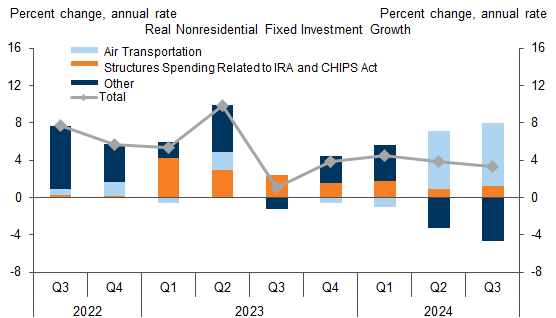

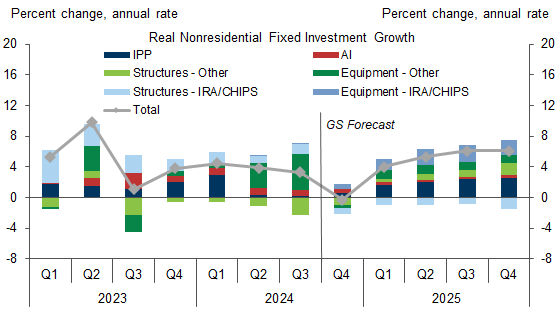

Business fixed investment grew at a robust pace of 3.6% over the past two quarters, even as the factory-building boom that powered capex growth last year plateaued. But this seemingly solid growth has actually been driven by a rebound in airplane production—excluding this, capital spending actually declined. In this week’s Analyst, we argue that these soft trends are temporary and that capex growth will rebound back to a solid pace in 2025.

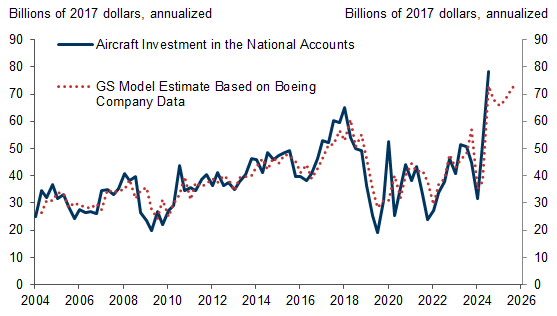

Two headwinds will weigh on capex growth in the near term. First, aircraft investment rose by an annualized 500% over the past two quarters as Boeing – the largest US aircraft producer – ramped up production after finishing safety inspections. But the end of this rebound and a temporary hit from the Boeing strike in mid-September are likely to turn aircraft investment into a -0.4pp annualized drag on capex growth in the next two quarters.

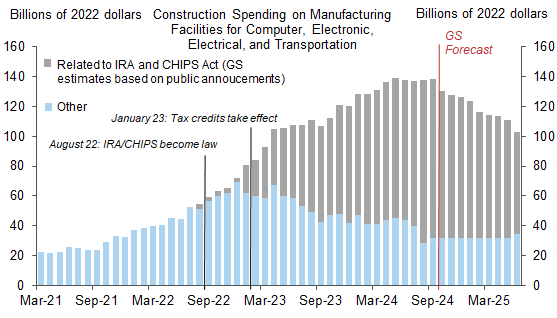

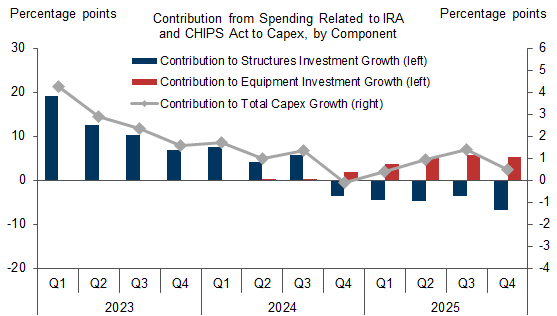

Second, the boost from construction spending subsidized by the CHIPS Act and IRA has plateaued, and we expect it will soon turn into a -1pp annualized drag on capex. Offsetting this, however, equipment spending for these new factories is poised to rise next year.

