- Intro

- 5 key points from the Goldman Sachs Hedge Fund Trend Monitor

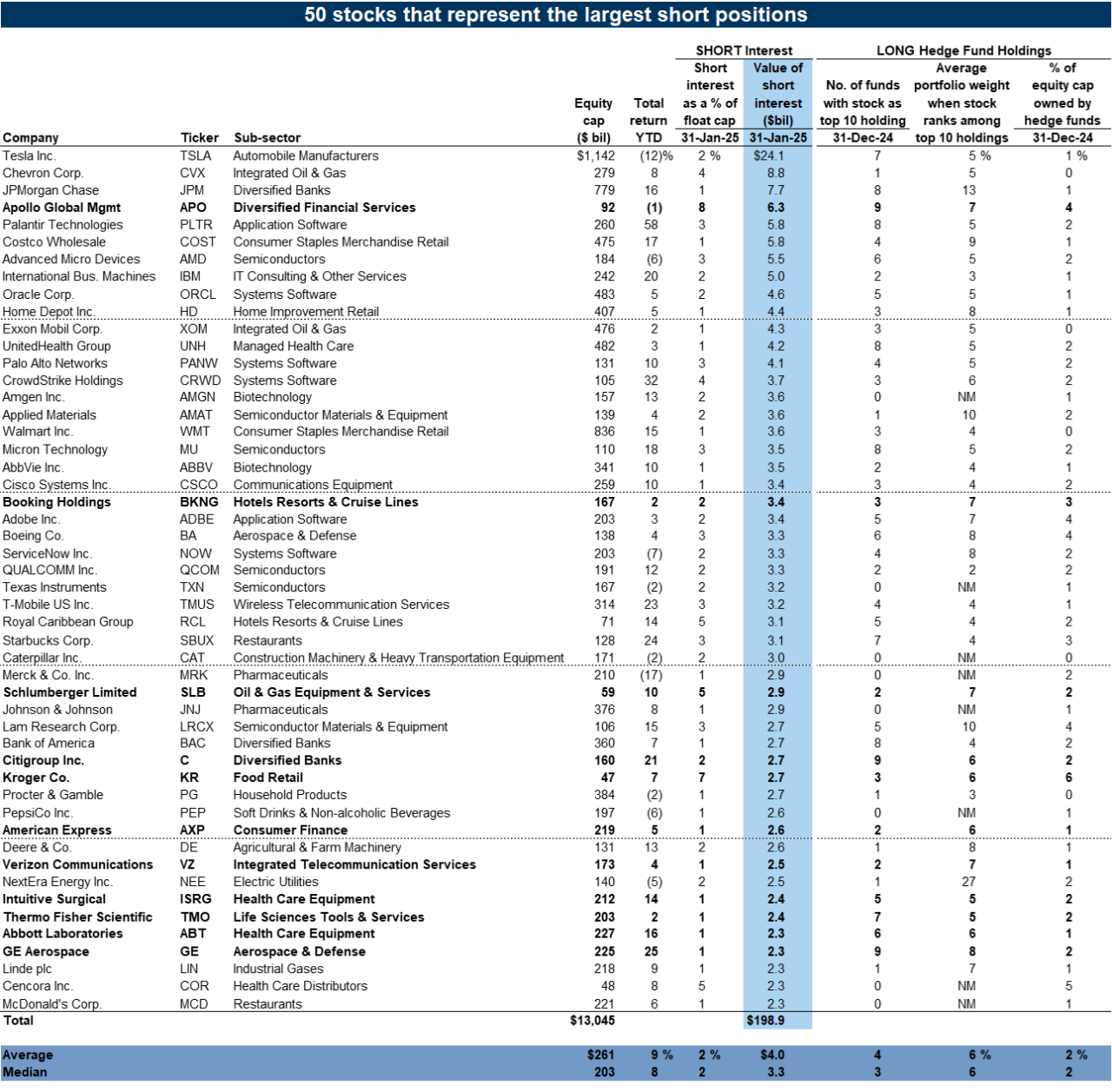

- Performance, leverage, and short interest

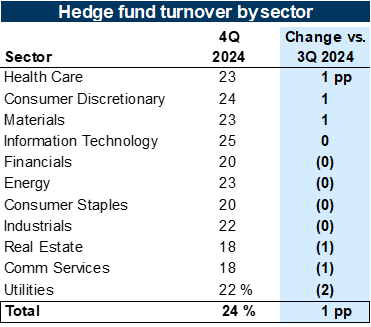

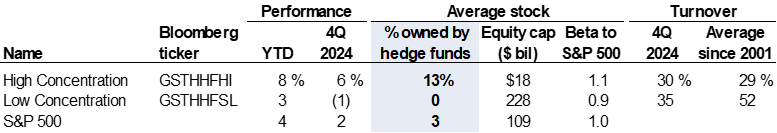

- Concentration, crowding, and turnover

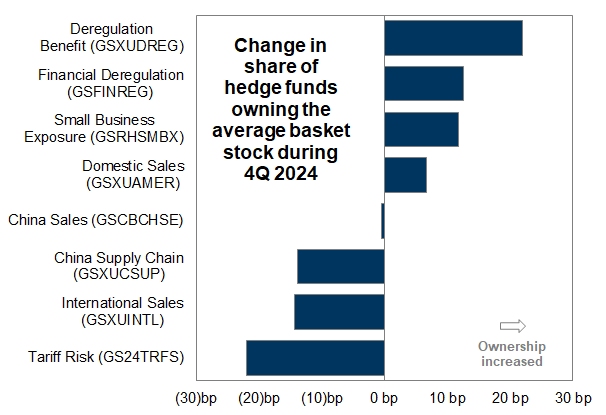

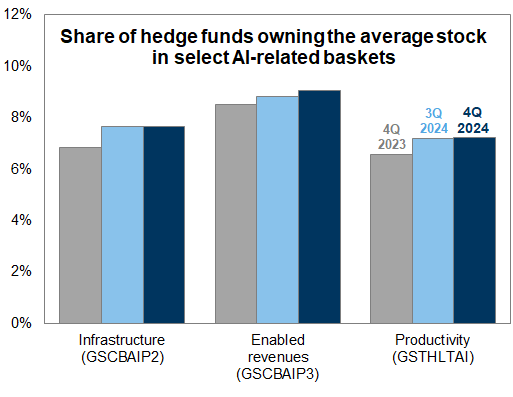

- Thematic and factor tilts

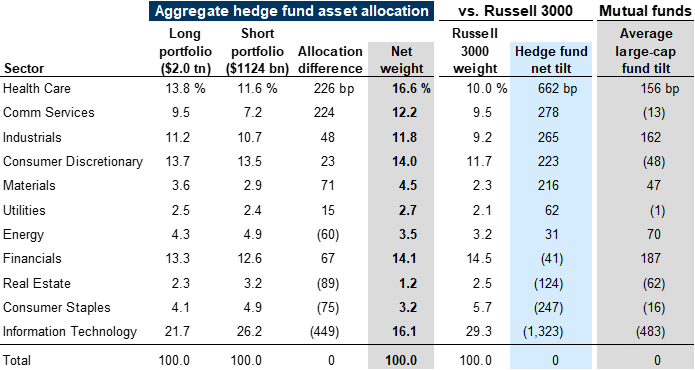

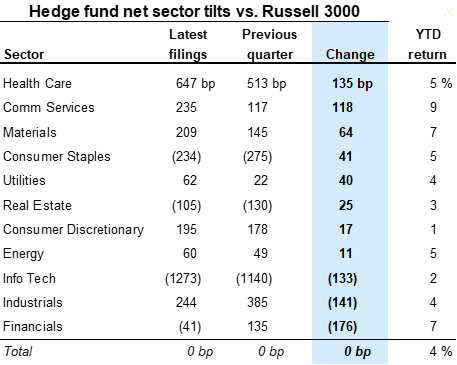

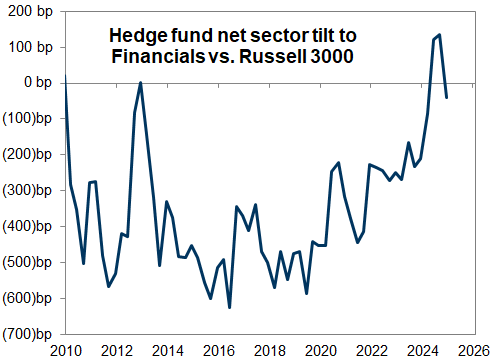

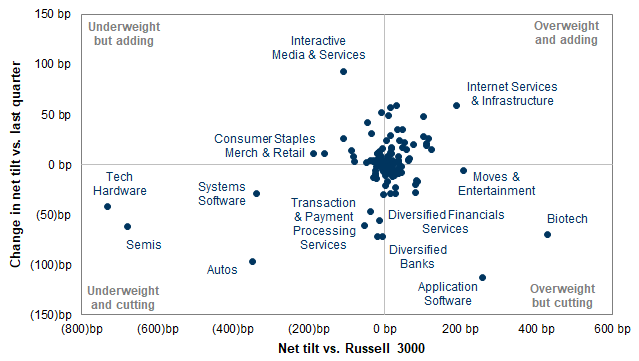

- Sector positions

- The Hedge Fund VIP List: "The stocks that matter most"

