Global Market Views: Double Trouble for US Exceptionalism

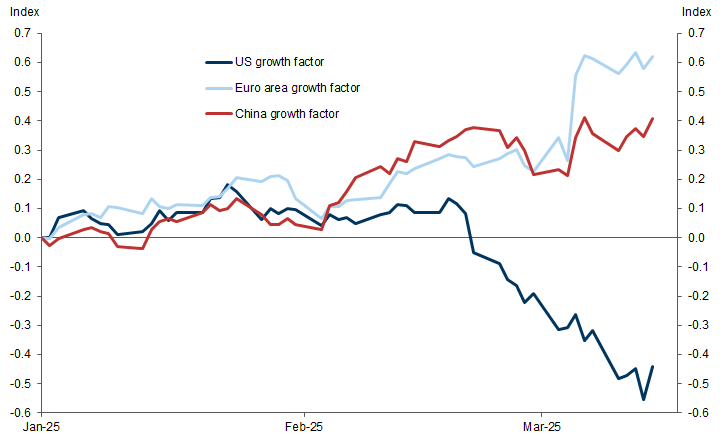

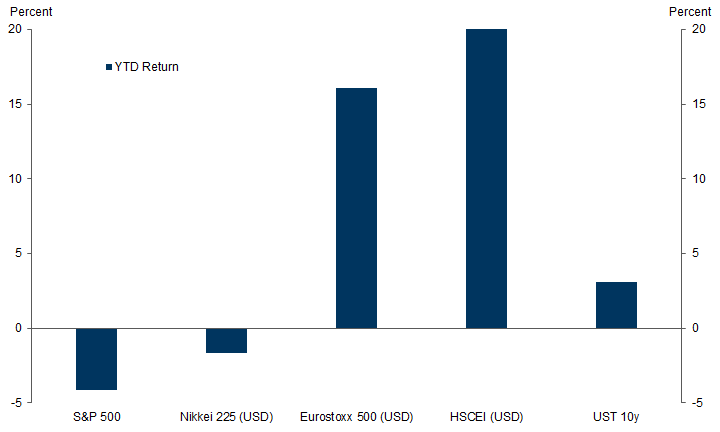

1. Two stark shifts in macro markets. The past month has seen two important shifts across global markets. The first is a sharp re-rating lower of US growth in US stocks (especially cyclicals), rates and the Dollar, on the back of tariff volatility and the environment of broader policy uncertainty created by the new Administration. The second is a sharp re-rating higher in the fiscal impulse in Germany, with an associated uplift to Euro area growth views and more modestly in China too. Together, these two shifts pose a significant challenge to the narrative of US exceptionalism that has been a dominant market theme. At the same time, they create the potential for a more balanced global growth and asset return picture than has been the case in recent years. As always, markets have moved rapidly to price these shifts, and arguably the moves have run ahead of the actual forecast changes that our teams have made for 2025. As a result, there are now paths to relief in US equities if US policy uncertainty is reeled in or if hard data remain resilient in the face of the ongoing market volatility. Equally, some reversal in the outperformance in the rest of the world is also possible if there are hiccups in fiscal delivery. But given substantial US exposures in global portfolios, often FX-unhedged, reflected also in high valuations and concentration risk, there is room for these market shifts to extend unless underlying policies are reversed.

