Global Views: From Above to Below

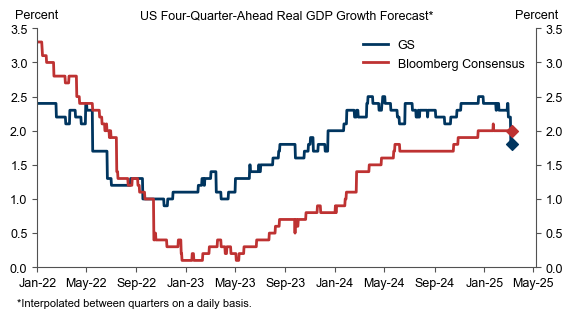

1. We have downgraded our 2025 US GDP growth forecast from 2.4% at the start of the year to 1.7% now (both on a Q4/Q4 basis). This is our first below-consensus forecast in 2½ years. The main reason for the downgrade is not the recent data, as the February jobs report was decent, initial jobless claims are still low, the February ISMs—as well as our broader business survey trackers—remain near their recent averages, and reports of sharply weaker Q1 GDP tracking have been greatly exaggerated. We also still believe that the US economy benefits from several tailwinds, including strong productivity growth and solid underlying gains in real household income. Lastly, there are important aspects of President Trump’s agenda—i.e., tax cuts and regulatory easing—that should support growth.

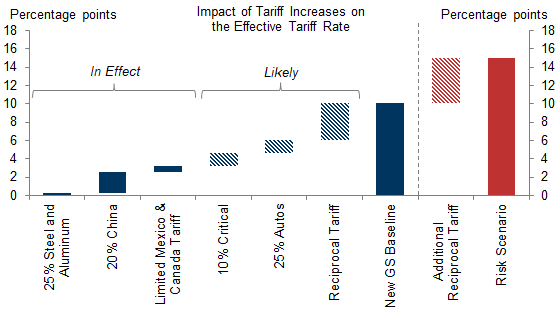

2. Instead, the reason for the downgrade is that our trade policy assumptions have become considerably more adverse and the administration is managing expectations towards tariff-induced near-term economic weakness. We now see the average US tariff rate rising by 10pp this year, twice our previous forecast and about five times the increase seen in the first Trump administration. While President Trump ended up softening the 25% tariff on Canada and Mexico soon after implementation, we expect the next few months to bring a critical goods tariff, a global auto tariff, and a “reciprocal” tariff. The reciprocal tariff matters most, not because other countries impose much higher tariffs on the US than vice versa—with a few exceptions such as India they don’t—but because the administration views e.g. Europe’s VAT of 20% as equivalent to a tariff (even though it is imposed equally on imported and domestically produced goods). If applied mechanically, a VAT-inclusive reciprocal tariff alone could raise the average US tariff rate by 10pp or more. Carveouts will probably lower this number, but if they are less widespread than we expect, the average tariff rate could rise as much as 15pp.