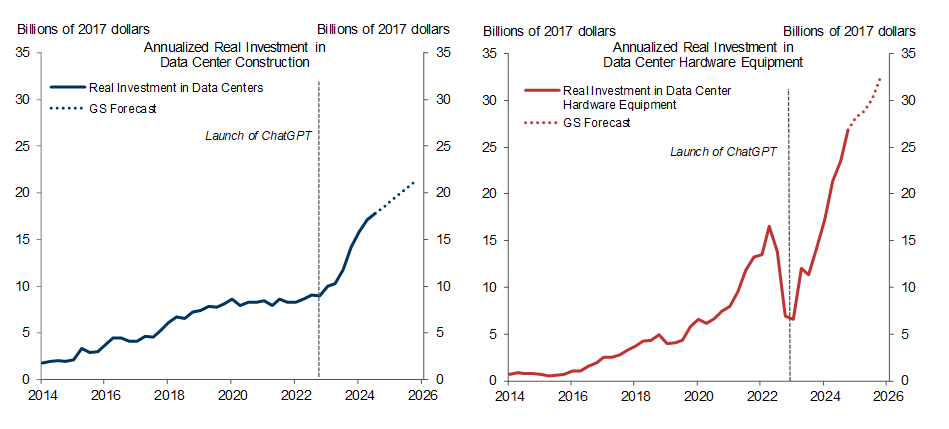

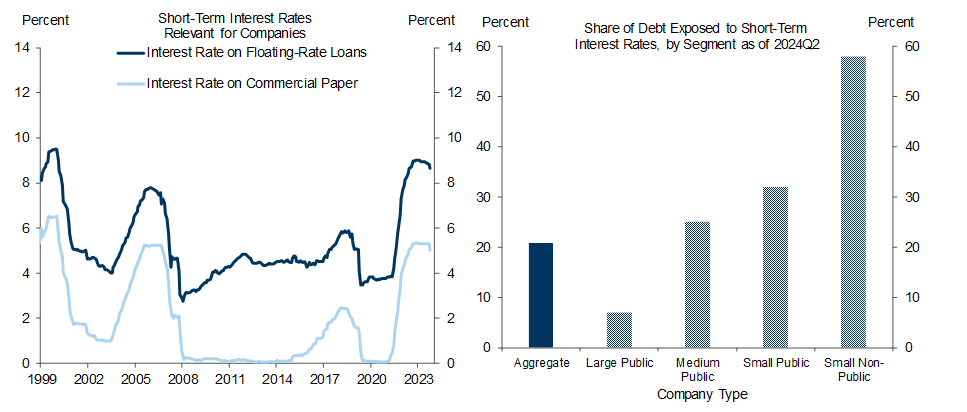

In addition, we see two other tailwinds for capex growth in 2025. Growing investment in data centers and hardware equipment supporting AI technology will continue to provide a +0.5pp boost to capex growth next year. And lower short-term interest rates should provide a modest boost to medium- and small-size companies that rely heavily on short-term floating-rate loans for financing.