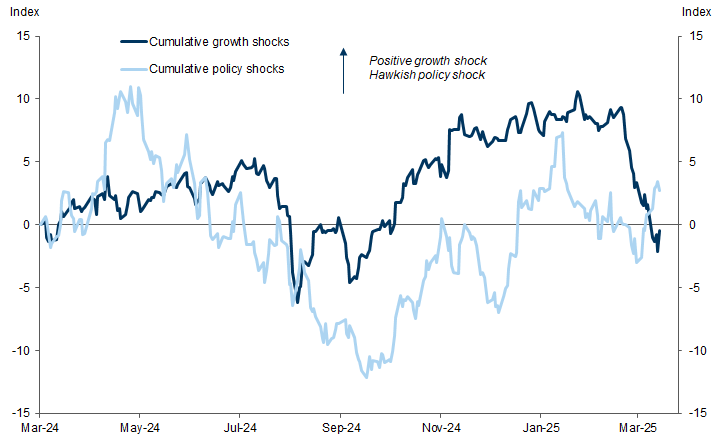

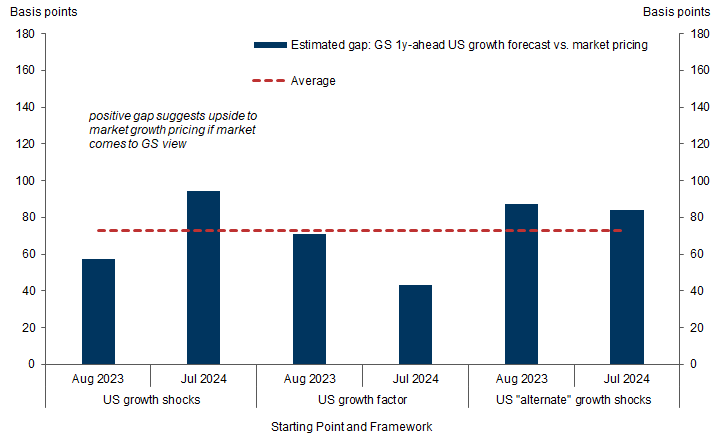

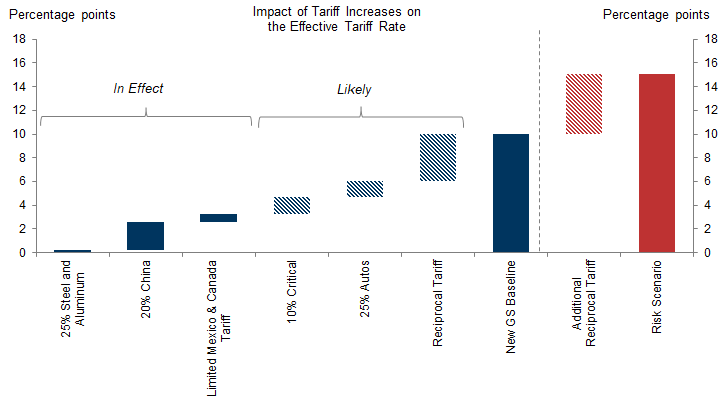

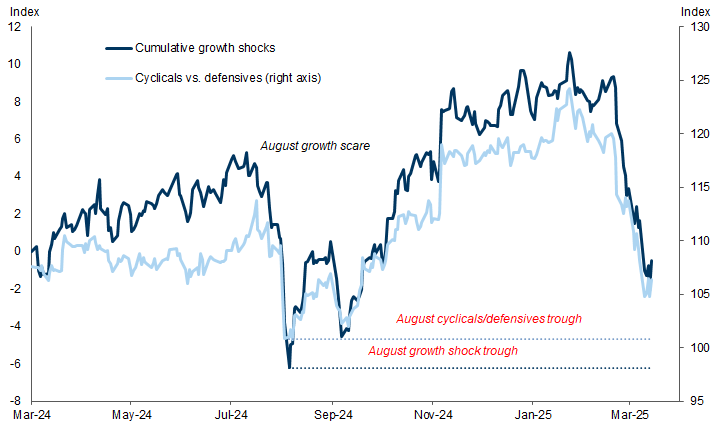

2. A sharp US downgrade, but still two-sided risk. After the large upgrade to US growth views at the end of 2024, we saw markets as increasingly vulnerable to downside risks to the US economy from optimistic pricing and policy. The combination of weaker spot data and growing concern about the impacts of policy actions and policy uncertainty have led to a sharp downgrade to US cyclical pricing. We have revised our own baseline GDP forecasts down to 1.7% on a Q4/Q4 basis (from 2.4% at the start of the year), mainly because of more adverse assumptions about trade policy. Market views have moved considerably more. Our latest estimates show the shift in market pricing as equivalent to a 150bp downgrade to 1-year-ahead GDP growth views. We think a path like our baseline would now likely create some relief and there is a clearer upside scenario than there was a few weeks ago. Given the optimistic starting point, however, markets are still priced for modest growth, and cyclical pricing still looks better than at the depths of the recession scare in August 2024. With ongoing risk from policy, this means that it is still easy to define plausible scenarios in which growth is worse than what markets have yet reflected.