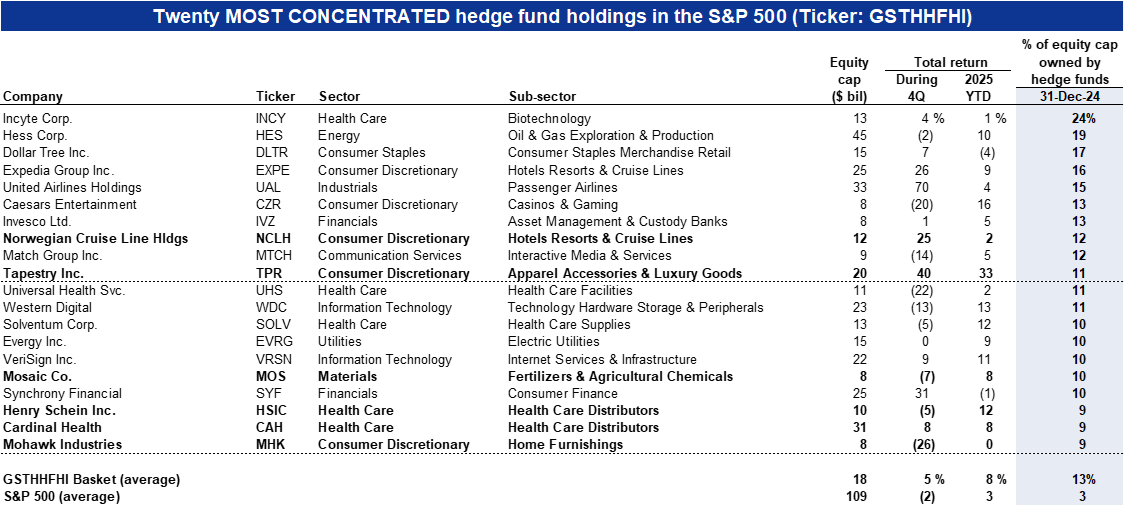

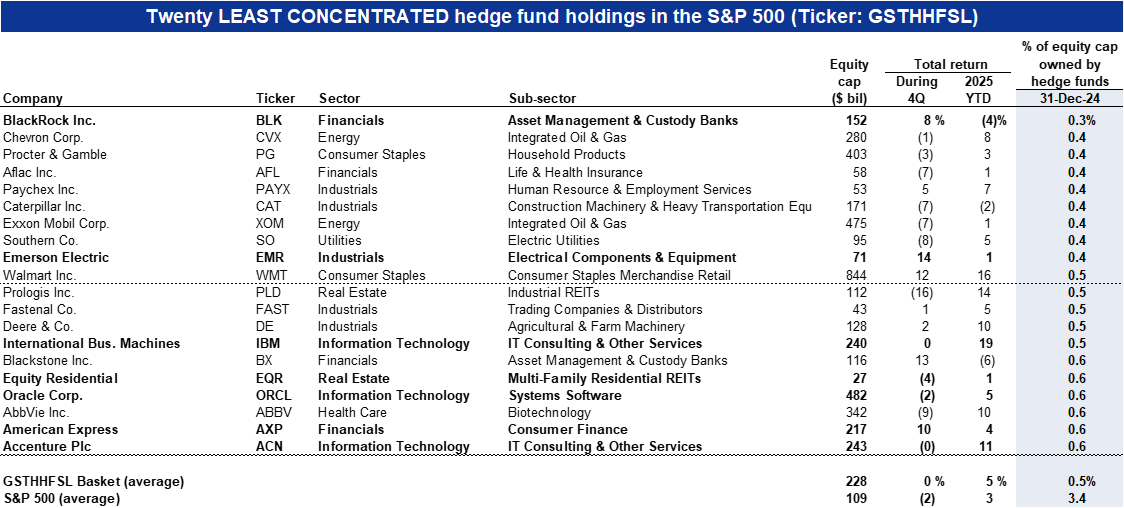

- The most concentrated hedge fund positions

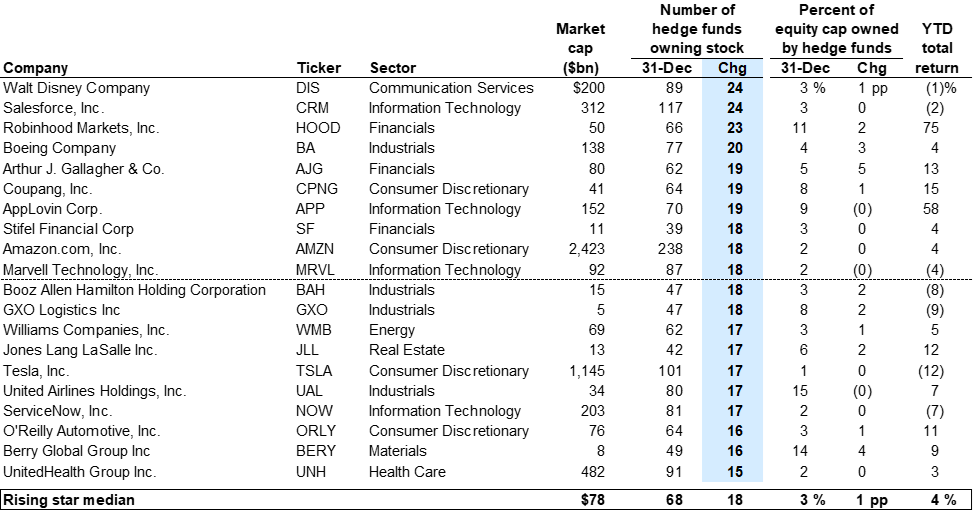

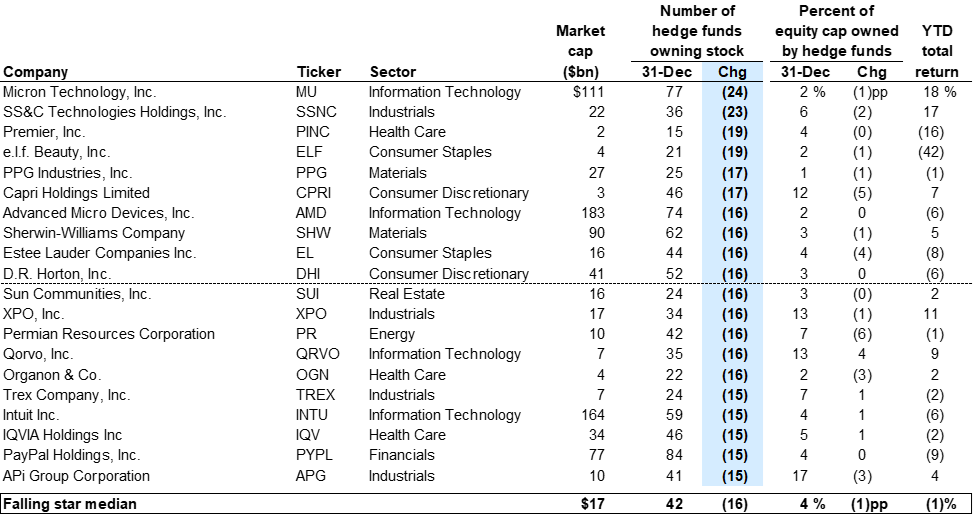