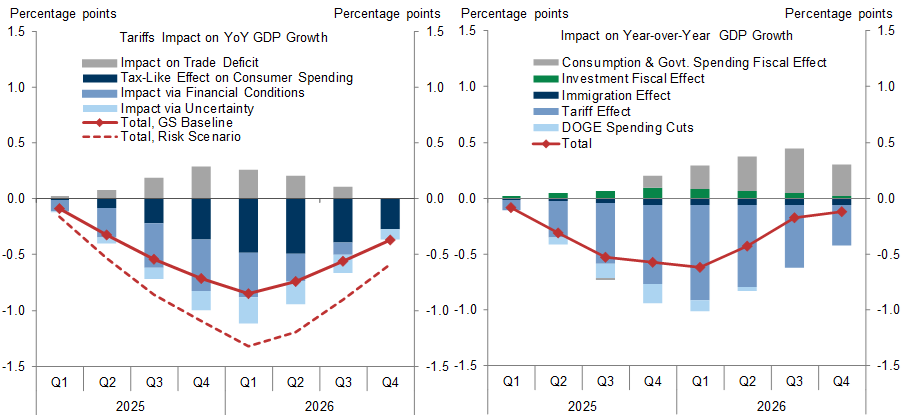

3. Tariffs weigh on growth via three main channels. First, they raise consumer prices—and thereby cut real income—by an estimated 0.1% per 1pp increase in the average US tariff rate. (In theory, the drag could diminish if the tariff revenue is recycled into additional tax cuts, but this revenue will not be scored in the ongoing budget negotiations if it results from executive as opposed to congressional action.) Second, tariffs tend to tighten financial conditions, although the impact in this cycle looks smaller than in the 2018-2019 trade war when scaled by the size of the tariff hikes. Third, trade policy uncertainty leads firms to delay investment. All told, our new baseline implies that tariffs will subtract an estimated 0.8pp from GDP growth over the next year, with only 0.1-0.2pp of this drag offset by the (relatively slow-moving) boost from tax cuts and regulatory easing.

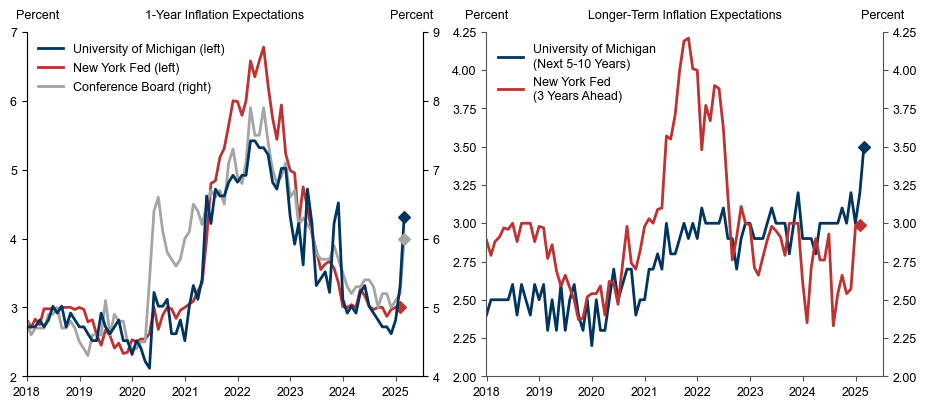

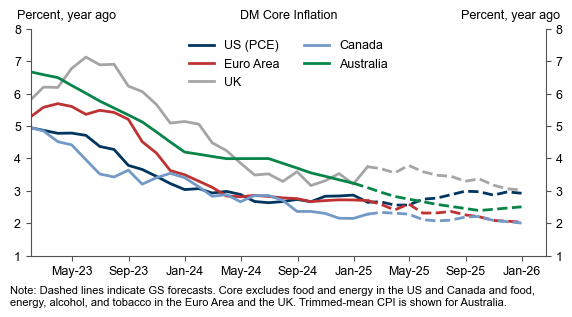

4. We now expect core PCE inflation to reaccelerate to 3% later this year, up nearly ½pp from our prior forecast. In theory, a tariff hike raises the price level permanently but only raises the inflation rate temporarily. In practice, this hinges on the assumption that inflation expectations remain well-anchored, which looks a bit more tenuous following the pickup in the UMich and Conference Board inflation expectations measures. But given our downgrade to growth, we have kept our baseline Fed call for two 25bp cuts this year (June and December). On a probability-weighted basis, our forecast is now broadly in line with market pricing after being more dovish than market pricing earlier in the year. Our near-term view is that the FOMC will want to stay on the sidelines and make as little news as possible until the policy outlook has become clearer.