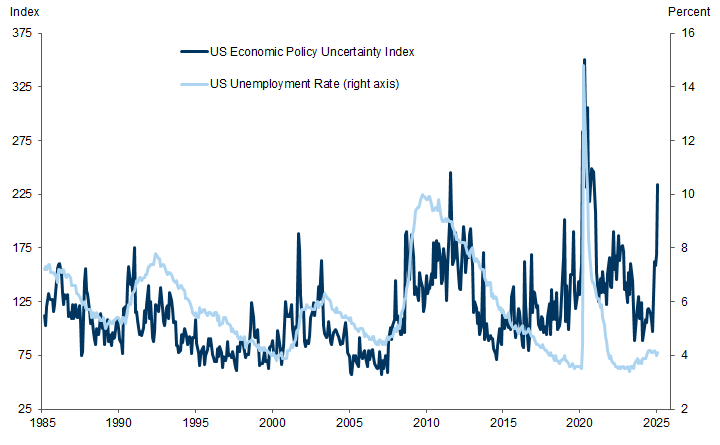

3. A weaker policy put. Signals from the Administration that they are not prepared to rule out recession are compounding the recent growth worry. Many investors came into the year with a strong view that policy would put a firm floor under US growth and implicitly under US markets. Both the prioritization of tariffs and spending cuts and recent messaging from the Administration about the potential for near-term economic weakness have challenged the assumption that there is a “policy put” close at hand. That too is driving a shift in the perceived distribution of outcomes, as markets increase the weight on recession from what had been an unusually low level early in the year. Because actual and proposed tariffs are also raising the near-term inflation outlook (and surveyed inflation expectations), the Fed put is also further away than it would otherwise be. We think the Fed will shift quickly on clearer signs that the growth or jobs outlook is deteriorating. But ahead of that point, a more hesitant Fed raises the risks to equities and to growth pricing too.

4. A quick floor likely only if policy shifts. With the market already priced for weaker growth, a key question is whether the large uncertainty shock will delay spending plans enough to increase recession risk further in the coming months. At this point, it is hard to be sure, since the links between uncertainty, confidence and spending are less reliably modelled than some other channels. So the data will need to speak. But in the near term, we think the asymmetry is still to the downside: deteriorating data would confirm market fears, but reassuring news (like the recent ISMs and jobs data) may be viewed as coming too soon to shed much light on the impact. Over time, continued stability, especially in the jobs market, may provide reassurance that recession risks are overstated. But, especially with new tariffs likely ahead, it may be hard for data alone to provide a definitive floor under market pricing. Policy shifts could, in principle, be a faster route to stability given that the downside risks from policy are the core concern. The Fed is unlikely to signal a shift without either sharper data weakness or financial conditions tightening. If the Administration were to give a clear message that they were prepared to adjust policy to support the economy or that they would prioritize more growth-friendly parts of their agenda, that could provide more immediate relief. Although it may be hard to put the uncertainty created completely “back in the bottle”, we think equity markets would still welcome that kind of signal.