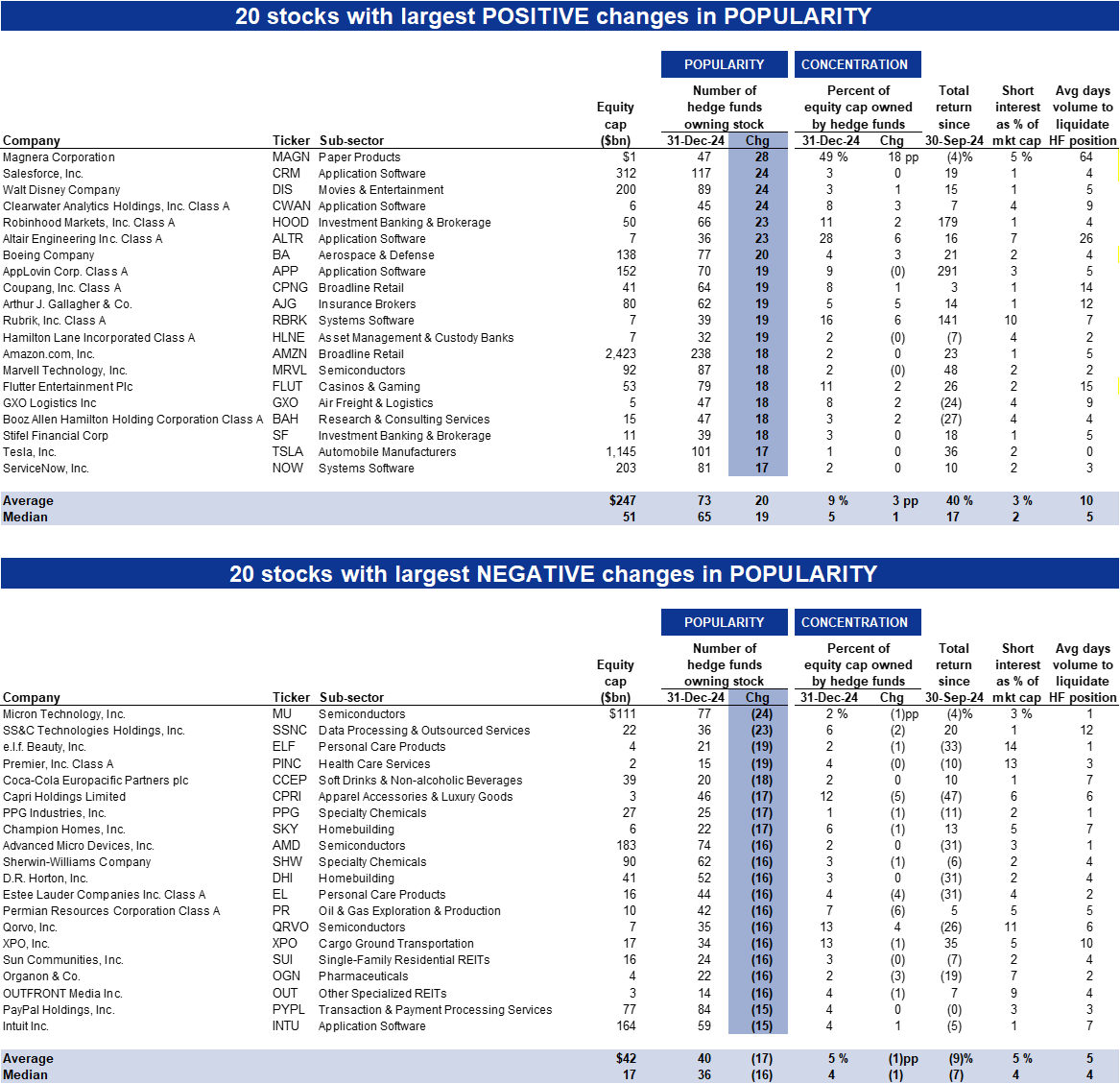

- Rising and falling stars

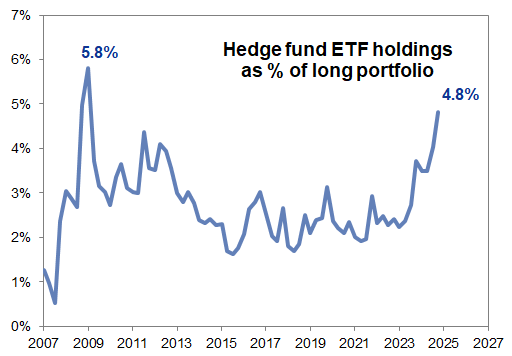

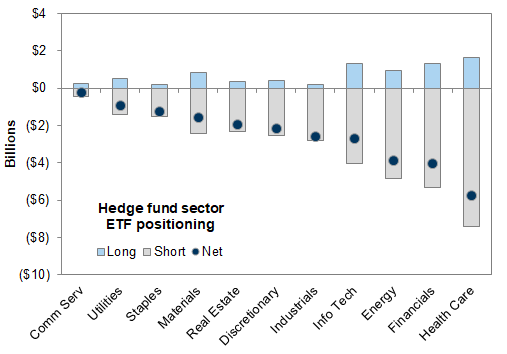

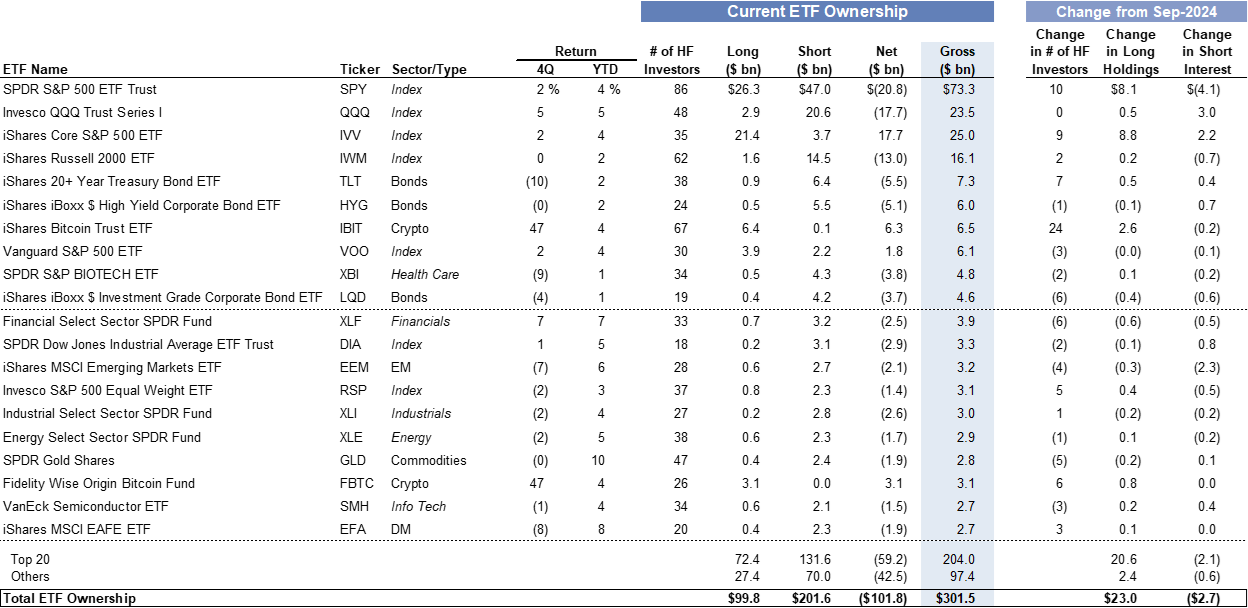

- ETF ownership

- Appendix A: Hedging the Hedge Fund VIP List

