Global Views: Sweet Spot

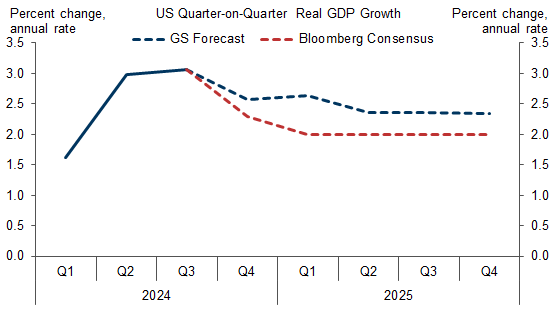

1. On Inauguration Day 2025, the US economy is in the sweet spot of healthy growth and gradual disinflation. We estimate that real GDP grew 2.6% in Q4 and expect a similar pace in 2025. Our forecast is ½pp above the latest Bloomberg consensus, in part because we are still more confident than others that real disposable personal income will grow solidly in 2025 and in part because of a sturdy forecast for business investment. That said, we are not as far above consensus as for most of the last two years because other forecasters have become more optimistic given ongoing strength in the data and, in some cases, high expectations for the growth-positive aspects of the Trump agenda.

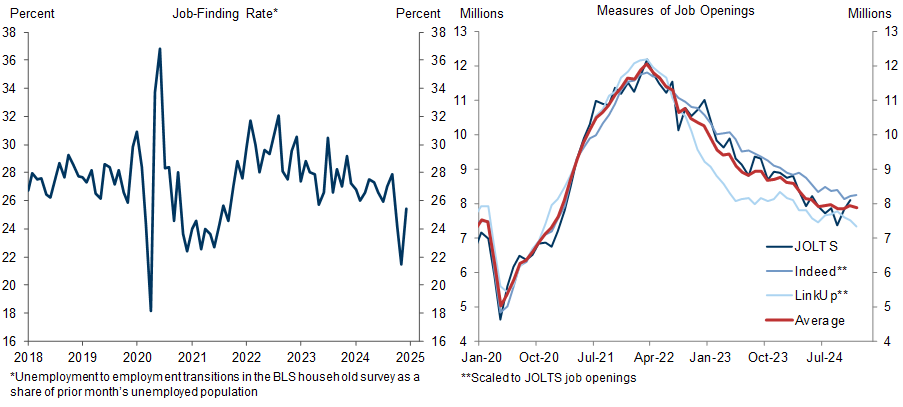

2. The labor market signal has caught up with the GDP signal as payrolls grew 256k in December and the 3- and 6-month trend rates are above our 150k estimate of the breakeven rate that keeps the unemployment rate stable. Indeed, the household survey showed declines in both U3 and U6, as well as a recovery in the job-finding rate (the flow from unemployment to employment) which undid most of the declines of the prior few months. And following the rebound in the November JOLTS report, our composite measure of job openings now shows a stabilization in labor demand over the past 3-6 months. All this has reduced our emerging concern that the labor market might be slowing more than desired.

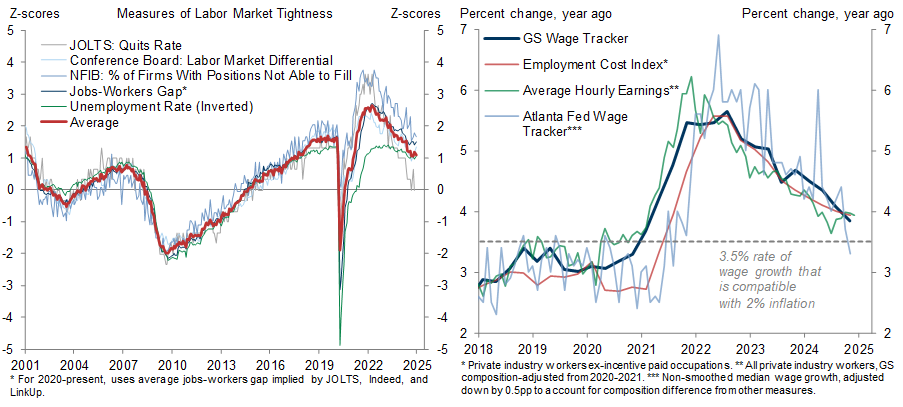

3. But there’s a Goldilocks flavor to it, as the strength does not point to a renewed risk of labor market overheating. It is still a low-hiring/low-firing labor market and our composite measure of labor market tightness—which includes unemployment, job openings, quits, and surveys of conditions as perceived by both firms and workers—has stabilized at a level below that seen in 2018-2019, when inflation was slightly below the Fed’s target. It is therefore not surprising that wage inflation has continued to decelerate into the 3.5-4% zone that is consistent with 2% price inflation given the 1.5-2% productivity trend over the past five years.

