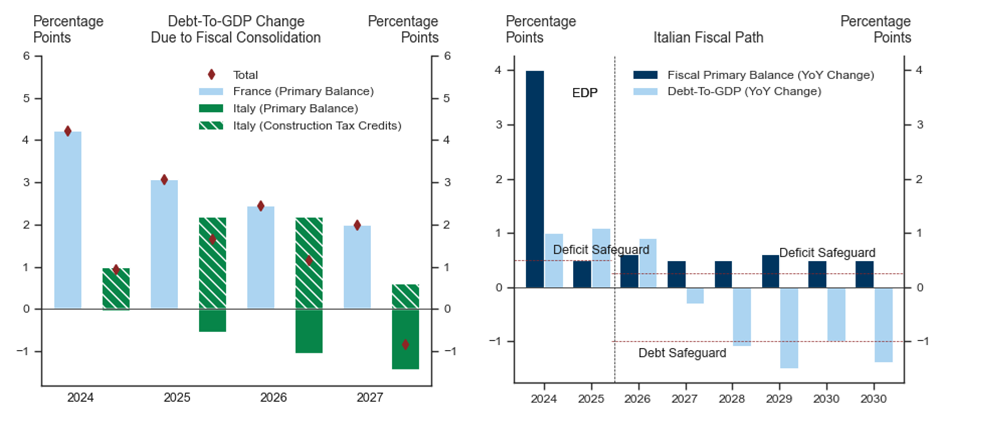

Fiscal consolidation in the EMU4 will continue for the next three years. In Germany, the constitutional Debt Brake is unlikely to be relaxed until at least the German election in September 2025. In France, the government led by PM Barnier promised a primary balance adjustment of a magnitude unseen outside of post-crisis normalisation in 2011 and 2021-22. The Italian Ministry of Finance has promised a faster fiscal consolidation than expectations, taking the country out of the Excessive Deficit Procedure in 2026. In Spain, the difficulties of the ruling coalition to bridge an agreement with the regional parties and approve the 2025 budget is likely to deliver a steady consolidation on the basis of the 2024 three-year plan.

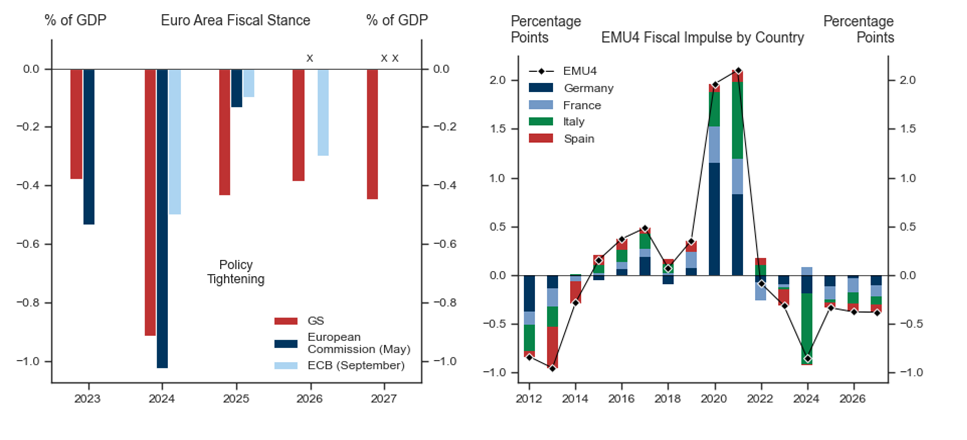

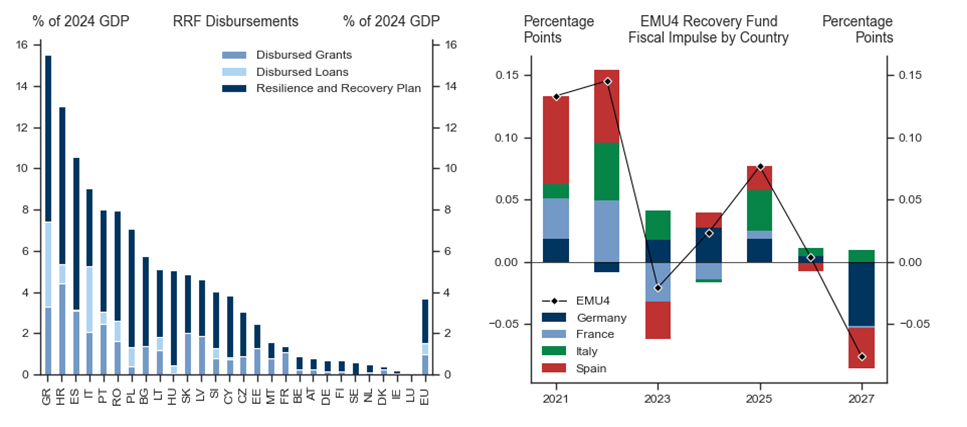

Given the broad-based fiscal consolidation, the European fiscal stance will remain negative until 2027, albeit less than this year, providing a drag on growth at about 0.3pp per annum in our estimate. Fiscal support fueled by the European Recovery Fund remained slightly positive in 2024, but fell once again short of our expectations. While Spain has increased the pace of spending, recovery fund expenditures were underwhelming in Italy, the main beneficiary of the plan. We expect Italian spending to increase in 2025 and 2026 with the growth impact peaking in 2025 at the European level.