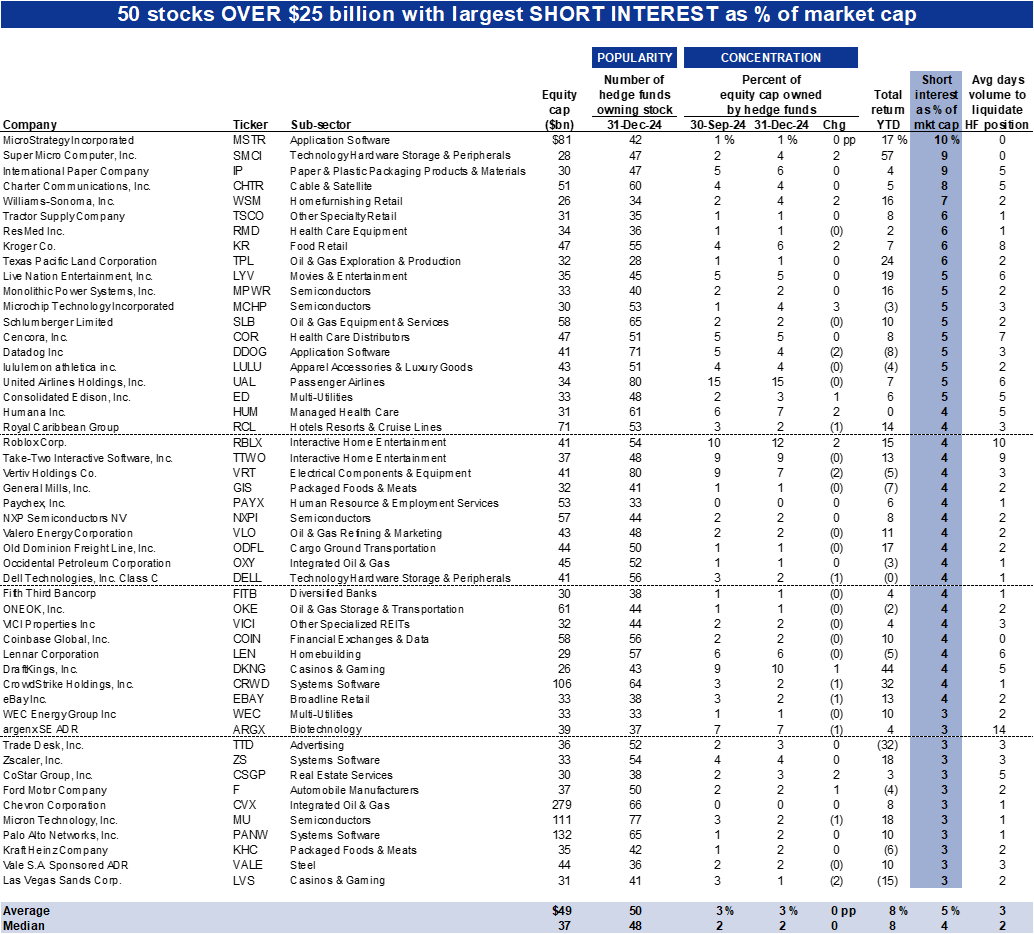

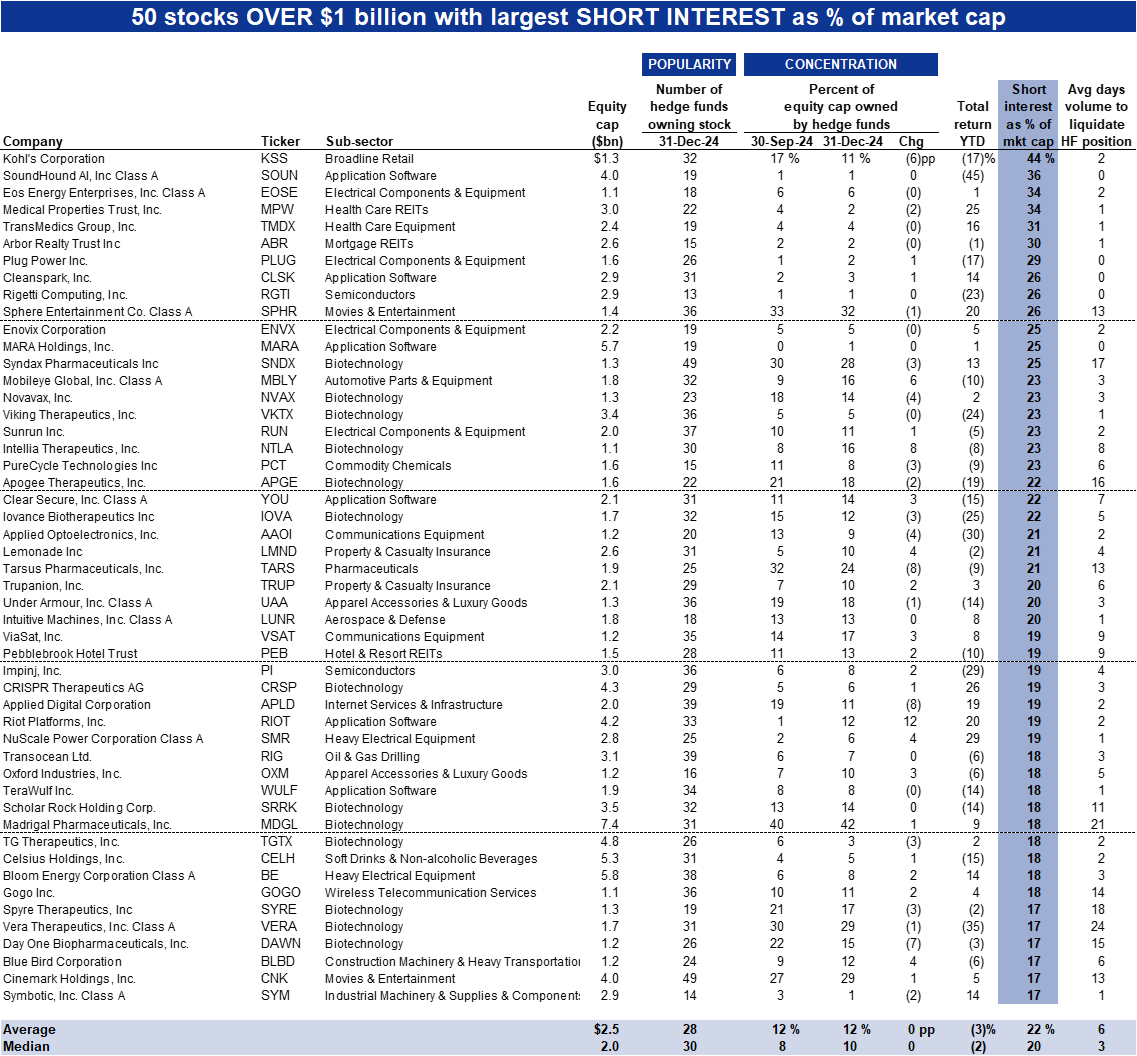

- Appendix B: Hedge fund data tables

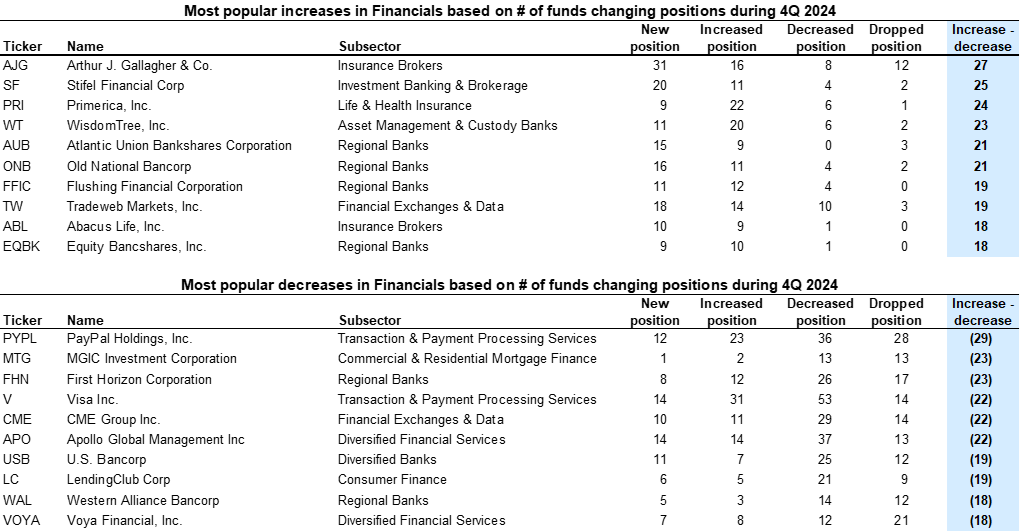

- Change in popularity: Largest increase and decrease in number of hedge fund owners