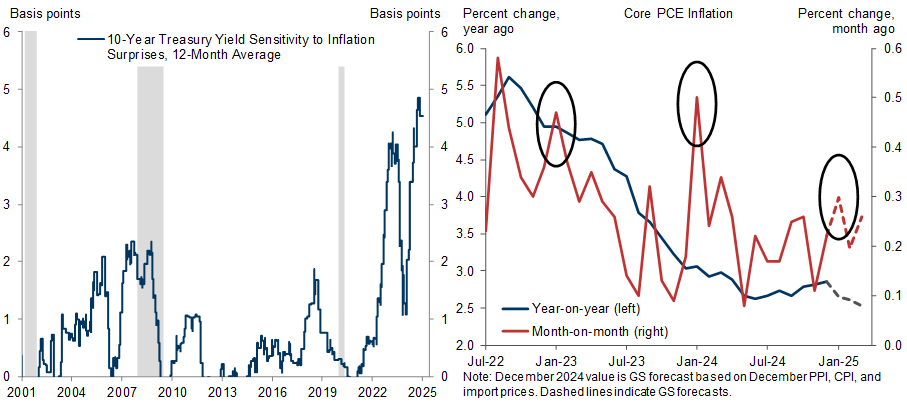

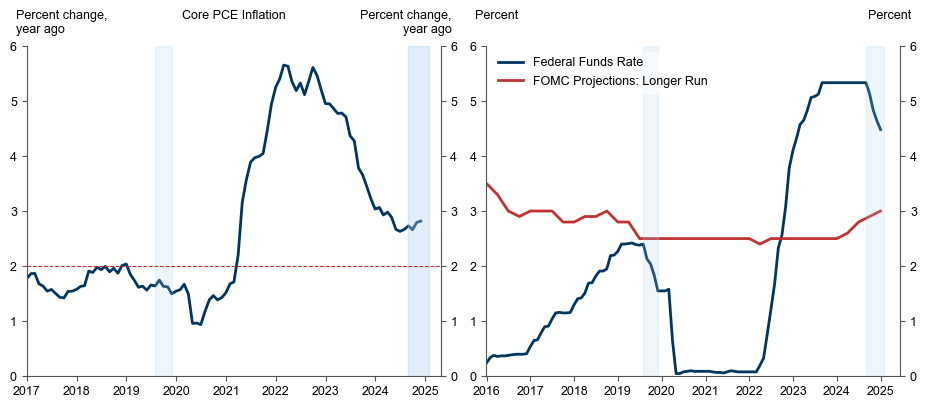

4. Inflation came in below expectations in December on net, with core PCE tracking 0.16%. This is obviously encouraging, but the underlying trend has changed much less than one might think from the volatility in the market narrative, as well as the outsized bond market impact of month-to-month inflation surprises. Inflation is trending down gradually, but the trend is occasionally obscured by month-to-month volatility, catch-up in categories with infrequent price adjustment, and post-pandemic difficulties in the seasonal adjustment process. Next month is likely to see core PCE reaccelerate to 0.3% month-on-month on a modest “January effect,” but the year-on-year rate will likely resume its decline assuming we see no repeat of the outsized 0.5% month-on-month jump of January 2024.

