- Intro

- Conversations we are having with clients: The 5% S&P 500 drawdown

- S&P 500 earnings and return forecasts

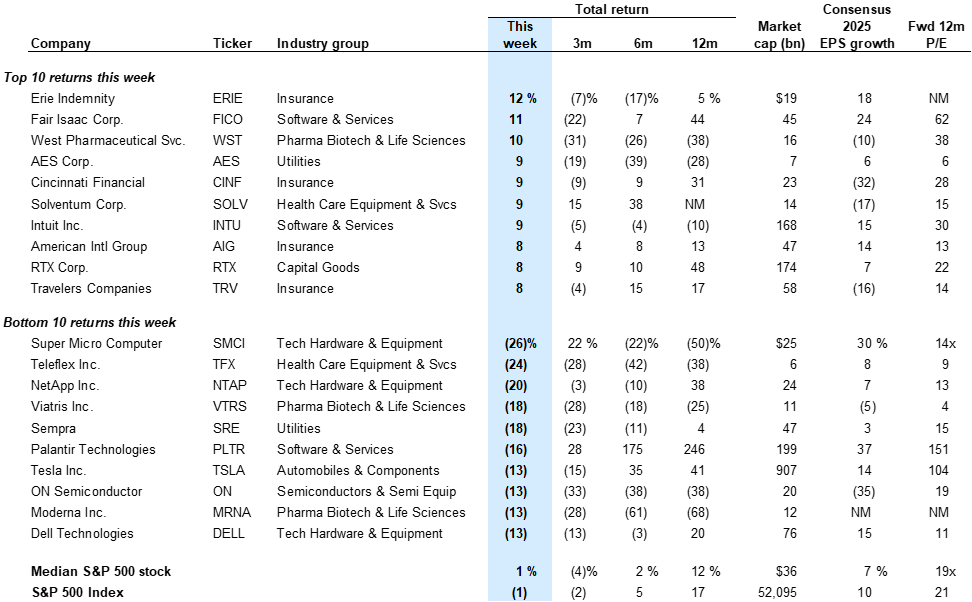

- Biggest stock movers this week

- Sentiment and flows

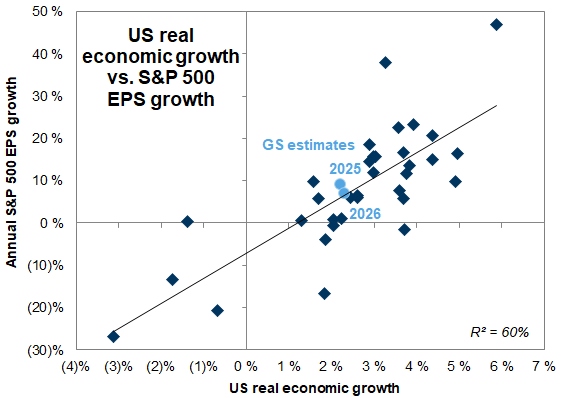

- Economic growth

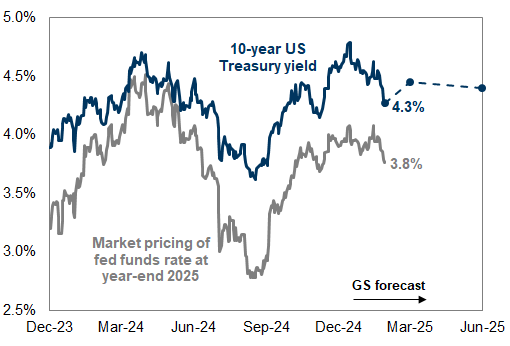

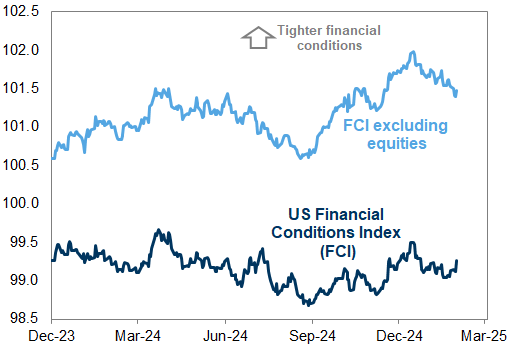

- Interest rates and financial conditions