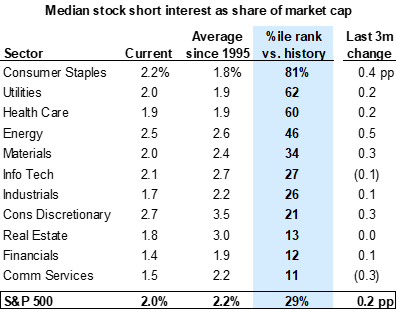

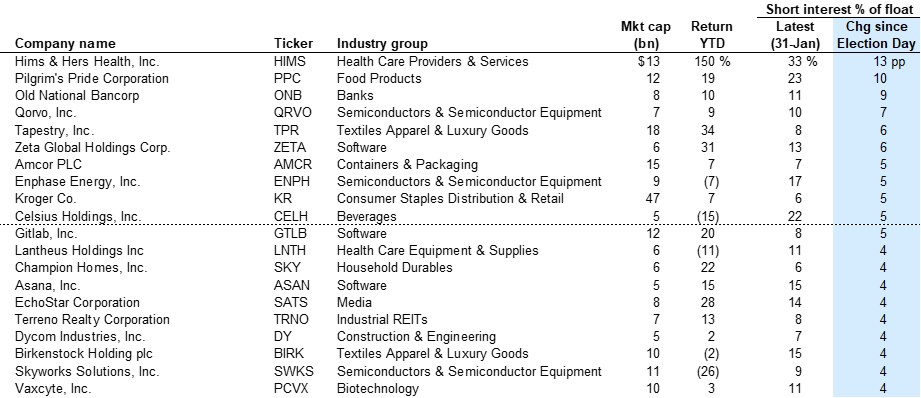

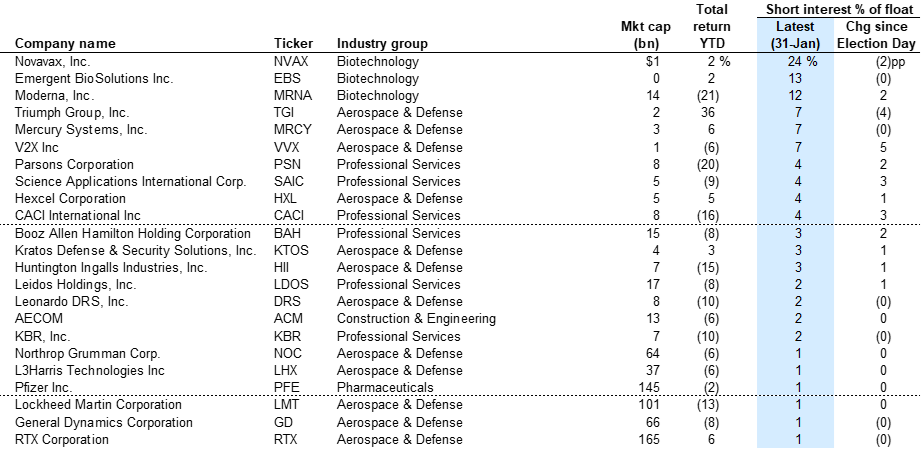

- Concentrated shorts: Highest short interest outstanding as a percentage of market cap