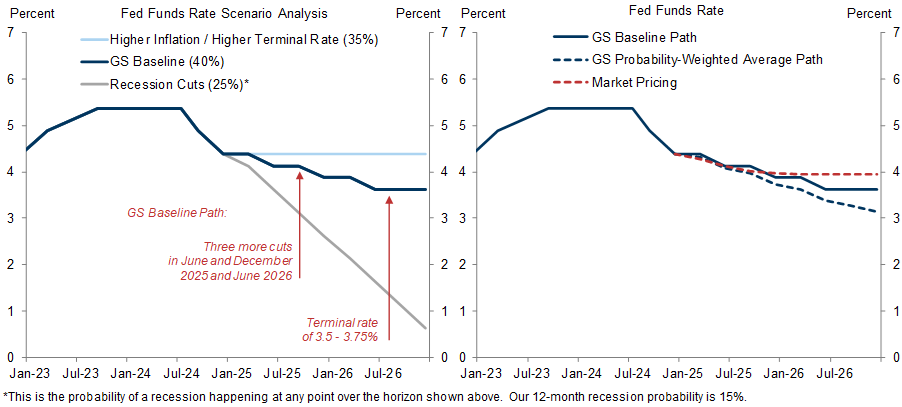

5. We are confident about two aspects of the US monetary policy outlook: a) no cut at the January FOMC meeting and b) no meaningful risk of rate hikes anytime soon. Beyond that, the picture is murky, as cuts look justifiable given the ongoing disinflation but not essential in light of the strength in the real economy. Nevertheless, we have a strong view that market pricing is too hawkish on a probability-weighted basis. Our baseline forecast is for two 25bp cuts this year (June and December) followed by one cut in 2026 to a terminal rate of 3.5-3.75%. But the risks to this forecast are tilted to the downside on net, both because the FOMC might decide to cut before June even if the economy does fine and because the FOMC would probably cut a lot more aggressively in the—unlikely but far from remote—event of a sharper deterioration in the economic data or in risk sentiment.

6. The key question over the next few months is how aggressively the Trump administration will implement its tariff agenda. We expect tariff hikes on China averaging 20pp to be announced over the next 1-2 months as well as aggressive tariffs on European autos and Mexican EVs. The outlook beyond these areas is shifting somewhat, with an across-the-board tariff becoming less likely and a universal tariff on critical goods becoming more likely. All this remains in flux, and tariff news is likely to continue creating volatility in financial markets. However, the ultimate effects of tariffs on Fed policy are more double-edged than widely believed. In 2018-2019, after all, the intensifying trade war set the stage for three 25bp rate cuts. While many commentators point out that this occurred in an environment of below-target inflation then (vs. above-target inflation now), it is also true that the funds rate is above neutral now (vs. below neutral then) and that labor market utilization is lower to boot.

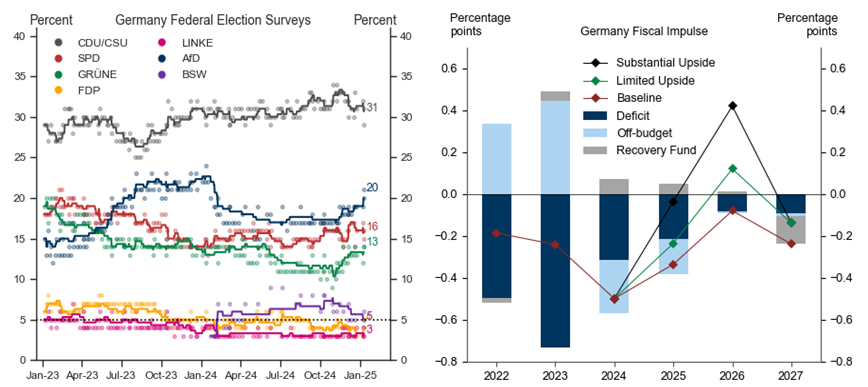

7. There is no such ambiguity in Europe, where trade policy uncertainty is already weighing on the business surveys, our growth forecast of 0.8% remains below consensus, and the ECB would likely respond to a significant escalation by stepping up its pace of rate cuts to 50bp per meeting. And even our baseline forecast of ongoing 25bp per meeting cuts through July remains below market pricing. Beyond US trade escalation and the potential retaliation measures, the biggest event in the next couple of months is the German federal election on February 23. While the polls indicate the center-right CDU/CSU under Friedrich Merz will lead the next government, both the makeup of the coalition and the prospects for incremental reforms of the infamous debt brake remain unclear. Either way, we expect at most a limited fiscal expansion, despite Germany’s considerable fiscal space.