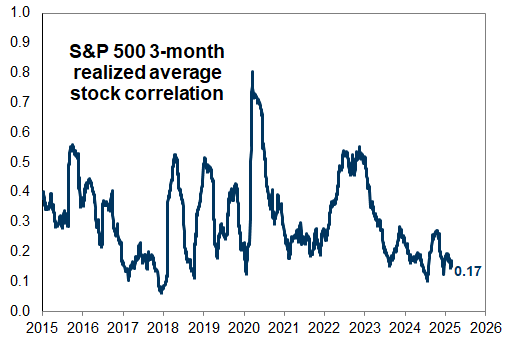

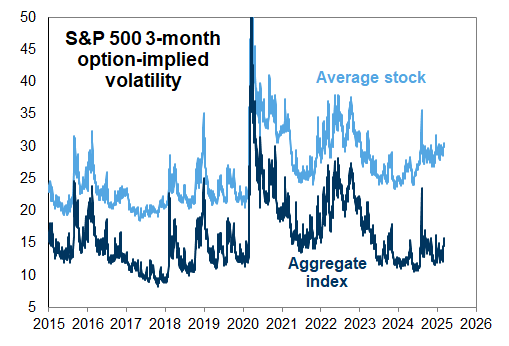

- Market breadth and concentration

- Correlation and volatility

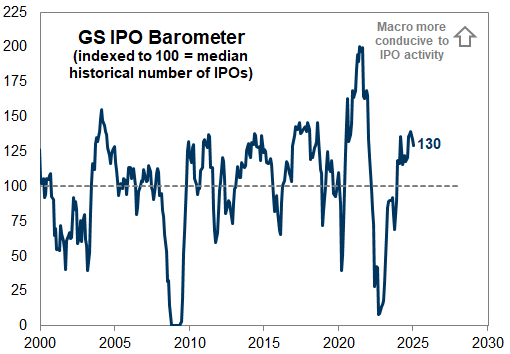

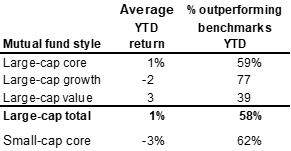

- IPO Barometer and mutual fund performance

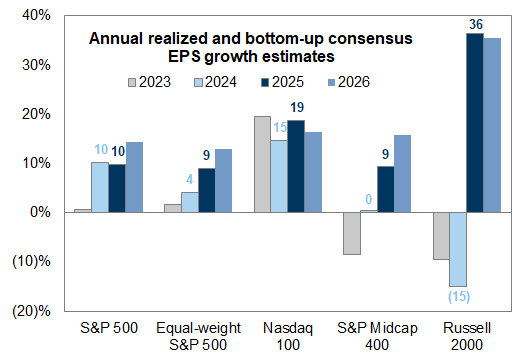

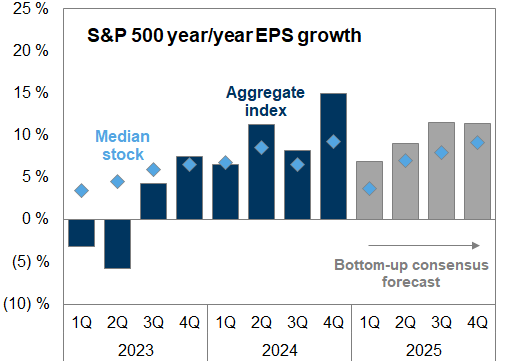

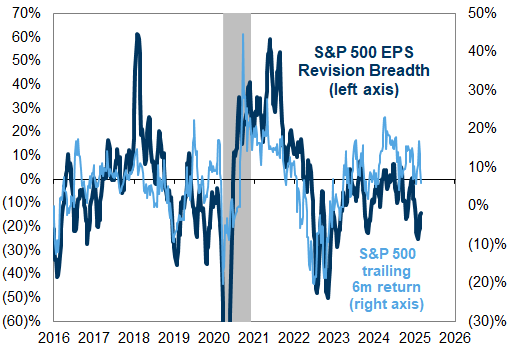