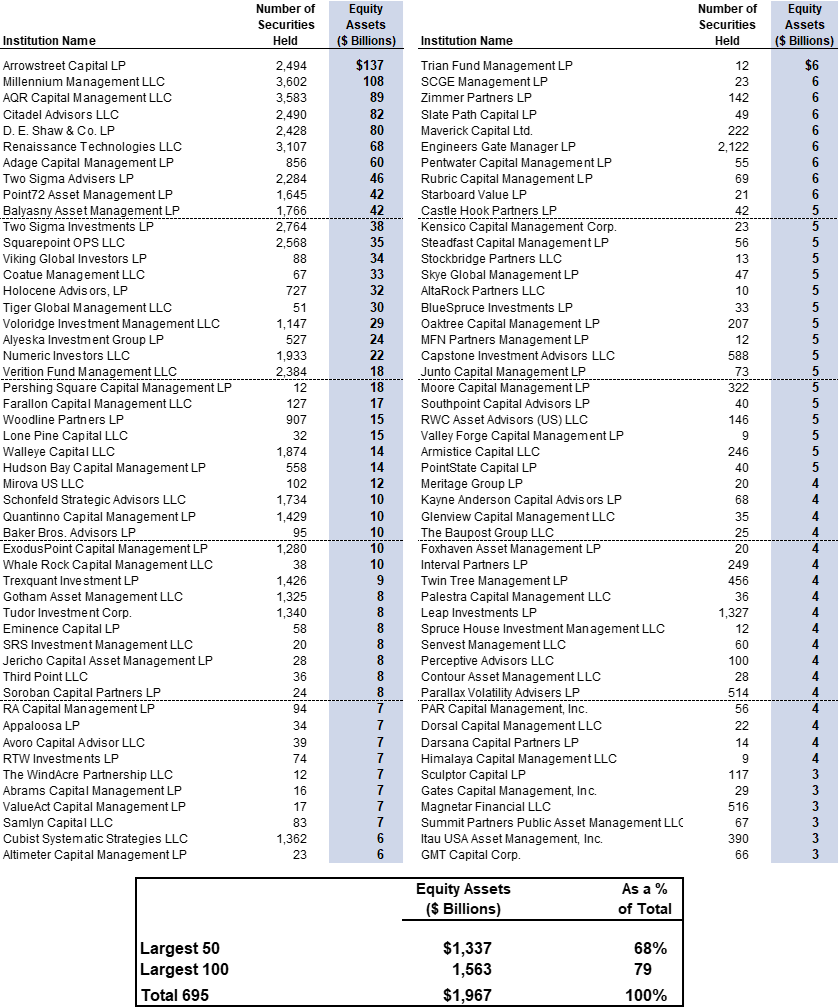

- Appendix C: 100 largest hedge funds in our analysis ranked by equity assets

- Appendix D: Drawbacks of our hedge fund holding analysis

5 key points from the Goldman Sachs Hedge Fund Trend Monitor

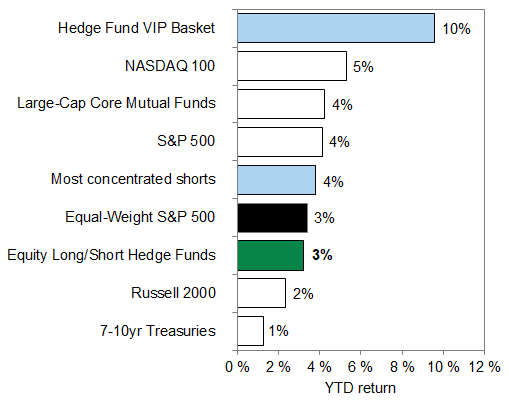

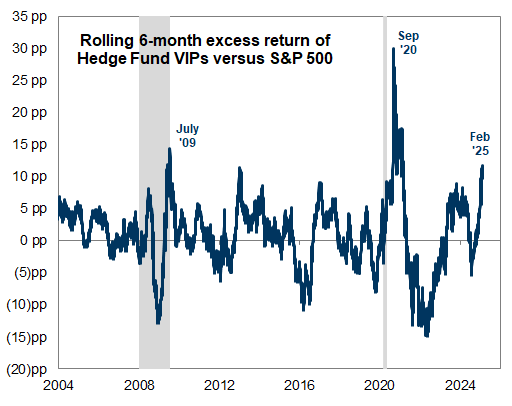

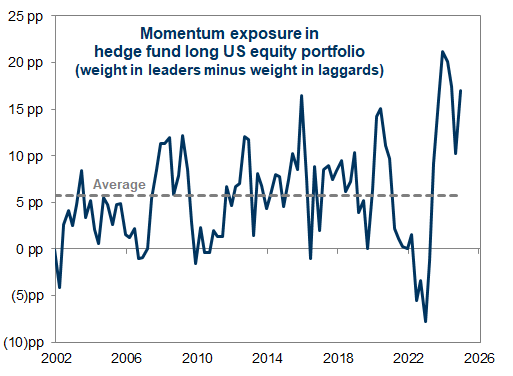

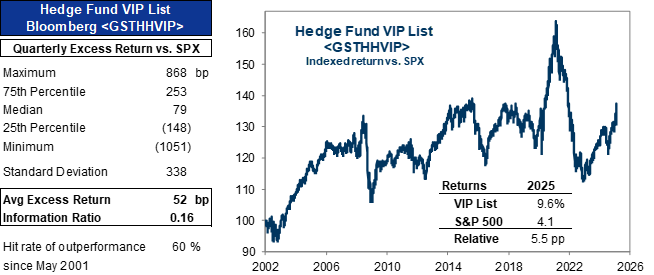

PERFORMANCE: Popular hedge fund long positions have supported US equity long/short hedge fund returns of +3% YTD. Our Hedge Fund VIP list of the most popular long positions (ticker: GSTHHVIP) has returned +10% YTD, outperforming the S&P 500 (+4%), the equal-weight S&P 500 (+3%) and the most shorted stocks (GSCBMSAL, +4%). Hedge fund VIPs have outperformed the S&P 500 by 11 pp during the last 6 months, the largest magnitude of outperformance since 2021.

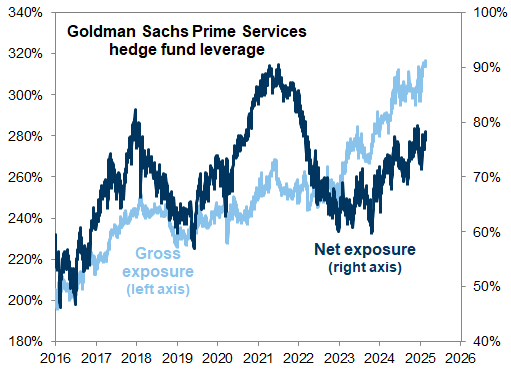

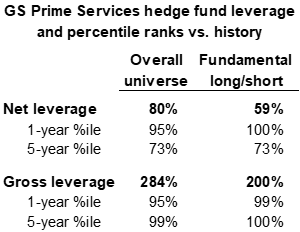

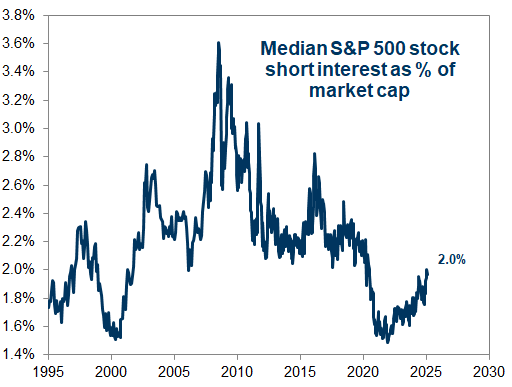

LEVERAGE AND SHORT INTEREST: Hedge funds have continued to lift gross and net leverage. Fundamental long/short hedge fund gross and net leverage now rank in the 100th and 73rd percentiles vs. the last five years. Funds continue to use macro products on both sides of their portfolios. Both the ETF share of the hedge fund long portfolio and hedge fund equity futures shorts are large relative to history.