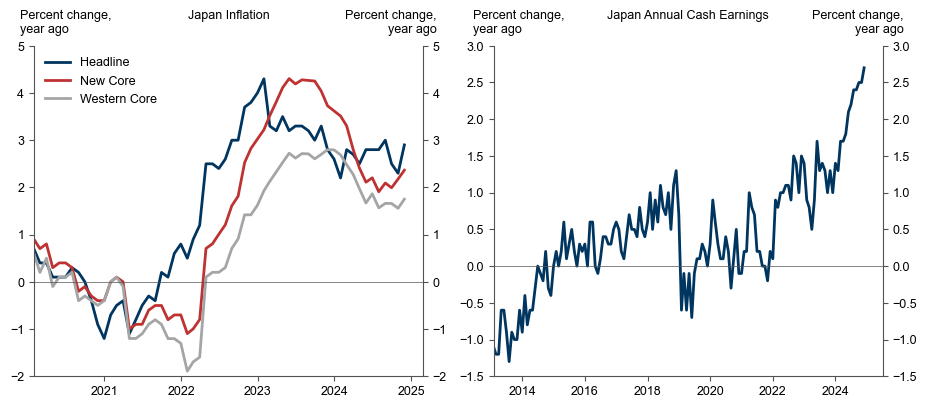

8. Market pricing of the January 23-24 BoJ meeting has been volatile, but we think the probability of a 25bp hike to 0.5% is high. While core inflation (at least in the Western ex food and energy definition) remains somewhat below the 2% target, the BoJ has become more confident that wage growth is rising to the 3% rate thought to be consistent with the target given the recent productivity trend of 1%. Perhaps more importantly, a decision to forego a hike that is now 80-90% priced could result in a sharp yen depreciation that draws unwanted scrutiny from the incoming Trump administration, which has so far been less focused on Japan than on other trading partners.

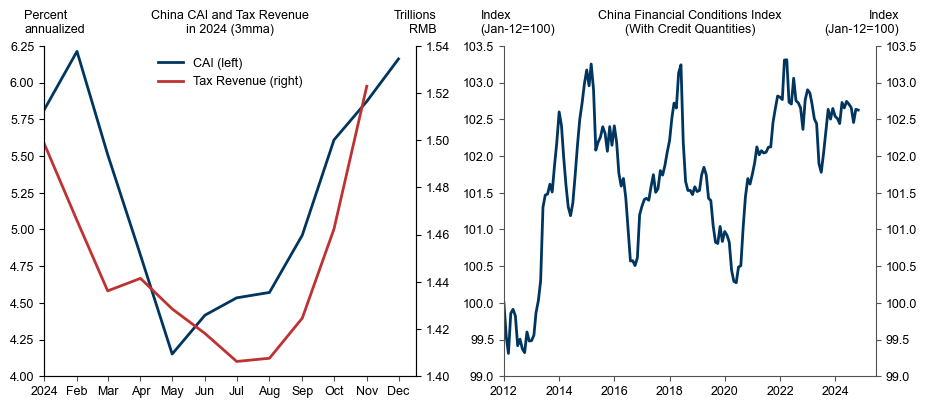

9. According to the official GDP data, China achieved a point landing for its 2024 GDP growth target of 5% with a pickup to 6.6% (annualized) in Q4. Markets remain skeptical about China’s data quality, but at least directionally the strength is consistent with other measures including our current activity indicator (CAI) and gains in areas of consumer spending targeted by the government’s “cash for clunkers” program, i.e. autos and especially home appliances. However, we expect growth to slow anew to 4.0% (annualized) in Q1, in part because of the pull-forward effect of the cash-for-clunkers program mechanically weighs on subsequent growth and in part because financial conditions remain relatively tight despite the government’s easing efforts.

10. On markets, our strongest view is that rate cuts by most major DM central banks (ex Japan) are underpriced on a probability-weighted basis and that longer-term rates have room to fall, especially in the UK and to a lesser degree in the US and Germany. If rates markets do rally, this could pose a near-term challenge to our FX strategists’ expectation of further dollar strength. High valuations and increased policy risks make us cautious on both equities and credit, but we see more opportunities in EM despite the undeniable risks from the Trump agenda; in particular, we like Latin America and especially Brazil given high carry and value combined with low sensitivity to China risk. Lastly, in commodities, our strategists acknowledge near-term upside risks to their $70-85/barrel range for Brent crude but still expect ample spare capacity to keep a lid on prices in the medium term.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.