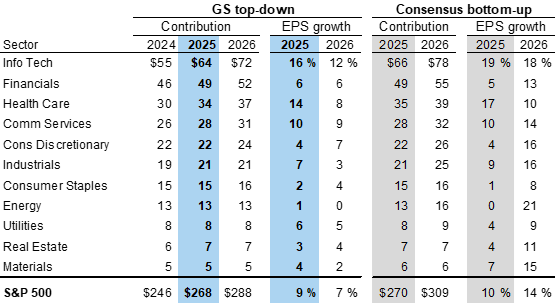

- Earnings growth

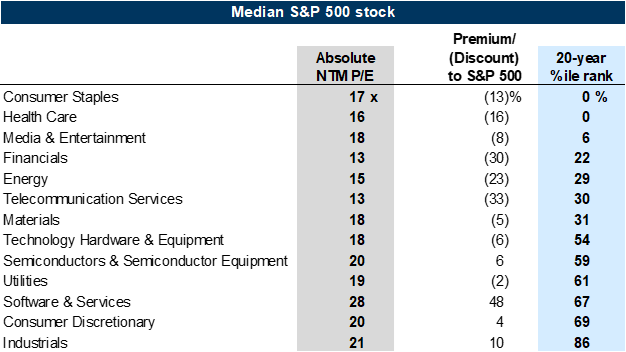

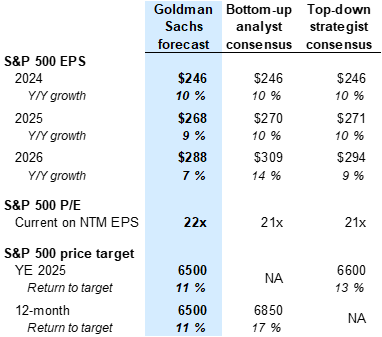

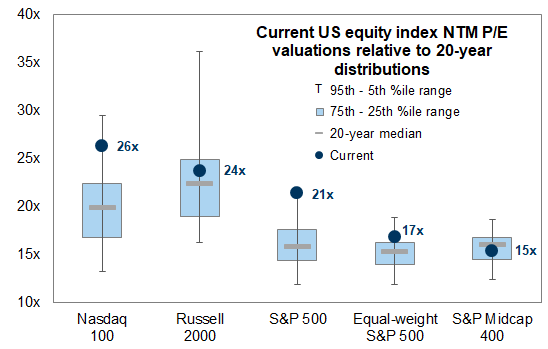

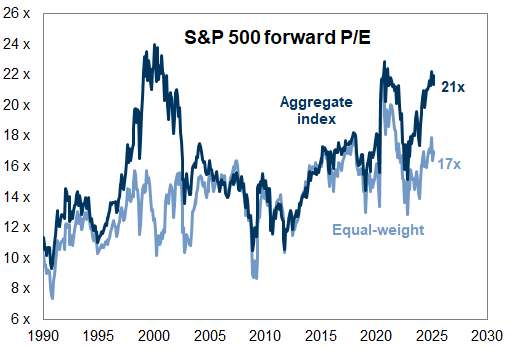

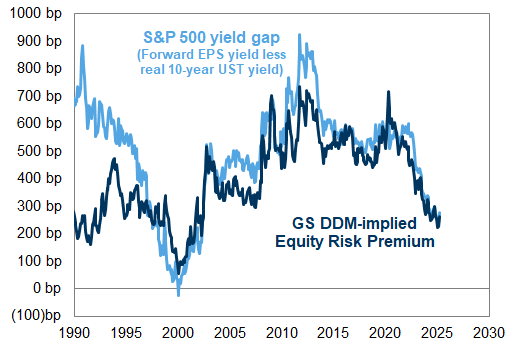

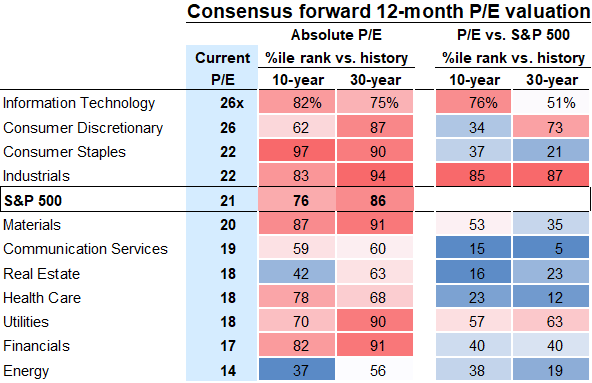

- Valuations

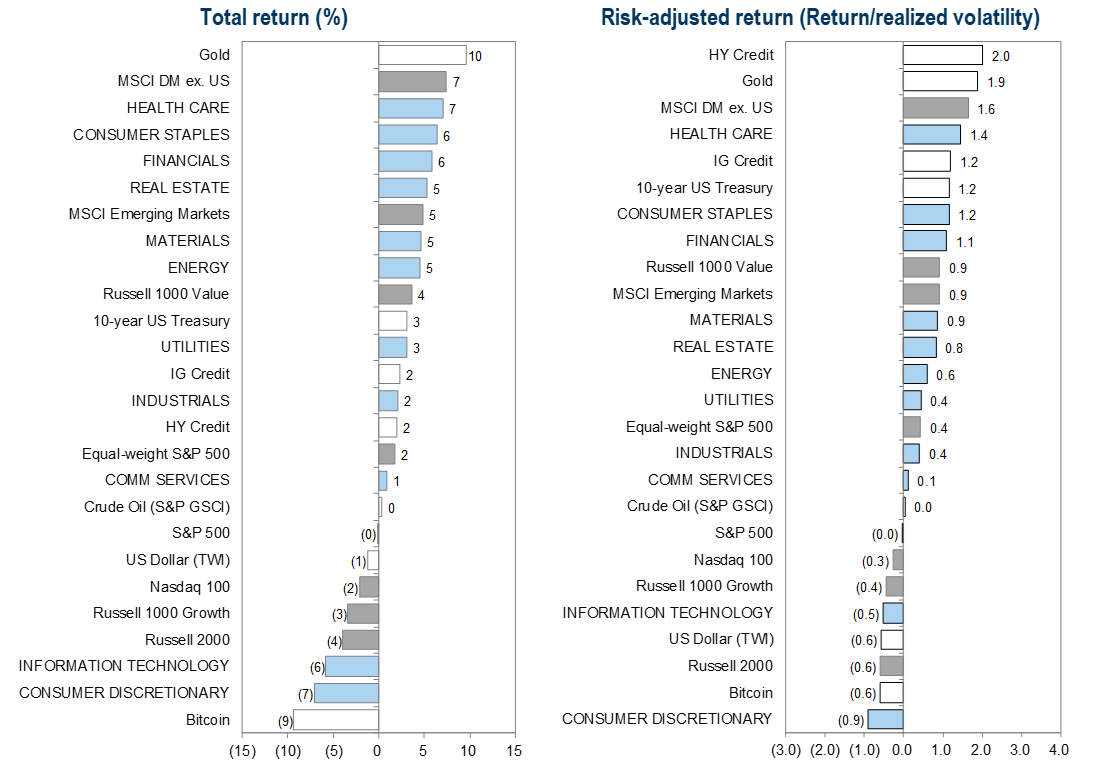

- YTD absolute and risk-adjusted returns