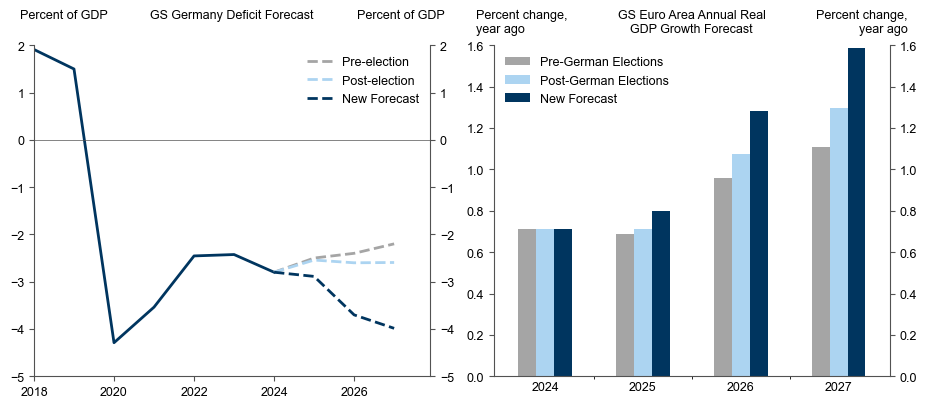

5. The medium-term growth outlook in the Euro area has improved on the back of the potentially dramatic change in German fiscal policy under incoming Chancellor Friedrich Merz. The preliminary agreement between Merz’s CDU/CSU and its smaller coalition partner SPD entails 1) suspension of the debt brake for defense spending above 1% of GDP, 2) a special infrastructure fund of EUR500bn or 10% of GDP, and 3) a small but politically astute loosening of the debt brake constraint on state and local governments. Assuming that the incoming coalition can persuade the Greens to pass the package without too many changes before the new Bundestag convenes, and that other Euro area economies also spend modestly more on defense, growth in each of the next 2-3 years should receive a boost averaging ½pp in Germany and ¼pp in the Euro area, where we now expect 1.6% in 2027. While we remain optimistic that inflation can return to 2% even in a stronger growth environment, we have scaled back our forecast of further ECB cuts and now expect a terminal rate of 2% vs. 1.75% before.

6. Elsewhere in DM, we expect further rate cuts as underlying inflation recedes and US tariffs weigh on growth, especially if the US dollar continues to defy predictions of significant appreciation. The Bank of Canada is very likely to cut on March 12 on the back of tariff uncertainty and a weaker-than-expected February jobs report. The Bank of England likely won’t cut on March 20 as the downtrend in inflation has stalled but we feel good about our comparatively dovish medium-term forecast, in part because we expect an ongoing loosening in the UK labor market. And the RBA may skip a cut on April 1 but we expect further cuts in subsequent months as inflation returns to the middle of the 2-3% target band.

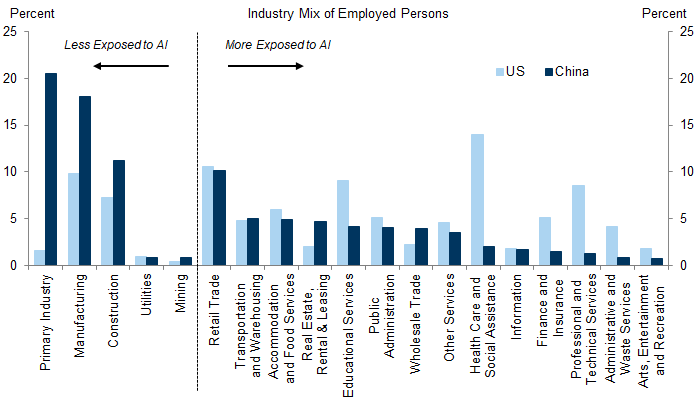

7. Despite another 10pp increase in US tariffs, sentiment toward the Chinese economy has continued to improve. With many releases on pause because of the Lunar New Year holiday, this is less related to economic data than to excitement about the advances of China’s domestic technological innovation since the release of the DeepSeek model in January as well as President Xi's meeting with tech industry leaders. We have pulled forward our estimated AI boost to China’s GDP growth; we now expect an impact that starts in 2026 and gradually rises to 0.2-0.3pp by 2030 (from 0.1pp previously). However, we have left our estimate of the cumulative impact from AI on GDP in China largely unchanged and still think that it will fall short of the impact in the US, which has a larger share of its labor force in AI-exposed white-collar occupations.

8. Markets have moved aggressively away from US growth outperformance across all major asset classes. Since the start of the year, the 10-year yield spread between the US and Germany has declined by 72bp, European equities have outperformed US equities by 14% in local currency, and the Euro has appreciated by 5% against the US dollar. Nevertheless, our equity strategists estimate that the equity risk premium in the US remains about 150bp below its level in Europe and nearly 400bp lower than in Asia ex Japan, and the US dollar remains well above both its PPP level and most measures of fundamental currency value. With US growth now more likely to underperform relative to consensus expectations on both an absolute and relative basis, and given the still-significant US asset exposure in most global portfolios, the recent moves might well have further to go.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.