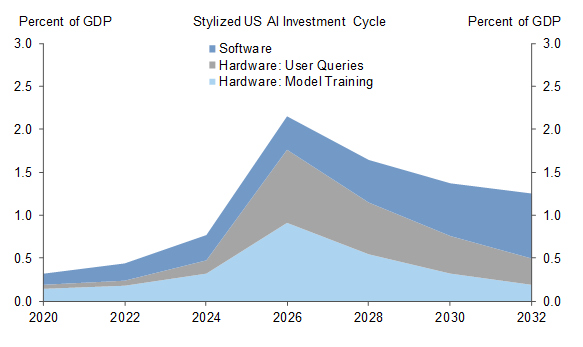

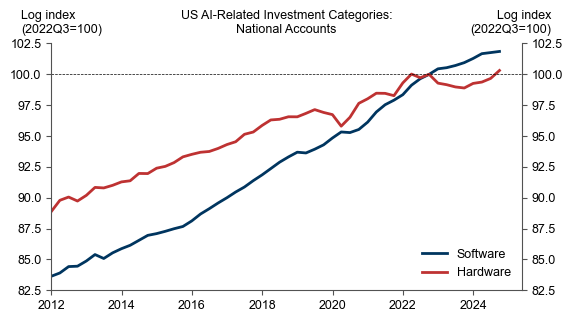

In mid-2023 we laid out the case for an AI investment cycle reaching 2% of annual GDP, where 1) an initial surge in hardware investment necessary to train AI models and run AI queries would ultimately fade as compute costs decline while 2) AI software investment increases steadily over time as end-user adoption increases. This thesis has largely borne out so far, albeit in a more frontloaded manner than we expected.

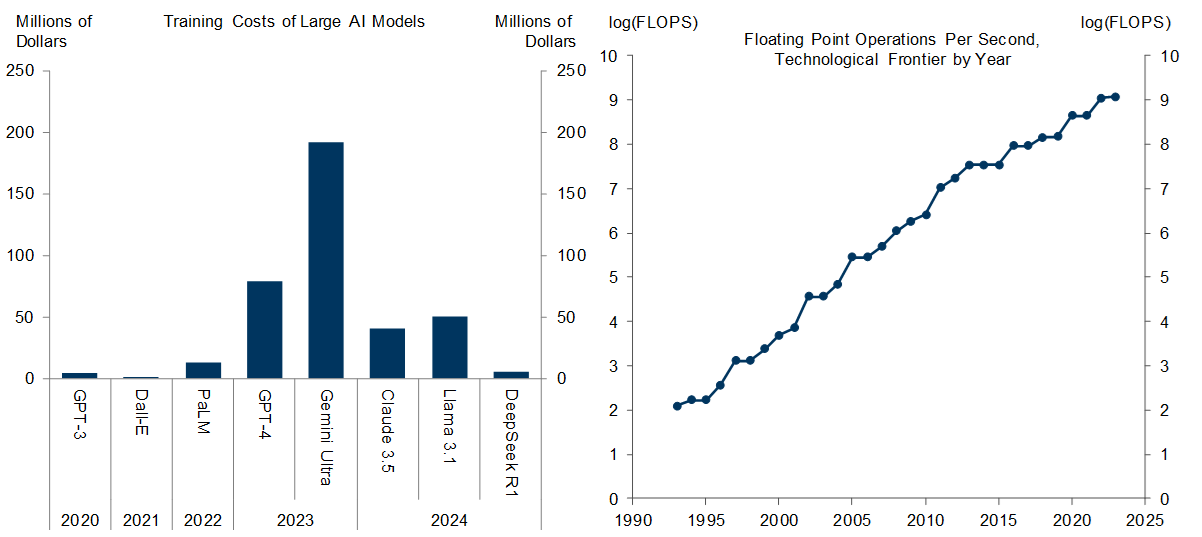

This weekend’s reports that DeepSeek obtained similar AI model performance at a fraction of the cost of existing models raises questions around whether the cost disinflation stage of the AI investment cycle is also arriving sooner than expected, whether large AI investments are sustainable, and whether AI infrastructure companies will be able to capture an outsized revenue share. These are valid questions regarding the distribution of profits, but the macro implications of DeepSeek’s breakthrough are more limited and most likely positive.

The main near-term risk to GDP is that more efficient model training and declining compute costs could lower AI-related capex. We are less concerned from a macro perspective since AI-related investment has so far had little impact on official GDP measures, thereby limiting downside even if investment does slow. Furthermore, our equity analysts note that DeepSeek could catalyze higher levels of real hardware spending if it pushes incumbents to invest more to maintain their lead.