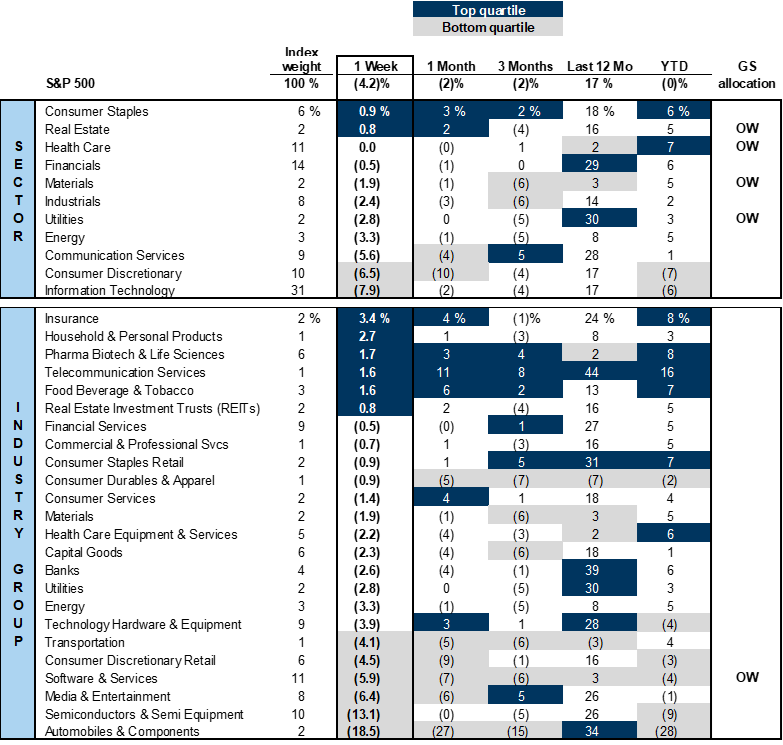

- Sector returns, earnings, and valuations

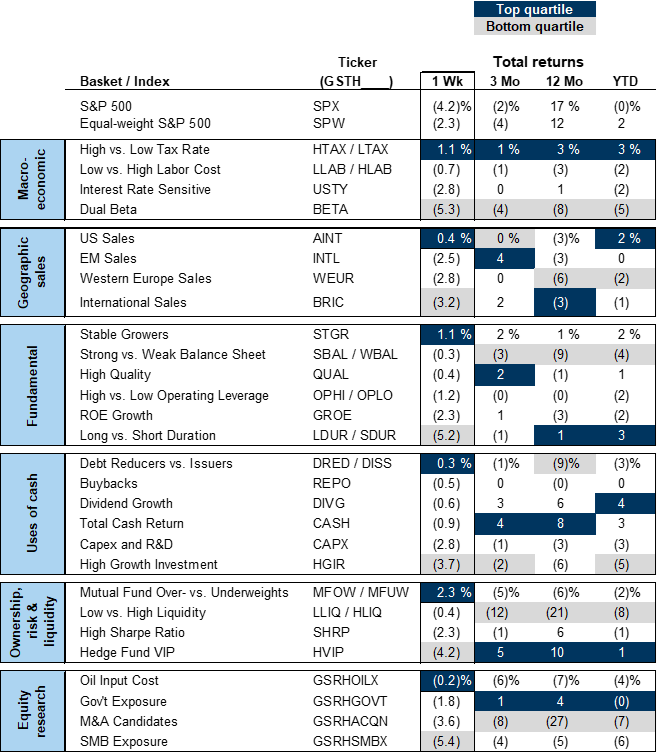

- Thematic baskets

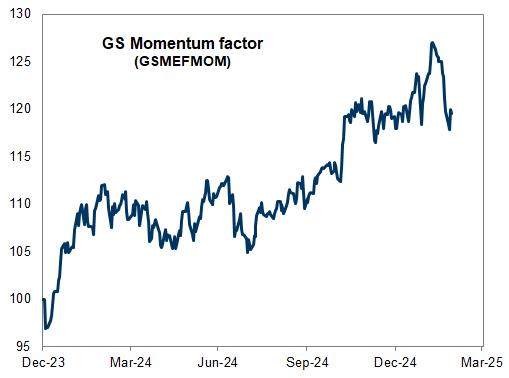

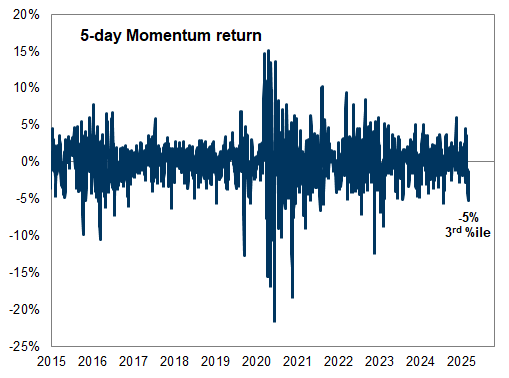

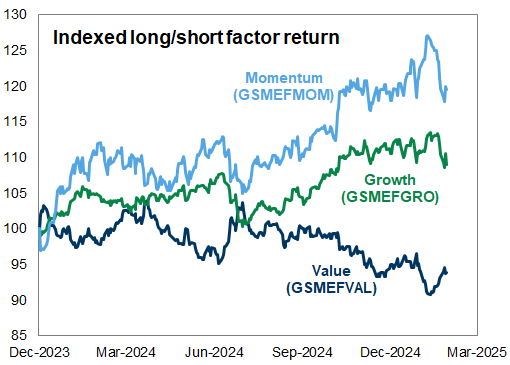

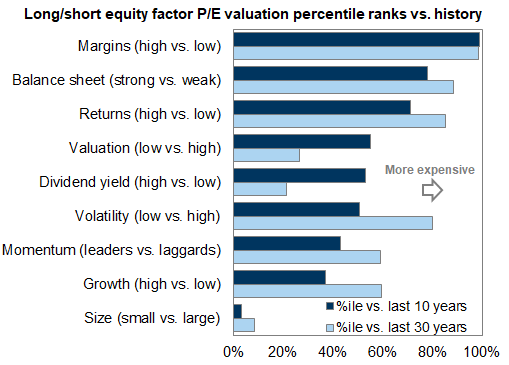

- Factors

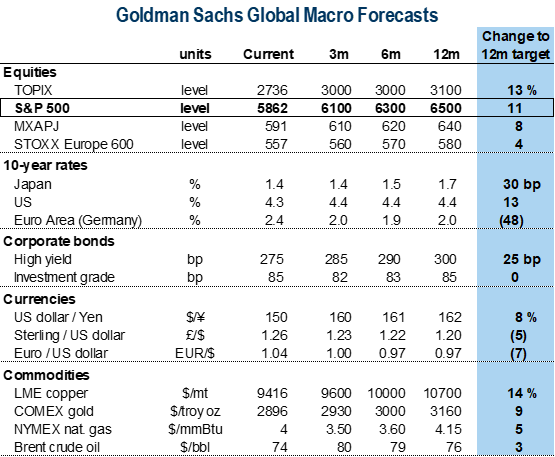