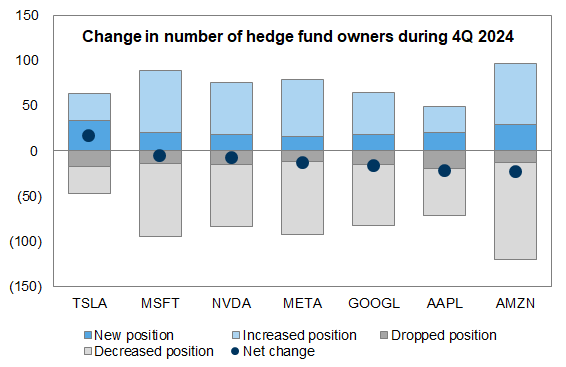

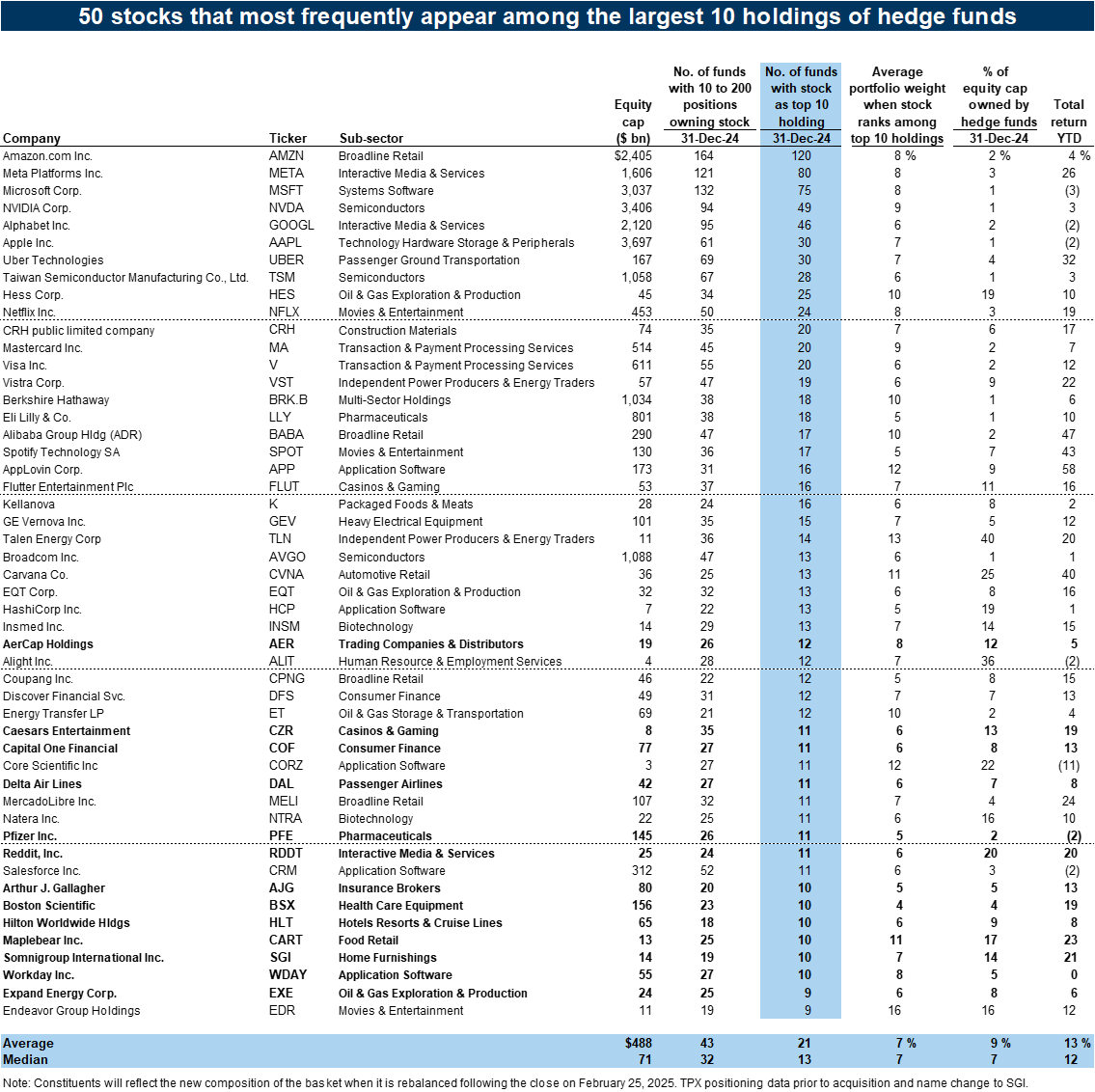

HEDGE FUND VIPS: The mega-caps continue to sit atop our list of the most popular hedge fund long positions. AMZN, META, MSFT, NVDA, GOOGL, and AAPL remain as the six most popular stocks. The VIP list contains the 50 stocks that appear most often among the top 10 holdings of fundamental hedge funds. The basket has outperformed the S&P 500 in 60% of quarters since 2001 with an average quarterly excess return of 52 bp. 13 new constituents: AER, AJG, BSX, CART, COF, CZR, DAL, EXE, HLT, PFE, RDDT, SGI, WDAY.

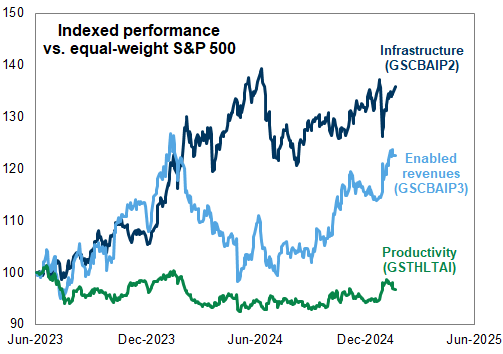

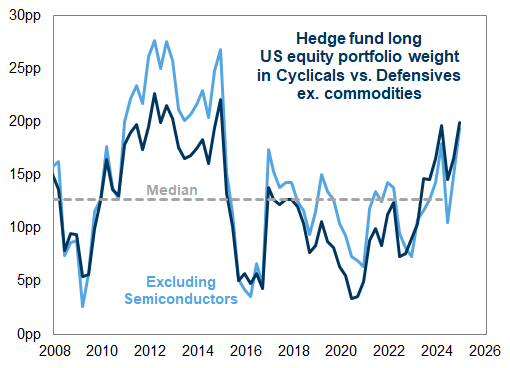

THEMATIC ROTATIONS: Hedge funds participated in post-election rotations. During 4Q hedge funds lifted the average ownership of potential deregulation beneficiaries, stocks exposed to small businesses, and stocks with domestic sales. In contrast, funds reduced ownership of stocks exposed to China and tariffs. QRVO, a company exposed to supply chains in China, ranked among our list of Falling Stars with the largest decrease in hedge fund popularity. Hedge funds also rotated into companies with AI-enabled revenues. Funds boosted the weight of the Software industry in the hedge fund long portfolio to 11%, the largest weight since 3Q 2023. Semiconductors MU and AMD joined our list of Falling Stars.