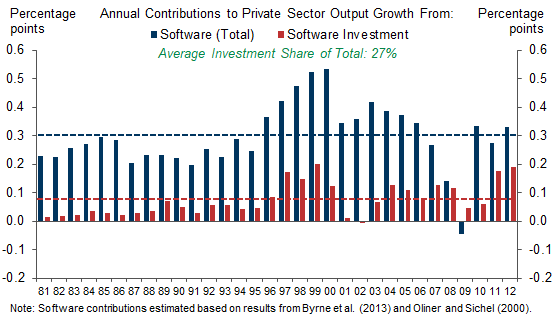

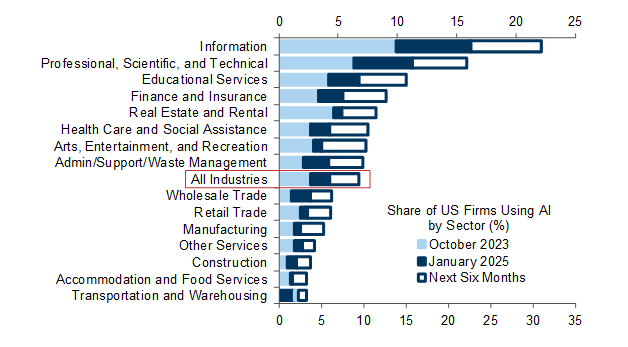

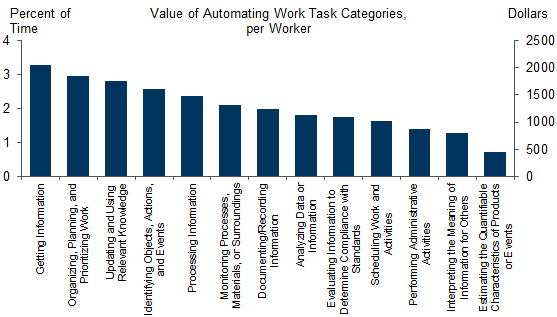

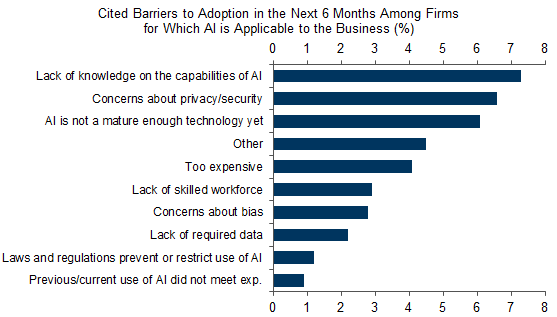

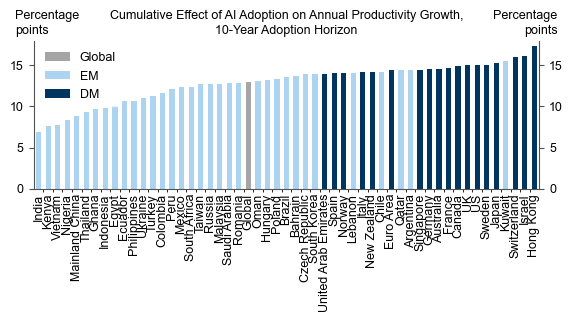

DeepSeek’s breakthrough could raise macroeconomic upside over the medium-term if its cost reductions help increase competition around the development of platforms and applications. Limited adoption is still the main bottleneck to unlocking AI-related productivity gains, and adoption would benefit from competition-induced acceleration in the buildout of AI platforms and applications. That said, the near-term adoption impact is probably limited since cost itself is not currently the main barrier to adoption.

The emergence of a credible global competitor to US-based AI leaders also raises upside risk to global adoption and productivity through two channels. First, the potential automation and productivity gains from generative AI are similar across major economies, and foreign adoption (particularly in major EMs) would benefit from the emergence of non-US based platforms and applications. Second, increased global competition could prompt governments to coordinate investments or lower regulatory barriers in efforts to spur adoption.

DeepSeek Raises Micro Risks, Macro Upside

Joseph Briggs

- 1 ^ See Byrne, David M., Stephen D. Oliner, and Daniel E. Sichel. "Is the Information Technology Revolution Over?" (2013) and Oliner, Stephen D., and Daniel E. Sichel. "The resurgence of growth in the late 1990s: is information technology the story?" Journal of Economic Perspectives 14.4 (2000): 3-22.

- 2 ^ See Daan Struyven, “Profit Margins: Rising Wages vs. Superstar Firms.” US Economics Analyst, August 18, 2018.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.