- Goldman Sachs global macro research cross-asset forecasts

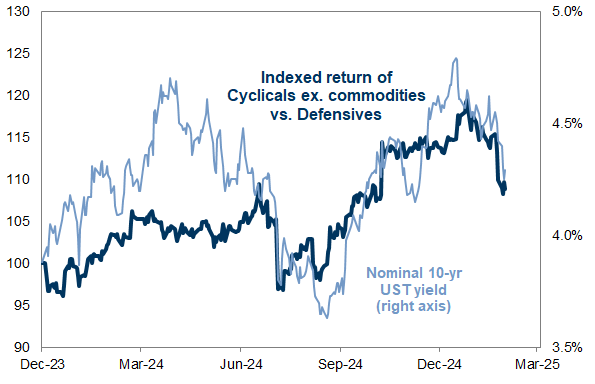

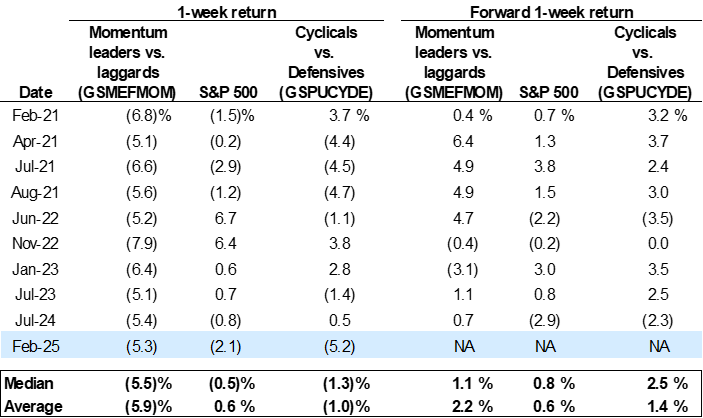

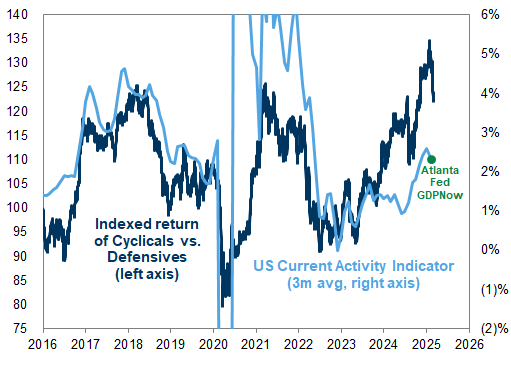

The S&P 500 sold off by 5% during the past week, driven by both an unwind of elevated positioning and economic growth concerns. Within the equity market, Cyclicals have lagged Defensives by 9% and our Momentum factor has declined by 7%.