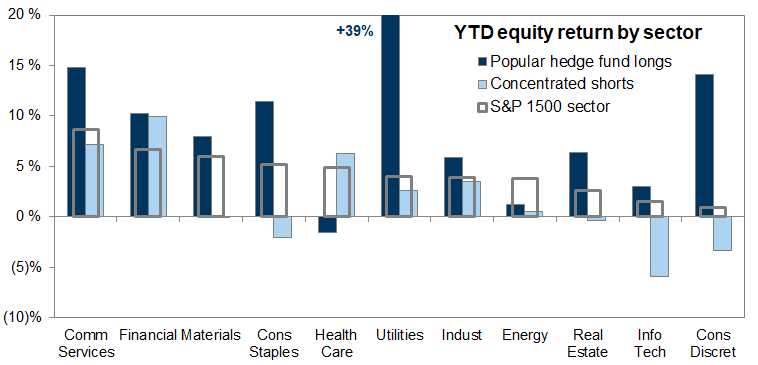

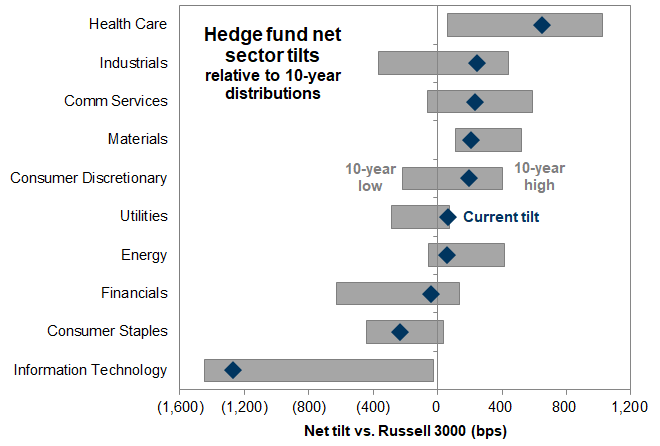

SECTORS: Hedge funds flipped to underweight Financials during 4Q and lifted exposure to Health Care and Comm Services. The reduction in Financials net tilt followed sharp outperformance after Election Day. However, many Financials stocks entered our list of Hedge Fund VIPs and Rising Stars. Consistent with the theme of getting selective, Health Care and Comm Services are two sectors with high dispersion scores offering opportunities for stock-pickers.

Performance, leverage, and short interest

Exhibit 1: Equity hedge funds have returned 3% YTD

Exhibit 2: Popular hedge fund positions have fared well YTD

Exhibit 4: Hedge fund gross and net leverage

Exhibit 5: Hedge fund leverage relative to recent history

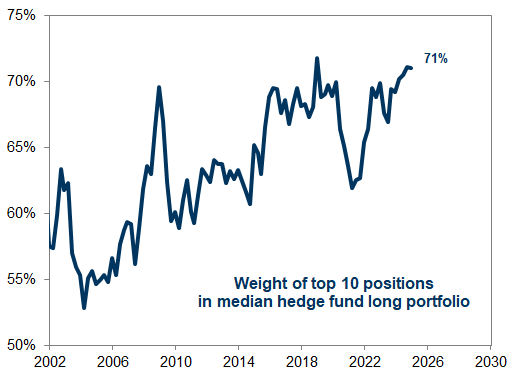

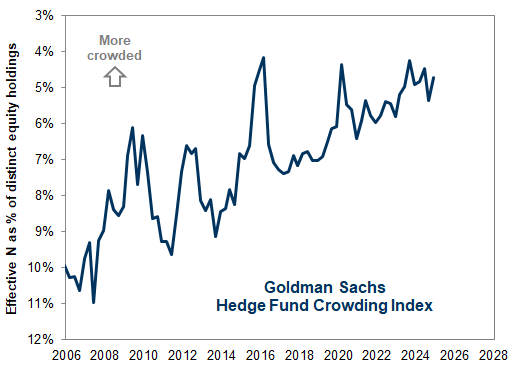

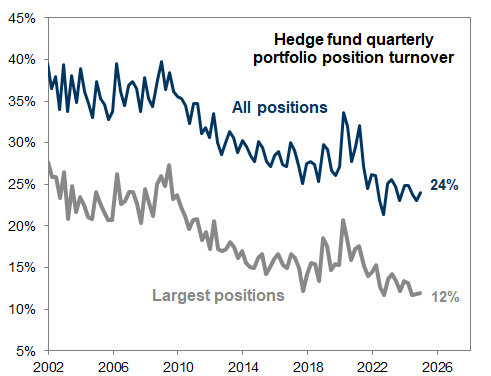

Concentration, crowding, and turnover

Thematic and factor tilts

Sector positions

The Hedge Fund VIP List: "The stocks that matter most"

GSTHHVIP: The 50 stocks that matter most to hedge funds

Exhibit 28: Very Important Positions (VIP) for hedge funds

The most concentrated hedge fund positions

Goldman Sachs S&P 500 hedge fund concentration baskets

Rising and falling stars

ETF ownership

Appendix A: Hedging the Hedge Fund VIP List

Appendix B: Hedge fund data tables

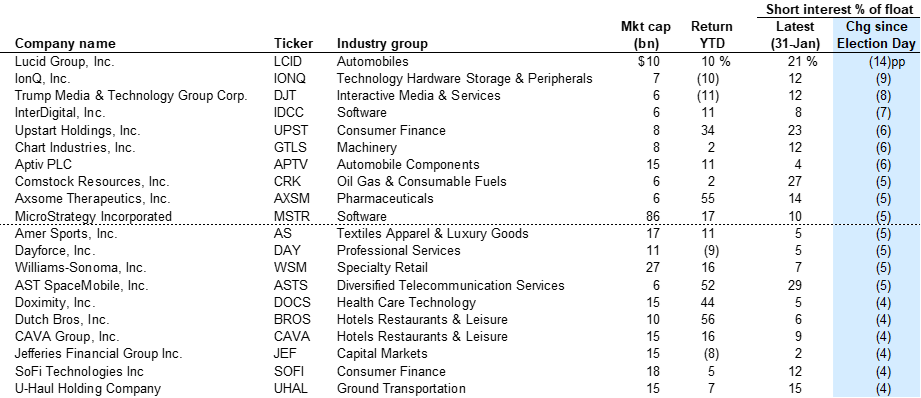

Concentrated shorts: Highest short interest outstanding as a percentage of market cap

Appendix D: Drawbacks of our hedge fund holding analysis

Data limitations

Lack of international holdings

Incomplete reporting of short positions

Timeliness

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.