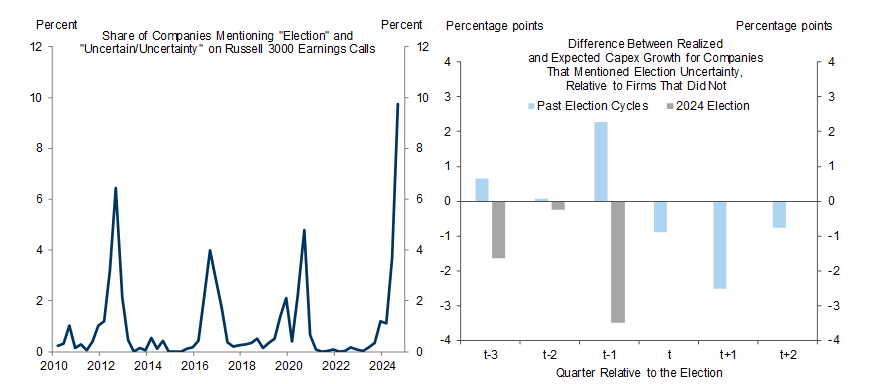

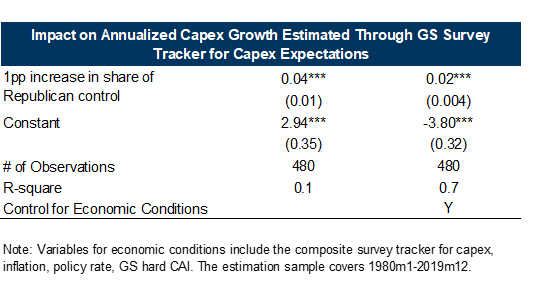

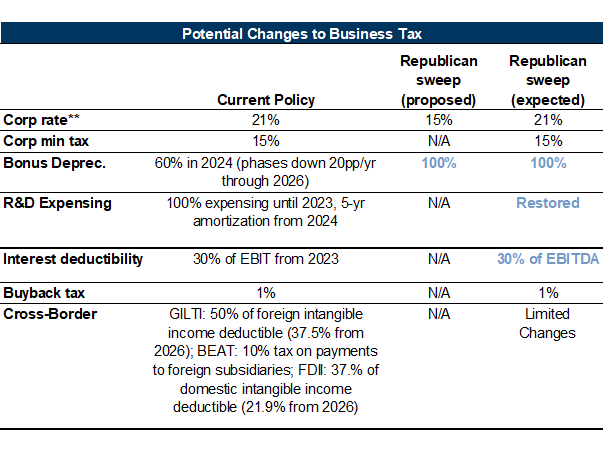

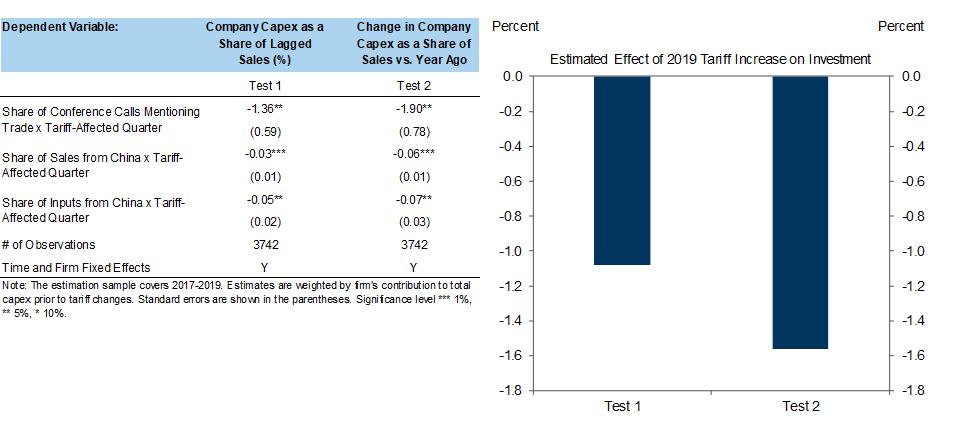

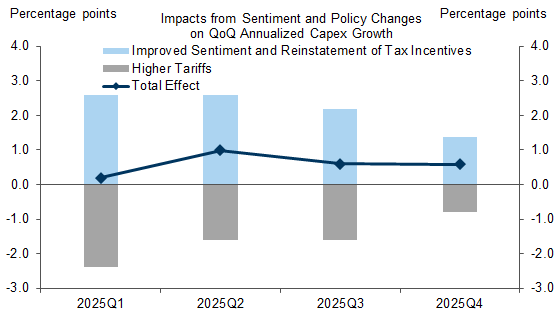

Post-election fiscal policy changes are likely to provide a boost to capex, while changes to trade policy are likely to be a drag. In particular, the likely extension of the 2017 corporate tax cuts and reinstatement of investment incentives should support business investment, reinforcing the impact of improved business sentiment. But the last trade war suggests that tariffs will likely reduce investment by raising input costs, prompting foreign retaliation, and creating uncertainty. Our estimates suggest that the net impact on 2025 capex of tax policy changes, improved business sentiment after the election, and tariff increases is slightly positive.

Taken together, we forecast flat capex growth in Q4, before growth gradually rebounds to a solid pace of just over 5% in 2025 on a Q4/Q4 basis, driven by rising equipment spending for the new factories, AI spending, lower financing costs, better business sentiment, and reinstatement of tax incentives.

2025 Capex Outlook: A Gradual Rebound After the Factory-Building Boom

Two Near-Term Headwinds: Fading Boosts from Aircraft Production and the Subsidy-Driven Factory-Building Boom

Tailwind #1: Growing Investment for AI Infrastructure

Tailwind #2: Falling Short-Term Interest Rates

Post-Election Uncertainty Resolution

Exhibit 7: Election-Related Uncertainty Has Come up in Corporate Earning Calls Much Earlier and More Often Than in Past Election Cycles; The Rise in Uncertainty May Have Weighed Modestly on Corporate Capex, but the Effect Should Fade Quickly in Coming Months

The Restoration of Bonus Depreciation and R&D Expensing

Tariff Increase

Capex Outlook

Elsie Peng

- 1 ^ This is also consistent with timelines announced recently by several companies (e.g. TSMC, Ultium Cells, Honda EV battery plant) that aim to start production in early 2025.

- 2 ^ Our Republican control variable weights the White House by one half and each house of Congress by a quarter.

- 3 ^ Gabriel Chodorow-Reich, Matthew Smith, Owen Zidar, and Eric Zwick, “Tax Policy and Investment in a Global Economy,” 2024; Gabriel Chodorow-Reich, Owen Zidar, and Eric Zwick, “Lessons from the Biggest Business Tax Cut in US History,” 2024.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.