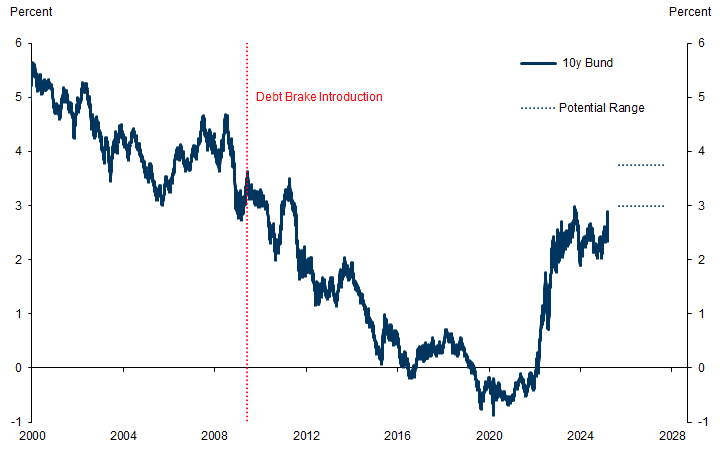

5. A fiscal turnaround in Germany. The post-election fiscal proposals from the incoming coalition government represent a sea change in the likely fiscal impulse in Germany. After a Bund breakout on announcement, investor focus has quickly shifted to the negotiation hurdles, odds of passage, and implementation wrinkles. That is an important conversation since nothing is simple in Europe, and the details will have an important bearing on the degree to which GDP growth increases in 2025—our economists have raised their German GDP forecast by 0.2pp to 0.2% in 2025 and their Euro area forecast by 0.1pp to 0.8% in 2025. But markets appear to be looking beyond the immediate implications and focusing on the bigger picture here. First, these policy shifts are larger and faster than most pre-election investor/analyst expectations. Second, given the security imperative, even if the package is altered or negotiations take longer, it is highly likely that some form of substantial fiscal expansion will be implemented. And third, Germany’s aggressive response to the new security outlook shifts the Overton Window for what is possible in terms of Euro area spending. Taken together, this supports a shift in the distribution of market outcomes in the Euro area—sharply reducing the tail of very poor growth and low ECB policy rates. And while some of the market optimism looks to have run too far relative to likely 2025 real outcomes, they do not look out of line with the potential sustained fiscal shift, which would further open up right tails in European equities, Bund yields and the Euro.

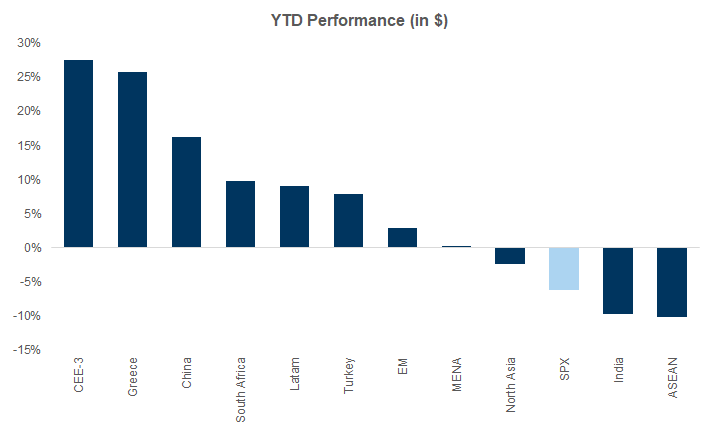

6. The limits of decoupling. One consequence of the two shifts we have discussed is an unusual outperformance of European and EM equities relative to the US. That kind of decoupling tends to have limits, particularly if US activity and growth continue to decelerate. A more balanced global growth profile with softer US growth and subdued US equity performance can coexist with stronger growth and equity returns outside the US, especially with better starting valuations and earnings revisions. But that dynamic is harder to sustain if recession becomes a real risk. In those scenarios—where the US catches a bad cold—tighter financial conditions and higher risk aversion tend to spill over into global markets as well. So while the softening in US growth we have seen so far—from above trend to below—may be a sweet spot for assets in the rest of the world, further sharp US growth downgrades from here likely pose more risk to non-US assets without offsetting positive developments elsewhere. China AI developments and European fiscal news are indeed offsets, but local equities have been quick to take credit already and more may be needed to extend the positivity in the face of further US growth and equity weakness. The limits of decoupling are also becoming risks to other core macro trades. For instance, while Japanese rates have so far continued their upward trend, that too could be vulnerable if US growth, equities and rates fall more sharply and boost the Japanese Yen significantly further.

7. (Some) ingredients for a lower Dollar distribution. The Dollar has fallen despite new steel and aluminium tariffs being implemented (at the time of writing). That is because, in our view, the constant back and forth on tariffs means that at this point investors are no longer confident that meaningful tariffs will be enacted with any durability and instead are treating trade policy as another source of uncertainty that could weigh on US activity. At the same time, China’s willingness to maintain a stable fix despite tariffs has allowed currency markets to focus on the more positive developments in Europe. At this point, the Euro’s surge has gone beyond its typical relationship with growth expectations (even if we allow for a more front-loaded shift than our economists expect) and, to a lesser degree, has outrun Bund yield shifts too. So there is a risk of a tactical strengthening in the Dollar if European fiscal negotiations hit a snag or US data remain stable (rather than deteriorate). But amid the tactical back and forth it is important to remember that if one had to sketch a set of macro conditions for sustained weakening in the broad Dollar, they would look like the shifts we have just had—easier fiscal policy boosting domestic demand and growth in Europe and China, and some corresponding softening in the US. To be fair, tariffs would not be part of such a mix, and it would be paradoxical if the US economy ends up facing the biggest downside consequences of the major economies from the increased tariffs in our baseline. It is also still questionable whether we will get the fiscal restraint and Fed easing that would complete such a mix. But the combination of potentially a more balanced global growth and asset return picture and a more muted response to tariffs could see this move extend given stretched valuation and positioning in Dollar assets.