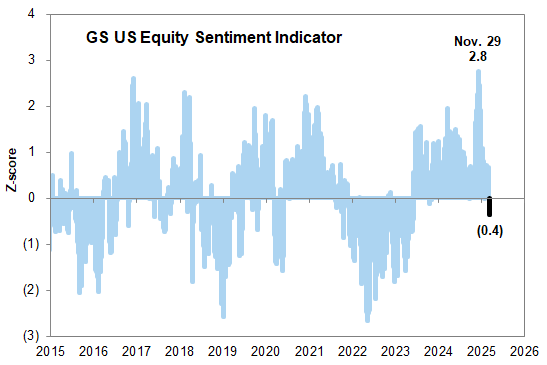

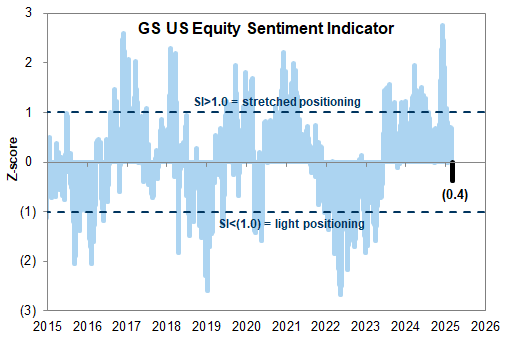

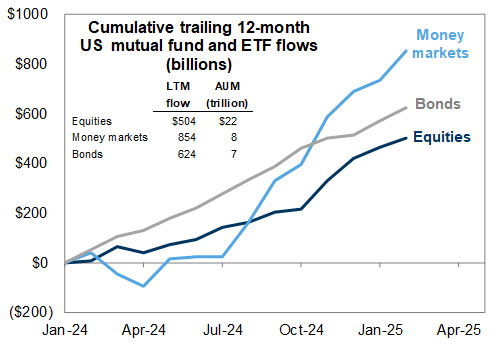

Our Sentiment Indicator stands at -0.4, substantially below the highs in late November but above levels that have historically signaled tactical upside as a result of depressed positioning. As a result, we believe an improvement in the US economic growth outlook will be required to fully reverse the recent equity market rotations. Next Friday's jobs report will be a key test. Policy signals that boost the growth outlook could also lift the market, but uncertainty remains high.