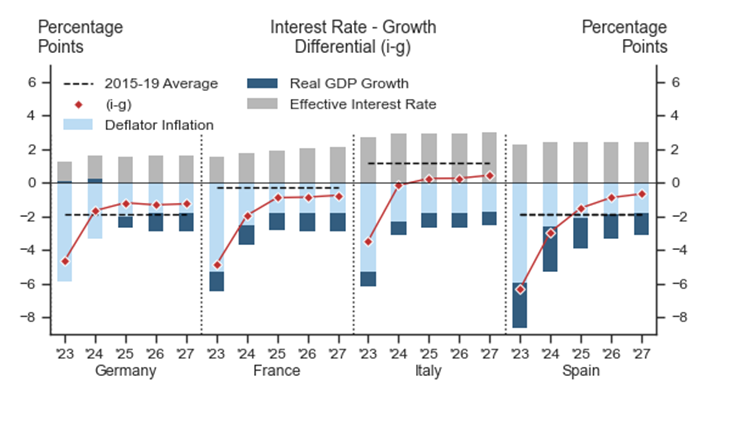

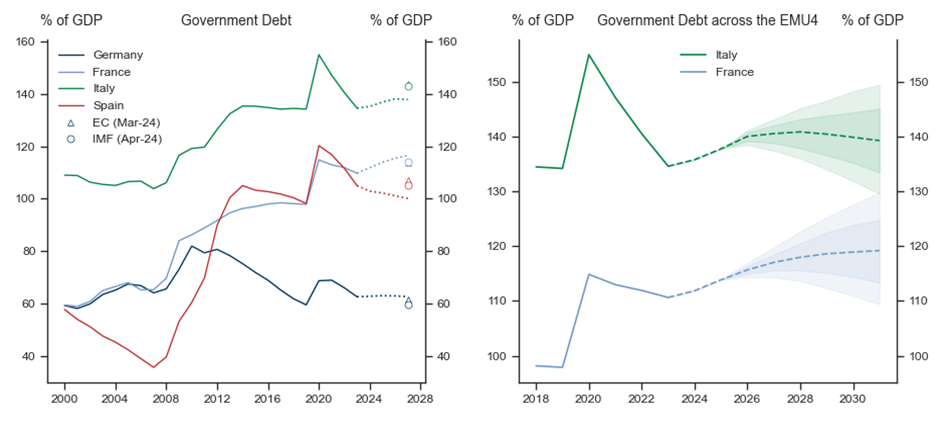

The macroeconomic backdrop will continue to proceed toward normalisation. Cooling inflation, subdued but stable real growth and a slight increase in the effective interest rate paid on debt are pushing up the real sovereign borrowing rates across the EMU4. We expect debt-to-GDP ratios will continue to decrease in Spain and, less markedly, in Germany, while debt ratios have begun to increase again in France and Italy. The decoupling in debt paths within the EMU4 reflects a diverging fiscal policy mix: France and Italy are burdened by higher deficits and, in the case of Italy, debt issuance in 2024-27 also needs to fund the 2021-23 construction tax credits.

The new European fiscal rules established a more transparent set of criteria to achieve debt sustainability. We expect both France and Italy, currently in Excessive Deficit Procedure (EDP), to reduce their structural deficit in line with the rules. The main innovation of the new fiscal framework is the shift in focus to multi-year planning through the medium-term fiscal structural plan (FSP). The biggest challenge in the Italian FSP is to achieve an average reduction of the debt-to-GDP ratio compliant with the rules. We expect the European Commission to scrutinise recent fiscal slippage in France but eventually to endorse the government’s intended speed of adjustment.

The cautious fiscal policy outlook in Europe stands out in the international comparison. This policy mix will decrease the chances of market stress in the sovereign space, in our view. However, in the absence of a clear commitment to address the industrial challenges at the European level or implement parts of the Draghi Plan at the EU level, we believe the policy stance will continue to weigh on future growth in the coming years.

Euro Area Fiscal Policy—Continued Consolidation and Debt Decoupling

Faster Fiscal Consolidation Still Ahead

Not a Growth-Friendly Policy Mix

Macro Normalization and Debt Decoupling

New Fiscal Rules to Address Old Problems

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.