8. EM resilience adds to better balance. The combination of some local policy support and AI tailwinds has allowed China’s equity markets to survive the imposition of tariffs for now. The medium-term challenges of property sector overhang and slowing potential growth remain, but even from current levels there is probably still upside—especially in the lagging onshore market relative to offshore—if policymakers can deliver on their targeted 5% growth levels. But the resilience of EM equities is broader than just China, with positive returns year-to-date across Latin America, Korea, South Africa, Turkey and CEE. India has been the conspicuous laggard after strong performance over several years, although even here the worst of the local headwinds of tight liquidity and slower cyclical growth may now be behind us. Reciprocal tariffs are still a risk to Indian equities, although after a meaningful de-rating and significant foreign outflows, stabilization is likely as we move through Q2. Lower oil prices may help a number of these markets, many of which are in large oil-importing economies. Lower energy costs will likely remain a focus of the new Administration via potential geopolitical agreements or increased OPEC production. In either case, less headline inflation pressure and stable current accounts make it more likely that we see yet more policy easing that supports EM cycles, and adds to the resilience in local earnings and equities.

9. A “portfolio approach”. At a high level, we think that the next few months could unfold in two ways. In the first, as in our baseline forecast, US growth softens relative to last year but ultimately stabilizes just below trend. In the second, the impact of uncertainty or of fresh policy shocks prompts a sharper slowing growth, more obvious labour market weakness, and a further rise in recession risk. Given that no single asset is likely to perform across both of those outcomes, our approach has been to focus on identifying parts of that distribution that may be mispriced and a portfolio of assets or trades that make sense collectively. We continue to favour diversification on that basis, both across equity markets and between equities and bonds: gains in non-US equities and US Treasuries have helped cushion US equity losses in balanced portfolios. For the first scenario, we think US equity upside or VIX downside may now provide the most leverage. The most common sequencing after growth scares is for equities to move higher ahead of a move higher in yields, but if US rates rise sharply too, Japanese equities may also do well. Although the medium-term risks skew towards lower prices, oil upside may also offer good leverage to growth relief, with implied volatility at low levels (unlike most other assets). In the second scenario, we think there is plenty of scope for US yields to fall and for risk- and rate-sensitive FX crosses such as CAD/JPY or AUD/JPY to move lower; and for safe havens like gold to move higher. We think a further downgrade to US growth would now create more risk for non-US equities too and should reinforce the steepening in European curves that is already underway, while a clearer rise in recession risk would create deeper upside for credit spreads. The mix of selective upside in risk assets (or downside in volatility) alongside longs or curve-steepening positions in rates reflects the “portfolio diversification” theme.

10. Finding a floor. In terms of near-term tactics, the most immediate question is what could put a decisive floor under US equities or cyclical pricing? We do not yet see the same level of dislocation or of recession risk pricing that we saw in last August’s recession scare, so pricing alone is not yet asymmetric enough to provide a floor. In simple terms, we think the main potential conditions are either a) signs from the data that the economic damage is proving more limited than feared, b) a shift towards more growth concern from the Fed, or c) a shift in the policy messaging or stance from the Administration. The challenge is that because new policy announcements are still coming and because the timing of the impact of uncertainty is not clear, it may take time before the market can gain confidence that the economy is avoiding more lasting damage even if the data holds up. And in practice, the lines between the two scenarios we laid out above [in #9] may also not be as sharply delineated, and we could easily see some further weakness in data even if ultimately the economy remains on a stable path. This is why a shift in policy stance is the clearest route to recovery here and why it is easy to see how the market can worry more about the US growth outlook. But the longer we can go without seeing another turn lower in survey data or ongoing stability in jobless claims data, the harder it will be to argue that the economy is taking a larger shift down. More locally, the good news is that implied volatility has risen sharply enough across assets that just the absence of fresh news—and of ongoing large daily moves—may now be enough to generate at least some modest relief.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.