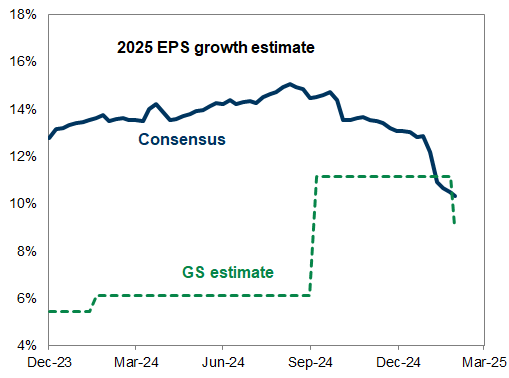

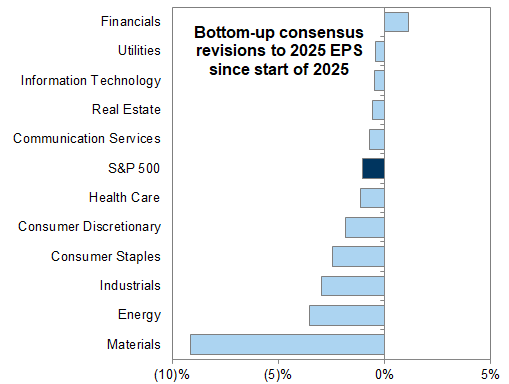

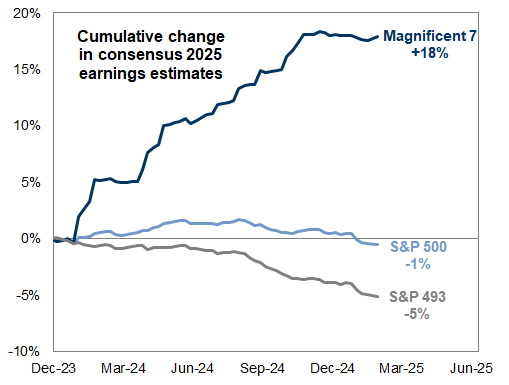

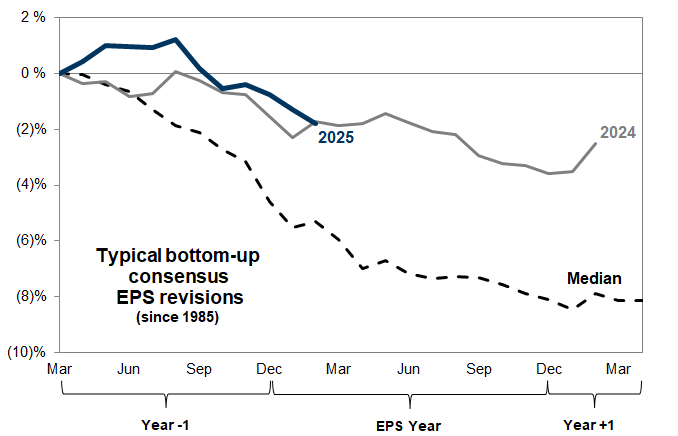

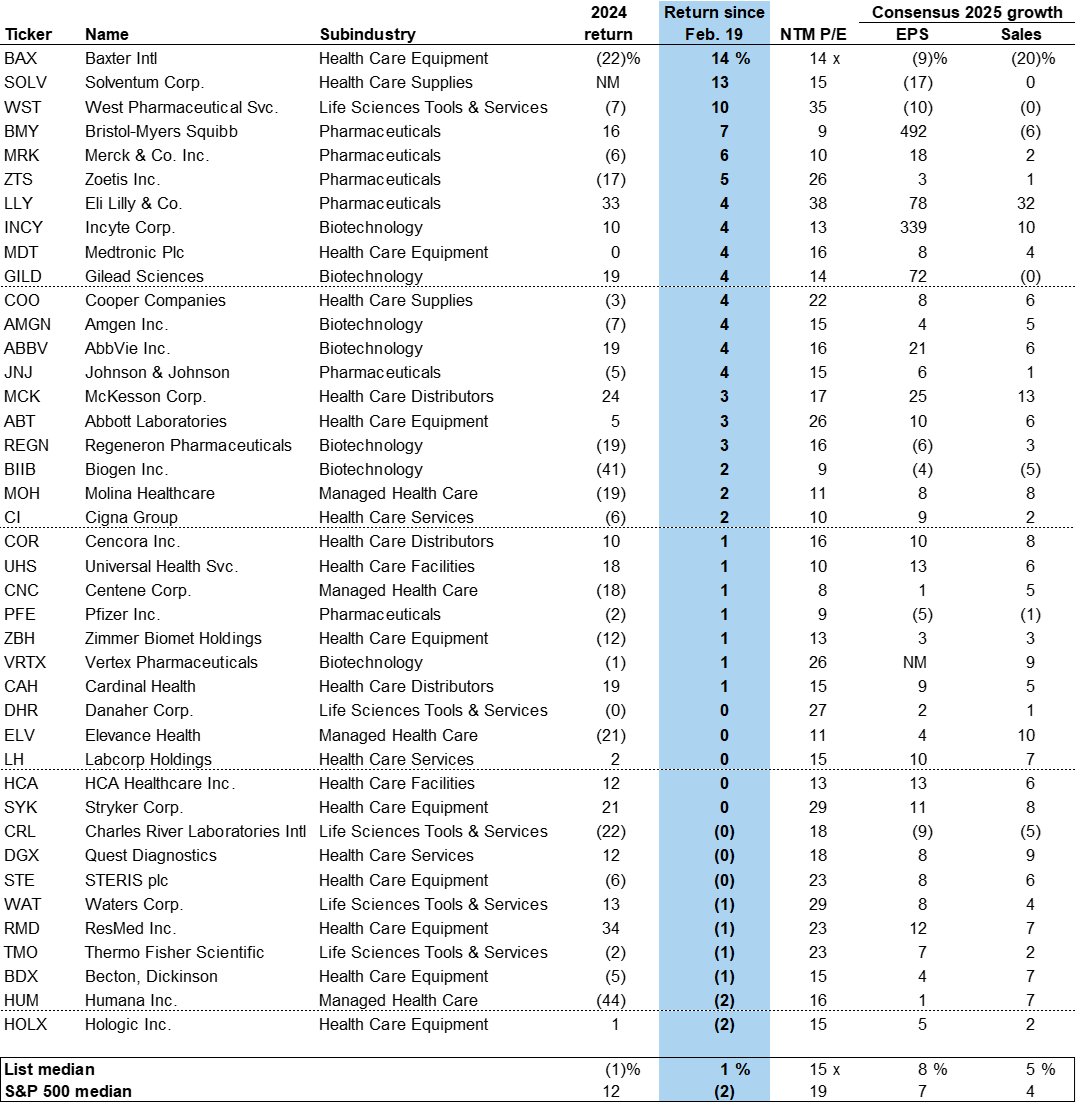

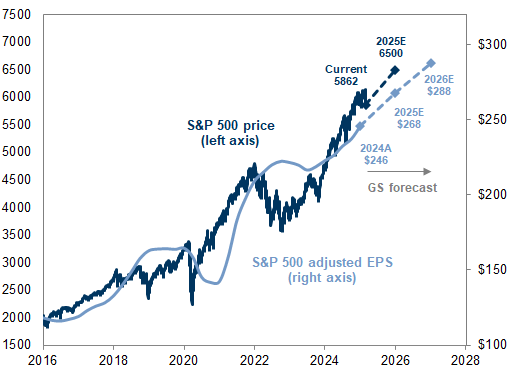

We revise our 2025 EPS growth forecast from 11% to 9% and maintain our 2026 growth forecast of 7%. The levels of our 2025 and 2026 EPS estimates remain unchanged at $268 and $288 following better-than-expected 2024 EPS growth but softer-than-expected economic data in 2025. The consensus bottom-up 2025 EPS estimate has been lowered by 1% since the start of the year but is now roughly in line with our top-down estimate. Elevated policy uncertainty creates risks in both directions around our forecast.

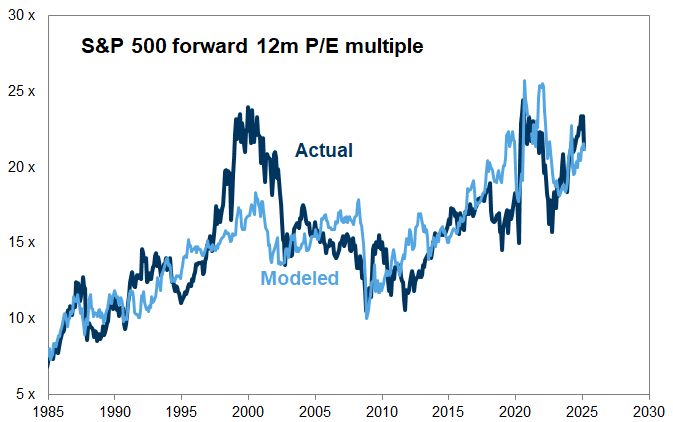

Looking further ahead, we maintain our year-end S&P 500 price target of 6500 (+9% from today). The equity market's pricing of the economic growth outlook is now in the ballpark of our economists' baseline economic growth forecasts, and the S&P 500 P/E of 21.5x is in line with our year-end S&P 500 P/E multiple forecast. We continue to expect equity returns will be more modest than last year and match the trajectory of earnings growth.

We continue to recommend investors own Health Care, which offers a defensive tilt and trades at historically low valuations despite outperforming the market by 7 pp YTD.

Conversations we are having with clients: The 5% S&P 500 drawdown

S&P 500 earnings and return forecasts

Sentiment and flows

Exhibit 18: GS US Equity Sentiment Indicator of investor positioning

Exhibit 19: Recent mutual fund and ETF flows

Economic growth

Exhibit 20: US equity market internal pricing of economic growth

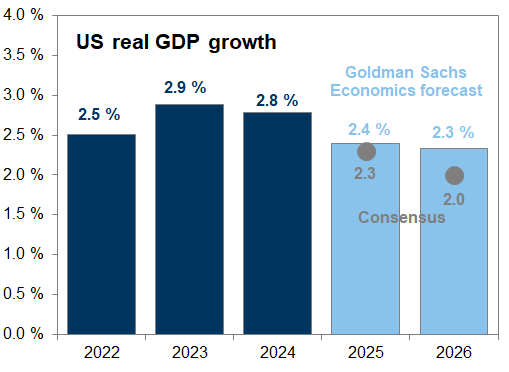

Exhibit 21: Goldman Sachs and consensus forecasts for US real GDP growth

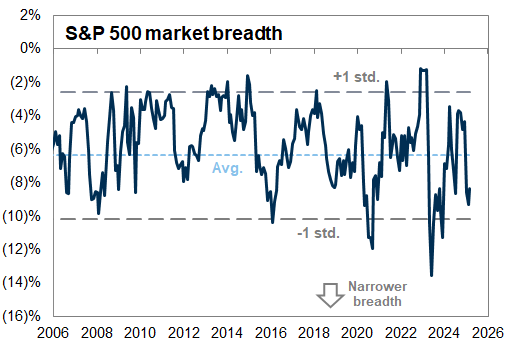

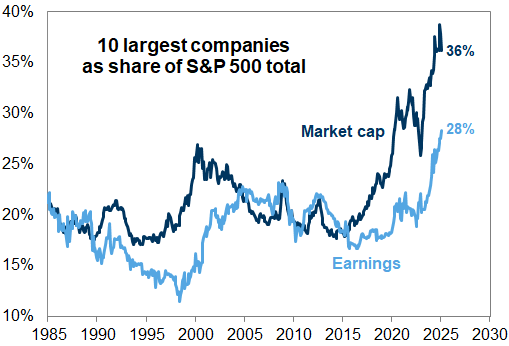

Market breadth and concentration

Exhibit 24: S&P 500 52-week market breadth

Exhibit 25: Concentration of S&P 500 market cap and earnings in the 10 largest index constituents

IPO Barometer and mutual fund performance

Exhibit 28: Goldman Sachs IPO Barometer

Exhibit 29: US equity mutual fund returns relative to benchmarks

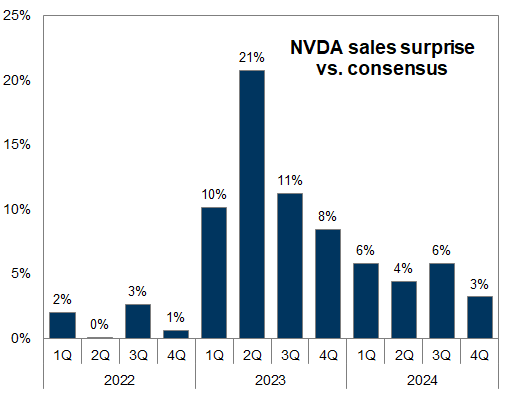

Earnings growth

Exhibit 31: Realized and consensus year/year S&P 500 EPS growth

Exhibit 32: S&P 500 FY2 earnings revision breadth

Valuations

Exhibit 34: S&P 500 consensus forward 12-month P/E

Exhibit 35: S&P 500 valuation relative to US Treasury yields

Sector returns, earnings, and valuations

Thematic baskets

Exhibit 40: Recent performance of select Goldman Sachs Research baskets

Factors

Exhibit 41: Indexed return of select equity factors

Exhibit 42: Equity factor valuations relative to history

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.